“What is a dividend safety score?” Simply Safe Dividends has developed a system to quantify the safety of a stock’s dividend payments. This score specifies the likelihood of a stock’s dividend being cut in the future. A broad range of factors are analyzed to calculate the safety of a stock’s dividend.

You can learn more about Simply Safe Dividends’ Safety Scores here.

A high dividend yield is great. Not if it comes at the expense of safety, though.

Remember the expected value formula:

(probability scenario 1 × payoff scenario 1) + (probability scenario 2 × payoff scenario 2)

Consider a fictional stock with a 25% dividend yield. That’s awesome and all, but not if the likelihood of actually receiving that dividend, in perpetuity, is only, say, 5%.

So, if the likelihood of receiving the 25% dividend yield is only 5% and the chance of receiving 0% is 95%, then our expected yield, from this fictional stock, is only 1.25% (25% × 5% + 0% × 95%).

Dividend safety is closely tied to the health of the company paying the dividends. The factors that follow are important to consider when estimating a stock’s dividend safety. Many will be addressed when you’re doing your overall investment analysis.

You’ll notice that many of these factors are closely related to one another too. They often revolve around the soundness and consistency of a company’s financial operations.

Also, theory is fine, but nothing beats real-life illustrations. So, in addition, I’ll look at some recent examples of stocks that have cut dividends.

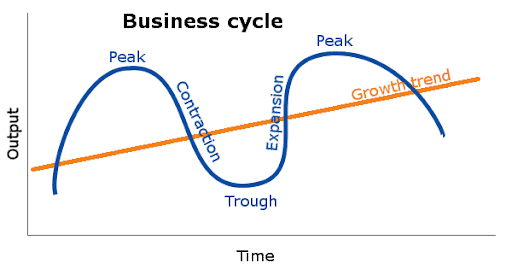

1) Industry cyclicality | Which stocks are the most sensitive to business cycles?

Cyclical industries are those that noticeably and consistently expand and contract. These cycles can be related to the overall economic cycle.

Not every industry is cyclical. Not every industry expands and contracts to the same extent.

Also, not every industry expands and contracts at the same time as the overall economy. In fact, some industries expand when the economy is contracting and contract when the economy is expanding.

Examples of cyclical industries include discretionary products and services. Things such as hotels, airlines, other travel-related businesses, high-end clothing, new automobiles, and restaurants.

Think about the first expenses that people cut when times get tough.

Examples of counter-cyclical industries include products and services that are necessities. Consumer goods and utilities, for example.

Stocks in counter-cyclical industries generally have a safer dividend than those in cyclical industries. Particularly during periods of economic contraction (recessions/depressions). Less volatility means less (perceived) risk.

Understand where our stock’s industry falls in terms of cyclicality. Does it expand before the economy as a whole? Or, afterward? Likewise with contracting.

The more severe the expansion and contraction, the less safe the dividend may be.

2) Recession performance | What happens when the economy contracts severely?

A recession is, technically, defined as two consecutive quarters of decreasing gross domestic product (GDP).

If your stock’s industry is cyclical, and it expands/contracts with the overall economy, a recession could present an enormous threat to the safety of its dividends. Recessions are, after all, a normal part of the economic cycle.

You should understand how your stock’s industry reacts to recessions in order to understand how safe its dividend is. There’s plenty of history to reflect upon as there have been three recessions already in the first 20 years of the 21st-century.

Dividends are paid from earnings. Earnings are what’s left of sales after all expenses have been paid. Obviously, dividend safety is directly related to sales and earnings growth.

If sales and earnings are growing, dividends are safer. Not only that, they’re likely to grow too!

Sales growth has been written about extensively on this site. Specifically, topics including:

- Sales growth analysis

- Sales target analysis

- Unique selling proposition

- Conversion funnel analysis

- Revenue, markup, and return on inventory

- Sales per rep analysis

While sales growth is critical to earnings (and dividend) growth – costs matter too. So, don’t forget to analyze profit margins as well.

