This is the second post on product growth potential. Here is the first.

These posts address Point 1 of Philip Fisher’s “15 points” from the book Common Stocks and Uncommon Profits. Point 1 asks: “Does the company have products (or services) with the potential to increase in sales for several years?”

Some types of business models have to work harder to succeed than others

Business (investing) is about three things, at its core. Money in, money out, and time.

Every for-profit business aims to bring in more money than it sends out the door. However, there a number of different ways to do that. Not all types of business models are created equal. Some are just more appealing than others.

The amount of profit per transaction certainly contributes to the appeal of a business model. That will be addressed in the next post on this topic. Here, I want to cover, in broad terms, the nature of different types of businesses. Specifically, in terms of the frequency of sales and the effort (time) required to achieve a sale.

In this post, I’ll look at five different types of business models. This is not an all-encompassing list. Some companies could have segments operating under two (or more) different types of business models. Or they might walk the line between one type and another.

An example of each type of business model is included for illustration. This is not a real-life example. But, it helps to articulate how some business models, as a rule-of-thumb, are more appealing than others.

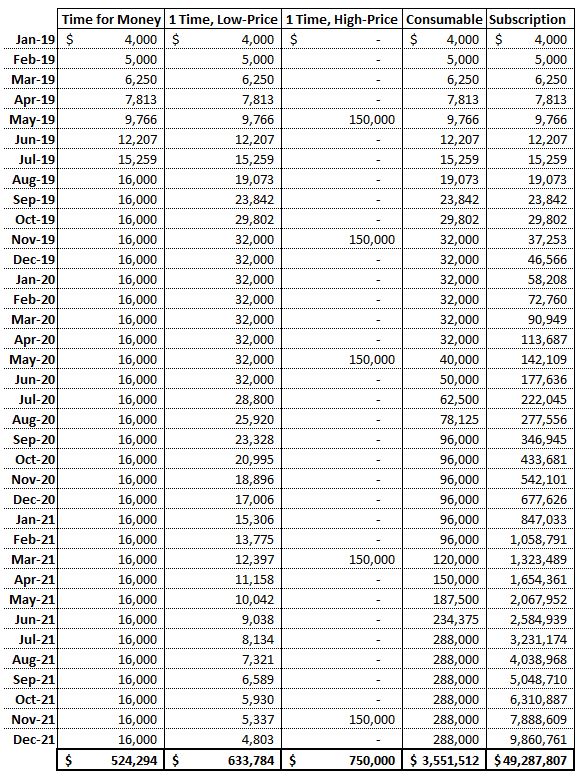

To illustrate these examples, the table below shows the five different types of business models listed across the top. Below that, the amount of revenue earned in this hypothetical situation is outlined for every month over the next three years.

In these hypothetical scenarios, it is assumed that you are the business owner. You start your business with one employee/resource. This particular employee is very skilled and is capable of performing any task you ask them. So, you’ll see how you choose to use this resource will have an enormous effect on the amount of revenue you make.

Also, in this scenario, it is assumed that prices are never increased. maybe that’s not the completely feasible thing to assume. But it’s done for the sake of comparison and simplicity.

Credit goes to WallStreetPlayboys.com for the conceptualization of this and the names of the different business models.

Trading time for money

Trading time for money is the least appealing business model. Consulting is an example of

Why is it so unappealing? Because time is a finite resource. More time can’t be created. Any one person only has 24 hours in a day and roughly 2,080 working hours in a year.

Sure, a company can hire more employees. You can even hire more skilled employees. But, they will never be so skilled that they can create more time. This type of business just isn’t easily scalable.

Trading time for money example

In the hypothetical scenario outlined in the table, we’re assuming that our one employee will act as a consultant. They will charge $100 per hour for their services. To begin with, our employee doesn’t have much of a reputation. So, he is only able to bill hours for one week out of every month (40 per month)

Word gets around fast, however. Since he is such a skilled employee and offers such great advice, his number of billable hours increases by 25% every month. In Feb-19, revenue is $5,000. In Mar-19 $6,250. And so on…

Revenue increases quickly, but, as mentioned earlier, time is a constraint. There are only (approximately) 160 working hours in a given month. Our skilled employee can’t make any more time. Therefore, revenue tops out at $16,000 (160 hours × $100 an hour) per month and remains there for the remaining 2+ years.

In this scenario, the total revenue earned over three years is $524,294.

One-time, low-priced products

Selling one-time, low-priced products is a more appealing business model than selling your time. But, it still presents some challenges that aren’t present in more superior business models.

“One-time” is kind of a relative term. Things that are purchased relatively infrequently, say, once every couple of years on average, would also be included in this category.

The reason this business model is unappealing should be somewhat obvious. Since it’s low-priced, each individual transaction isn’t going to bring in much revenue. Additionally, since it’s not the sort of thing that people will buy again tomorrow, next week, or even next month – you can’t count on frequent return customers.

An example of this type of business would be Bed Bath & Beyond

Things like bedding, bath towels, and bakeware are not purchased very often by your average consumer. Sure, some of these things, if you purchase high-end, can cost a pretty penny. But, if you do purchase high-end, that typically means it’ll be that much longer before you purchase a replacement. Also, compared to some things that are sold in the business-to-business arena, a couple of hundred dollars is still relatively low-priced.

One-time, low-priced example

If we look at the table for our hypothetical situation, we’ll assume that our employee operates a machine capable of making 20 widgets per hour. Each widget is sold for $10 apiece. This hypothetical machine can operate on its own and merely require oversight by our one employee.

