In today’s day and age there are a ton of different avenues that you can take advantage of in order to make a profit.

Literally everywhere you look you can find a decent way to invest some money and the best part about it is the fact that while it may all seem complicated at first, you don’t even need to fully understand what you’re doing in order to come out with a hefty profit.

By far the most beloved avenue that you can invest into nowadays though is the magical world of stocks. Stocks can either make or break your life, and it is this risk to profit line that truly separates them from any other way of making money.

This is why for today we decided to bring you our very own top 25 of the best stocks that you should invest into as of 2022. Each of these has proven to be well worth the money you spent on it and even though some of them have been declining in these last couple of months, this might be the best period to start buying in.

We’ve included stock charts for the last year from Google Finance for each of the companies in this list, so without further ado, let’s just jump right into our first pick of the day:

25. Charles Schwab (NYSE: SCHW)

Financial stocks always make for a great investment because of their rising interest rates and high liquidity. There is a reason as to why banks are always thriving and if you want to make a quick buck while buying stocks then Charles Schwab may very well be the best choice for you.

They are set to have a growth of almost 60% as of 2022 as well, which explains why so many new investors have started to pop up from out of nowhere, trying to get a piece of their profit with them.

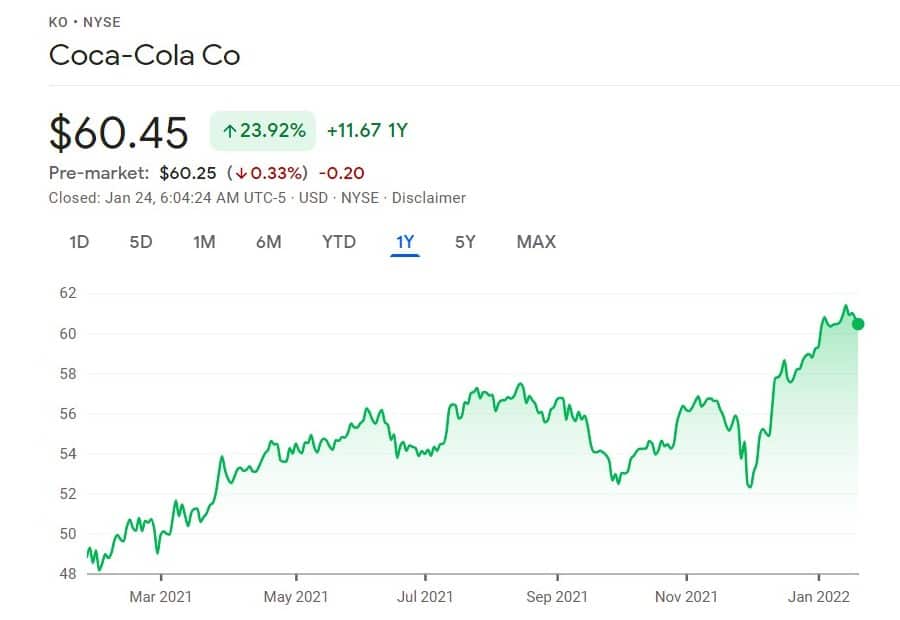

24. Coca Cola (NYSE: KO)

The main reason as to why Coca Cola is so low on our list is because it’s actually been on the decline for quite some time now because of its COVID-recession losses.

Luckily however, financial experts have stated that Coca Cola is on the rise again and that the sales of mini packs and Coke Zero Sugar have definitely helped it rise back up to its former self already.

So, if you want a safe bet that will most definitely result in a nice profit then Coca Cola might be the perfect choice for you.

