Investing has now reached an all-time peak as far as the userbase goes, as more and more people have decided to enter this world, often under the guidance of distinguished investment professionals.

But as participation in the market continues to grow, the increase in competition and the evolving financial landscape has also made it a lot more challenging to achieve distinction and success.

The market is overly saturated today and requires investors to adopt more nuanced and strategic approaches to make sure they stay ahead of the curve.

We believe that there are no shortcuts to success and rather than looking for methods to get quick gains, we strongly recommend embracing sound investment strategies that provide sustainable growth.

That’s why we think that following well-established investing methods can lead to rewarding outcomes.

With this philosophy in mind we have chosen to explore a time-tested investment approach known as the all-weather portfolio, that offers a great framework for investment diversification and risk management, and has proven its worth across various market conditions.

In this comprehensive guide we’ll take an in-depth look at the intricacies of the all-weather portfolio, offering you a concise and insightful examination of its benefits and applicability. Let’s start off with:

What is an All-Weather Portfolio?

An all-weather portfolio is an investment tool that is literally built to be able to do well through any sort of market conditions whatsoever.

While the original all-weather portfolio was created by none other than Ray Dalio, one of the most renowned investors out there, the idea has far exceeded what he figured was possible at the time.

In order to understand what the typical all-weather portfolio is though and what it can be used for you just need to keep in mind the following:

This portfolio is meant to help you diversify your investments and will help you get a decent profit regardless of what the market is like at the time.

This is especially important now because as we all know, during periods of economic stagnation, a lot of investors are forced to pull out or even worse, they are forced to put all of their money into the projects to make them work.

The all-weather portfolio changes the rules by taking a more passive approach at these investments, so much so that it doesn’t even force the investors to allocate their money separately anymore based on the current volatility or rising inflation of the market.

There are currently four different types of events that all investors should know of and look out for, and they are the following:

- The inflationary period during which the prices pretty much just raise through the roof altogether

- The deflationary period which is the opposite, showcasing the constant downfall of the prices

- The bull market period which has the economy continuously growing to new heights

- The bear market period which is the opposite, showcasing the continuous slowdown of the economic growth until complete stagnation takes over

The market as we know it is very volatile, to the point where you can see it transition from one end to the other pretty much overnight here, which is really not that good of a news for any new investor that is trying to maximize his investments.

So, the all-weather portfolio pretty much removes the possibility of this causing the downfall of the investor by putting the eggs in every basket at once and preparing for every possible outcome before it even bares its teeth at the world.

According to Dalio himself, the market as we know it is driven by these little surprises and based on whichever of these periods you are experiencing, chances are that unless you specifically prepared for this outcome, you’re already losing money as we speak.

How Does the All-Weather Portfolio Work?

As we mentioned previously, the main purpose behind the all-weather portfolio has always been to cover any and all of the possible outcomes that Dalio and his team had foreseen over the current market.

It is meant to showcase the direct relationship that we can spot between asset class performance and changing market environments altogether, and in its own way it was meant to completely take away the risk factors that most of the investors out there have to look out for.

The constant uprise and downfall of the asset classes and how they are influenced by the current economy is the all-weather portfolio’s bread and butter, so if you even considered this as a major risk that you could be facing off against in the near future you should definitely consider opting for one.

