The economic climate right now is harsh one. Whether you are a consumer struggling to meet rising food costs, or an investor straining to find good options, 2022 is hurting everybody. In this post we are going to take a look at the Canadian stock market, examine its health and look at some of the best Canadian dividend stocks picks for 2022 as well as the best dividend ETFs.

Before we begin, do remember that when trying to identify the best dividend stocks, it is important to focus on an options dividend growth strategy as well as its current yield. Whilst high yield dividend stocks may look good in the short term that impressive yield may soon recline if the company is not growing.

An Overview of The Canadian Stock Exchange

The Toronto Stock Exchange (TSX) traces its origins back to 1852 and is currently accepted as being the 11th largest stock exchange in the world. Based in EY Tower, the Toronto Stock Exchange has over 1,700 listed issuers with a combined market capitalization of CAD $3,059,755,023,680. The TSX is home to Canada’s Big 5 Banks (we will come to these later) and a number of commodity trading companies who currently are doing well out of the global energy crisis.

The Toronto exchange is only 6% of the size of the US exchange and does not perhaps enjoy the same global esteem as its counterparts on Wall Street and the City of London. Still, it does include some very well-known companies including the Royal Bank of Canada, Suncor, and Canadian Pacific and has more oil and gas companies listed than other exchanges.

Also, recent decades have demonstrated that the Canadian exchange does maybe offer a stability that it’s more booming-and-busting rivals lack. Whilst the Canadian exchange was hit by the global financial crisis of 2008 and its value dropped 50%, it still fared better than both the US and the UK’s exchanges owing to a lower exposure to mortgage securities. Ultimately Canada is one of the world’s richest countries. It boasts a strong natural resource base and traditionally has a stable, low deficit, monetary policy.

Criticism Of The Canadian Stock Exchange

Some commentators have argued that the Canadian Stock Exchange is overtly vulnerable to swings in the global economic cycle. Indeed, the biggest sectors in the TSX are financial services (33.5%), energy (14.8%) and industry (11.7%). However, whilst cyclical stocks may trouble some investors, others consider them preferable to swing stocks – after all, a cycle always eventually comes back around.

Additionally, some Investors are perturbed by Canada’s close ties with the US which can undermine diversification. Additionally, the country’s natural resources sector is especially susceptible to fluctuations in commodity prices and will presumably decline in coming decades as green energy finally comes into its own.

Who Can Invest in The Canadian Stock Exchange?

You do not need to be a Canadian citizen to invest in the Canadian Stock exchange. Some Canadian stocks are “inter-listed” on other exchanges (mostly in the) US, and US citizens are also free to buy any stocks through American Depository Receipts.

The 10 Best Dividend Stocks in Canada By Sector

Energy – For High Yield Dividend Stocks

Energy stocks are widely considered to be a very safe investment – afterall, we all need energy all of the time. In Canadal the sector is also tightly regulated which lends it a degree of extra stability although it can sometimes impede growth.

Canada produces a lot of oil and gas and as such, can benefit from rising fuel prices. Whilst the world’s consumers are currently wrestling with an energy price crisis, this is good news for a lot of Canada’s energy firms who are looking forward to posting good yields in 2022.

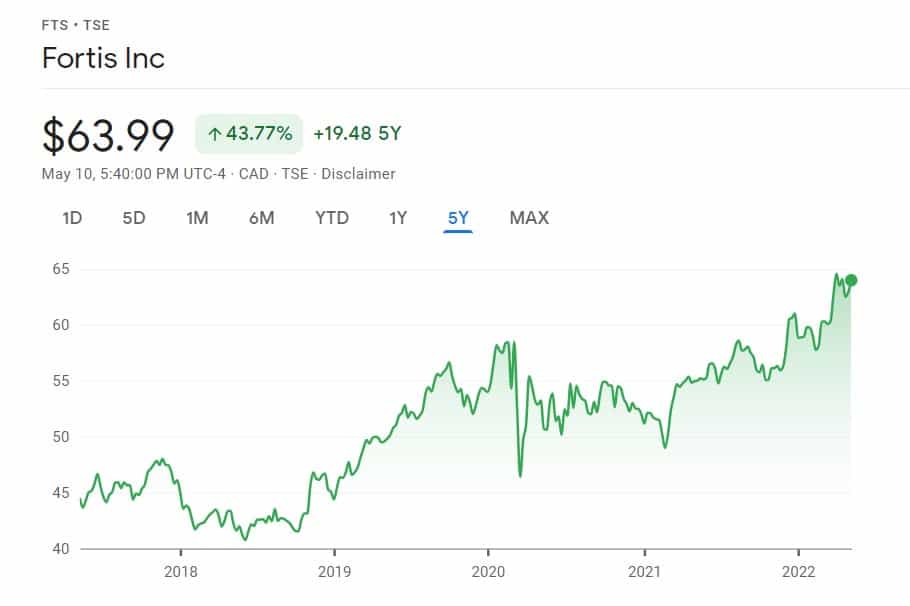

Fortis (FTS)

The Oil and Gas company services around 433,000 homes in Canada, the U.S., and the Caribbean. Not only does Fortis generate its own power it also sells wholesale electricity to companies in the US. As such, Fortis is a major beneficiary from the spiking energy prices.

