In the ever-evolving landscape of stocks and investments, 2023 has emerged as a year that’s both exciting and daunting for investors.

The complexity of the market has grown, and the nuances are understood best by those seasoned in the game.

But even if you’re a newbie to this world you don’t really need to fear, because there is a clear path for those looking to maximize profit without navigating the intricate maze that is today’s market.

That path takes us to the topic of this article: blue chip stocks – a term that might be unfamiliar to some, but represents one of the most stable and promising investment options out there.

Blue chip stocks are not merely a trend; they are a cornerstone for those seeking reliable growth in their portfolio.

But before we dive into the specific blue chip stocks that stand out in 2023, it is vital to understand what they are and why they matter.

What Are Blue-Chip Stocks?

To put it bluntly, a blue-chip stock is just a stock that you can trust because it comes from a very well-established company or brand. These stocks are known for having a very reliable history and on top of that they usually pay dividends.

The term “blue-chip” actually comes from the world of poker where it was the most valuable chip on the table.

In the stock industry, this term represents the safest avenue for investors, particularly those who are taking their initial steps into the complex world of investments.

How to Identify Blue-Chip Stocks?

The thing about blue-chip stocks is that they are very easy to identify because they instantly come off as the most reliable stocks to invest into.

Since they have that strong history that we mentioned previously, you can usually find them by simply looking over the following facts:

- Large market capitalization – You can usually find the blue-chip stocks by looking at their market cap which is always going to be around $10 billion or more.

- Growth history – We mentioned previously that their history is always on the bright side, which means that you should be able to see this translated directly into its numbers going up gradually over time.

- Component of a market index – You will usually find blue-chip stocks in market indexes such as S&P 500 or the Nasdaq 100.

- Dividends – While not all of these blue-chip stocks pay dividends, most of them do as this is a strong indicator of the fact that they no longer need to invest as much revenue back into their growth.

Why You Should Invest into Blue-Chip Stocks?

While we do always recommend investing into blue-chip stocks, you shouldn’t take this as a “you must invest in these or you will lose all of your money” type of a deal.

Instead, you should always diversify your portfolio regardless of whether you’re looking for a quick buck or if you really want to take the ultimate gamble and invest your life savings into something.

So, what you do need to do is you need to find a bunch of small companies, maybe a few mid ones as well and you need to try your luck with them. If you want to almost guarantee your winnings however, you can always invest into blue-chip stocks.

While they’re not a hundred percent safe, they do offer a lot less opportunities for failure than most other stocks out there.

So, take this with a grain of salt for now, should you invest into blue-chips? We personally believe so, but don’t limit yourself to them alone. Diversification is the key word here, never forget it.

Since we’ve established the significance of blue-chip stocks, we’re now prepared to dive into the top 20 best blue-chip stocks available on the market as of today, August 17, 2023.

While some of these stocks are currently trading way below their historic peaks, their inclusion in this list stems from our belief in their inherent value and potential.

This might just be the right moment to enter and capitalize on these stocks. So, let’s explore which blue chip stocks we think are noteworthy and which might align with your strategic goals.

20. Exxon Mobil (NYSE: XOM)

With a total market cap of $438.11 billion and an attractive dividend yield of 3.33%, this blue-chip stock actually checks off every mark that you would need to know that this is a safe investment that you shouldn’t miss out on.

This is the largest energy company by market cap, and on top of that it has a very nice history to say the least, making this by far one of the best choices in the game right now.

19. Verizon Communications Inc. (NYSE: VZ)

We all know Verizon, and that’s not an over-exaggeration. This is one of the three largest mobile phone networks in the country, but while this may be true it is also the only one of the three that has been steadily growing over the past couple of years.

Thanks to a lot of new income investors and a lot of promises, Verizon seems to be one of the best choices for you if you want to invest in something that is sure to bring you back a decent profit.

