You know that tech stocks have the potential to earn you a lot of money. Tech stocks have created vast amounts of wealth over the past 30+ years and you’re scared of missing out on your share.

I can’t tell you, specifically, what tech companies to invest in. Though, you might wish I would. Hopefully, however, I can give you some food for thought.

I’m more of a dividend stock guy, myself. When I speculate, I focus more on crypto.

That said, here are some questions to consider:

- Do you have to invest your entire portfolio in tech in order to particpate in some of the gains?

- Why not dump every dollar you have into the next overhyped tech darling?

- If you decide to invest in tech, are you going to make 100% optimal decisions in terms of the company you invest in and the entry/exit price?

- What are your ultimate goals for your portfolio? To grow it to the max possible value? To live off of the income it generates someday?

- How will investing in tech companies help you reach those goals?

Think through these questions along with the potential benefits and risks listed below. Then, if you decide to move forward, listen to your gut. Invest the amount you are comfortable with – in tech companies that you believe in. Companies that you want to own, even if they won’t be the highest performers.

Tech stocks can be purchased individually, of course. Or, if you’d rather leave the picking to someone else, you can invest in an ETF or mutual fund.

Pros of investing in tech companies

Many of the best-performing stocks (and investments in general) have been tech companies.

Tech companies often have high margins. This means that a large part of their revenue gets carried to their bottom line and provides a “margin of safety” against risks.

Investing Risk Tolerance | The Key to Wise Decisions

Technology is a sector that, generally speaking, never becomes obsolete. Sure, specific products, services, and companies within the sector do. But, technology, as a sector, is constantly evolving.

A lot of technology is created for and marketed toward consumers. Therefore, there’s a reasonable chance that you could have a solid familiarity with the products and services that will drive revenue.

Tech stocks can be (somewhat) recession-proof. As shown in the COVID pandemic, technology, like it or not, seems to be viewed as essential to life. Of course, this depends on the type of technology.

Successful tech companies tend to be (near) monopolies. Due, in part, to the winner-take-all nature of the sector. This means that it’s difficult for competitors to take market share. That advantage can be a disadvantage too. See below…

Cons of investing in tech companies

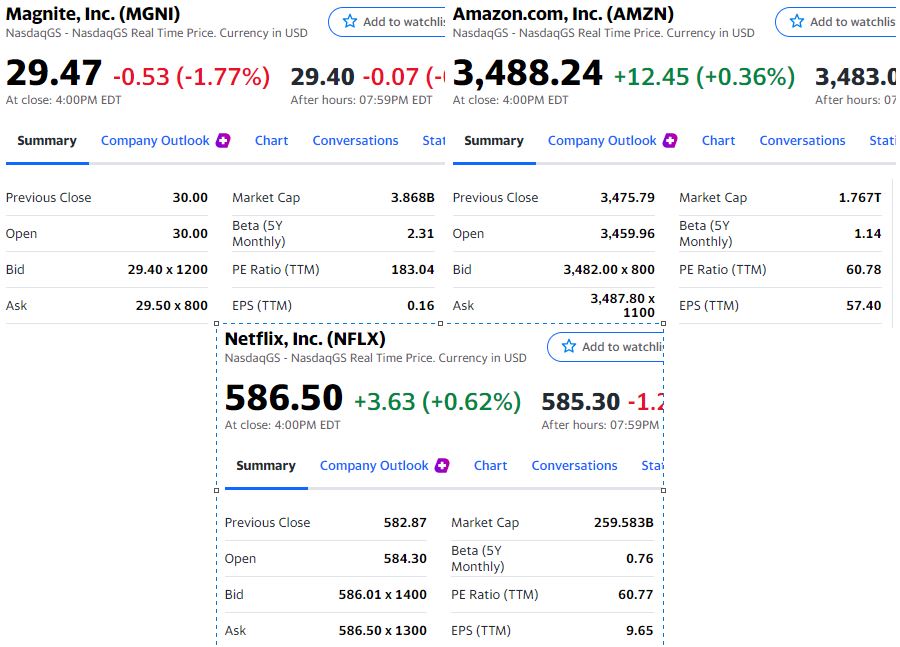

Not every tech company is a good investment. Some underperform the S&P 500 (SPY) by a considerable margin.

