“What are the benefits of a long-term strategy?” All things being equal, buying and holding is easier than frequent trading. If you decide to buy and hold for the long-term, then you want to invest in a company with a long-term outlook. This will ensure that they are operating on the same time horizon as you. Therefore increasing the likelihood that your interests are aligned.

We’ve arrived at Point 12 of Philip Fisher’s 15 points from his iconic book Common Stocks and Uncommon Profits. Point 12, in essence, asks “does the stock you’re analyzing have a short-term or long-term outlook?”

If the company you’re analyzing aims to stay in business for a long time, then they hopefully have a long-term outlook. Yes, some businesses can fall ass-backward into success (or at least appear to do soon). But, not many are so lucky.

This reminds me of Nassim Taleb’s Lindy effect, which I addressed in the Stock Valuation Spreadsheet post. The gist of the Lindy effect is that the longer something has existed, the longer it will continue to exist.

A lot of stakeholders depend on the company you’re analyzing to stay in business and be successful. These stakeholders include not only investors, but vendors, employees, and local economies.

The future is coming, like it or not

Why should a company bother with planning? Especially for the long-term?

As I write this, the year is 2020. A year that has shown us how volatile the world can be.

2030 will be here soon enough. If you’re investing your money in a stock – you probably want that company to be successful in 2030. Whether you still own those shares or not.

Sure, missing out on gains hurts. It’s not a good feeling to sell shares after a year of ownership only to see the stock skyrocket over the following decade. However, there’s still some solace in being smart enough to recognize that potential. Even if you got out too soon.

Plus, it’s sour grapes to want to see a company fail (unless you’re short, or unless they’re unethical). Again, one should consider the other stakeholders.

If you are holding onto the stock for the long-term, then the company having a long-range outlook is essential. You’ll still need to do periodic analysis, of course. Investing is relatively easy when you buy a company and it’s enormously successful for a long time. Meanwhile, paying you handsomely in capital gains and/or dividends.

Analysis is time-consuming. Analysis is risky. Mistakes can be made. If you make investments in companies with a long-term outlook, you increase the likelihood of having to spend less time analyzing.

Short-range outlook vs long-range outlook

“Tomorrow never comes.”

This was what a manager of mine often said, a long time ago, when I was working for a company with a very short-term mindset.

Long-term goals are built on short-term goals. So, short-term goals are important. Nobody’s disputing that.

There’s a balance to be struck between long-term and short-term, however. Investing in a business that sacrifices one for the other is risky. In order to determine if a balance exists, I think, you have to ask yourself if the achievement/failure of short-term goals is part of something bigger?

To clarify, short-term means within one year. Mid-term usually encompasses a range of 2-5 years out. Long-term is anything beyond that.

Speculate too far into the future, and there are too many variables to juggle. Time is volatility, and, in some respects, the world gets more chaotic as time goes by. Nevertheless, you want to be invested in a company that’s putting forth a good faith effort toward being proactive regarding the future and is managing its downside risk.

Does your company have a long-term outlook?

Like so many other aspects of investing, making a determination here is difficult. I’ve written many previous posts about the effect management has on a company’s performance. The people in management are the ones pulling the strings. The entire company operates within the culture they dictate. For better or for worse.

Fortunately, management’s ego makes the public eye somewhat irresistible. There is, typically, no shortage of articles or soundbites from a company’s management. So, use this to your advantage. Research management’s discussions of strategy to aid in determining whether they have a long-term outlook or not.