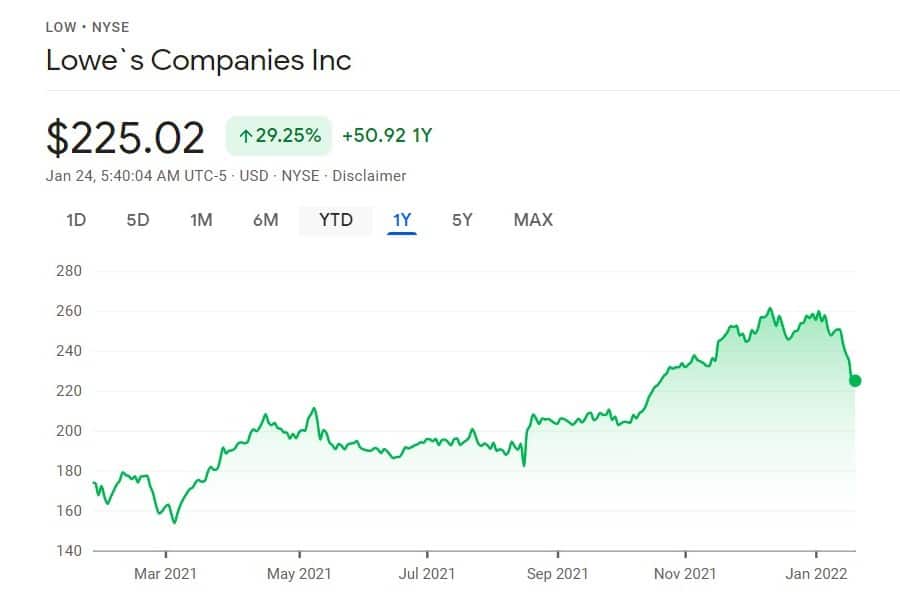

23. Lowe’s (NYSE: LOW)

Home improvement is always extremely popular in today’s world especially so during the pandemic. While most of us were stuck in our homes we ended up trying to revamp our houses a little bit, perhaps buying some new furniture or repainting our ceiling to make it more homely.

This has actually driven Lowe’s numbers through the roof, and things are only going to get better and better as time moves on.

22. Altria Group (NYSE: MO)

The best part about the Altria Group is that despite the fact that they’ve been ruthlessly attacked from every which way possible by now, they still continue to thrive no matter what.

Doctors all around the globe have come out demanding that people stop destroying their health by smoking cigarettes, but this hasn’t stopped anyone yet nor will it do so in the future.

This is because companies such as the Altria Group have such a hold over our society that no matter what, they will continue to thrive.

21. Laboratory Corporation of America (NYSE: LH)

The LCH is one of the most illustrious and largest clinical laboratory network operators of all time, and because of this more and more people have decided to invest into it.

Considering just how important health has become to us in recent years, let’s just say that buying its type of stocks has never been more profitable to say the least.

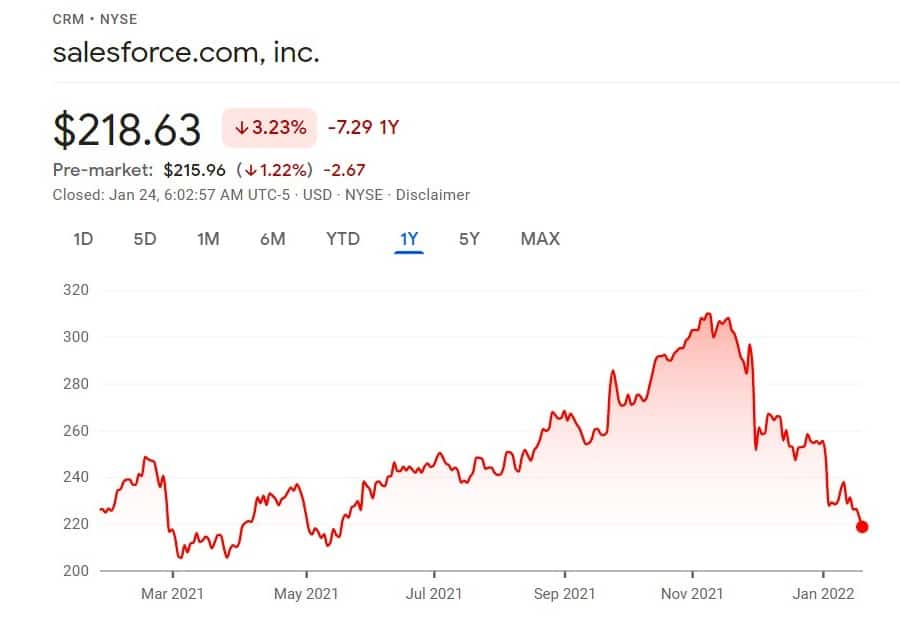

21. Salesforce.com (NYSE: CRM)

2021 has definitely been one of the best years in the history of this company right here and that’s a fact. This all stems from the fact that the cloud-based or digital transformation companies out there have all experienced a continuous economic growth, to the point where they almost seem unstoppable.

Even some of Wall Street’s most ingenious analysts have stated that this avenue is set to rise exponentially in the near future, making this a great company to invest your hard-earned money into.