In Jan-19, the demand for our widgets is 400 units per month. At $10 apiece revenue is $4,000 – just like consulting. Also like consulting, demand is increasing fast and is growing at a rate of 25% per month.

Unlike consulting, however, since the constraint is our machine and not time itself, capacity is much higher. At 20 widgets per hour, and 160 hours in the month, our employee and his one machine are capable of producing 3,200 widgets. At $10 apiece, this translates into a monthly revenue of $32,000. Twice the cap of the trading time for money example.

If you look at the table you’ll see, due to high growth, capacity is reached in Nov-19. So, why wouldn’t we go out and buy another machine? Since demand is so hot for our widgets? Because, since widgets are the sort of thing that people don’t buy very often, we know that demand will peak and then start to die off.

Sure enough, we see that, by mid-2020, demand begins to fall below capacity. At this point, most of the people who would want one of our sweet widgets already has one. Sales begin to fall at a rate of 10% per month. They

Because our machine had a capacity that translated into more revenue than the trading time for money business model, revenue over the three years was higher. Even though sales trailed off to almost nothing by Dec-21. The total revenue for the three years was $633,784.

One-time, high-priced products

A business model selling one-time, high-priced products is more appealing than a one-time, low-priced product business model – for obvious reasons. Sales might be made much less frequently. However, since the price is so high, the amount of revenue earned per transaction is much more than it is with the one-time, low-priced items.

Investment banking is an example of this business model. As is the sale of some types of business software (not cloud-based), airplanes, and real estate. Each of these things is purchased infrequently. However, their price is so high, that the infrequency does not matter as much.

One-time, high-priced example

Let’s say, in our hypothetical example, that our employee is brokering the sale of commercial real estate for us. He earns commissions for every sale. In the first few months, we’re starving. Our employee is a relative unknown and hasn’t made a name for himself yet.

However, through a lot of hard work and networking, he finally manages to close his first deal – in May-19. He brokers the sale of a 2.5 million dollar property and earns us a 6% commission ($150,000). All of a sudden, those first few months of $0 revenue don’t matter as much.

But, sales are still few and far between. Our employee’s next sale doesn’t take place until Nov-19. At which time, he does the same thing again and earns another $150,000 in revenue

This continues over the next three years. There might be times when nine months pass between sales. However since the revenue per sale is so high, when all is said and done so, our business has received $750,000 over the course of three years. More than any of the preceding examples.

Consumables

Selling a consumable usually involves selling something relatively low-priced. Unlike the one-time, low-priced business model, however, the consumables get used up and customers keep coming back for more.

Food is probably the most obvious example of a consumable. Companies that sell food might not make a lot on every sale. But, if people like what they’re offering they will continue to come back again and again and again. What customers bought yesterday does them no good today. So…they need to buy more.

Consumables example

In this hypothetical situation, our employee has a piece of equipment that makes a tasty drink. The initial demand and price for that drink are the same as the widgets in the one-time, low priced example. The demand is 400 units a month and the price is $10 each.

Just as before, demand grows at a healthy rate of 25% per month. So, by the time we get to Nov-19, sales for the consumable and the one-time, low priced item are the same – $32,000 per month. This is where sales remain for the next six months.

After six months, things change. In the one-time, low priced example it didn’t make sense to expand capacity. That’s because we knew the demand would begin to trail off. Since we’re selling a consumable, however, people are going to keep coming back for more. Demand is growing at such a healthy rate it makes sense to expand capacity. So that’s what we do. Capacity is tripled.

With the extra capacity and the still healthy 25% monthly growth in demand, sales quickly climb to $96,000 per month. At this point, we consider expanding capacity yet again. After six months of demand at full capacity, that’s exactly what we do

You know what happens next. Demand grows at 25% per month until it again reaches capacity. At this point, we’re earning $288,000 per month, and continue to do so through the end of the three years. Even with all of those months spent waiting to increase capacity -total revenue ends up at $3.5 million.

Subscription (licensing, recurring) based products

Consumables are a good business model – particularly if you’re making something that’s popular. But, what if you could bill customers automatically? So that they didn’t even have to make an effort to come and buy your product

Also consider, what if you were providing a service or something intangible? Meaning you didn’t have to invest in capital to expand your capacity? Or, if you did, the cost of doing so was negligible?

If you had a business model like that, you would have close to the ideal business. Netflix is an example of this type of business model. As is Facebook – even though their platform is free.

Another type of business that kind of walks the line between a consumable and a subscription-based business is prescription drugs. When someone begins taking a maintenance drug, they’re typically a customer for life. Most of the cost of selling prescription drugs is racked up in research and development. Manufacturing pills

Subscription-based example

In this last example, our enterprising employ has created a membership website. Things start off the same as with most of the other examples. We sell our subscription for $10 apiece. Demand in Jan-19 is only 400 subscriptions. Also, like the other examples, demand grows at a

This is where the similarities end though. This business model is not constrained by time. Sales are recurring (

This simplified illustration should make it easy to see why you are getting up-sold all the time to some sort of subscription-based plan. Once you start paying in, they know that it’s likely that you’ll continue to do so for the foreseeable future. That’s easy revenue for the company doing the selling!

Types of business models

Hopefully, you can see how a company’s business model can affect its potential to increase sales in the coming years. Just because one company has a more desirable business model over another doesn’t necessarily make it a good or bad investment. Rather it will simply help you when it comes time to forecast future sales.

Are there any types of business models that I left off this list?

If so, g

Also, do you have a question about what business model a company you’re analyzing uses?