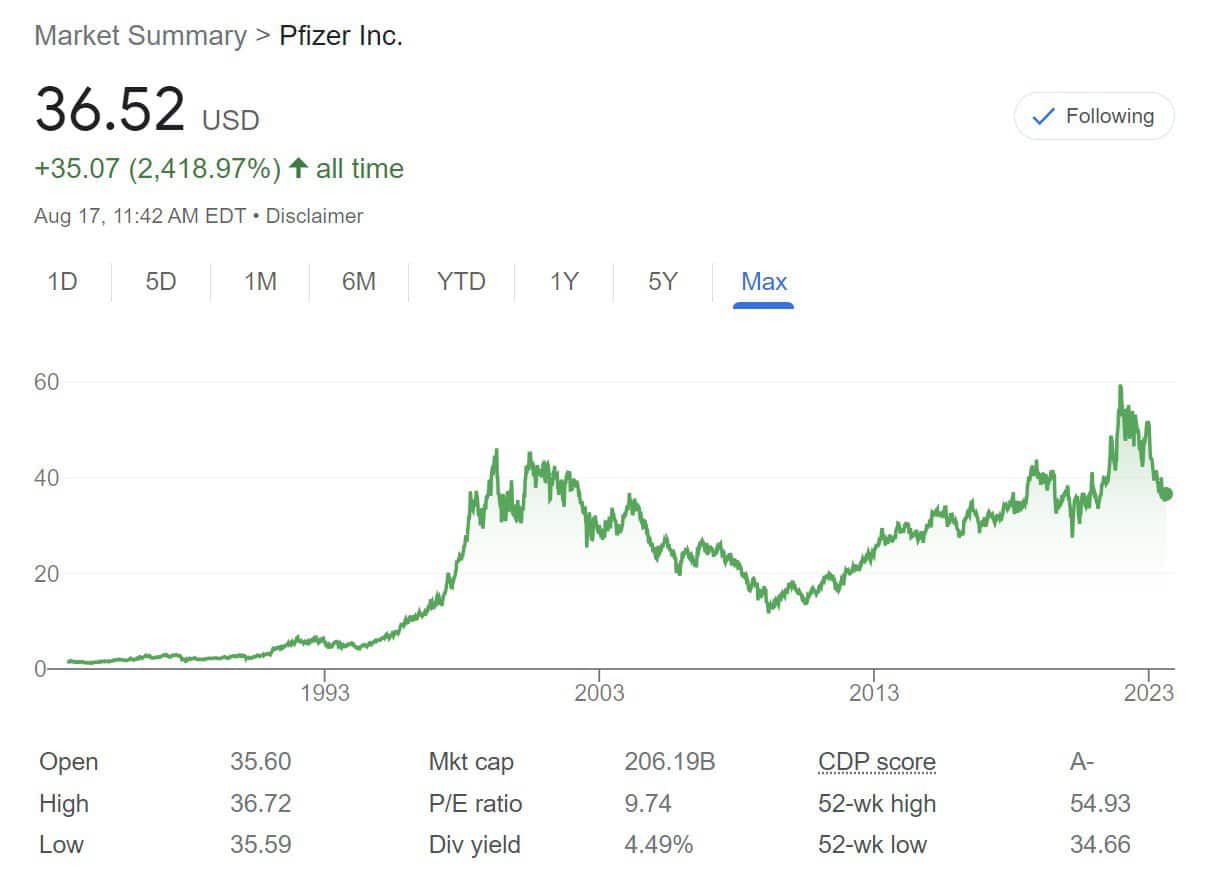

18. Pfizer (NYSE: PFE)

Pfizer has always been one of the most well-known and respected names in the world. They might have dropped from their peak after the massive success they’ve had in these last two years with vaccine sales, but the company’s real attraction resides in its sustainability as a long-term investment.

This can be attributed in part to a consistent health dividend stream. With a record of uninterrupted dividends since 1980 and several increases since 2010, Pfizer’s financial stability stands out.

Additionally, Pfizer has always been a favored selection among active mutual fund managers, that rank it among the 50 best stocks of all time.

17. Intel (NASDAQ: INTC)

Intel might have been on a sharp decline in these last few years, but 2023 looks very promising and this might just be the perfect moment to invest in the company.

With a total market value of $136.28 billion and a dividend yield of 1.54%, Intel will always be one of the most popular names in the tech industry and that’s a fact.

Although there have been quite a lot of bad moments in the history of Intel, specifically during the past couple of years when their competition really rose to the top, Intel is still one of the most popular chipmakers in the world right now and they are definitely fighting to get their position back.

Ever since they hired Pat Gelsinger, the former CEO of VMWare they’ve been on the right path slowly yet surely.

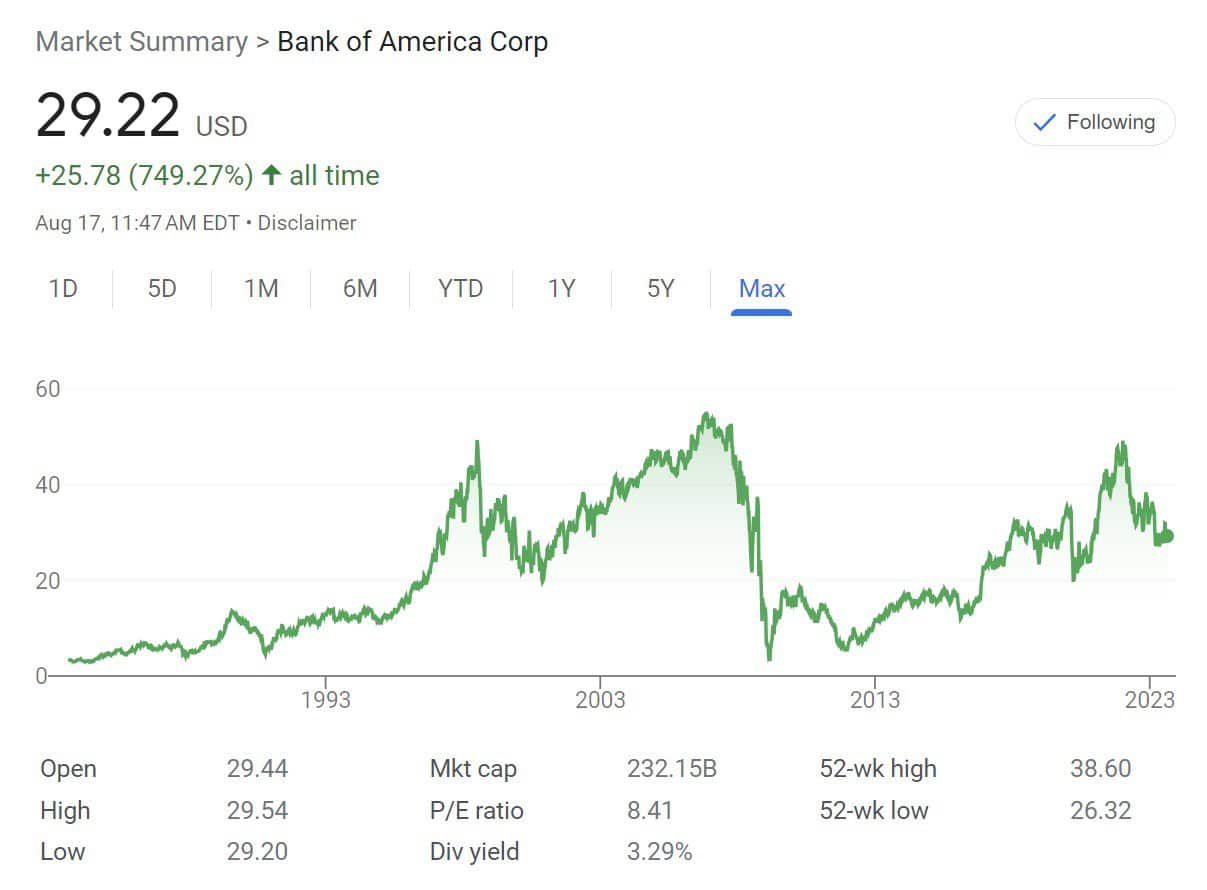

16. Bank of America (NYSE: BAC)

The Bank of America is one of the best options if you’re looking to invest in the financial sector. If you still doubt its reliability though simply think of it this way: Investing in the international money-center bank that has a total market value of $232 billion is definitely a smart choice.

On top of that, analysts all across the globe came together to say that the numbers and the good history that this company has to offer are both top-tier to say the least, and as time moves on the numbers are only going to get higher and higher.