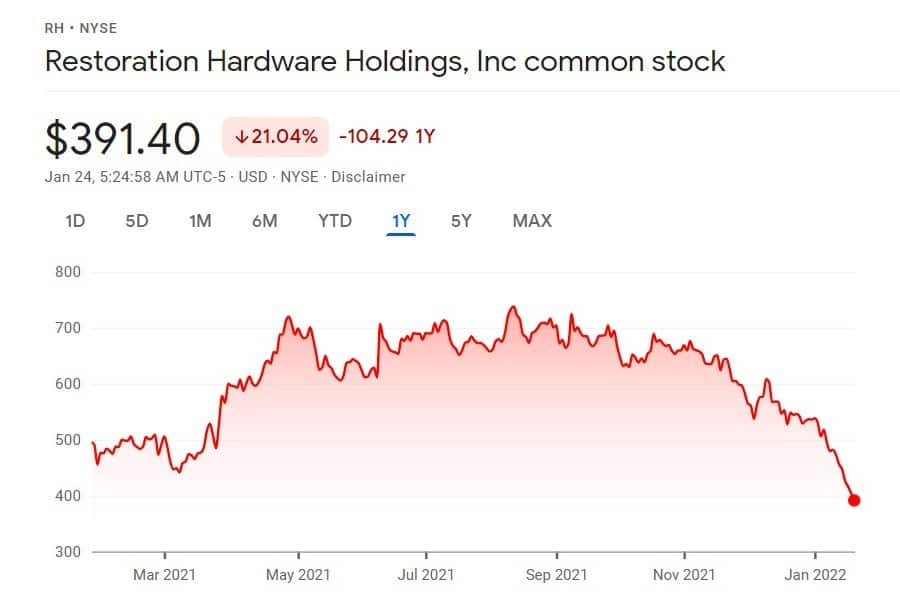

19. Restoration Hardware (NYSE: RH)

RH experienced something similar to what Lowe’s went through for the past couple of years, as most people were forced to stay indoors and in doing so everybody decided that it was about time to invest in their houses.

This increased RH’s shares by 569% in 2020, and the numbers have continued to rise higher and higher as the pandemic forced us to isolate further and further.

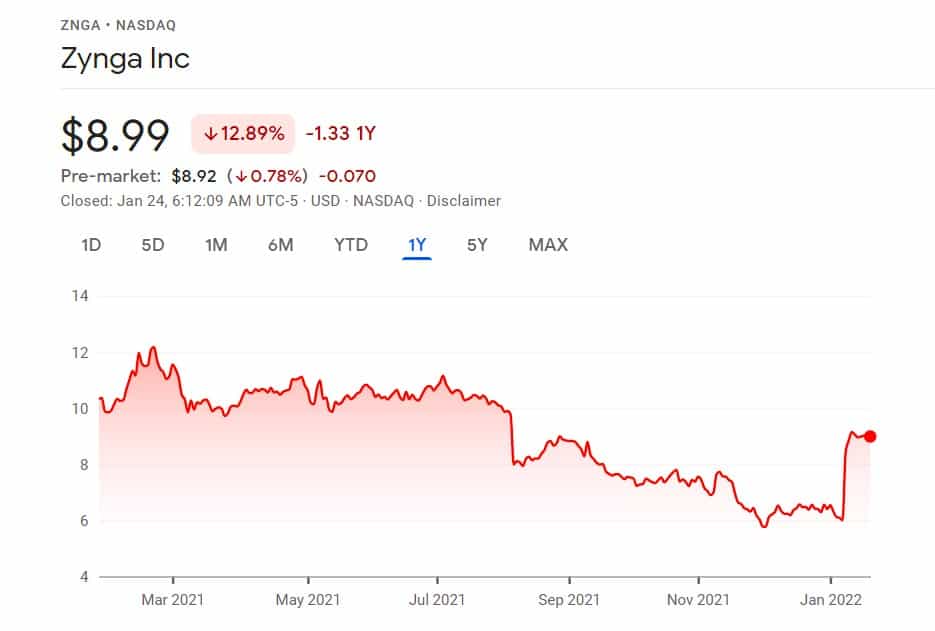

18. Zynga (NASDAQ: ZNGA)

You may not remember the titan that is Zynga, but we can assure you that you remember the titles that they had under their belt in the past. Names such as Farmville and Words With Friends should instantly indicate what company you’re dealing with here.

Needless to say, Zynga have always known how to develop some of the most addictive games of all time, and according to Wall Street’s analysts, they will continue to do so going further into the future as well which is why they’re well worth the investment.

