Generally speaking – growth in stock price depends on growth in profit; which depends on growth in sales. The company you are analyzing will likely need a sound strategy to grow sales. As a potential investor, you want to draw your own conclusions about management’s business growth and expansion strategies. Otherwise, you might look at past sales alone to forecast future sales. Or, you might simply rely on the company or analysts to tell you what they think/hope sales will do. Better to rely on your own conclusions.

Search and speculate

This is the third post on Point 2 of Philip Fisher’s 15 Points outlined in his book Common Stocks and Uncommon Profits.

Point 2 is summarized as follows:

Does the management have a determination to continue to develop products or processes that will still further increase total sales potentials when the growth potentials of currently attractive product lines have largely been exploited? All markets eventually mature, and to maintain above-average growth over a period of decades, a company must continually develop new products to either expand existing markets or enter new ones.

(Source)

The first post discussed how to perform due diligence on senior management. The second addressed the business life cycle and what strategies a company can employ to achieve new growth.

With the groundwork laid, it’s time to size up the company you’re analyzing.

Nothing too complicated here. All you’ll need is a search engine and the willingness to do a lot of ready. It’s as simple as searching “[company name] growth strategy”. Or, some variant of that phrase.

If you want to dig a little further, you can search for specific growth strategies, e.g. “[company name] market penetration,” “[company name] market development,” “[company name] product expansion,” “[company name] diversification,” and “[company name] acquisition/merger/joint venture/alliance.”

They’re usually happy to tell you

Fortunately, in this day and age, this sort of information is easy to come by. Companies are self-promotional by nature. So you don’t have to commit industrial espionage to get a general idea of what direction a company is heading.

Along the way, you’ll find a lot of the same stories popping up again and again. You’ll also learn a little more about the company’s recent history. There will plenty of press releases that paint a rosy picture of everything the company does. Additionally, you might actually find some thoughtful commentary from other analysts.

When all is said and done, you should have a solid picture of the company’s strategies for growth – assuming one exists. It’s up to you then, to decide whether these strategies will be effective or not.

How I gauged Energizer Holdings’ strategies to grow and expand

Similar to what I did on the Point 1 posts, I’ll attempt to apply what I’m writing about to an actual publicly traded company.

For Fisher’s Point 1, I used Foot Locker, Inc. (FL) as my example. Here, I’ll use Energizer Holdings, Inc. (ENR). Foot Locker was chosen at random. But, since I have a professional background in manufacturing, I thought it would be smart to stick with what I know best. That’s why I decided to pivot to Energizer Holdings (Energizer) this time around.

I’ll start off by walking through the processes I outlined in my previous two posts (Does Senior Management Have the Right Qualifications and Business Growth Strategies for Each Stage of the Life Cycle). Then, I’ll wrap up with commentary based on what I found when searching for “Energizer [strategy]”.

The head honchos at Energizer

Here, I’ll start with the readily available information. From there, I’ll dig deeper and see what can be found beyond the stale corporate-approved boilerplate info.

10-K & investor relations website

Neither the company’s 10-K nor their investor relations (IR) website offered an overabundance of information. Both read about the same for all of the members of senior management.