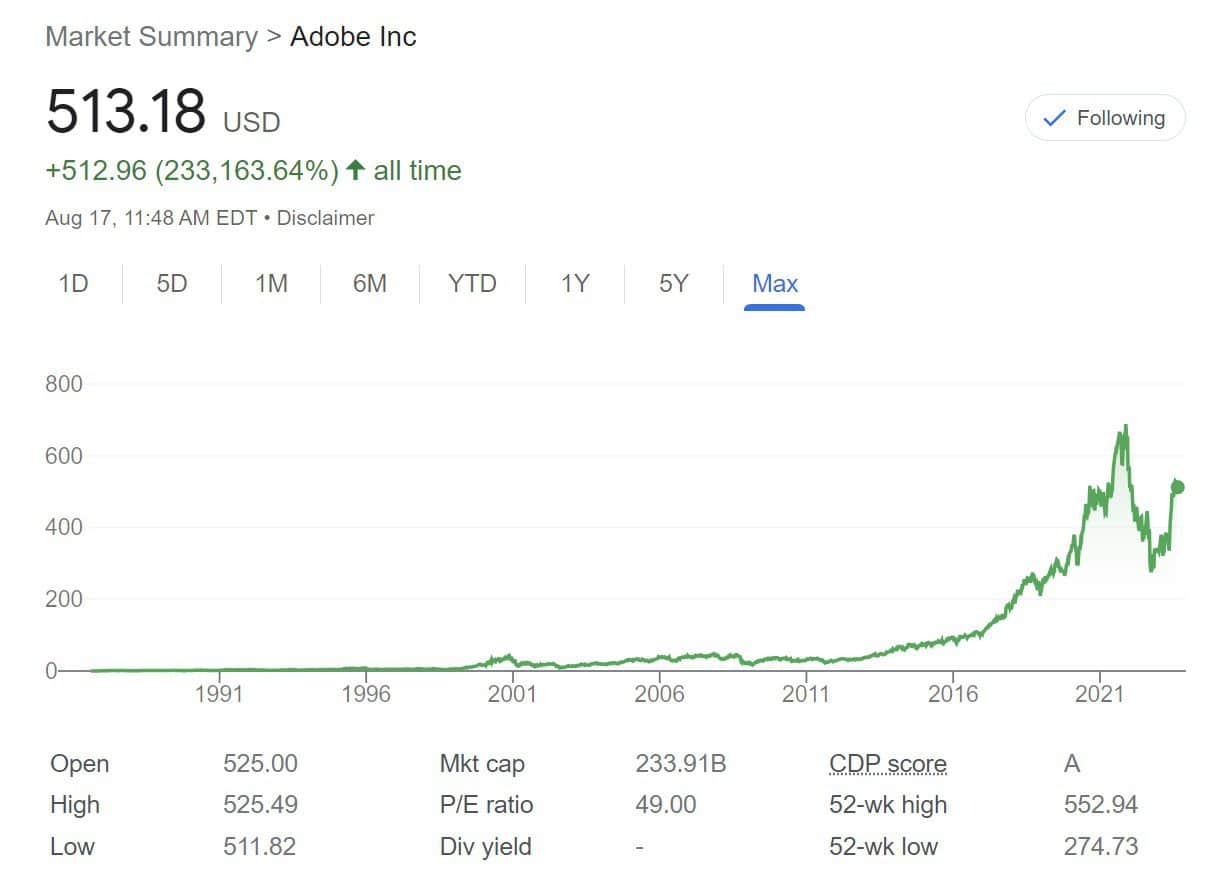

15. Adobe (NASDAQ: ADBE)

Adobe is one of the leaders in the software making industry. Although there are plenty of competitors to choose from, they are leagues above almost everyone else, which is why it’s a very safe bet to invest in it.

This company has a total market cap of $233.91 billion and on top of that, it encompasses over 20 extremely popular applications, including Photoshop, Premiere Pro and Illustrator.

All of these have become staples of the tech designer industry and they continue to become more and more popular as time moves on.

14. Home Depot (NYSE: HD)

This has been one of the most popular blue-chip stocks in the world for a very long time now and it’s pretty easy to see why.

Home Depot has been on the rise since it first hit the scene, and on top of that you’re looking at a company that holds a market value of over $333.64 billion right now with a dividend yield of 2.52%.

Analysts all came together to give Home Depot a big plus sign as even though the pandemic has had some less than desirable results in our lives, the one thing that it couldn’t damage is the people’s love for Home Depot.

In fact, during the pandemic Home Depot actually became the nation’s largest home improvement retail chain, showing us that even when the times are hard, a blue-chip stock will still persevere no matter what.

13. Broadcom (NASDAQ: AVGO)

Coming up next, we have Broadcom – one of the top semiconductor businesses in the world right now. If you’re on the market looking for a semiconductor supplier or manufacturer then chances are that you know all about the reliability behind this brand’s name.

It currently holds a huge market cap of $343.26 billion and a dividend yield of around 2.21%, and on top of that it also featured a total increase of $50% over the last year which is always nice to see.