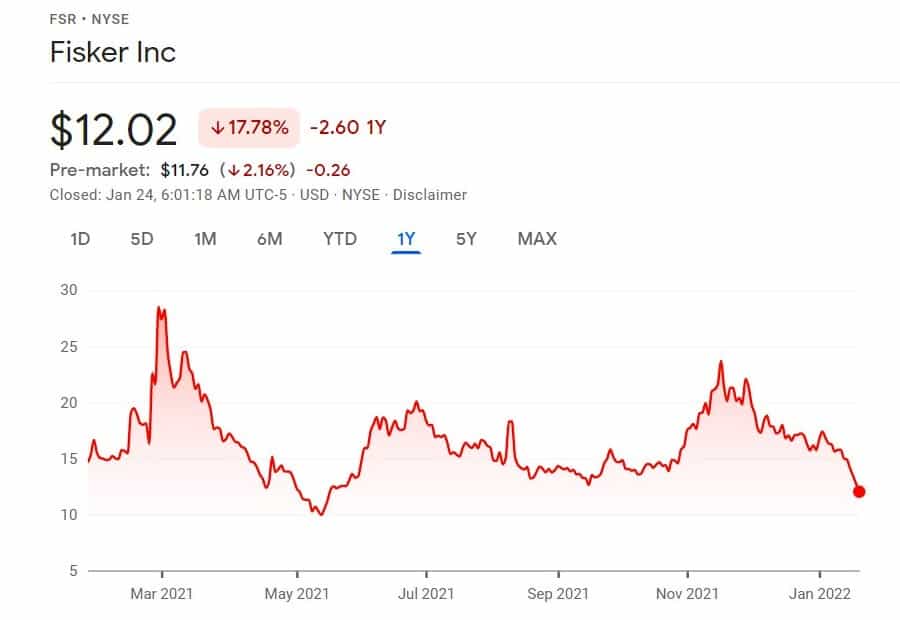

17. Fisker (NYSE: FSR)

The electric car industry is a growing medium to say the least, and as one of the top representatives in the field, Fisker is a no brainer when it comes to the possibilities it withholds.

Hopefully its Fisker Ocean plan will come to fruition and win the company and its investors a big paycheck as it is their first mid-size premium SUV and their best chance at beating out some of its top competitors.

16. Under Armour (NYSE: UAA)

The more time passes, the more we start to pay attention to our health and this has definitely reflected in the market price for sports equipment companies.

Because of this we can safely say that by the end of 2022, Under Armour, one of the top apparel retailers in the world, is sure to make you a good profit if you decide to invest into it and buy its stocks this very moment.

15. Johnson & Johnson (NYSE: JNJ)

Sure, investing in Johnson & Johnson appears to be the very best choice you could make right now, but what most people don’t realize is that this company has been on the rise constantly over the past couple of years now, and they will continue to grow exponentially as time moves on.

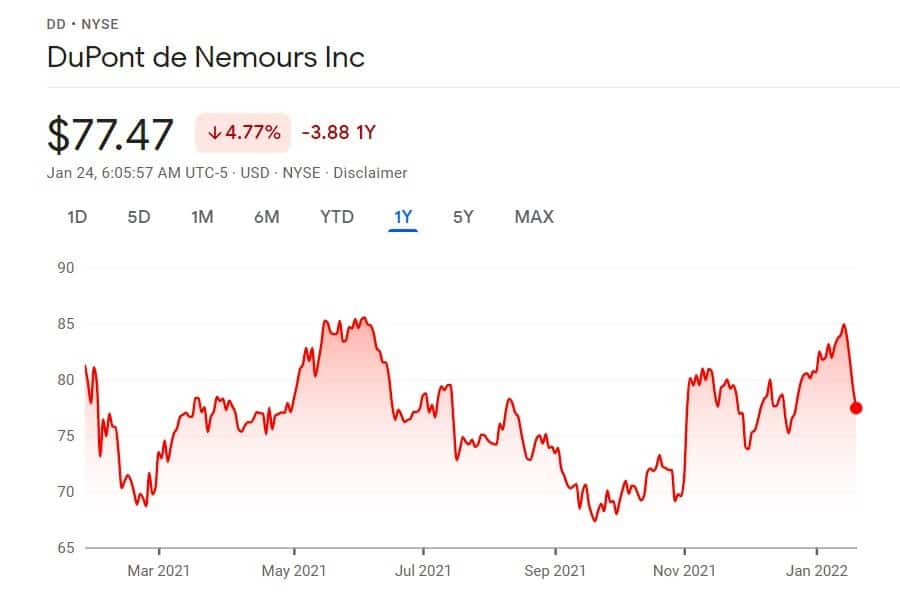

14. DuPont de Nemours (NYSE: DD)

According to some of the top analysts of our time, there will be an upcoming rise in the cyclical boat industry. This is very important for companies such as DuPont de Nemours as they are amongst the top names that provide the world with the materials sticks that they need to do so.

