We all know just how intimidating investing in real estate can be, especially when you can’t really afford to pour a lot of money into the process.

Everybody keeps talking about how you need to start somewhere when investing and while that may be true, you can still make that initial step without actually using any money to begin with.

There are plenty of ways that you can start investing through, in order to make the most out of each and every planned purchase, and in this guide we will walk you through every method that we can think of that has been proven to work in the past.

So, let’s not beat around the bush anymore and just start off our list with the first method that we have in store for you:

Hard Money Loans

Hard money loans are mostly used for short-term financing of mortgage loans. While this may not be the best option for making a profit on the long run, it can help you get that initial push that you need in order to get started with the process.

We should mention here that you can’t actually get a hard money loan directly from a credit union or a bank for that matter. Instead, you will have to opt for a private and individual lender that is willing to trade off real estate hard money loans for you.

Getting a loan from a bank can be quite a hassle as you will need to get through a lot of paperwork and logistics to actually get the job done, but luckily the process of getting a hard money loan is more often than not a lot easier and quicker at the same time.

You won’t need to get past a lot of different approval requirements, as long as you’re willing to trust the lender and they’re willing to trust you that’s all of the prep time that you’ll need.

Since hard money loans are asset-based, your history is pretty much insignificant for the lender as well, so you won’t need to live in constant fear that one of you won’t keep their end of the bargain either.

For the most part you’ll find that most of your fellow hard money loaners are house flippers, the type of people that buy, renovate and then sell these houses in order to make a profit.

Government Loans

In case you didn’t know by now, you can actually opt for a direct loan from the US government if you want to, especially when it comes to real estate investment plans. Here are two of the most popular options that you can pick from out there:

The first of these is known to guarantee loans to practically any veterans, service members, National Guard members, reservists or surviving veteran spouses, as long as they fit the requirements to do so in the first place.

For the most part this is one of the better options out there since it requires $0 down payment for the majority of the time and very favorable interest rates.

The latter option here is known to offer you both direct and guaranteed loans for you to buy, build and pretty much just continue to improve upon the property you just bought.

As long as the place was bought from a government-approved contractor or dealer you’re pretty much in the green for this type of loan, but just remember the fact that the property itself needs to be in a rural area and you can’t be making too much money either.

You do need to classify as a low-income earner otherwise you will be rejected from the get go. So, make sure that you are eligible in the first place before you start looking for deals here.

House Hacking

House hacking is definitely a fan favorite option right here, especially when you realize the fact that it even scores you free housing in the process.

On top of that, house hacking is considered to be a very simple concept to get a grasp over, you just need to get yourself a small multifamily home, move into the house itself but secure only a corner of it for yourself, and rent out the rest of it.

The reason as to why we mentioned this as being a free housing option is the fact that you don’t actually need to worry about paying your mortgage or any other housing costs since all of that will be covered by the rent money that you’ll be collecting from the people living there with you.

As soon as you move out you can also be sure of the fact that you will continue to make money from it, and the more time passes the more money you’ll make from it as well.

A very popular low-down-payment loan that you can opt for is FHA, and the reason as to why it is like this is because it actually allows a total of 3.5% down payment as long as your credit score is over 580.

If you are not eligible for this though just know that you will most likely be forced to pay down all of your debts before you actually buy the rental property yourself.

There are plenty of other options to go around though besides FHA, like for example you can take advantage of a ton of different conventional mortgage programs that will take even less money from you and they can even promise you no money down in the first place.

While buying a very large house and renting it out in segments to different people is definitely a good choice, just remember that you can also opt for a slightly smaller house and still get it done although you can expect less of a profit on the long run since you won’t be able to rent it out to too many people at once.

