“How do I start investing in the stock market?” Education is the most important first step to investing in stocks. A big part of that education is applying what you learn in a risk-free environment. This can be done by using trading simulators. From there, you want to pick the right brokerage for you, understand the costs involved, and then decide what methodology you want to use for picking stocks to invest in.

Investing in the stock market is interesting to a lot of people. Even those who don’t know much about business, finance, or investing know that there’s the potential to make a lot of money in stocks.

Investing in stocks can be a complicated topic. There are a million ways to approach the subject and it can be difficult to know where to begin.

Obviously, I find the prospect of investing in the stock market intriguing – I created a whole website dedicated to learning as much as I could about the subject. Maybe you’re interested in the subject too, but you don’t know how to invest money in stocks. There’s so much information available on the subject that it makes your head spin and you don’t know where to start.

Investing can be an exceedingly complicated subject. In this post, I’ll pass along a couple of things I think you should know before you get started.

1. Start investing in stocks by paper trading

The term “paper trading” means to simulate trading stocks without actually investing any money. You’ll place buy and sell orders in a simulated account.

“I want to invest in real stocks, not fake stocks!” you might be saying.

I understand because I felt the same way when I first started investing in stocks. But, I was wrong. I needed a reality check because I wasn’t as smart as I thought I was. I should have started with a good guide to investing and I should have applied what I was learning in a paper trading investment account. Doing so would have likely saved me a lot of money.

Even after you’ve gotten your feet wet investing in stocks, I would suggest you keep the paper trading account open to test investment ideas in a risk-free environment.

There are a lot of stock market simulators out there. Investopedia’s simulator is my go-to for stocks.

2. Open a brokerage account to invest in real stocks

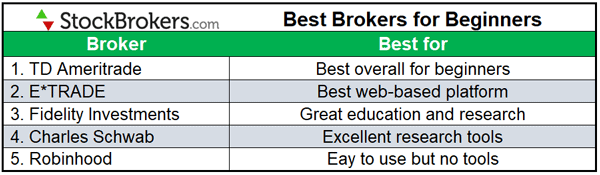

I’ve only ever had brokerage accounts with E-Trade and Scottrade (now part of TD Ameritrade). So, I haven’t invested in stocks with anyone else. But, as far as I can tell, they’re all pretty much the same.

Different brokerages might have different layouts and advanced features. But, if you’re a newbie, none of that will matter much. Read some reviews, look at some screenshots, and go with the one that makes you most comfortable.

I know that Robinhood is pretty popular with those who are new to investing in stocks. The screenshots I’ve seen lead me to believe that they have a pretty clean and simple layout. Information is kept to a minimum, which could help a newcomer avoid becoming overwhelmed.

Also, Robinhood is commission-free. Which leads us to a discussion of…

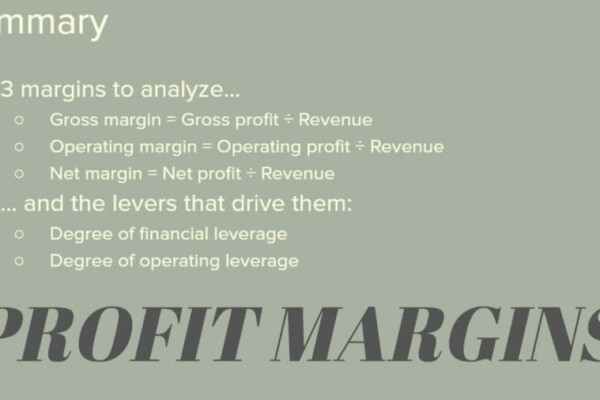

3. Understand the costs of investing in stocks

These are the “costs of doing business” in the world of stock investing. These costs include commissions, fees, and taxes.

Brokerage fees comparison

Commissions are the fees charged by a brokerage to trade stocks (and funds). Different brokerages might charge different amounts. Typically, though, you’ll pay around $7 per trade. That’s $7 to buy and $7 to sell, so $14 total.

Most people who are new to investing in stocks start with relatively small amounts. Even if you use an online discount brokerage like E-trade, TD Ameritrade, or Merrill Edge that $14 is:

2.8% of $500 and

1.4% of $1,000.

*Edit – this information was accurate as of August of 2018. Most brokerages now offer commission-free trades.

So, even though the amount of commission is negligible, it can dig you a bit of a hole if you’re investing small amounts. Also, keep in mind that these percentages are before tax.