4) Return on invested capital | Every expense is an investment

Return on invested capital (ROIC) is a ratio that compares after-tax profit to invested capital. The particulars on how to calculate that is beyond the scope of this post.

The bottom line is that ROIC is a measurement of how well the firm invests its money. Remember, every investment (business) boils down to three things – money out, time, and money in.

A company must be investing its money wisely if its dividend is to remain safe. In particular, the firm must invest its money and earn a return beyond its cost of capital. The cost of capital is the cost of debt and equity.

How does a firm invest its money exactly? By purchasing materials, labor, advertising, overhead, and so on. Every dollar of expense is an investment. Whether the firm earns a satisfactory return on that investment, is a different matter

5) Free cash flow | Not the same as net profit

Free cash flow (FCF) is another one of those financial concepts that can be calculated in a number of different ways.

Generally speaking, however, it is calculated by taking cash from operations and subtracting the net investment in operating capital (also known as CapEx).

Cash from operations is net profit plus non-cash expenses such as depreciation and amortization. Source.

Net profit, as reflected on the income statement, is technically what dividends are paid from. But, obviously, a company needs cash to pay dividends. General ledger entries don’t put cash in investor’s pockets. That’s why non-cash expenses are added back into net profit and cash that will be spent on CapEx is taken out.

These tweaks to net profit better reflect how much cash is available for dividends. The more cash available for dividends, the safer those dividends are.

Free cash flow is the money left over from normal operations after “necessary” expenses for property and equipment have been paid. Free cash flow is what actually flows through to the owners of the company (shareholders). It tells investors about the health of the business. A quick calculation of FCF every quarter can offer valuable insights into the safety of your stock’s dividend. You can find the information you need to calculate FCF on some financial websites and in a company’s SEC filings.

6) Debt and dividends | Can a company do both?

Debt is not nearly as dirty of a word for companies as it is in the personal finance space. In fact, leverage is commonly used by companies in order to earn higher returns on invested capital.

Generally speaking, leverage comes in two forms:

- Financial – The use of borrowed money (debt)

- Operating – The use of other fixed costs besides interest

While the use of leverage can amplify positive sales and earnings growth, it can also amplify declines in sales and earnings. When borrowed money (and other fixed costs) cannot be used to earn high returns, the safety of the stock’s dividend decreases.

The degree of financial leverage and the degree of operating leverage equations are useful when performing analysis on a stock. Simply speaking, these formulas tell you what a change in sales and operating profit will mean for net profit.

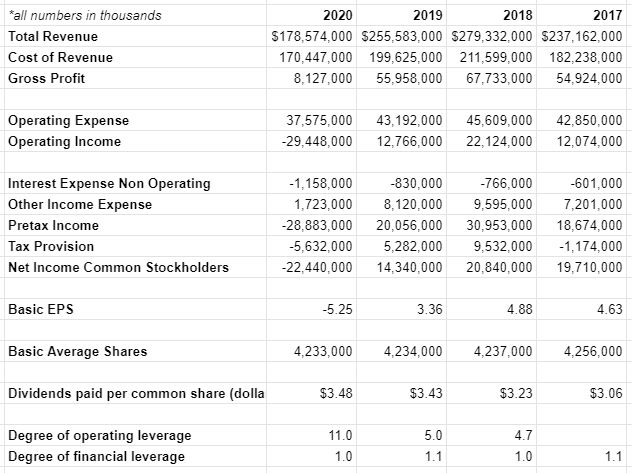

Let’s consider Exxon Mobil Corporation (XOM).

Their degree of financial leverage is usually around 1.0. Meaning that the cost of debt isn’t going to affect net income excessively. A 42% decrease in operating income would likely result in a 42% reduction in net income, all other things being equal.

XOM carries a lot of operating leverage (fixed operating expenses), however. Which is not surprising, given the nature of their business. A degree of operating leverage of 5.0 meant that a big decrease in revenue in 2020 translated into a negative operating income.

Operating leverage is not debt – in the traditional sense. You can see however how huge fixed operating expenses can have the same effect as a lot of debt.