The BRRRR Method

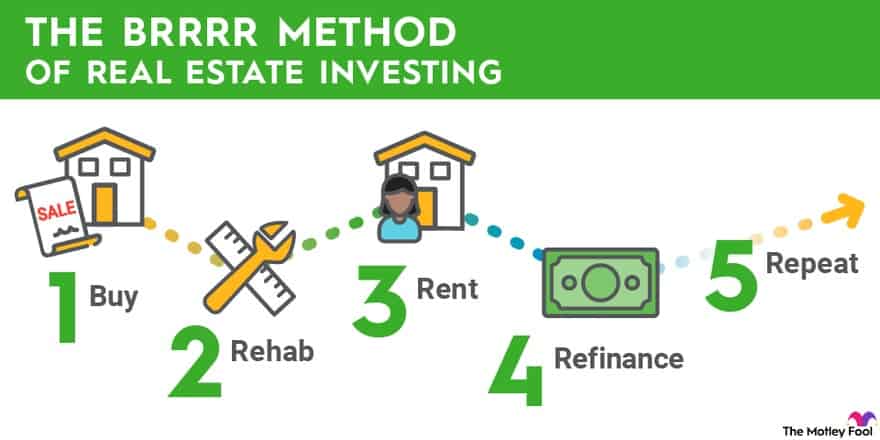

Before you start questioning whether we fell asleep on our keyboards or not based on that name alone, you should know that BRRRR is an acronym which stands for buy, renovate, rent, refinance and then lastly repeat.

Essentially you just set your eyes on a fixer-upper and you take a rehab loan which does tend to come with a down payment.

You take that money and you get the house for yourself, but instead of moving in you start renovating it, you upgrade it to a new level and you continue to do so until you’re satisfied with the end product.

Then and only then you can check in with a long-term landlord loan and take out your money. This is a very safe method to employ especially if you have a history with renovating older houses.

Since the landlord loan is pretty much based on the After-Repair Value concept, the only thing that you’ll need to worry about is getting that initial down payment and after you’re through that hoop you can be sure that your profit will come next.

Equity Partnerships

Another very safe and easy method that you can employ is the use of equity partnerships. As long as you lack the money to get started you can actually take full advantage of your alliances to simply make up the difference altogether.

The first step that you will need to take here is to find the affordable property that is also not in its best shape.

Next up just look for an equity partner and work together for the sake of financing your purchase. Basically, every equity partner that invests in the house will be getting a certain percentage of ownership over the property which in turn funds the purchase altogether.

Home Equity Loans

Home Equity Loans are also a good option when you can’t really afford to make that down payment yourself, especially now that property values have hit an all-time high by now.

Just keep in mind that the more equity there is in your home, the higher the chances of you making a profit because you can instantly consider the following options:

- Rewrite and refinance the first mortgage loan

- Keep that original loan and then withdraw another HELOC for good measure.

But before you do any of this you need to make sure that you have the right lender backing you up. Remember the fact that you will need a lender that actually does allow you to make use of the HELOCs on rentals.

