Making lots of money quickly with investing typically requires the use of margin (either real or synthetic). For example:

- Penny stocks bought on margin

- Options

- Forex

- Futures

- Buying crypto on margin

Oh, and it’ll require a good degree of luck!

Best investments to make money quickly

Conventional wisdom says that risk and return are correlated. Meaning that in order to earn greater returns, you have to invest in riskier assets.

If there is a correlation, I think it’s very loose. Even seemingly safe investments are subject to risk in the form of “unknown unknowns.”

On the flip side, there are investments that offer the potential to double, triple, quadruple, or more, your money in a rather short amount of time.

That’s what we’ll look at in this post – how to invest money to make money fast!

Obligatory word of caution

This is not an invitation to invest in any of these assets. You could lose your ass. If you don’t know what you’re doing – you probably will. I don’t stand to gain or lose anything whether you succeed or fail, so I’m not endorsing any of these investments. I’m just trying to give you a starting point for your education.

Alright, let’s get down to the matter at hand. You’ve got some cash that you’re willing to risk and you want to either multiply it many times over – or just write it off. You don’t like casinos (or you don’t have one near you) so you want to put that money into an aggressive investment.

Here are some ideas for you:

1. Buy penny stocks

Penny stocks are stocks that trade below $5 a share.

What makes them (potentially) so profitable?

First of all, you can buy a lot of shares with a relatively small amount of money. If a stock is trading at $2, then you can buy 500 shares with $1,000 (commission excluded).

If you want to ramp up your potential earnings, then you can use margin and buy 666 shares. This is based on E-Trade’s margin requirements. Your brokerage’s margin requirements might be different.

Penny stock example

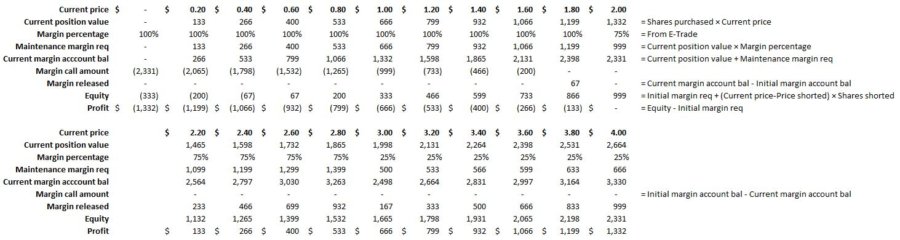

The best way to illustrate the profit potential of penny stocks is to get the data into a spreadsheet. Here, I’ll use the same model I used on my short-selling post – tweaked to work for long positions purchased on margin.

Here’s the setup:

The Initial margin req (equity) is the money you start out with.

If the price of this penny stock subsequently moves between $0.00 and $4.00, here’s how the balances would change:

The amplifying effects of margin are made obvious on the Profit line. If the price of this penny stock goes down $1.00, you would lose $666, or 2/3 of your initial investment of $1,000. Conversely, a rise to $3.00 would give you a solid 67% return on the initial $1,000 investment.

As you can see, it doesn’t take much of a dollar change in the stock price of penny stocks to equal extraordinary returns. Hence the appeal, I suppose.

2. Equity options trading

Options are one class of what are known as derivative securities. Meaning that their value is derived from something else.

Options are contracts. If you buy one, you have the right to enforce that contract. If you sell one, you have the obligation to act accordingly if the person who bought the option enforces it.

Most equities (stocks) have corresponding options available for investment. Most other types of securities (bonds, futures, currencies) do too, but for simplicity’s sake, I’m just going to focus on equity options here. Derivatives on derivatives will just confuse people further.

An option is exactly what it sounds like – it’s a contract that gives you the option to buy or sell a stock at a specific price. The option to buy a stock at a particular price is known as a “call” option. That’s what I’ll be referring to in the example below.

