Stock picking involves actively choosing stocks to invest in with the goal of earning greater returns than would be earned with a passive strategy (e.g. index funds). Many investors open brokerage accounts for stock picking, but very few live up to their own expectations. Over the course of decades, index funds tend to be a more efficient investment. If you do decide to pick stocks, make sure you’ve done your homework and only invest in companies that you “have to” own.

Maybe you’ve come to a stage of your life when you have started to think about investing. That’s good, but, it is important that you stay realistic.

Famous investors such as Warren Buffet and Charlie Munger make it look easy. There is a common misconception among newbie investors that investing is some kind of get-rich-quick scheme. It’s not. Instead, it is a steady financial process that can take multiple decades.

What exactly is stock picking?

Stock picking is something that can be done by anyone that has a brokerage account and the required funds. The stock investor will pick one or more stocks that they will hope will greatly rise in value in the short or long term.

The art of stock picking is something that requires a lot of skill and knowledge – as well as time. All of the greatest stock investors do this as a full-time job so if you think that you can simply log into your stock trading app for 10 minutes after work and make a lot of money it might not end well for you.

Pros of stock picking

Potentially higher returns

If you are lucky you can make large returns very fast, this is something that is not as likely if you are investing in more conservative ways such as index funds.

Benefiting from your expertise

Good for those that are experts or knowledgable in a certain area. For example, if you work for a construction company then you will be a lot more aware of the leading companies in this industry and the value of their competitive advantage.

Betting on high growth startups

If you can identify or simply pick the next Google, Apple, or Amazon for example you will be a very rich person. Especially if you stay invested long-term.

Focusing on the best

You are only investing in what you think are great companies, rather than investing in all of the companies included in an index. Indexes have both bad and good investments.

Ability to outperform

Individual stock investors that are particularly dedicated to learning and making good decisions can outperform the average investor if they employ their up-to-date knowledge and stick to investing principles.

Cons of stock picking

It can become a form of gambling

For the overwhelming majority of investors that stock pick, they will be essentially gambling on stocks that they do not fully understand. There are real businesses behind every stock, so there are a lot of things that you have to take into account such as politics, future innovation, and even who will be managing the company.

Bad choices are guaranteed

No matter how good or lucky you are, you will make bad investments. Often when you stock pick you will not be sufficiently diversified in different companies and/or business sectors.

Quick profiteering is inefficient

A common trait of investors that are stock picking is the urge to buy stocks and then sell them for a quick profit. This can be highly inefficient. Though most brokers don’t charge commissions any longer, volatility and spreads are still working against you.

Real wealth is created over the long term. For example, if you had bought Apple stock on the 6th of February 2004 at $0.41 (split-adjusted) you would have more than doubled your money by the 10th of December 2004 when the stock would have hit $1.16. You would have made a tidy profit if you sold it back then, but if you were patient and waited 21 years then you could have seen returns of 30,604.9% at the current stock price of $125.89 as of the 4th of June 2021.

Higher tax obligations

Taxes are another major drawback. Capital gains tax in the United States and most other countries around the world will be applied when you sell assets such as stocks. You can save a lot of money on tax by investing for the long term.

Common sense affected by faised emotions

Finally, there are emotions, you should never involve emotions when you are investing, as this will prevent you from being objective and making the optimum choices. When you are picking stocks and then checking every couple of hours during the day on the performance of that stock you will get too emotionally invested which is not good for your mental health and investor’s frame of mind.

Alternatives to picking stocks

Stock picking vs stock market indexes

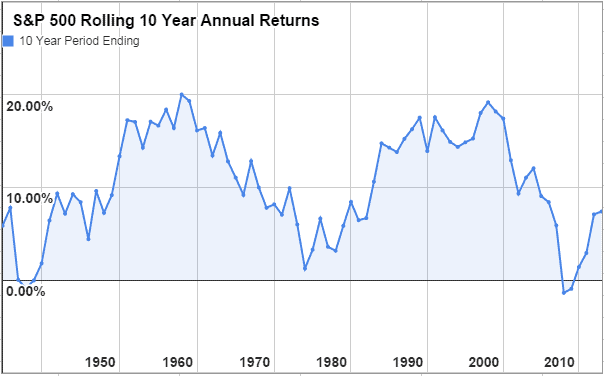

Stock market indexes are a collection of stocks. The most prominent one in the world being the S&P 500 which includes the biggest 500 companies in the United States.