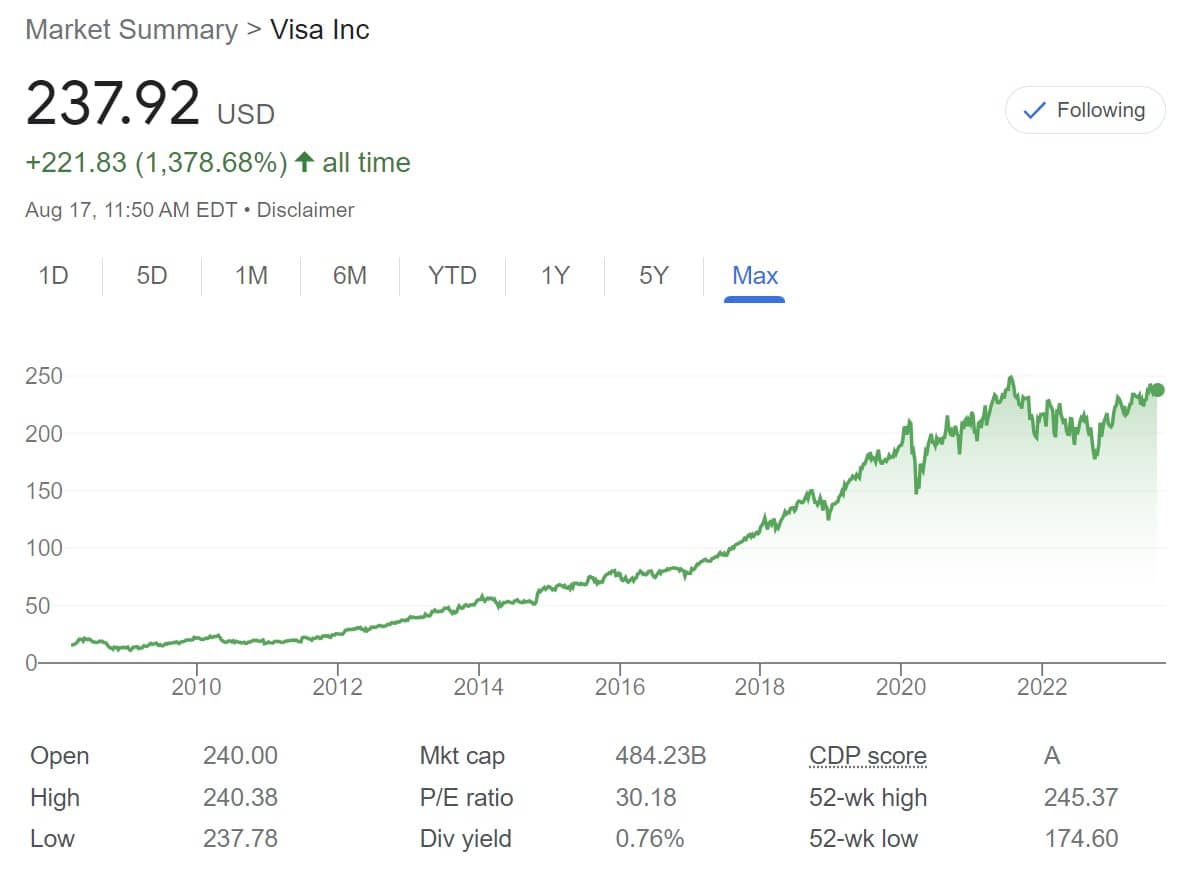

12. Visa Inc. (NYSE: V)

We all know what Visa is all about and why it’s such a great investment, so we won’t spend too much time on it.

All that we will say is that even though it’s not a big dividend payer as of yet, with it only featuring a total of 0.76%, it is still worth the money simply because it’s Visa.

11. Nvidia (NASDAQ: NVDA)

Over the past three decades or so, Nvidia has managed to build itself up as one of the top tech giants in the world, reaching all across the globe with its excellent products.

It features a massive market cap of $1.07 trillion right now, and if that wasn’t enough to get your attention, the numbers are rising steadily every single year as they have for over two decades now.

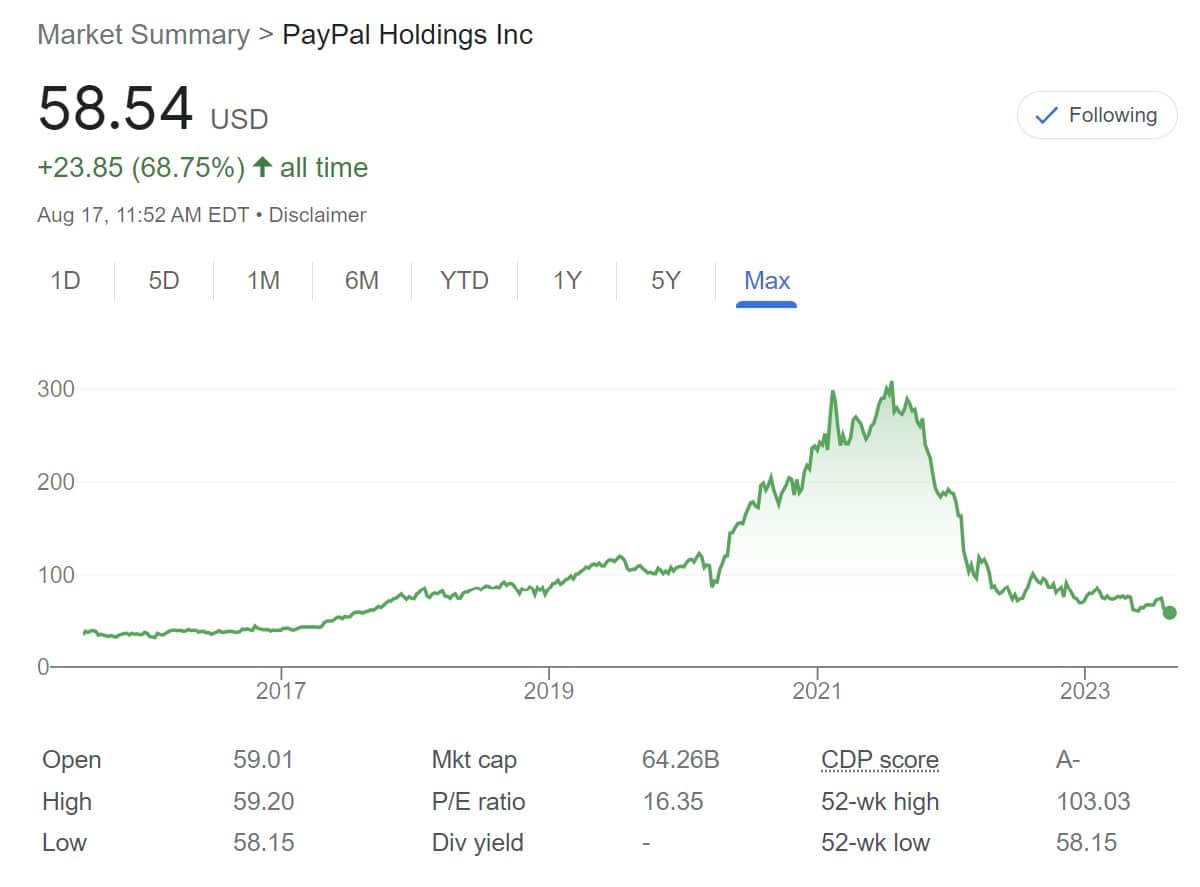

10. PayPal (NASDAQ: PYPL)

PayPal have already solidified themselves as one of the top blue-chip stocks out there by continuing to be on the rise for a very long time now, making good decision after good decision growing its capital value with every passing year.

But in this past year things took a different turn and PayPal’s shares have dropped a lot from their peak. That might be a reason to panic for some investors, but for newcomers this could be the right moment to get in.

PayPal currently holds a total market cap of $64.26 billion and although it doesn’t actually feature a dividend yield, it is still one of the most well-respected names in the industry.