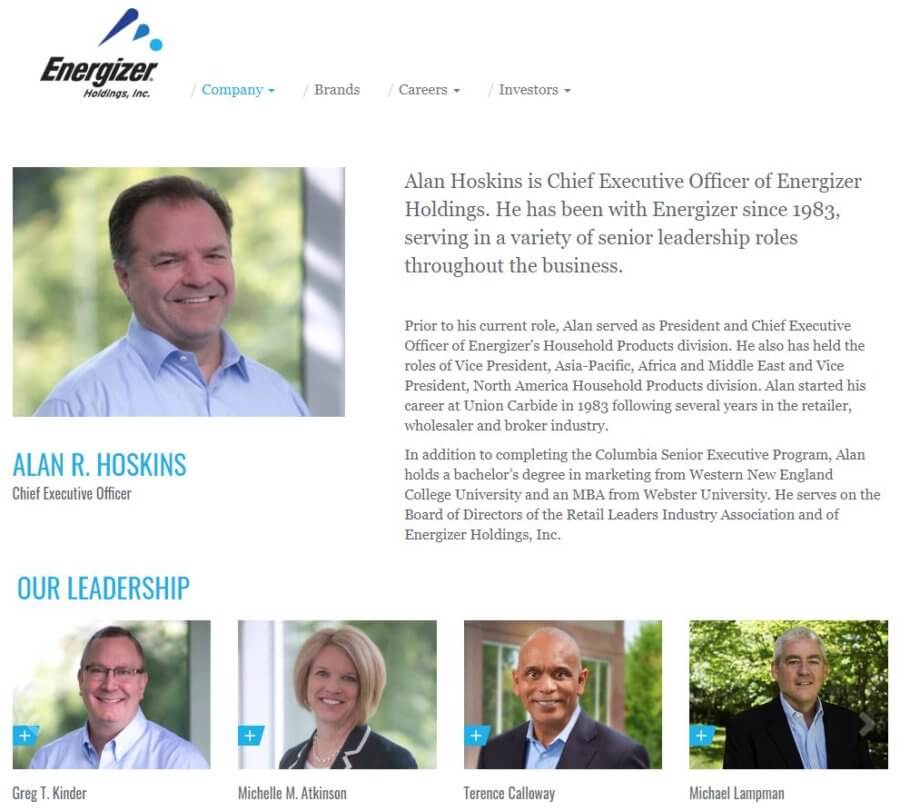

Missing leadership

Oddly, though, I noticed that a couple of individuals had their profiles removed from the IR website. The only reason I know this is because I took a screenshot from the Energizer IR website for my post on senior management.

Here’s what it used to look like:

Now, Michelle Atkinson, Terence Calloway, and Michael Lampman (and possibly others) are conspicuously missing.

It’s probably just a matter of redesign. But, a little surprising nonetheless. It would seem to me to be a slap to the face to be removed from the “Our Leadership” section of the IR website.

Other items of note

Beyond that, there were a couple of other things that stood out to me when acquainting myself with Energizer’s senior management.

Let me preface this by saying that I don’t know any of these people and have never worked with them personally. They might be great, they might not be worth a damn. I don’t know. I’m merely drawing conclusions based off of the information I can find – just as they would if they were reading my resume.

Mark LaVigne, COO

One of the things that jumped out at me first, is the employment of someone who had previously worked their entire career as a lawyer in the Chief Operating Officer (COO) position. I’m referring, of course, to Mark LaVigne. When I think of managing operations for a manufacturing company, I think of managing everything from purchasing raw materials to shipping finished goods. I don’t think of mastery of the law, per se.

Beyond that, he is listed 2nd on the IR website, behind Alan Hoskins, CEO. Maybe I’m reading too much into this. But, when someone was entering this information into the IR website, they had to think to themselves “Okay, the CEO is first, of course. Who is unofficially 2nd in command? What about 3rd?” and so on…

It just seems like an odd appointment to me. Perhaps LaVigne serves as the figurehead and Greg Kinder (EVP and Chief Supply Chain Officer) is the one who makes most of the operating decisions? Maybe LaVigne is a hell of a “yes man” and that’s why Hoskins keeps him as his right-hand guy? In any event, we have a lawyer as COO and (seemingly) 2nd in command at Energizer.

Tim Gorman, CFO

Next, is Tim Gorman, CFO. I’m not a huge fan of the university system, by any means. In fact, I think it’s refreshing that many of Energizer’s senior management team don’t have Master’s degrees. It implies, possibly, that they’re judged more on their merit than their formal education.

However, knowing what I know about accounting, I would think it appropriate to have a CPA as your CFO. Unlike other business disciplines, accounting deals with pretty straightforward rules. Therefore, given the scrutiny that publicly traded companies are under, it’s just surprising that the head of finance doesn’t have more formal education/training in accounting.

He does have a bachelor’s degree in accounting. And, I imagine he has several CPA’s working for him. Which is good for Energizer. Because, I can tell you from experience when the head of finance isn’t formally trained in accounting, it can be trouble. Not because the head of finance is an idiot. But, the problem lies, again, in the nature of accounting.

Accounting has a universal language that is taught in the textbooks you read on your way to an accounting education/certification. If a person doesn’t receive their education about accounting from those textbooks, they tend to develop a vocabulary of their own. This hurts their ability to communicate with their peers and to those who they manage.

LinkedIn profiles

Not surprisingly, the LinkedIn profiles for Energizer’s senior management was a mixed bag. Everybody had a profile, but some were very detailed and others didn’t even have a profile picture.

I can’t really draw any firm conclusions from this because some people just aren’t compelled to spend time on LinkedIn. Frankly, I can’t blame them. I’ve spent a lot of time on my LinkedIn profile and I don’t know that it’s ever amounted to a damn bit of good.

That being said, of the profiles, Greg Kinder’s (Chief Supply Chain Officer) gave me the most warm and fuzzy feelings. I just got the impression that he was a competent manager.

Again, I might be wrong and it might all be a facade. Maybe he’s the weak link in senior management at Energizer? Maybe the others are more “doers” than “tellers?” In any event, it’s Greg that I have the most positive opinion of at this point in my analysis.

With that, let’s move on and see if we can find some actual evidence that any of these people “…have a determination to continue to develop products or processes that will still further increase total sales…”

Diggin’ a little deeper…

I searched web results, news, and videos for each executive. My search query was simply “[name] energizer”.