While stocks are definitely a bit more on the expensive side with it, they’re well worth it since the business will continue to thrive as we go deeper and deeper into 2022.

13. General Motors (NYSE: GM)

Saying that the automotive industry is a good investment is like saying that the water is wet. The fact of the matter is that most car companies out there have been on the rise as of late, and they will continue to rise exponentially as the years roll on by because of the public’s need for them. General Motors might be the car company that has the biggest upside.

12. Beauty Health (NASDAQ: SKIN)

The beauty and self-care industry has been thriving a lot for the past decade or so, and by far one of the best examples of this is none other than Beauty Health.

With its flagship brand HydraFacial, Beauty Health has pretty much taken over the market, and the experts have stated that this is just the beginning for the brand as it will continue to take over small businesses, growing exponentially with no real end in sight.

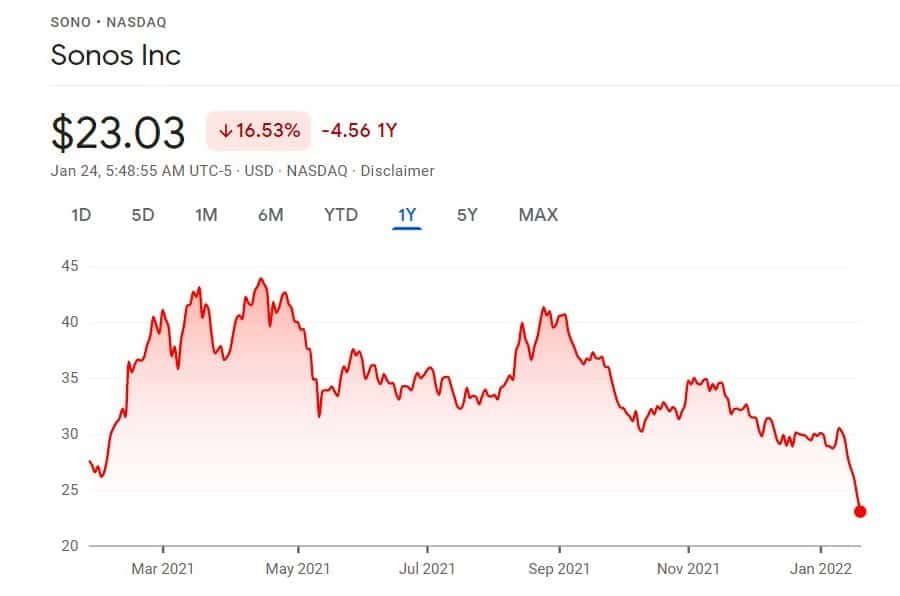

11. Sonos (NASDAQ: SONO)

The tech world has slowly yet surely taken over our lives, to the point where we can’t even picture a world without our computers or our smartphones by our side.

Sonos have noticed this and slowly yet surely they improved upon their scalable smart-speaker platforms, essentially implementing themselves into the lives of millions and expanding to never-before seen heights in doing so.

Their potential is just through the roof to say the least, and as we jump headfirst into 2022 let’s just say that they’re not going to be slowing down anytime soon.

10. Alibaba (NYSE: BABA)

The saddest part about Alibaba is the fact that it is still just as profitable to invest in it as it has ever been, but despite this we can’t put it any higher on our list because it is constantly targeted by both the CCP and the US government.

It is definitely struggling a lot as we speak, but even with these massive juggernauts constantly picking away at it, Alibaba still remains one of the leaders in terms of e-commerce and cloud computing.

If you do feel like this is too big of a risk for you then you can always opt for Shopify instead, but we still have to remind you that Alibaba is nowhere near as damaged as it appears to be.