Technology companies with high potential usually have high valuations (PE, PS ratio). This means they must perform exceptionally well to justify their current price.

It’s not necessarily obvious which tech companies are going to be good investments. Hindsight is 20/20. Looking back, the FAANG and CIMQ (Cisco, Intel, Microsoft, Qualcomm) stocks were destined to succeed. That wasn’t so clear in 2010 or 1990 respectively.

Technology companies, usually, do not pay dividends. They reinvest that money back into themselves. So, you will, most likely, not receive any sort of (semi) guaranteed return. This makes tech stocks a speculative investment.

Examples of High Dividend Stocks – Know What Aspects Matter

Technology companies can be subjected to a lot of scrutiny. Some of which can come from regulators who may have the power to disrupt operations or create fear among investors.

Tech stocks can be volatile. Volatility can be forgiven if the end result is extraordinary gains. However, the effect on your mental wellbeing can be negative.

Investing Risk Tolerance | The Key to Wise Decisions

Tech companies tend to abuse their power and frequently act in a disreputable manner. This could present an ethical problem for some investors.

Technology is deflationary, in that prices tend to decrease over time. This puts pressure on companies to innovate. Those that can’t innovate, could lose market share.

On that note, there is a huge amount of competition in the tech sector. Because of the winner-take-all nature of technology, there is a huge incentive for startups to better meet the needs of customers. Also, since fixed costs are generally small, the barriers to entry are also relatively low.

Tech industries and companies

Industries within the tech sector are listed below. Also included, are a few of the biggest companies in the industry (based on market capitalization).

- Communication equipment

- Cisco Systems Inc (CSCO)

- Motorola Solutions Inc (MSI)

- Telefonaktiebolaget LM Ericsson (ERIC)

- Computer hardware

- Dell Technologies Inc (DELL)

- Canon Inc (CAJ)

- HP Inc (HPQ)

- Consumer electronics

- Apple Inc (AAPL)

- Sony Group Corp (SONY)

- LG Display Co Ltd. (LPL)

- Electronic components

- TE Connectivity Ltd (TEL)

- Amphenol Corporation (APH)

- Corning Incorporated (GLW)

- Electronics and computer distribution

- Arrow Electronics, Inc. (ARW)

- Avnet, Inc. (AVT)

- PC Connection, Inc. (CNXN)

- Information technology services

- Accenture Plc (ACN)

- IBM Common Stock (IBM)

- Infosys Ltd ADR (INFY)

- Scientific and technical instruments

- Keysight Technologies Inc (KEYS)

- Garmin Ltd. (GRMN)

- Fortive Corp (FTV)

- Semiconductor equipment and materials

- ASML Holding NV (ASML)

- Applied Materials, Inc. (AMAT)

- Lam Research Corporation (LRCX)

- Semiconductors

- Taiwan Semiconductor Mfg. Co. Ltd. (TSM)

- NVIDIA Corporation (NVDA)

- Intel Corporation (INTC)

- Software – application

- salesforce.com, inc. (CRM)

- Shopify Inc (SHOP)

- SAP SE (SAP)

- Software – infrastructure

- Microsoft Corporation (MSFT)

- Adobe Inc (ADBE)

- Oracle Corporation (ORCL)

- Solar

- Enphase Energy Inc (ENPH)

- Solaredge Technologies Inc (SEDG)

- First Solar, Inc. (FSLR)

- Internet Content & information (finviz lists in the Communication Services sector)

- Alphabet Inc Class C (GOOG)

- Facebook, Inc. Common Stock (FB)

- Snap Inc (SNAP)

- Telecom (Communication Services sector)

- Verizon Communications Inc. (VZ)

- AT&T Inc. (T)

- T-Mobile Us Inc (TMUS)

- Electronic Gaming & Multimedia (Communication Services sector)

- Sea Ltd (SE)

- Activision Blizzard, Inc. (ATVI)

- Roblox Corp (RBLX)

- Entertainment (Communication Services sector)

- Walt Disney Co (DIS)

- Comcast Corporation (CMCSA)

- Netflix Inc (NFLX)