A company’s executives have a direct and indirect effect on every decision made throughout the organization. They are the people behind every number in a financial statement.

The decisions these people make will ultimately determine whether a company is successful or not. An investor who is not familiar with the senior management qualifications for the company (s)he owns (or is analyzing) could be handicapped when speculating about its future.

Why care about a company’s senior management?

When people think of fundamental analysis they typically think of financial statement, ratio, and other types of analysis to ascertain the true value of a company. That, of course, is rational.

However, behind all of that, are the humans that made decisions which manifested those numbers.

Granted, a company may have hundreds of thousands of employees and many many individuals that make day-to-day decisions which contribute to the financial state of a company. Not every single decision is made by senior management, certainly.

But, if you’ve worked in a company for any amount of time, maybe you’ve found the same thing I have. Senior management, for better or worse, defines the culture for the entire company.

What’s important to senior management, becomes important, by default, to the VP’s and directors who report to them. In turn, through a desire to please the VP’s and directors, middle management decides that what’s important to their boss (and their boss’s boss) is now important to them. And so on down the pyramid.

Thinking independently, or counter to the corporate culture, will probably grate on any individual who decides to do so for very long. So, it’s just easier to leave the job; or to shrug and say “that’s just how things are done around here.”

This isn’t a lecture on the ills of corporate life, though. It’s simply my take on how the personality of a company starts at the top. If you buy into that – you’ll likely understand why it’s important to get as good of a read as possible on the individuals who define the corporate attitude.

Management in Fisher’s 15 points

- Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years?

- Does the management have a determination to continue to develop products or processes that will still further increase total sales potentials when the growth potentials of currently attractive product lines have largely been exploited?

- How effective are the company’s research and development efforts in relation to its size?

- Does the company have an above-average sales organization?

- Does the company have a worthwhile profit margin?

- What is the company doing to maintain or improve profit margins?

- Does the company have outstanding labor and personnel relations?

- How about outstanding executive relations?

- Does the company have depth to its management?

- How good are the company’s cost analysis and accounting controls?

- Are there other aspects of the business, somewhat peculiar to the industry involved, which will give the investor important clues as to how outstanding the company may be in relation to its competition?

- Does the company have a short-range or long-range outlook in regard to profits?

- In the foreseeable future will the growth of the company require sufficient equity financing so that the larger number of shares then outstanding will largely cancel the existing stockholders’ benefit from this anticipated growth?

- Does the management talk freely to investors about its affairs when things are going well but “clam up” when troubles and disappointments occur?

- Does the company have a management of unquestionable integrity?

What you’ll notice about them

Since this post is one small piece of my series on Philip Fisher’s book on investing – Common Stocks and Uncommon Profits, it’s appropriate that I point out how he emphasized the importance of sizing up management.

Of the 15 points, 4 of them mention management directly:

Other points, that don’t mention management explicitly, certainly allude to its influence.

It’s for all these reasons, that I thought to write this post outlining some of my ideas on how to “get to know” the senior management of a company better.

Start with the low-hanging fruit

These are the places where you’re almost guaranteed to find information about the individuals who run the company you’re interested in investing in. Most of the information will be the same across all of the companies you research. It makes for a good foundation and will allow you to hopefully expand on what you learn.

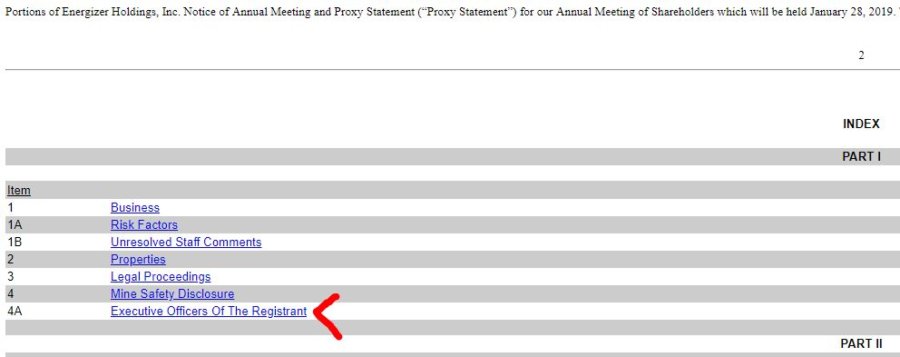

10-K Filing

The company’s SEC Form 10-K will contain brief information about senior management. Look for a section named “Executive Officers Of The Registrant.” This will be listed in the table of contents as Item 4(A). Usually, you can click on the link to be taken to that section of the 10-K.

There’s not too much information here and it can be inconsistent from company to company. But, it can be used to familiarize yourself with these individuals. You should be reading (some of) the 10-K anyway, so it’s a good place to start.