Microloans

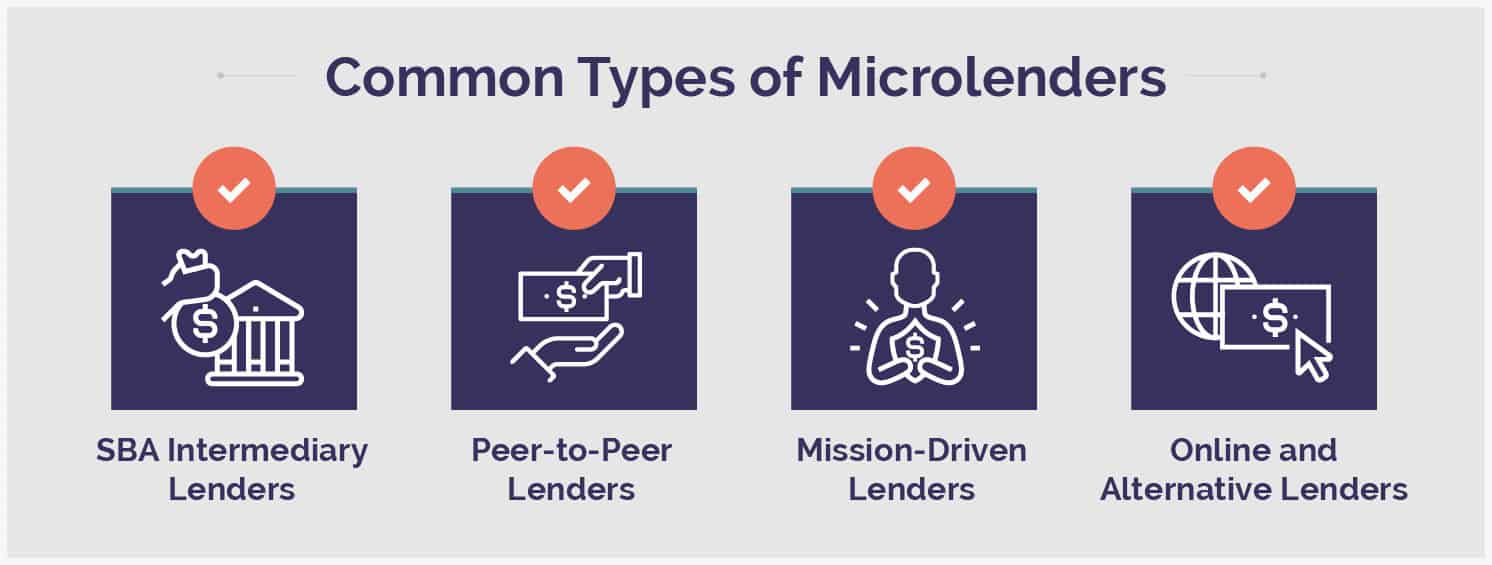

Microloans may sound very innocent and insignificant but they can easily make your career as an investor and set you up for the future if you actually take the time to research them altogether.

They are usually meant for startups or newer businesses, especially when these require a lot more resources than the owners were willing to invest into beforehand.

As the name implies, microloans are nowhere near as massive as most of the other options on our list, especially when compared with traditional financial institution loans.

What this means for you though is the fact that you will be able to get access to them a lot easier since they don’t require a lot from you, such as a credit score and whatnot.

If you have no money on you and you want to invest in real estate without risking your whole life in the process this may very well be the best option for you.

Microloans are very easy to understand and very easy to get your hands on, just remember that your investment can still go wrong and you can still lose all that money in an instant if you’re not careful.

Trade Houses

Trading houses is pretty much exactly what it sounds like, and despite the fact that it sounds a bit silly at first, you should be able to tell quite easily why this can be very profitable for you and whatnot.

Essentially, you just need to keep your eyes on a new property that you can see a lot of profit through and then you can contact the owner for more information regarding it.

After the process is done you will have your hands on a new property while also avoiding the capital gains that would come from selling the original house you owned.

Even if you don’t own any money, you can still opt for this choice and easily make a huge profit as long as you make sure that the trade is in your favor.

This option is definitely meant more so towards the investors out there that have quite a few years under their belt so they can properly assess which property has a more profitable future and whatnot.