Tim Gorman, CFO…again

The first thing that caught my eye was the press release from when Tim Gorman, CFO was hired. It read: “Following an extensive search for a Chief Financial Officer, Tim Gorman was the clear choice,” said Alan Hoskins…” (Source).

This struck me as odd because “clear choice” implies that an “extensive search” wouldn’t be necessary. Especially when Gorman was already an employee at Energizer.

While researching Greg Kinder (Chief Supply Chain Officer), I came across this press release. In it, I noticed that the former CFO, Brian Hamm, also worked previously at PepsiAmericas. Presumably alongside Tim Gorman.

This leads me to believe that Gorman got his position because of who he knew rather than what he knew. Of course, that’s the way the world, I know. But, we’re undertaking this exercise to ascertain the appeal of investment in Energizer. So, personally, I would want to believe that the executives of the company I’m invested in earned their position based on merit. Not being chummy with their boss.

Admittedly, I might be misinterpreting what I’m seeing. To me, it’s worth noting, however.

As for the rest of Energizer’s senior management, Mark LaVigne (COO) aside, there wasn’t much more information to be found through a web search.

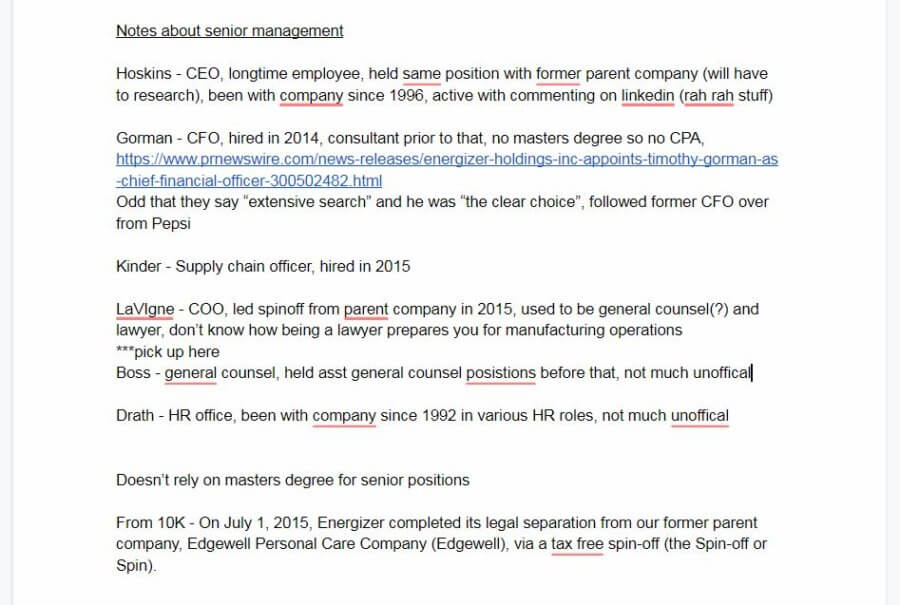

My notes and conclusions

Having gone through this exercise, I now feel that I know Energizer’s senior management a little better. Short of meeting and spending time with these people, there’s not much more I could learn about them.

Additionally, I learned more about the company – particularly details of its recent spinoff from Edgewell Personal Care Company (EPC).

As I said in the post on evaluating management. I recommend you keep, at least, some rudimentary notes. Particularly if you’re planning to do this sort of research often.

Here’s a glance at the notes I took:

I now feel prepared to move forward with my analysis of Energizer’s stage in the business life cycle and the potential strategies it might employ to perpetuate growth.

Energizer’s life cycle and potential growth strategies

Energizer’s roots go back to 1896 when it was founded as the American Electrical Novelty & Manufacturing Company (Source). Since then, it has been acquired and spun off a number of times.

Given its long history and after a quick glance at its financials over the past eight years, I’m lead to believe that Energizer is a mature company.

Hopefully, it’s not teetering on the brink of decline. Sales have fallen (and rebounded a little) from a high of $2.2 billion in 2011 (Source).

Growth strategies for a mature company

So, if I assume that Energizer is a (very) mature company, what strategies might I expect it to undertake to promote growth?

Market penetration seems unlikely. Batteries and most other household consumables are commodities. Since Energizer sells to retailers, they don’t interact directly with end-users. So, there’s no chance to offer more customer service in order to increase market share.

Market development is a possibility, I suppose. Though, being as mature as it is, I would imagine Energizer has already thoroughly explored this strategy. I know from what I’ve researched thus far that they have divisions across the world.

Product expansion (R&D) would seem to be a viable strategy for such a mature company. A quick glance at their financials shows me that they do make a pretty steady investment in R&D. It is, however, a relatively small percentage of sales. Which might be okay, since their R&D efforts haven’t produced much fruit to date.

The discovery of something novel could give Energizer a boost in sales. The discovery of something revolutionary, particularly in the energy (battery) market, could propel them to a whole new level of success.