When you invest in a stock index, you are buying into a fund that owns a share of every one of these 500 businesses. These funds are managed by third-party wealth managers such as Vanguard which makes sure to update their holdings based on the latest dropouts and entries in the S&P 500.

The average yearly return of the S&P 500 since 1950 is 11.40%. When adjusted for inflation this return drops to 7.69%. Both of these figures are still much higher than the rate that most amateur stock pickers will be able to consistently achieve over a period of a decade or more.

A common mistake is thinking that it’s easy to match Warren Buffet’s success. It is also important to note that Buffet’s legendary market-beating returns are powered by what is known as insurance float. Source.

Stock picking vs ‘talking head’ picks

In the age of the internet, there are more than enough self-described stock pickers. This is on top of the ones you will find on TV, such as Jim Cramer, and stock publications such as The Motley Fool.

Even if the talking head has a decent track record there are still major risks involved and no real advantages to picking the stocks yourself.

Keep in mind that tens of thousands of other people are consuming the same stock picks from these media figures and influencers. This will diminish your returns. You have to be careful not to get caught up in the hype as there are many examples of hyped-up bad performing companies such as the Nikola Corporation and Yahoo!.

It is also key to consider if the advice that you are receiving was truly so good, why would someone be sharing it? By sharing it, they will be diminishing their own returns by naturally pumping up the stock’s price. You have to be careful to not get caught up in stock pumps. Stock pumps are when stocks are promoted by individuals that want to make a quick buck from the price increase on the misfortune of others.

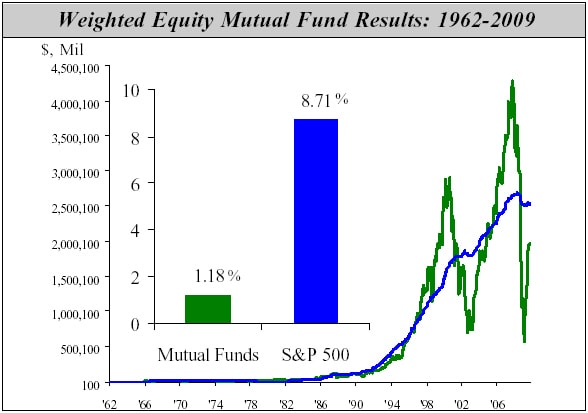

Stock picking vs mutual funds

An interesting alternative to stock picking yourself is to put your money in a mutual fund that will be managed by what is presumably an expert investor.

Often amateur investors will gain the wrong assumption that there are investors out there that are super talented at stock picking and have this magic touch that turns whatever stock they pick into a big winner. The statistics, in fact, show the exact opposite, from the graph that you can see above, over a period of 47 years we can see that mutual funds had a terrible return when stacked up against the average S&P 500 returns which we covered further above.

It is possible to beat the market by a lot for a year or even a few years in a row as you can see on the graph, yet over time you will also make big losses that will wipe out your big gains during the previous years. As the saying goes, it is better to go slow and steady if you want to win the race. Even if the mutual fund is run by an expert, this expert is still not immune to the whims of the markets and the greater business climate.

Understand your likelihood of success before picking stocks

Stock investing, as with all types of investing, is better if you work smart. Thankfully working smart in this discipline is pretty effortless. The best option is to invest in an index fund run by a reputable company.

The average investor will likely make returns when stock picking. But they will, at best, likely be in the single digits over the long term. The average stock picker will be outperformed by the investors that may be even less knowledgable than you who have simply parked their money in an S&P 500 index fund.

At the end of the day, if you find investing exciting, you can always delegate a small amount of money every year to invest in stocks that you pick yourself. This “risky” portion of your portfolio should be separate from your larger index fund investment.

Furthermore, you have to be patient. Stock picking is appealing to beginners because of the desire to get rich quickly. Give your investments time to grow. Resist the urge to check on them every single day. Real value is created over many decades of ownership.