Fortis’ dividends have increased year on year and Fortis stock is now currently trading at $63.99. This means investors can expect a yield of 3.51%.

Atco Group (ACO.X)

Alberta’s largest gas distribution company, has a diverse asset base that includes power plants, power lines and even hydrocarbon storage facilities. As such it is a good bet for a low risk investment.

Atco has increased year on year shareholder dividends for over 25 years now. The stock is currently trading at $46.77 meaning investors can expect a yield of 4.41%.

T.C. Energy

T.C. Energy is a pipeline company. It has a diverse operations base and is currently engaged in some expansion projects all over North America.

The stock is currently trading at $16.37 and it has a lot of different stock options – investors can expect a yield of 5.25%.

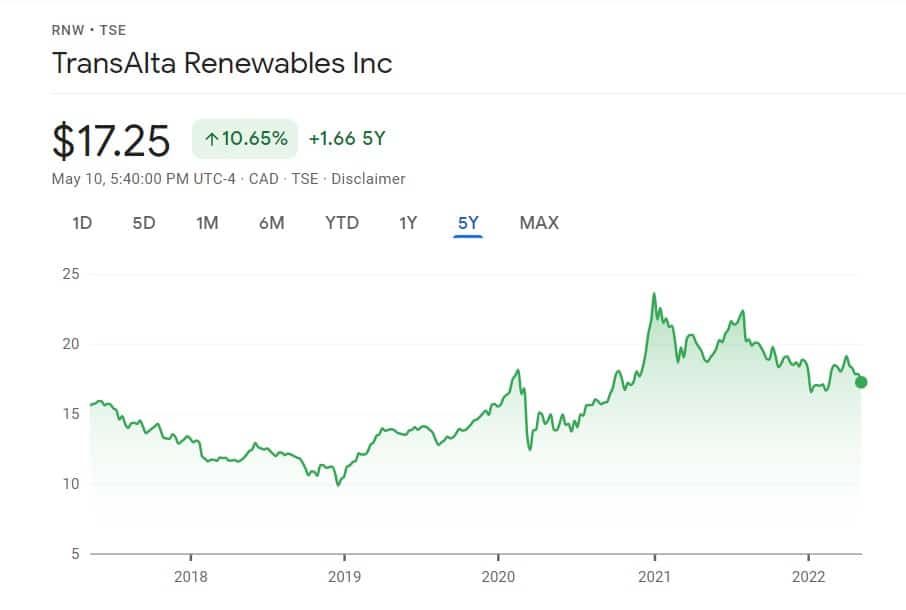

TransAlta Renewables (RNW)

Whilst Oil and Gas is currently doing very well, some investors question its long term future and others have made a conscious decision not to invest in the environmentally damaging sector. Therefore TransAlta Renewables are an excellent alternative for those who still want a piece of Canada’s energy market.

The stock is currently trading at $17.25 meaning investors can expect a yield of 5.13%.

Financial Services – For The Best Dividend ETFs

Canada’s financial service sector makes up 33.5% of its stock market. Whilst not as lucrative as its equivalents in Wall Street, London and Shanghai, a firmer regulatory hand and a sensible fiscal culture does mean that the sector swerved the catastrophe of 2008, and even fared better during the COVID-19 pandemic.

Note that many EFT and Mutual Fund baskets consist of one or more of Canada’s big 5. This is because they are seen as safe investments albeit ones with modest yield. As such, as investors interested in EFT’s may wish to seek out ones which include our 2 picks below.