I see a lot of people talking about $0 commission brokerage Robinhood. Full disclosure – I’ve never used Robinhood, but the feedback I’ve seen is almost all positive, so if you’re starting out with a modest amount to invest, they might be worth investigating.

Mutual fund fees explained

Yes, this post is primarily about investing in stocks. Mutual funds are a way to invest in stocks indirectly. More on that below.

If you opt to leave the stock-picking to someone else and choose to invest in mutual funds or ETFs then you will likely pay fees.

Fees can come in many shapes and sizes. The most common is a “management fee” paid to the fund company to cover their salaries and overhead expenses. People don’t do these things for free after all.

Keep in mind that if you purchase funds through a brokerage you might be paying a commission when you purchase and then a management fee every year you’re invested. As long as the fees are modest, they shouldn’t eat away at your gains too bad.

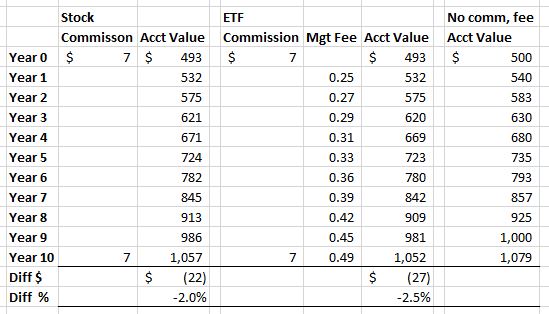

Here’s a quick look at the effects of commissions and fees on individual stocks and ETFs over the course of 10 years:

The parameters were as follows:

Beginning balance = $500

Commissions = $7

Management fee = .05% per year

Account value = 8% annual growth

As you can see, the differences among the Year 10 Acct Values were pretty tame. This is due, in large part, to 10 years of 8% returns. A different time period or bigger beginning balance would have also reduced the effects of these costs.

Do you pay taxes on investments?

Taxes are, of course, a very complicated subject. Too complicated to cover in-depth here.

Just know this – if you make money investing, the federal and state (and maybe local?) government is going to want a piece of your success.

Investing in stocks has two main taxable events – dividends and capital gains.

Stock and fund dividends

Dividends are a share of earnings that a company pays out to its shareholders. Usually quarterly. Since mutual funds and ETFs invest in individual stocks, they will often pay out dividends too.

Dividends are usually taxed as ordinary income. Depending on your total taxable income, this could mean that your dividends are taxed at 10% to 37%. Ouch! Not a bad deal for the government considering they didn’t risk any money.

Stock and fund capital gains

Capital gains (or losses) are the change in value from what you bought something for and what you sell it for. Buy 1 share of stock for $5 and sell it for $10? That’s a $5 capital gain.

There are two levels of capital gains tax- short-term and long-term.

Short-term means that you closed the position (sold) in the stock less than a year after you opened it (bought). Long-term gains are those incurred after holding the stock for more than a year.

Short-term gains, like dividends, are taxed as ordinary income. 10% to 37%.

Long-term gains are taxed anywhere from 0% to 20% depending on your taxable income. Most taxpayers would pay the 15% rate.

Obviously, the federal government wants you to hold onto your investments for more than a year!

4. Do you want to invest in stocks or funds?

Now that you hopefully have an idea of what it takes to get started, it’s finally time to think about what you want to invest in.

My last post went into a little bit more detail about the differences between investing in individual stocks and funds.