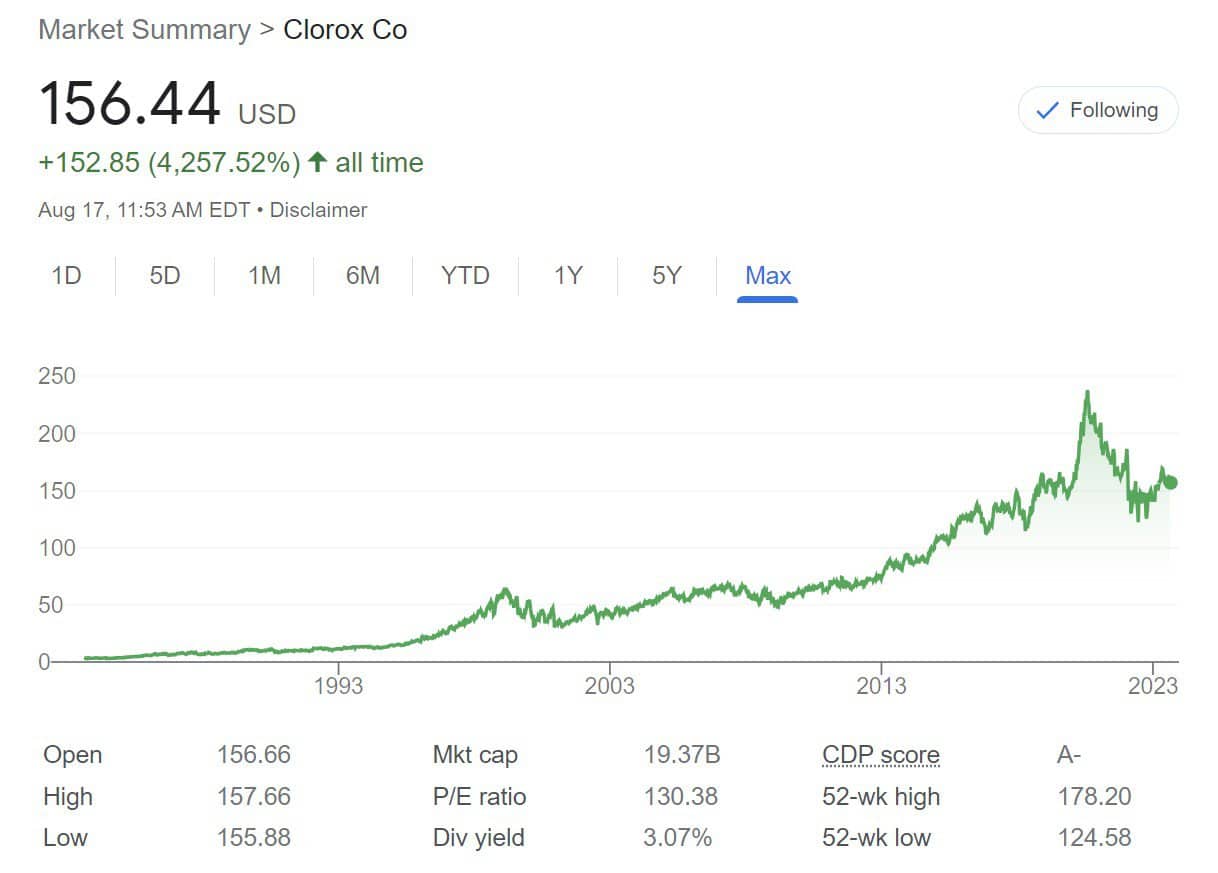

9. Clorox Co. (NYSE: CLX)

Clorox have definitely started the year swinging left and right as they actually managed to break records during the pandemic, almost doubling their sales and reaching new cost inflations that no one even considered to be possible.

On top of that, they continue to garner more and more attention from the general public and are sure going to be one of the top cleaner brands in the whole world for a very long time.

With a $19.37 billion market cap and a 3.07% dividend yield, things are looking pretty good for investors.

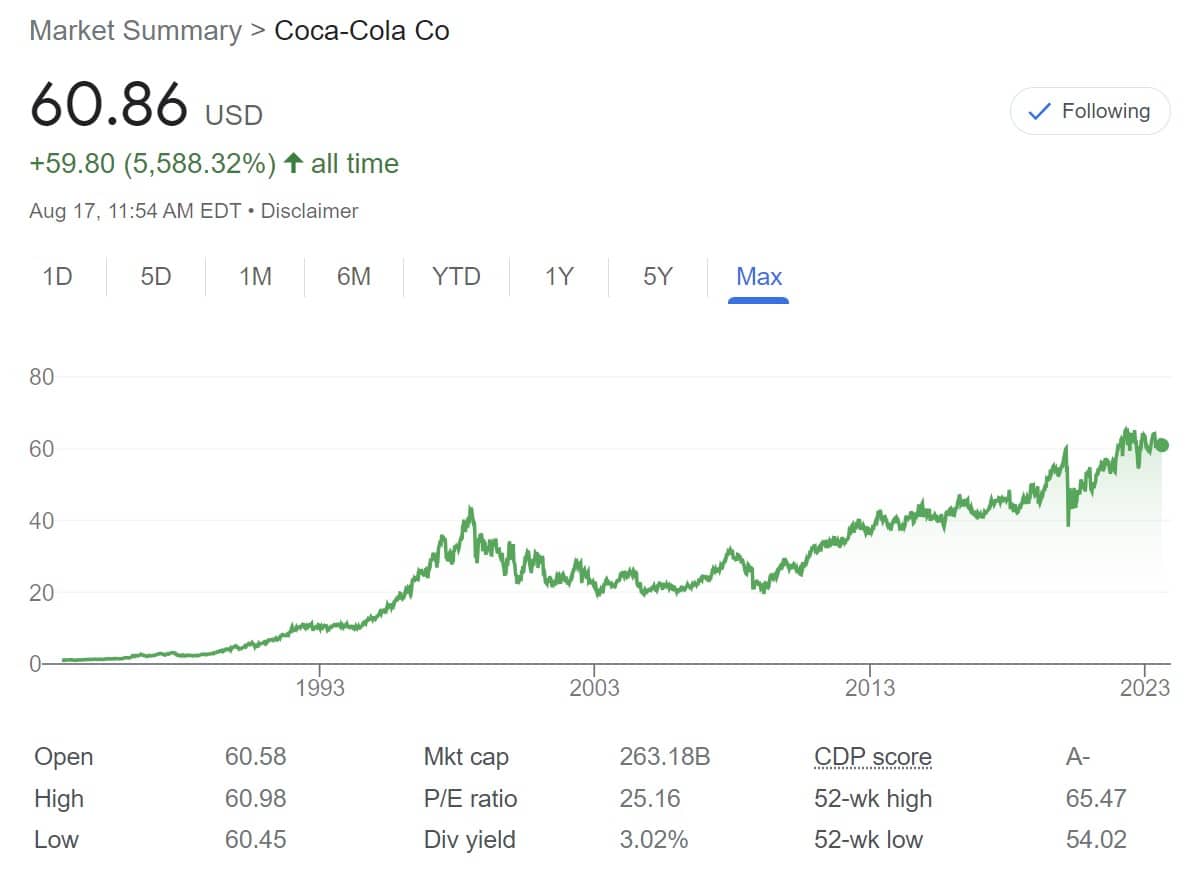

8. Coca Cola Co. (NYSE: KO)

Although Coca Cola has been one of the top soda brands in the world for a very long time now, they actually took quite a dive when the pandemic started, essentially losing around 28% in their sales as soon as 2020 rolled up.