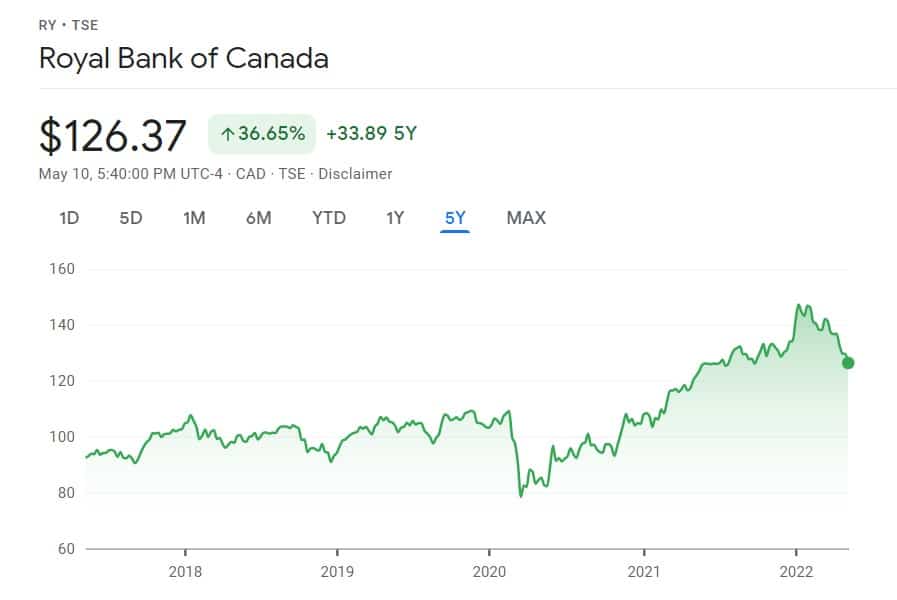

Royal Bank of Canada (RY)

One of the 15 biggest banks in the world, the banking behemoth is widely regarded as the 2nd biggest company in Canada. The banking sector has not exactly been a thriving investment over the last decade but BOC has weathered the storm and the recent rise in interest rates may signal a return to true buoyancy.

The stock is currently trading at $126.37 meaning investors can expect a yield of 3.38%.

Bank of Montreal

Another of the big 5, BOM is also currently gaining some traction in the US market. Bank of Montreal has an extensive network of over 1,400 physical branches and nearly 5,000 banking machines.

The stock is currently trading at $131.70 meaning investors can expect a yield of 3.48%.

Property and Real Estate – For The Best Dividend Growth Strategy

Whilst the global real estate market is another one that is prone to the occasional catastrophe, the sector has only been going from strength to strength for over a decade now as property rises soar. That said, the recent hike in interest rates may soon begin to buck that trend. Nevertheless as far as the sector goes, this one is a good and safe investment option.

Killam Apartment (KMP.UN)

The Halifax based residential landlord manages an impressive property portfolio valued at over $3 billion. Killam is presently looking to expand its vast portfolio via acquisitions and by developing high-calibre properties in its core markets.

The stock is currently trading at $18.45 meaning investors can expect a yield of 3.45%.

Transport – For Safe Dividend Stocks

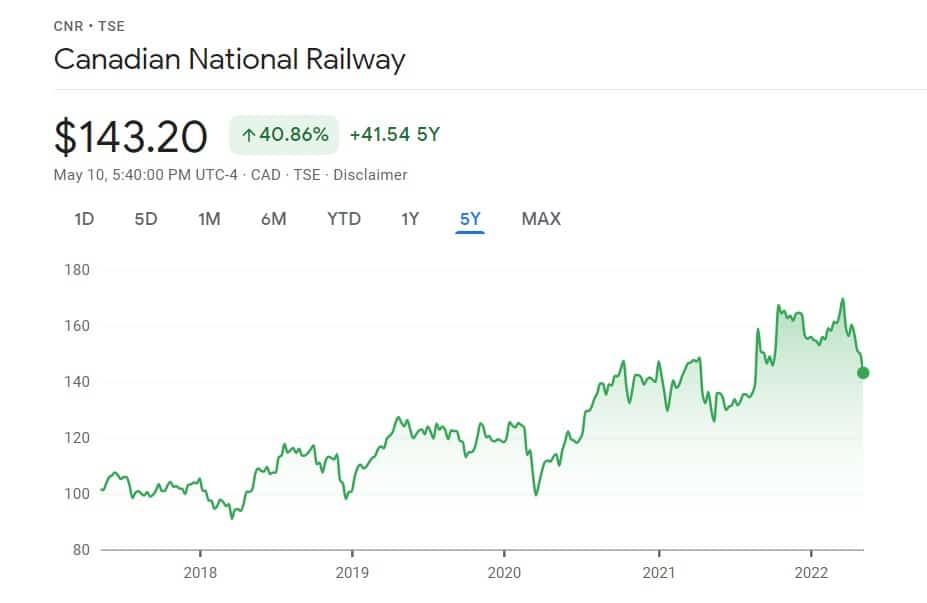

Canadian National Railway (CNR)

A true giant in the Canadian transport sector, the Canadian National Railway owns and operates an extensive network that takes in over 33km of track knitting the breadth of the nation together. With a renewed global emphasis on public transport and rising gasoline costs, the prospects for future growth for railways are very intriguing.

The stock is currently trading at $143.20 meaning investors can expect a yield of 1.80% Whilst this may not seem too exciting, the robust company can safely fund dividend hikes for years to come.