SBA Loans

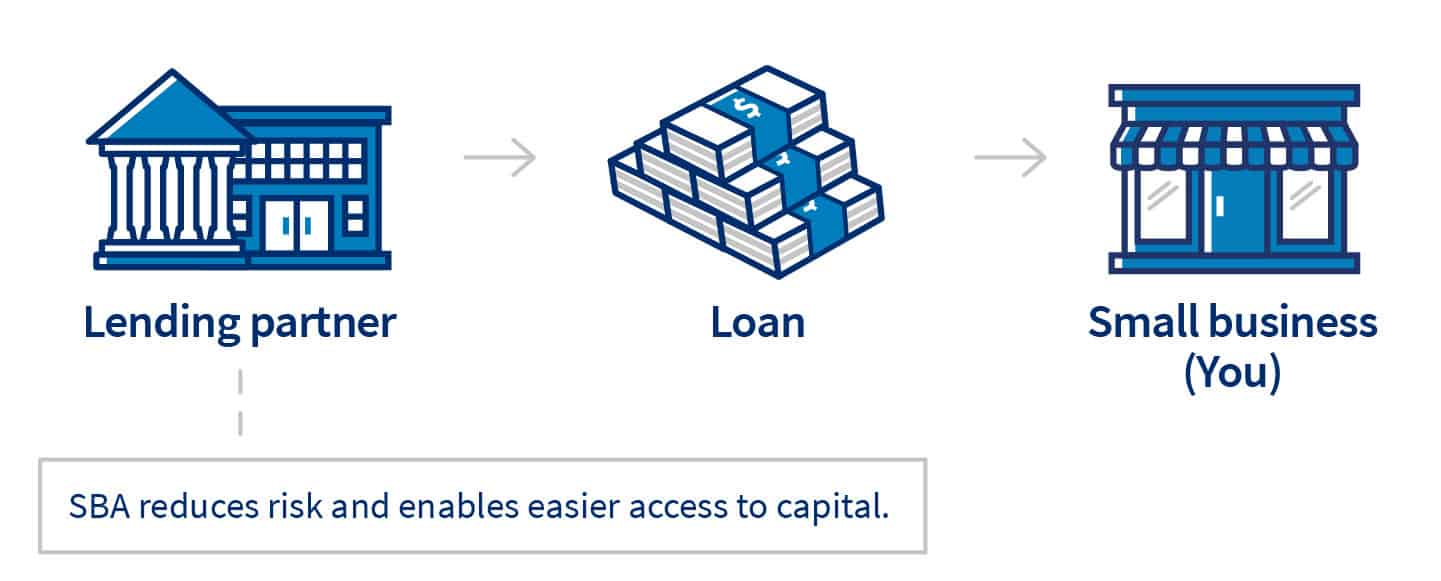

SBA loans are simply put just meant to provide you with the funds necessary to support your small business. For anyone out there that is looking to get their hands on commercial real estate, just know that SBA 504 is pretty much always going to be the best choice for you.

This specific type of a loan is perfect because it is meant to serve as the main funds that you’ll be using to get owner-occupied properties.

SBA loans are also great because they take only 10 percent down payments from the owner and while later on the funding may get a bit higher than we’d like, around $125,000 to $20 million, it is still a great way to invest into building or improving your small business without actually having any money on you to begin with.

Seller-Held Second Mortgage Plans

This is another great option for you in case you literally can’t afford to put any money into your investment.

Hypothetically, let’s say that you can find a lender that can easily cover 80% of the original price on a landlord loan, which would imply that you only need to pay for the rest of the 20%.

But if your credit card is as depressing as the current world situation then chances are that you won’t be able to do this to begin with, which is where that second mortgage comes in.

You can opt for another person to do this with you or you can ask for money from the same seller. While this heavily relies on the seller being willing to offer you a second mortgage altogether, if you can get this done you can start investing in the house without ever having put a single dime into it.

Private Money Loans

Last but not least we would like to mention how the more of a reputation you gain for yourself in the real estate industry, the more people will start to follow you around and look to make money off of you.

Luckily, this works in your favor for the most part since you can borrow private money loans from them in order to make a profit. The reason as to why this works out for you is because you have already established yourself as a worthy investment so nobody should be able to contest your skill as an investor.

Just remember the fact that each and every private money loan comes with it sown requirements, and while some may be very lenient, if you’re in need of a lot of money fast you may need to take up some less than desirable conditions which you wouldn’t have considered to begin with normally.

Pretty much anyone can become a private lender for you as long as they have the money for it. All that you need in order to take advantage of this is you will need to gain everyone’s trust through your past investments and escapades in the industry.

So, if you have already established yourself as a top real estate investor then this should come off as a no brainer but you should definitely take advantage of it by saving yourself the trouble of purchasing rental properties without a down payment to begin with.

Conclusion

But anyways, should you invest into real estate if you don’t actually have the funds of it? Actually yes, you definitely should, regardless of how much money you have in your bank account, simply because there is no better option out there for you.

What we mean by this is that if you want to get started on working in the real estate industry then you need to do so as soon as possible because the world as we know it is changing ever so slightly to the point where the more time passes the more expensive things get.

So, make your move now, get the property you’ve been wanting to get your hands on for so long now and make sure that you make a profit from it. It will definitely take a lot of luck, skill and time but the more you do it, the more you will establish yourself as a great real estate investor which in return will make it easier for you to request for private money loans from anyone out there.