Finally, the prospect of buying another company to propel growth seems like a very viable strategy for Energizer. In fact, I know from what I’ve read thus far, that it’s a strategy they’ve employed recently with the acquisition of certain Spectrum Brands brands.

Let’s get into specifics and see what strategies Energizer has, and might yet, use to “…further increase sales…”

Energizer’s business growth and expansion strategies

Since I now have an understanding of the players (senior management) and a context (stage in life cycle, potential strategies), I can now search and speculate about what Energizer might do next.

I’ll start first with a simple web search of the term “Energizer growth strategy”.

The top result was a Motley Fool article that touted Energizer as a great investment after their acquisition of “feminine care” brands from Johnson & Johnson (JNJ) in 2013 (Source). It speaks of the opportunity for Energizer to continue to grow via acquisitions. It even goes so far as to mention Spectrum Brands Holdings, Inc. (SPB) by name. As if on cue, Energizer recently bought several brand names from Spectrum.

So, it seems that growth by acquisition is certainly one strategy that Energizer wants to employ to further increase sales.

If you’re like me, you don’t have a ton of faith in the Google algorithm. My experience is that the top results are rarely the best results. So, I’m going to expand my search beyond just page 1. I’ll also check out some other results like video and news.

It’s up to you how much time you want to spend searching. You might find tidbits of information that aren’t directly related to your company’s growth strategies – but are valuable nonetheless. There is no hard-and-fast rule about how much research you should do. I’d say – research until you don’t feel like you’re getting any new information.

As far as Energizer goes, it seems that their primary strategy for growth is via acquisition. Not of companies, but of brands.

Rounding out the research

Though I feel like I have my answer as far as Energizer’s growth strategy, I’ll perform a few more cursory searches so that I can be comfortable that I have a (more or less) complete picture.

Energizer market penetration

My search for “Energizer market penetration” showed several articles about their previously mentioned acquisitions from Spectrum which included the Rayovac brand name. From what I gather, Rayovac was 3rd in market share behind Duracell and Energizer. This acquisition should come close to closing the gap between Duracell and Energizer (Source).

I wouldn’t really classify this as market penetration since this growth in market share wasn’t obtained organically. But, it did, technically, increase Energizer’s market share.

I also found an interesting presentation and a pretty good WSJ article (seriously) that expounded further on the battery market.

Energizer market development

A search for “Energizer market development” also referenced the acquisition from Spectrum. Another battery brand acquired by Energizer is called Varta. However, if I read the information correctly, they had to turn around and sell the Varta brand in order to receive approval from the European Commission for the purchase of the Rayovac brand (Source).

I don’t know that Varta would have helped Energizer reach new markets. But, it would have helped to increase market penetration in international markets.

Energizer product expansion

A search for “Energizer product expansion” turned up an article about Energizer EcoAdvanced batteries which are made of 4% recycled batteries. Not sure how old the article was.

I also found a press release regarding Energizer Recharge batteries which are also comprised of 4% recycled material but are rechargeable.

Neither appears terribly groundbreaking. But, I suppose, its something for the folks in R&D to hang their hat on.

Energizer diversification

Finally, a search for “Energizer holding diversification” gave me results on their recent acquisitions. Again, it seems that they are using acquisitions to execute on the other growth strategies. In a second deal with Spectrum, they have opted to purchase auto care brands including Armor All and STP.

Obviously, auto care is a far cry from batteries and feminine products. So, definitely a diversification of product lines.

Business growth and expansion strategies

It seems to me that Energizer’s business growth and expansion strategies involve acquiring other household brands. There is very little evidence of organic market penetration, development, expansion, or diversification.

Buying growth is fine and good. It’s essentially what we are doing when we buy stocks as investments. Just as us individuals are judged by the performance of our investments, so will Energizer and companies that employ a similar strategy.

You make your money when you buy – the saying goes. Energizer paid a lot for these brands. So, the returns had better justify these enormous expenses.

It could be that Energizer saw something in these investments that the seller did not. Or, they saw a way to utilize their existing infrastructure in order to realize extraordinary returns.

However, the point of these posts on Fisher’s Point 2 isn’t to scrutinize the prudence of these investments with a DCF analysis. It’s simply to ascertain if “…management have a determination to continue to develop products or processes…”

I do believe they have a determination. However, since they chose to exercise that determination via acquisitions rather than organically – what that means for the company is unknown. It will depend, in large part, on senior management’s ability to exploit opportunities related to these acquisitions. In that respect, I’m not terribly confident.

Do you think I’m wrong in my sizing up of Energizer’s management and their strategy for growth? If so, why?

What other search terms would you use to determine management’s strategy for growth?

Would you use a different means besides an internet search? What other ways are there to suss out management’s strategy?