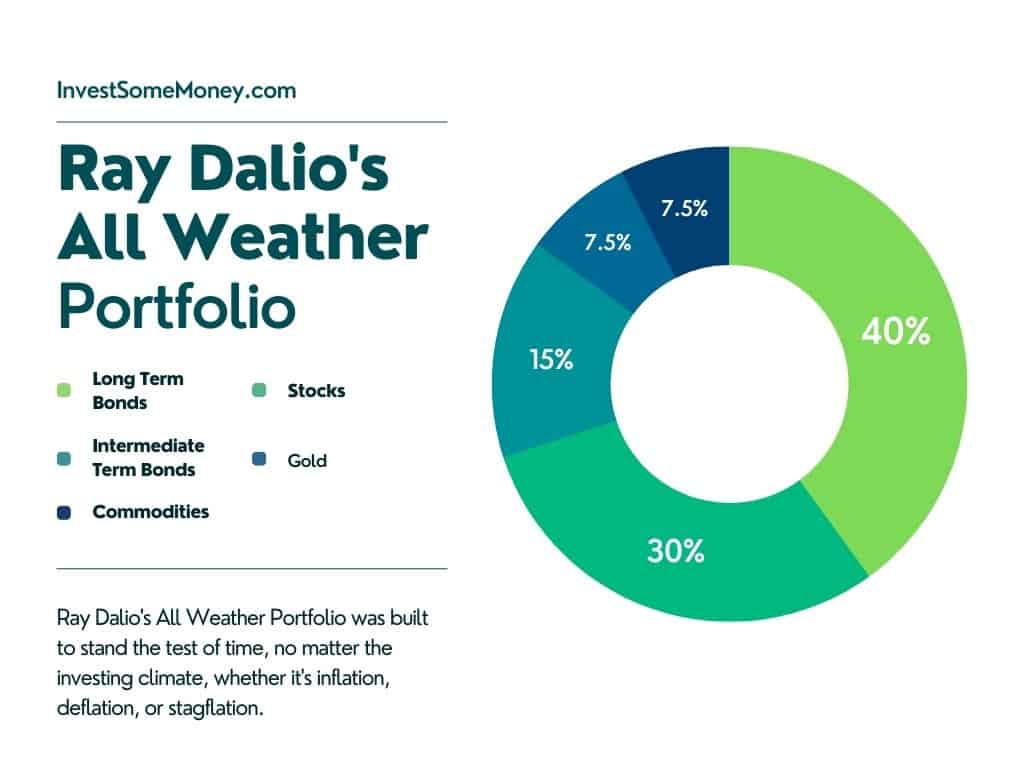

Commonly referred to as the ideal assed allocation service, the all-weather portfolio allows you to make a profit regardless of the current conditions of the market, by allocating your investments into the following bonds as such:

- Long-Term Bonds get a whopping 40%

- Intermediate-term bonds get a slightly less impressive 15%

- 30% is then rushed off into the stock market

- 7.5% goes directly into commodities

- 7.5% is invested into gold

But why would you go for this mix and not for a different one? Why not go with 10% in gold or 15% in long-term bonds? The secret of this recipe lies in its risk diminishing factor.

As you can already tell by now, in theory, this asset allocation is meant to pretty much take away any possible career-ending losses and minimize them to the point where they’re no longer all that dangerous to begin with.

Minimizing losses definitely sounds like a good deal to us, especially considering the current volatility of the market environment.

Most investors out there would opt for the three-fund portfolios or better yet, they’d go for the old school 60/40 portfolio split to slightly minimize the risk factor while maximizing the profit range, but what these people don’t realize is the fact that there is still a lot that can go wrong here.

Age and life expectancy portfolios have been all the rage now for many years but just because they have been popular that shouldn’t dictate whether they are the best options you could go for out there.

The all-weather portfolio is a lot more nuanced than any of those while at the same time offering you a safety net that you can bounce out of in case the worst does come to happen.

Bull markets for example are very much so considered to be career-ending events in the industry, especially since it has to do with rising inflation which no investor can properly predict or look out for with a one hundred percent success rate.

In the case of one such bull market, an investor would do well to have a lot of investments in their intermediate-term bond and commodities categories since that’s where the real money will be made here.

You should also know that equities and bonds altogether are not exactly known for their compatibility with inflation which is more often than not going to help you come out on top during periods of falling prices.

The Pros and Cons of All-Weather Portfolios

The saddest part about the all-weather portfolio is the fact that for as much as we would like to praise it as being the most risk-free option out there, it is also nowhere near foolproof as there are still a lot of variables that you need to keep in mind here.

That is not to say that there are no real advantages to this portfolio either, as the list goes on and on as far as their list goes, but you should still weigh out both the pros and the cons to make sure that you are ready to make the most out of the all-weather portfolio in case you actually choose to opt for it.