Equity options example

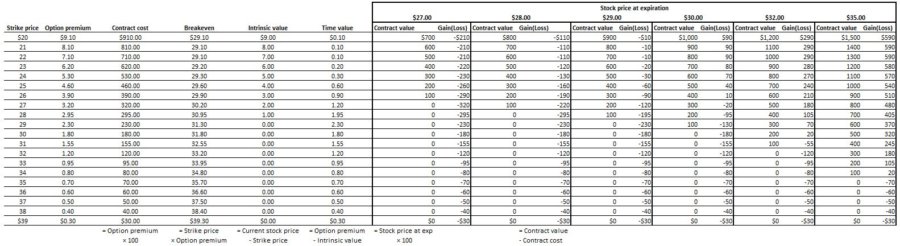

In this example, the stock you want to buy an option on is trading at $29. You don’t want to look too far into the future, so you’re only interested in options that expire next month (October).

The Strike price column shows the call options you can buy and the Option premium is the price you’d pay for that option. Since a call option is the right to buy 100 shares of stock, the total Contract cost is 100x the Option premium.

The Option premium consists of an Intrinsic value and a Time value. Intrinsic value is the difference between the Current stock price and the Strike price. Everything else is Time value.

At the time of option expiration, it is assumed that the option will be worth only its Intrinsic value (no time left = no Time value). So, if an option’s strike price is above the Stock’s price at expiration, then it will be considered worthless.

As you can see in the Gain(loss) column, the more the stock price climbs over the next month, the more money the call options make. If the stock price were to climb $6.00 to $35.00 (21%) you could potentially more than double your money (Gain(loss)).

Therein lies the appeal of call options. They are a relatively low-cost way to participate in the gains of much-higher-priced stocks. Plus, your downside is limited to what you paid for the option contract. But, since the underlying stock price theoretically has no limit to how high it can rise – your potential profit is unlimited.

3. Foreign exchange (Forex)

As you probably know, Forex involves the buying and selling of different currencies.

“But, exchange rates don’t usually change much. Where’s the huge profit potential in that?” You might be asking.

You’re right, of course. However, through the power of leverage, Forex brokers allow you to control much larger amounts of money with a relatively small deposit.

It’s like the leverage used to trade stock on margin, except on steroids.

In the below example, I’ll only look at a long (buying, betting on) position. Traders are able to take short (selling, betting against) positions too, but since this post covers a wide array of topics, I’ll keep things somewhat simplistic.

Also, there are other factors involved in Forex that a real-life trader would need to be aware of; such as rollover rates and maintenance margin. In this example, we’ll just assume that the position is closed if the initial margin is lost.

Forex example

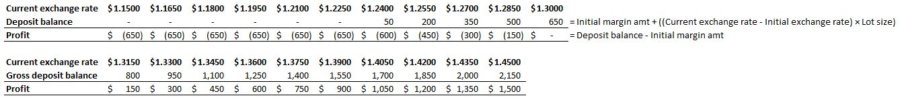

The Initial margin amt is your beginning investment. The currency you’re interested in trades for $1.30 USD. You’re buying 10,000 units of the other currency and you’re required to deposit only 5% of the initial position (Lot value).

Below, you can see that very small changes in the exchange rate can translate into big changes in your account. With such a heavily leveraged position, a ¢7.5 (seven and a half cents) change in the currency rate will double your money, or wipe you out.

Forex trading is popular because of its huge profit potential. Keep in mind though, the table above is only an illustration. Unlike call options which have a limited downside, in Forex trading, if your long position lost enough value – the broker might pull more of your cash into the deposit balance to cover shortfalls. The downside isn’t necessarily limited.

4. Futures trading

Futures, like options, are derivatives. They are contracts which allow traders to settle on a price today, but not worry about delivery until a future date. In fact, the actual delivery of assets rarely takes place, and contracts are usually settled with their cash equivalent.

Futures are traded on assets such as commodities, currencies, treasury securities, among other things.

Like Forex, futures contracts are typically heavily leveraged.

Here to, we’ll only focus on a long position. Maintenance margin calls will be also ignored.