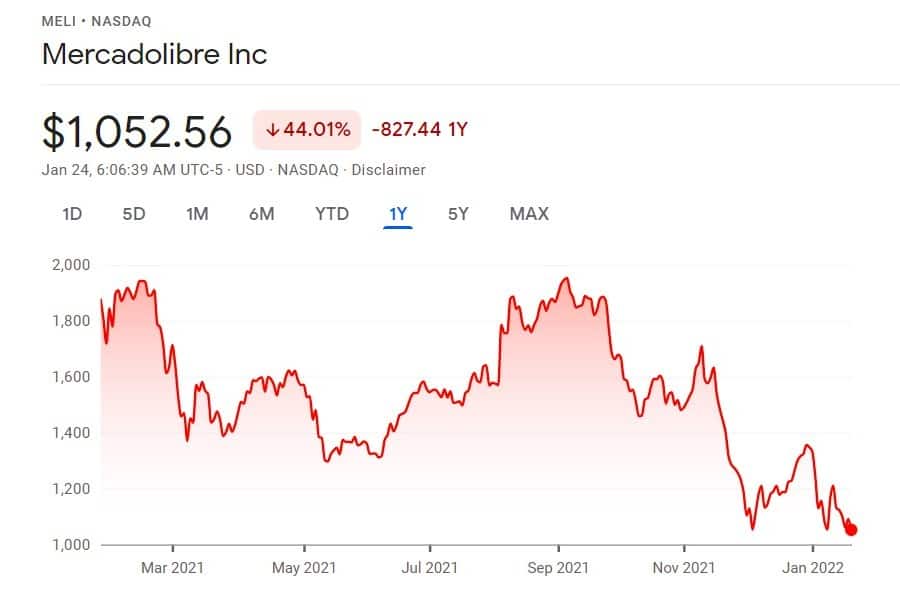

9. MercadoLibre (NASDAQ: MELI)

In case you didn’t know what MercadoLibre is, it is essentially the Amazon of South America. Sure, the company itself doesn’t own any gaming items, but what it does have is practically everything else you could think of.

Its main competition comes from the Sea, and although it definitely has seen better days, it still remains as one of the best options we could think of in terms of stock buying in 2022.

Most experts agree over the fact that it is set to have a rebound this year, with some even claiming that there will be a revenue growth of over 36% within the next 12 months or so.

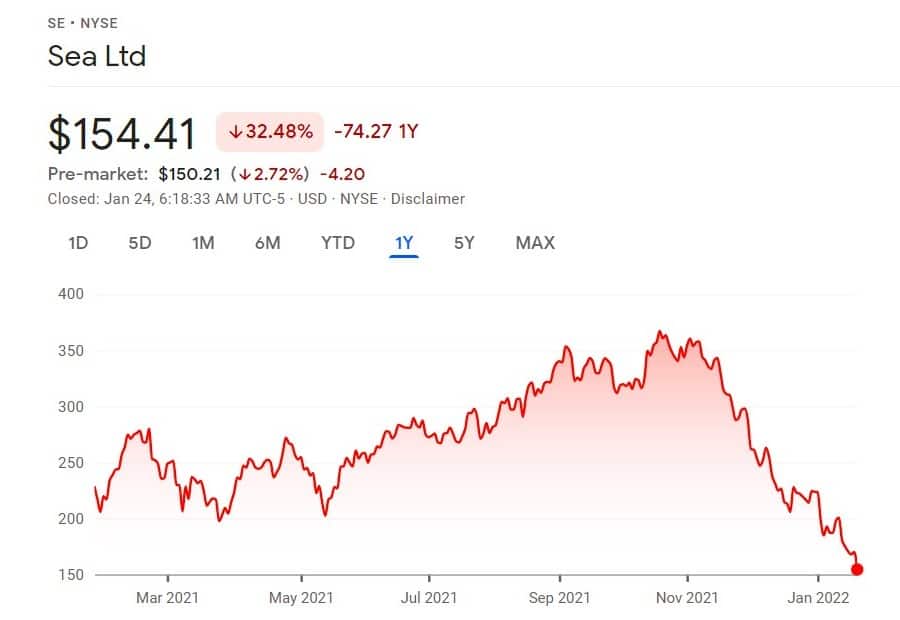

8. Sea Limited (NYSE: SE)

One of the top names in the world of e-commerce, Sea Limited is often times considered to be the Amazon of Southeast Asia because of its Shopee platform.

The reason as to why it is worthy of your investment however is the fact that it’s only at 11% penetration within emerging markets as opposed to the 18.7% that we have seen in the United States of America.

This in itself is a great indicator of why it’s worth buying its stocks in 2022, especially considering the fact that the GDP is set to grow by 5.7% within the younger population in Southeast Asia.