Mining

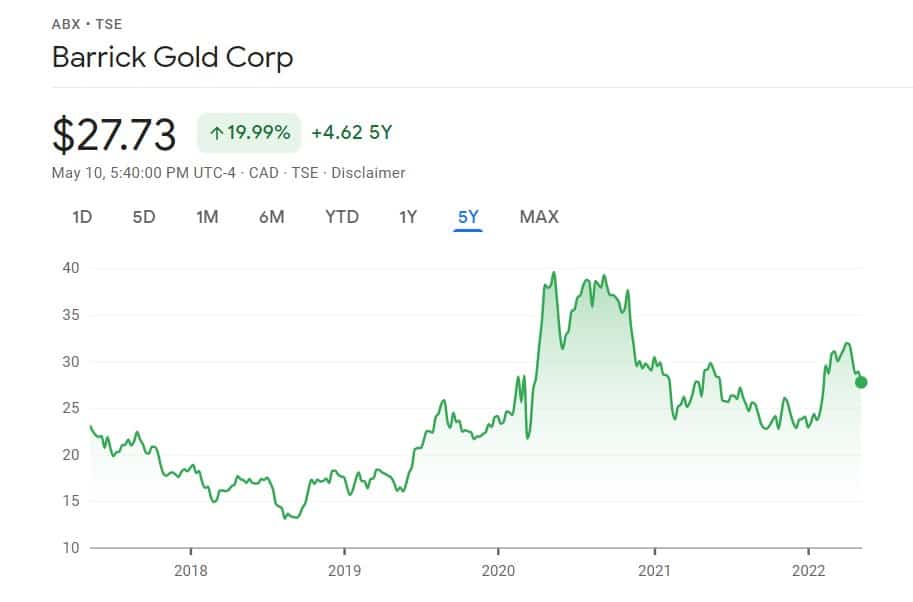

Barrick Gold Corporation (ABX)

Wth gold and copper mining operations in 13 countries, Barrick offers a diverse portfolio that focus on prolific mining areas and lifelong assets. Times of global uncertainty tend to result in an increase in gold prices as central banks buy up more – so this may well be an excellent year for Barrick.

The stock is currently trading at $27.73 meaning investors can expect a yield of 1.64%.

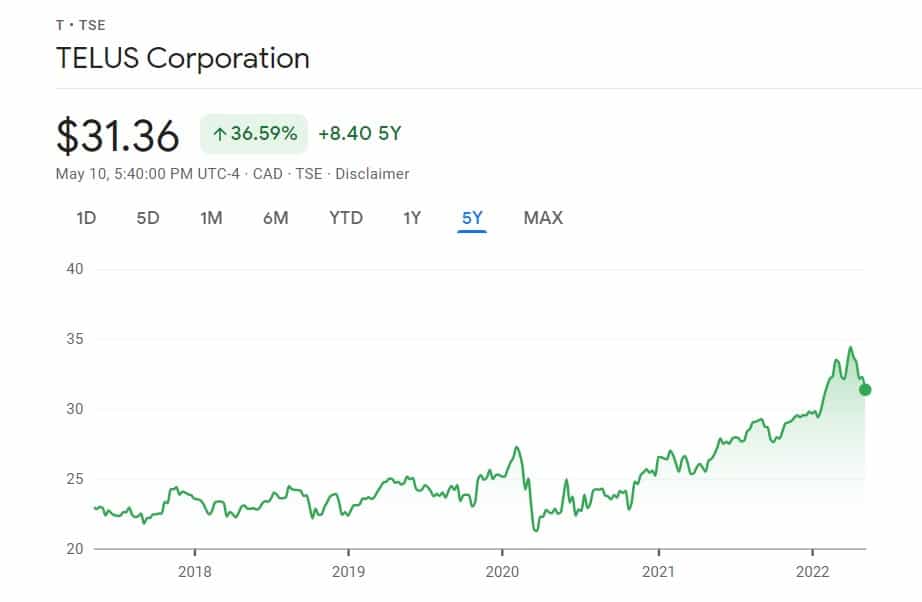

Telecom (T)

Telus Corp

The information and telecommunications giant can post some truly impressive numbers indeed. The company has around 9 million mobile customers, 2.1 million internet subscribers, 1.2 million T.V. subscribers and even more across its landline and security functions.

The stock is currently trading at $31.36 meaning investors can expect a yield of 4.06%.

Final Thoughts on Canada’s Best Dividend Stocks

As we have seen, Canada offers a lot of high yield dividend stocks as well some with lower yields that offer a compelling dividend growth strategy. A sensible portfolio will usually contain a few from both categories as well as throwing in a few of the best dividend ETFs for good measure.

Contents

- An Overview of The Canadian Stock Exchange

- Who Can Invest in The Canadian Stock Exchange?

- The 10 Best Dividend Stocks in Canada By Sector