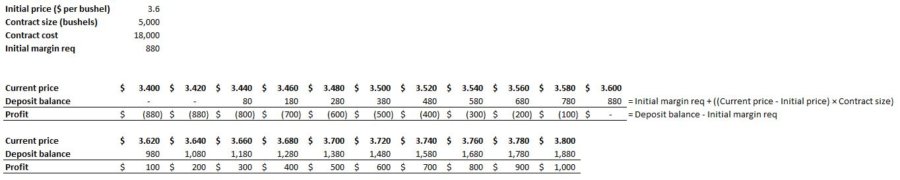

Futures trading example

The Initial price is what one unit of this example commodity trades for. Each contract in this example is for 5,000 units. Initial margin amounts for futures contracts are stated as dollar amounts, not percentages. So, in this example, the amount of cash you’re investing is represented as the Initial margin req.

Just as with Forex trading, it doesn’t take much of a change in the price of the commodity to affect an enormous change in your Profit. In this example, a ¢18 (eighteen cents) change will double your money or wipe you out.

Futures prices tend to be more volatile than currency prices. So, if you’re on the right side of a trade, you can make a lot of money very quickly. If you’re on the wrong side, you will lose your deposit and might be subject to a margin call.

5. Cryptocurrency trading

Most people who trade crypto-only take long positions with no margin. Not necessarily out of fear, but due to the lack of opportunity to make different trades. Due to its relative newness, crypto doesn’t have markets as sophisticated as some other assets.

There is an “exchange” called BitMex that found a workaround for this. Here you have the opportunity to not only trade long and short but to employ a lot of leverage if you so, please.

Now, I should note that I’ve never used BitMex and had to spend some time educating myself about it in order to sound vaguely knowledgeable about the subject. So, take what I say here with a grain of salt and be sure to educate yourself if you decide to delve into this. Here is a pretty good resource.

As you’ve probably guessed by now, I’ll only be looking at a long position in my example.

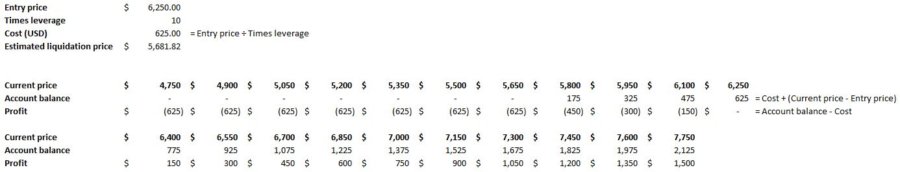

Cryptocurrency trading explained

The Entry price is the price of the cryptocurrency you’re interested in. The Times leverage amount determines how much you’ll have in deposit and how much you’ll borrow. BitMex allows for 2, 3, 5, 10, 25, 50, and 100x leverage!

So, in the example, since we’re going with 10x leverage, the Cost is $625.

Estimated liquidation price is how BitMex protects their downside. It’s at this price that your position will be closed and the amount you invested will be gone forever.

While cryptocurrencies aren’t quite as volatile as they were earlier in 2018, they can still swing several percentage points in any given day. With BitMex, you could profit the same as buying actual cryptocurrency, but with the leveraging, you can do so while risking less money.

Trading with BitMex means that you can only lose what you’re willing to risk. The upside, is potentially enormous, though.

Keep in mind that as you increase the Times leverage amount, the Estimated liquidation price moves closer to the Entry price. At 100x leverage, the price of the cryptocurrency would need to move, more or less, straight up after you entered the position.

Now you have some ideas on how to invest money to make money fast

Before you run out and try your luck at any of these “fast” methods, I would suggest that you start off trading in a paper (simulated) account. Simulated accounts allow you to get a feel for how these things work without risking any money. Even if you only practice for a week, you’ll probably increase your chances for success.

But, if that money is burning a hole in your pocket, by all means – get out there and get your fix.

Did I miss anything? Do you have any questions?

What if you don’t know how to trade