7. Okta (NASDAQ: OKTA)

Okta is a stock that is solely focused on the convergence of cloud computing and cybersecurity, and it is by far one of the best at it too.

The main reason as to why you should look into it as a good investment route for 2022 is because it heavily focuses on the idea of identity management which in turn gives it a better and stronger cybersecurity for most companies out there.

Since cybersecurity is such an important aspect of having a business in the 21st century, let’s just say that companies such as Okta make for a great investment to say the least.

6. Cloudstrike (NASDAQ: CRWD)

Cloudstrike is a great stock to buy as of 2022 because it is essentially a triple beneficiary in terms of cloud computing.

What we mean by this is that it uses hyperscale cloud providers to scale quicker than most other brands, it makes a profit by increasing the cybersecurity of the companies it deals with and of course, it displaces the legacy providers that are not yet in the cloud.

Experts have also stated that by the end of the year we can see a total increase in earnings of 58% in total, making this the perfect time to invest in Cloudstrike.

5. ASML Holding (NASDAQ: ASML)

ASML has been a top pick for the past couple of years now simply because it is the only provider of EUV equipment. This equipment is the only available choice for advanced semiconductor manufacturing, and they more than took advantage of this back in 2021 and they will continue to do so onwards.

Sure, it is one of the more expensive options on the market, but this doesn’t change the fact that it is also set to grow by 23% in earnings by the end of 2022.

4. Taiwan Semiconductor Co. (NYSE: TSM)

When it comes to semiconductor manufacturing tech, there just isn’t any option out there that can rival the likes of TSMC and that’s a fact.

They’re so good at what they do that they even have names such as Apple, Nvidia and AMD amongst their most prized customers, and the list doesn’t stop there.

Although they have risen a lot over the years, experts still believe that by the end of 2022, the company will have a total growth of 19% which makes this more than worth the investment.

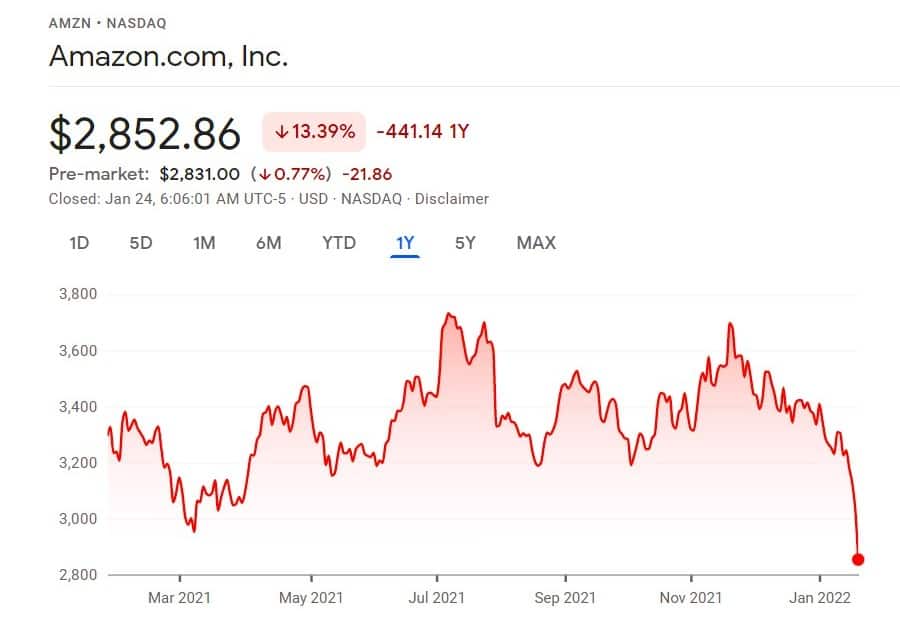

3. Amazon (NASDAQ: AMZN)

Let’s be honest here, regardless of the year that we’re in, Amazon will always be a great stock to buy simply because there’s just nothing quite like it out there.

It is the absolute leader when it comes to e-commerce and cloud, the world as we know it would be vastly different without it and quite honestly regardless of what growth it had in the past, Amazon is the type of a company that will never stop rising.

Even so, analysts have stated that by the end of 2022 the company is set to raise the bar up when it comes to its income, growing as much as 29% in total.

2. Google (NASDAQ: GOOGL)

Google or now Alphabet is currently one of the three leaders that are controlling the hyperscale cloud world. Our number one pick takes the cake by far, but what this company does different from it is the fact that it is actually constantly evolving and making sure that it does not drop in the slightest.