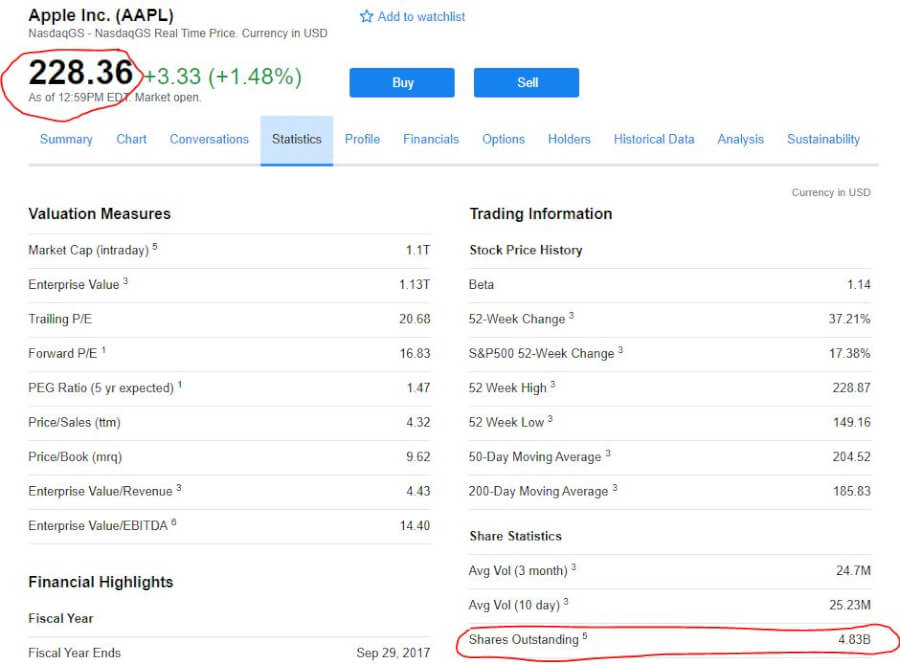

Individual stocks are shares of ownership of a company. For example, if you invested in one share of Apple Inc. stock (as of 8/30/18) it would cost you about $228 and you would own 1/4,830,000,000th of the company.

Funds, on the other hand, are investments that pool people’s money. A fund manager then purchases stocks on their behalf. They might invest to make gains or to match an index (like the S&P 500). There are also other types of funds that might invest in bonds or commodities (like oil or gold).

If you choose to leave the work of picking stocks to someone else, invest in mutual funds or ETFs.

If you want control over your investments you’ll invest in individual stocks.

You can actually do both. But if you decide to invest in individual stocks, you’ll have to decide how you’ll pick stocks…

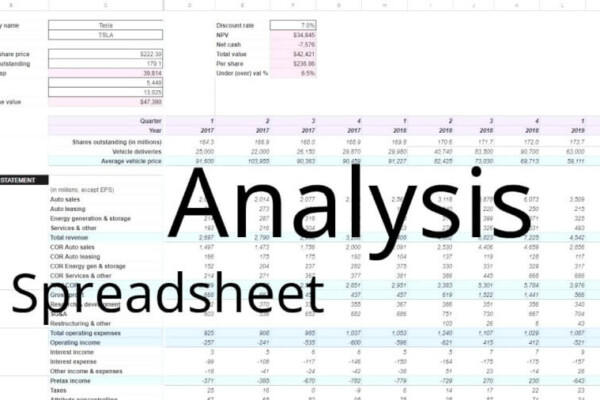

5. Technical analysis vs fundamental analysis for investing in stocks

This is something you’ll have to ultimately decide for yourself. First of all, let’s talk about the differences.

Technical analysis can be loosely defined as the use of past price data to predict future prices. People who use technical analysis feel that by looking backward, they can predict the future. Investing in stocks on the basis of technical analysis tends to result in short-term investments.

Fundamental analysis involves using a company’s current and expected financial condition to ascertain whether its shares should be bought or sold. People who use fundamental analysis view buying shares in a company the same as they would if they were buying the entire company. Investing in stocks on the basis of fundamental analysis tends to result in long-term investments.

Each school of thought has its proponents and detractors. Personally, as of now, I can’t say which I’d recommend. The reason I created this site was to, once and for all, settle on a methodology for picking stocks. I’ve only just started that journey.

Here is a post I wrote to give you a little taste of what technical analysis is about.

Here is a great YouTube channel that will get you started with fundamental analysis. Start with Introduction to Investing and Finance – Lesson 1, and work your way through all 18+ lessons.

I will continue to write content about both methodologies on this site and plan to test the waters on YouTube before long.

How do I start investing in the stock market?

Investing in stocks is a multi-faceted and complicated endeavor. Start simply and increase complexity from there.

- Take what you learn

- Apply it

- Learn from your successes and failures

- Learn something new and repeat

If you stay on this path, you’ll likely be learning for the rest of your life. Learning how to invest in stocks never ends. If that doesn’t sound appealing to you, you had better hand your money over to someone else to invest it for you.

As a new stock investor, what else would you like to know about?

Join the conversation on Twitter!

Contents

- 1. Start investing in stocks by paper trading

- 2. Open a brokerage account to invest in real stocks

- 3. Understand the costs of investing in stocks

- 4. Do you want to invest in stocks or funds?

- 5. Technical analysis vs fundamental analysis for investing in stocks

- How do I start investing in the stock market?