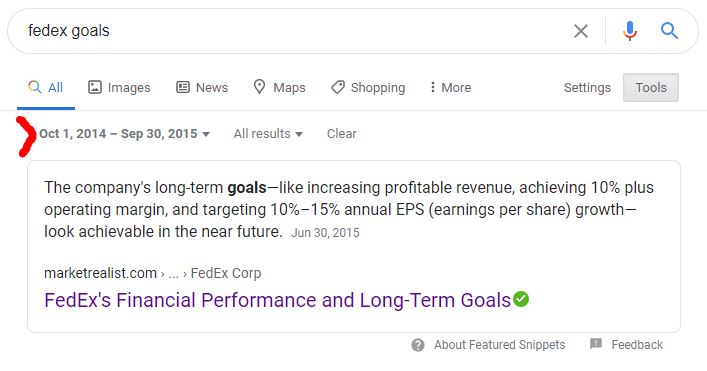

One way to do this is to simply search for “[company] goals”. Browse the results – particularly the news.

“Goals“ isn’t the only keyword you can use either. Here are some others you might try:

- Outlook

- Projections

- Targets

- Objectives

- Forecast

- Plan

- Estimate

Furthermore, if you’ve read any of my other Common Stocks and Uncommon Profits inspired posts, you know I’m a big fan of analyzing a Company’s SEC Form 10-K. If you delve into this document and use Ctrl+F, you can find where they use those words, and in what context.

Pro tip: use search “Tools” and old 10-Ks to see what the company’s outlook was in the past. One year, three years, five years ago, or more. Were they setting long-term goals back then? Have they achieved them, or, were they just empty promises?

Example analysis of long term planning

Let’s put some of these suggestions into action and see what I find.

I’ll use FedEx Corporation (FDX) as an example.

I’ll start by looking about five years in the past and seeing what (if any) goals were stated at that time. Then, I’ll transition to the present to see if those goals were met.

A search for “fedex goals” turned up a snippet that stated the following: “The company’s long-term goals—like increasing profitable revenue, achieving 10% plus operating margin, and targeting 10%–15% annual EPS (earnings per share) growth – look achievable in the near future.”

It will be pretty easy to judge if they were successful or not. However, after further reading, these goals are actually from 2009 and are conveyed by a third party (the author). That’s not to say they’re fabricated. Just that they didn’t come “from the horse’s mouth.”

Let’s move on to the 2014 Form 10-K.

Searching for “goal” and its synonyms in the 10-K turned up a couple of mentions of a 2013 Profit Improvement Program. Here was the gist of that: “We will continue to work towards our goal of annual profitability improvement at FedEx Express of $1.6 billion by the end of 2016.”

This would qualify more as a medium-term plan, in my opinion, but it looks like it’s the best I’m going to find.

Okay, so that’s a little bit to work with. Let’s see how these plans panned out.

Here’s what I was able to find:

| 2015 | 2016 | 2017 | Average | |

|---|---|---|---|---|

| 10% + op margin? | 3.9% | 6.1% | 8.4% | 6.1% |

| 10-15% EPS growth? | -51.2% | 78.4% | 70.0% | 32.4% |

| Express $1.6B improvement? | $1.0B | $2.0B | $2.1B | $1.7B |

I should note some of the assumptions I made.

First, I looked at the operating margin and EPS growth for the consolidated company – not at any specific segment.

Alternatively, for the profit improvement goal, I looked at the FedEx Express segment solely and referred to operating profit. I could not find any reference to segment net profit. The improvement was measured from the 2013 operating profit of $555 million.

So, what do we see? Way off on the operating margin, but the other two goals were easily beat.

This tells me that FedEx does make, at least, mid-term plans. And, they don’t appear to be “window dressing.”

I think, as a potential investor, you can have some confidence in FedEx’s long-term outlook. At least until Fred Smith retires…

What are the benefits of a long-term strategy?

You may or may not be a long-term investor. Whatever your investing timeline, I think you can agree that “setting it and forgetting it” is simpler than buying and selling repeatedly.

Early on in this blog, I wrote a number of posts comparing the CCI indicator with a buy and hold strategy. Frequently, buying and holding won. But…not always.

In any event, judging a stock’s long-term outlook is time-consuming. It’s also very subjective. So, don’t let it take a disproportionate amount of your time. As with most things, you should be able to get a feel for management’s tone with a reasonable amount of research.