This was because Coca Cola made most of its revenue from their social gathering sales.

We all know that you can’t go to the movies, to your local football match or to a restaurant without buying a bottle of Coca Cola so when all of these events were stopped their numbers plummeted hard.

Even with this massive dive though they still managed to keep themselves afloat, as a lot of new up and coming investors have decided to put their faith into it, and right now things are looking better than ever.

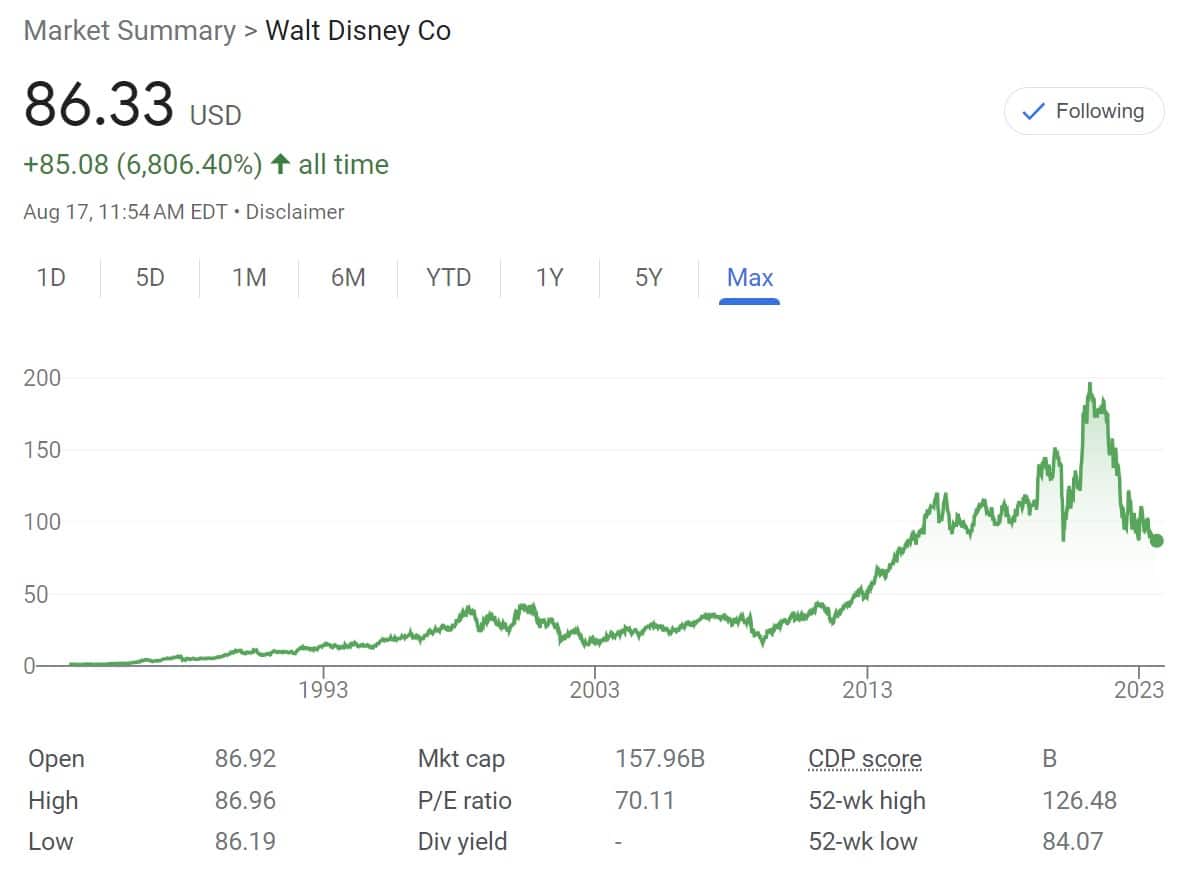

7. Walt Disney (NYSE: DIS)

If you’re looking for a safe stock then there aren’t a lot of better options out there than Walt Disney simply because they represent one of the top media and entertainment conglomerates out there.

They managed to adapt to the new age quite easily, creating some of the absolute best movies of all time for as long as we can remember.

Now, with a total market cap of $157.9 billion and a lot of new upcoming projects, let’s just say that investing in it is a no brainer to say the least.