First and foremost, we should mention the fact that this is a very easy strategy to implement. You can easily create your very own all-weather portfolio by simply using a handful of mutual funds or you can even go for exchange-traded funds if you want to go the extra mile here.

You won’t need to actually do any real research as far as individual stocks or bonds go and you won’t even need to take the time and check out the index funds to begin with either.

Secondly, we should mention the fact that actually creating and maintaining an all-weather portfolio is a lot more affordable than most people care to admit.

Since there is no active trading that you need to take part in, you won’t need to pay up for any commissions anytime soon and on top of that, as long as you are using ETFs to invest, you are still in the green as these carry a lot lower expense ratios than any traditional mutual funds out there.

Thirdly we would like to mention the versatility of the all-weather portfolio as you are pretty much covering the whole surface of the moon with it, investing in everything under the sun such as stocks, bonds, commodities and of course, gold.

As far as cons go though you do need to keep in mind that you will not be able to really make a hefty profit out of any real transactions overnight since you won’t be pulling all that much money from the 5 percent stocks investment.

Most investors out there know that if you want to win big you need to invest into stocks and since you’re barely putting any of your money into them, you’re never going to experience the same profit that your colleagues are basking in to say the least.

Someone that has invested a whopping 90% of their portfolio into stocks for example is sure to make a lot more money than you and even during peak hours you still will barely make any profit out of it to begin with.

Another serious con that we can immediately think of is the interest rate risk which is always going to be present when investing into bonds so much.

Bonds yields and interest rates are very much so two sides of the same coin, which is why investing as much as 55 percent of your portfolio into them will easily result in you losing a lot in case of rising inflation.

Since it is known as a passive approach to investing, the all-weather portfolio may not be the perfect choice for everyone out there but it can still be a very viable option for those of you that want to avoid making a wrong choice at the wrong time.

We all have our very own investing biases to keep in mind, which is why you should always watch out for panic buying/selling as these can quickly result in losses if you’re not careful.

But at the same time, if you’re out there trying to maximize your profits then you may want to avoid opting for an all-weather portfolio as these are rarely if ever going to result in anything over an above-average growth.

How to Start Your Own All-Weather Portfolio?

At the end of the day, if you’re looking for a passive investing strategy you can’t go wrong with an all-weather portfolio, but how do you actually build one for yourself?

Honestly it’s nowhere near as complicated as it sounds, you just need to go for the simple 30% in stocks, 55% in US bonds (long term and intermediate term) and 15% in hard assets such as gold and commodities and you’re settled.

For the stocks you can go for any stock index fund such as the Vanguard S&P 500 ETF (VOO) and you can customize your next options any way you want to. You can even go for an intermediate bond fund such as iShares 3-7 Year Treasure Bond ETF (IEI) while you’re at it too.

The trick to making a successful all-weather portfolio is to construct it based on whichever funds you find most appealing, just keep in mind that each fund is different and they come with their very own expense ratio that you’ll need to cover.

Conclusion

So, should you actually invest into an all-weather portfolio or should you instead take on a different route altogether, such as the traditional 60/40 model or the golden butterfly portfolio?

Well, as far as we can tell you based on the rather well-documented past that the all-weather portfolios have, it would definitely appear so, especially considering the fact that they have witnessed a total rate of 8% a year since February 2006 and the numbers are just continuing to rise higher and higher with every passing year.

While there have definitely been more than a handful of drawbacks, for the most part the numbers here don’t lie, the all-weather portfolio has definitely had a very good history and it’s definitely not going to slow down anytime soon either.

The Great Financial Crisis has definitely taken a toll on the all-weather portfolio if you look at it from a general point of view, but what you need to realize is the fact that the general decline has been halved when compared to the 60/40 portfolio.

So, if you’re looking for a passive investment strategy this may very well be the best choice you could make for now, just keep in mind the fact that you will never experience huge profits either since you’re hyper-focused on minimizing losses as opposed to maximizing profits.