With a P/E of 29 and a PEG below 1, it makes for a great investment to say the least, and considering the massive 17% revenue growth that the specialists foresee in its near future, let’s just say that you can’t miss out on this option right here.

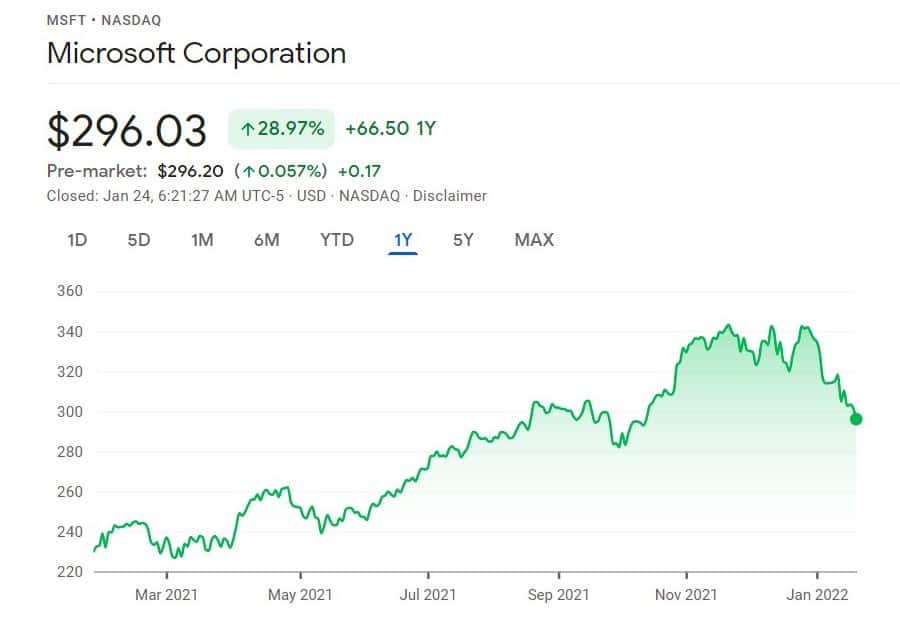

1. Microsoft (NASDAQ: MSFT)

Microsoft is one of the two companies that has an even higher credit rating that that of the US government. That in itself is insane, but if that weren’t enough, they are also the sole providers for a ton of different tech related avenues.

Their utility in the modern world is undeniable, Microsoft has pretty much taken over our life and because of this there’s just no way that we can ever see the company ever dropping in numbers.

Sadly though, this company isn’t all that cheap either, with a P/E of 37 in total to back it up. The good thing about this though is that this is Microsoft that we’re talking about over here, so regardless of what the cost is, you can always be sure that you’ll end up with a nice profit on your hands no matter what.

Conclusion

So, there you have our top 25 best stocks to buy in 2022. While the world of stocks is definitely quite volatile and risky to delve into, it can also make for a great profit by the end of the day.

So, take every company that we pointed your way with a grain of salt and always take the time to look into your investment before you actually cash in your money.

Contents

- 25. Charles Schwab (NYSE: SCHW)

- 24. Coca Cola (NYSE: KO)

- 23. Lowe’s (NYSE: LOW)

- 22. Altria Group (NYSE: MO)

- 21. Laboratory Corporation of America (NYSE: LH)

- 21. Salesforce.com (NYSE: CRM)

- 19. Restoration Hardware (NYSE: RH)

- 18. Zynga (NASDAQ: ZNGA)

- 17. Fisker (NYSE: FSR)

- 16. Under Armour (NYSE: UAA)

- 15. Johnson & Johnson (NYSE: JNJ)

- 14. DuPont de Nemours (NYSE: DD)

- 13. General Motors (NYSE: GM)

- 12. Beauty Health (NASDAQ: SKIN)

- 11. Sonos (NASDAQ: SONO)

- 10. Alibaba (NYSE: BABA)

- 9. MercadoLibre (NASDAQ: MELI)

- 8. Sea Limited (NYSE: SE)

- 7. Okta (NASDAQ: OKTA)

- 6. Cloudstrike (NASDAQ: CRWD)

- 5. ASML Holding (NASDAQ: ASML)

- 4. Taiwan Semiconductor Co. (NYSE: TSM)

- 3. Amazon (NASDAQ: AMZN)

- 2. Google (NASDAQ: GOOGL)

- 1. Microsoft (NASDAQ: MSFT)