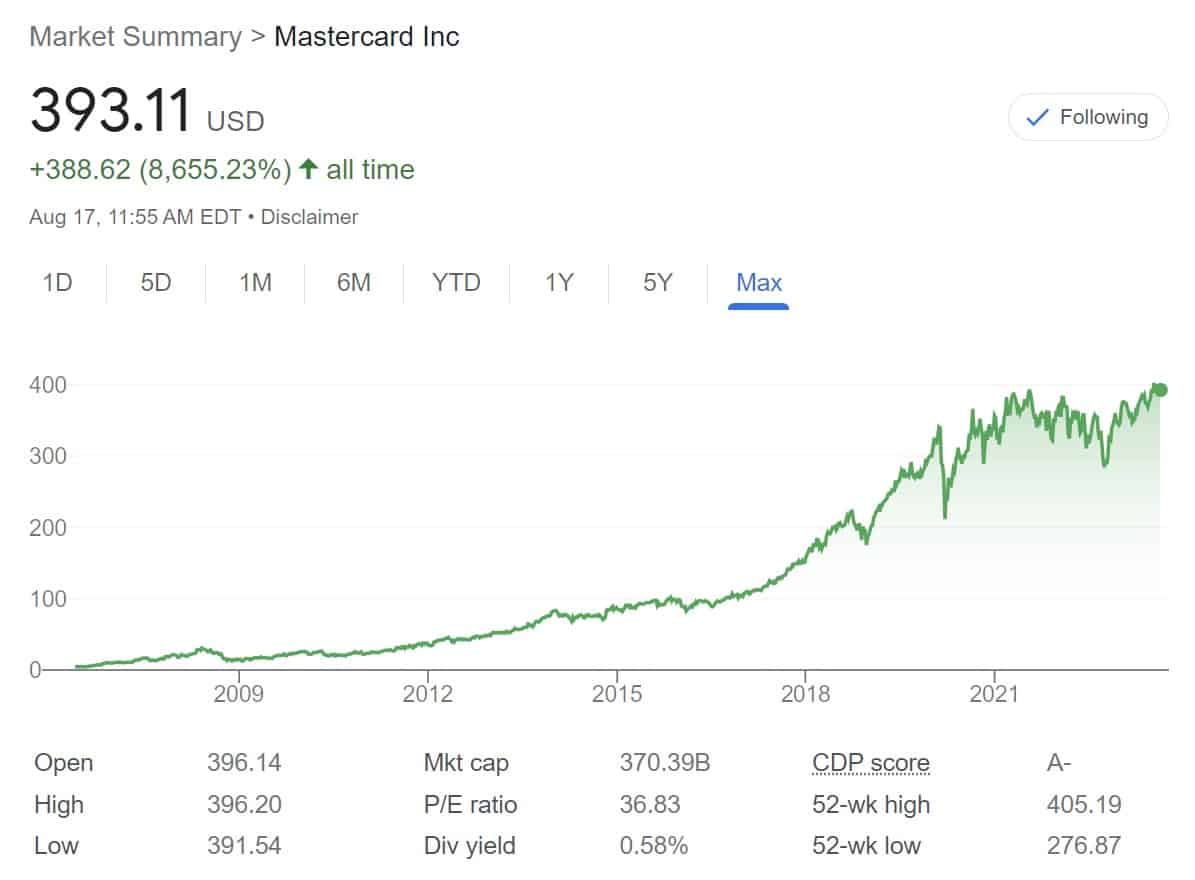

6. Mastercard (NYSE: MA)

This global payments processor is incredibly viable as a blue-chip stock simply because of how universally acclaimed it is.

We can’t even begin to imagine a world without Mastercard right now, and as much as we’d like to think that the crypto market is changing the world, there’s no way that the world can go on without the likes of Mastercard or Visa, which is why it’s such a good investment.

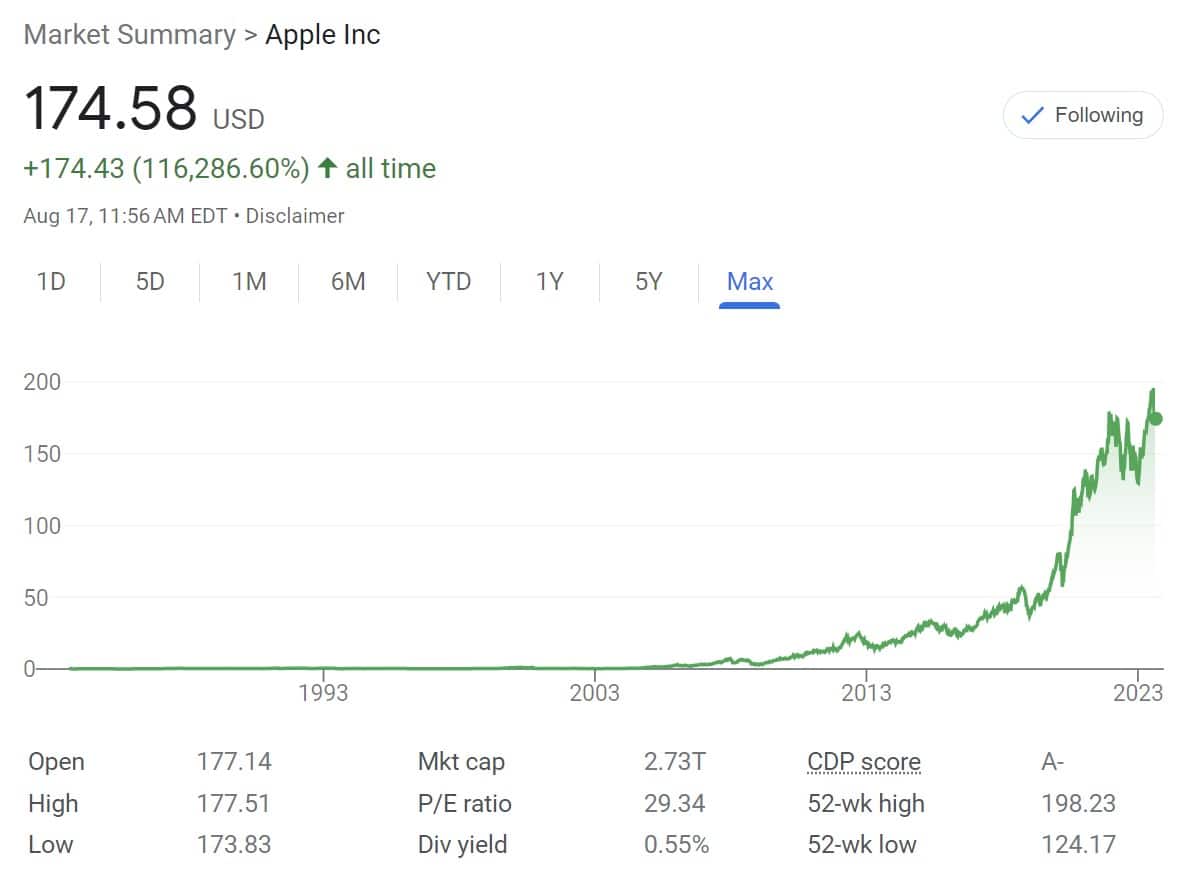

5. Apple (NASDAQ: AAPL)

Apple has always been one of the most recognizable and valuable brands in the world, and they hold a total market value of over $2.73 trillion as we speak.

Although their dividend yield is only 0.55%, let’s just say that nobody is every going to say that Apple isn’t a good investment regardless of the year we’re in.

4. PepsiCo (NASDAQ: PEP)

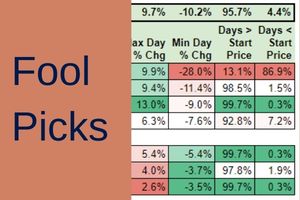

Pepsi, as opposed to Coca Cola, have actually managed to survive the pandemic quite easily, actually growing in numbers as time moved on, and according to most investors out there (or the graph above) it seems as though within the next year the numbers will grow even further.