To XOM’s credit, though, they proved how safe their dividend is in spite of extraordinary circumstances. Not only did they avoid a dividend cut in 2020, they actually increased their dividend by $.05!

7) Dividend payout ratio | What does it tell us?

The dividend payout ratio tells you what percentage of earnings the company is returning to shareholders.

If you’re not familiar with the dividend payout ratio, it might seem that the more that gets returned to you, the shareholder, the better. In a vacuum, that’s true. But, due to industry cyclicality, the threat of recession, and other risks, it makes sense for the company to retain some of its earnings for when times get tough.

If a company returns all of its earnings to the shareholders in the present, the safety of the future dividend payments might be put in jeopardy

There is no firm payout ratio that is good or bad. However, a rough rule of thumb is to assume that 80% or more is detrimental to dividend safety.

8) Consistent dividends | What signal do they send?

There’s a concept known as the Lindy effect which states the longer something has happened the longer it’s expected to continue to happen.

Consider how that might apply to dividend safety. The longer a company has paid a dividend the longer you might expect it to continue doing so – all things being equal.

Why?

Well, paying a consistent dividend for a long time implies that the company has sound dividend policies. It implies that the firm knows how to handle:

- Industry cyclicality

- Economic downturns

- Sales and earnings growth

- Financial operations

- Leverage

In fact, there’s a whole class of dividend-paying stocks that are renowned for their consistent (and growing) dividends. These dividend stocks are known as the Dividend Aristocrats.

They’re the bellwether, blue-chip, dividend payers that serve as the benchmark for all other dividend-paying stocks. Their consistent and growing dividends are considered very safe.

Of course, there are no shortcuts to dividend consistency. Only by delivering quarter after quarter, year after year, can a company prove its dependability.

Recent dividend cuts | Real life examples

Below is a sampling of three stocks that have recently cut their dividend. Additionally, some of the safety factors that might have contributed to the dividend cut are highlighted.

Why did Wells Fargo cut its dividend?

On June 29, 2020 Wells Fargo & Company (WFC) announced that it would be cutting its dividend by a whopping 80%.

This was a by-product, in part, of a change in the capital requirements by the Federal Reserve. Changes made in response to COVID-19.

Beyond that, Wells Fargo’s earnings performance during the COVID-19 related economic downturn has been disappointing. Wells Fargo reported a $2.3B loss for the quarter ending 06/30/2020.

Why did BP cut its dividend?

On August 4, 2020, BP p.l.c. (BP) announced that it was cutting its dividend 50%. BP’s first dividend cut in ten years.

The cut was necessitated by BP experiencing its largest quarterly loss in the history of the company. The loss was driven by a steep drop in oil prices fueled by the COVID-19 economic downturn.

A high dividend payout ratio and debt level also contributed to the dividend cut.

Why did NLY cut its dividend?

On June 10, 2020 Annaly Capital Management, Inc. (NLY) announced a 12% dividend cut.

This dividend cut is on the heels of steadily decreasing net interest income. NLY is a capital manager that invests in, and finances, commercial and residential assets.

Dividend cuts are nothing new for NLY. This is the 9th time NLY has cut dividends since 2011. Not exactly the model of dividend consistency.

What is a dividend safety score?

As you can see, ascertaining the safety of a stock’s dividend goes hand-in-hand with analyzing a stock for investment. Investing in sound, growing companies increases the likelihood of receiving consistent, safe dividends.

Remember, that yield isn’t everything. It’s about finding a balance between a great yield and a safe yield. If the dividend is safe, your yield on cost will likely increase over time.

Contents

- 1) Industry cyclicality | Which stocks are the most sensitive to business cycles?

- 2) Recession performance | What happens when the economy contracts severely?

- 3) Sales and earnings growth | Directly related to dividends

- 4) Return on invested capital | Every expense is an investment

- 5) Free cash flow | Not the same as net profit

- 6) Debt and dividends | Can a company do both?

- 7) Dividend payout ratio | What does it tell us?

- 8) Consistent dividends | What signal do they send?

- Recent dividend cuts | Real life examples

- What is a dividend safety score?