Pepsi will always be a good choice to make especially thanks to its 2.80% dividend yield and the fact that it currently holds almost $248.49 billion in market cap.

3. Walmart Inc. (NYSE: WMT)

This is the perfect time to invest in Walmart simply because they just recently went on a small decline in numbers because of how slow their app was when the pandemic hit.

Analysts believe that this is a good sign as this brand has been on a constant rise for quite some time now, so this would be a good time to invest into it if you want to get your money’s worth off of it.

2. Amazon.com (NASDAQ: AMZN)

We all knew that Amazon was going to be on this list, so we won’t spend too much time talking about it.

It has a total market value of $1.39 trillion and even with no dividend yield it is still by far one of the safest investments you will ever make.

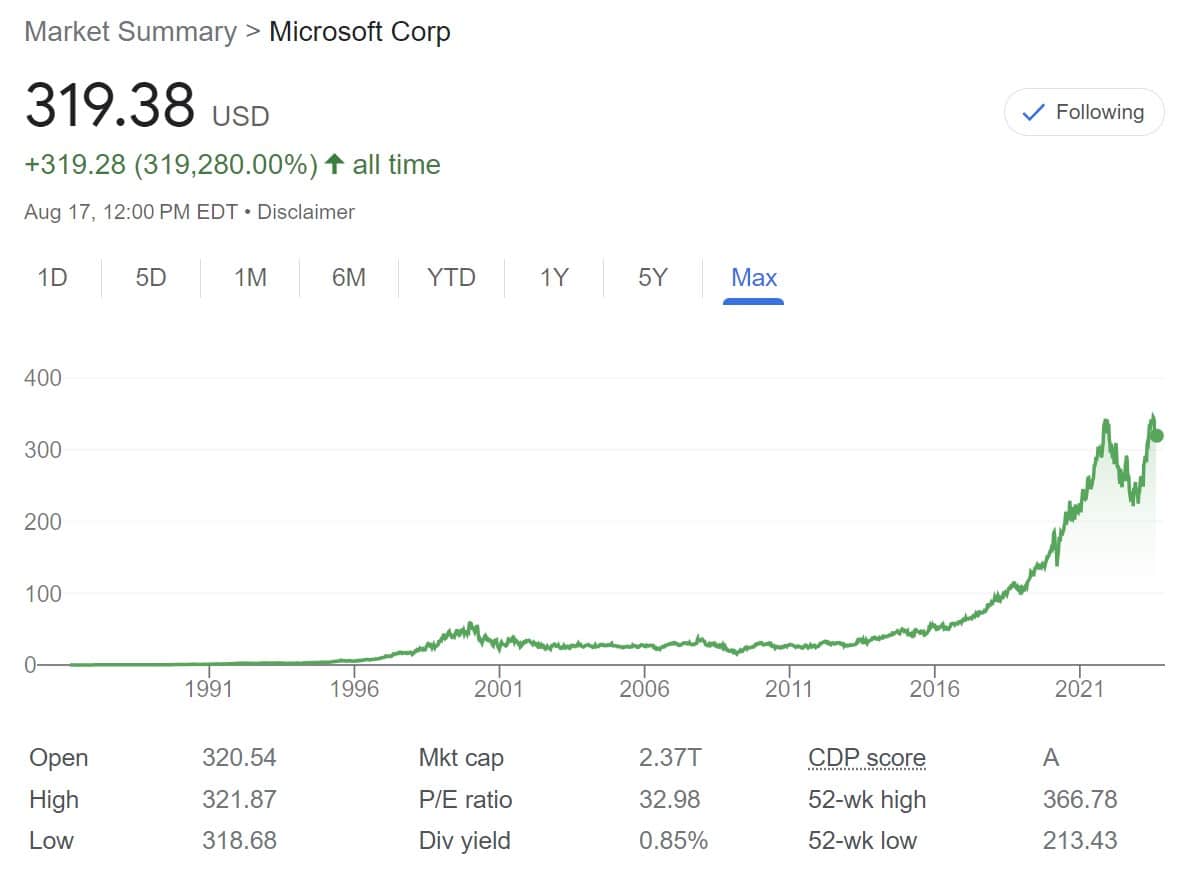

1. Microsoft (NASDAQ: MSFT)

Microsoft might have been overtaken by Apple in terms of its market value, but it is still a much better blue-chip stock to invest into simply because nearly 43% of all hedge funds rest on it in the Dow Jones Industrial Average, which is already a green flag to say the least.

Even so, you already know how big of a titan Microsoft is, and knowing this you should instantly figure out why investing in it is such a profitable idea in the first place.

Conclusion

Knowing all of this, you should be set on your way to making a profit today. Remember however that these are still stocks that we’re talking about, and you can never entirely get rid of the risk factor that comes with every investment.

In conclusion, blue-chip stocks are still an attractive opportunity for both newcomers and seasoned investors in 2023. Their stability and proven performance make them a valuable addition to any portfolio.

Yet, as with all financial endeavors, thoughtful consideration and careful planning are key to maximizing your potential gains and minimizing risk.

Contents

- What Are Blue-Chip Stocks?

- How to Identify Blue-Chip Stocks?

- Why You Should Invest into Blue-Chip Stocks?

- 20. Exxon Mobil (NYSE: XOM)

- 19. Verizon Communications Inc. (NYSE: VZ)

- 18. Pfizer (NYSE: PFE)

- 17. Intel (NASDAQ: INTC)

- 16. Bank of America (NYSE: BAC)

- 15. Adobe (NASDAQ: ADBE)

- 14. Home Depot (NYSE: HD)

- 13. Broadcom (NASDAQ: AVGO)

- 12. Visa Inc. (NYSE: V)

- 11. Nvidia (NASDAQ: NVDA)

- 10. PayPal (NASDAQ: PYPL)

- 9. Clorox Co. (NYSE: CLX)

- 8. Coca Cola Co. (NYSE: KO)

- 7. Walt Disney (NYSE: DIS)

- 6. Mastercard (NYSE: MA)

- 5. Apple (NASDAQ: AAPL)

- 4. PepsiCo (NASDAQ: PEP)

- 3. Walmart Inc. (NYSE: WMT)

- 2. Amazon.com (NASDAQ: AMZN)

- 1. Microsoft (NASDAQ: MSFT)