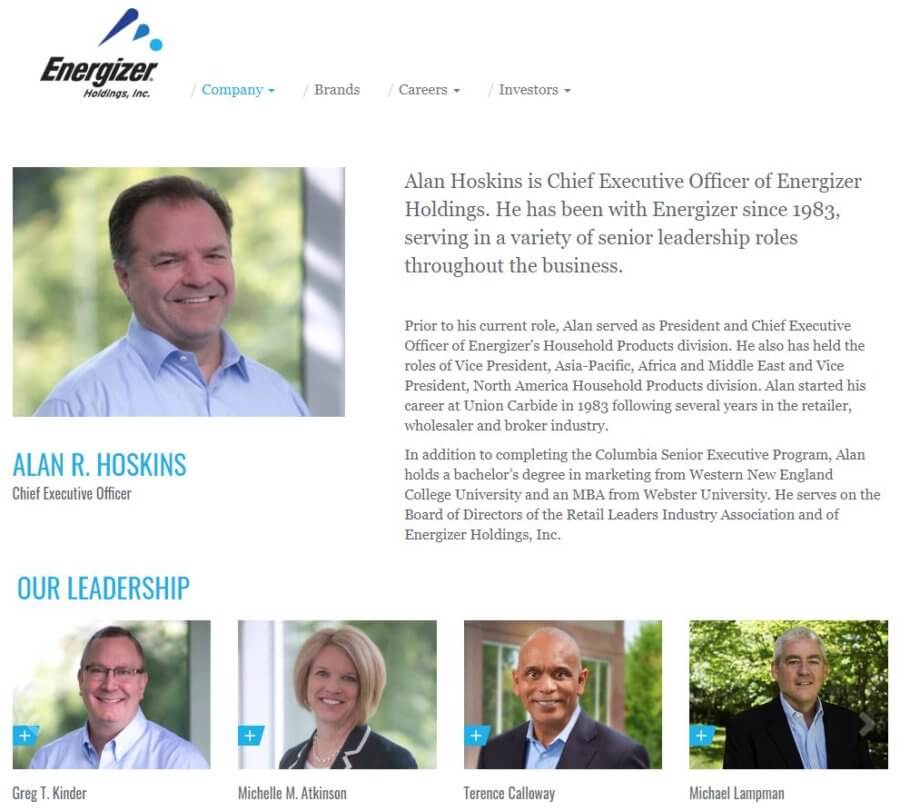

(Investor relations) website

More in-depth biographical information about senior management can usually be found on the company’s website. This information might not be on the “regular” website, but will probably be on a special investor relations website. A lot of times, the investor relations website has an address like investor(s).[company’s website].com.

If you’re having trouble finding it, just search for “[company name] investor relations.”

Just as the biographical information is more in-depth, you’ll also find a lot of financial information that’s complementary to the 10-K.

Every investor relations website is a little different. Many times, what you’re looking for is accessed from the main menu. Under the title “Leadership;” or something similar.

In fact, you’ll probably find a greater number of senior managers covered on the investor relations website than the 10-K. Additionally, you might find information about the Board of Directors too.

You’re probably familiar with LinkedIn – the professional social network that you know you should be on, but aren’t quite sure what to do with.

Anyhow, just because they’re hotshots, that doesn’t mean that the senior management of a big, publicly-traded company doesn’t have LinkedIn profiles. You might be surprised to find that almost all of them do.

I’m guessing that most senior managers won’t link to their LinkedIn from the investor relations website. So, you’ll simply have to go to LinkedIn and search for them individually.

If they have a somewhat complete LinkedIn profile, you’ll be able to take the next step in learning more about their professional history and personality. You could see what positions they held prior to their current one. Where and when they went to school. Skills and recommendations that were given by others. Skills and recommendations that were given to others. Some might even post or comment regularly.

Dig a little deeper on senior management qualifications

Now, armed with some basic, polished, information about senior management, you can engage in some light internet stalking. The goal is to learn more about the decision-makers in the company. Nothing illegal or unethical, of course. We’re just looking for information that is publicly available, just not necessarily owned by the company or the individual we’re researching.

Some executives are going to have a greater public presence than others. The Elon Musks, Mark Zuckerbergs, and Jeff Bezos’ of the world are going to have more written about them than the VP of Human Resources for some company with a $5 million market cap.

Tips for searching

Particularly for those senior managers that are a little more obscure – you might include the company name when searching for them. That way you’re not getting results for the wrong people.

Another tip is to put their name in quotes when searching. This forces the search engine to find an exact match and could prevent a bunch of results for people who share the same first or last name. The potential problem here, though, is that results which use a slight variation won’t be included. For instance a middle initial or a shortened version of the first name.

Also, don’t forget that a lot of these executives worked at a different company in the past. So, consider a search for them with their old company’s name too. This might provide an opportunity to compare the tone of their communications between the two companies to see if it’s changed over the years.

The default search results will hopefully include a lot of info in the form of articles, press releases, and other useful content. However, don’t forget to check the video and news results too. Heck, even the image results might unearth something useful?

Keep notes

The heading kind of says it all.

Most of these individuals aren’t going to be particularly memorable. If you start analyzing a large number of companies, you’re probably not going to be able to keep things straight. That is, without, at least, a rudimentary set of notes.

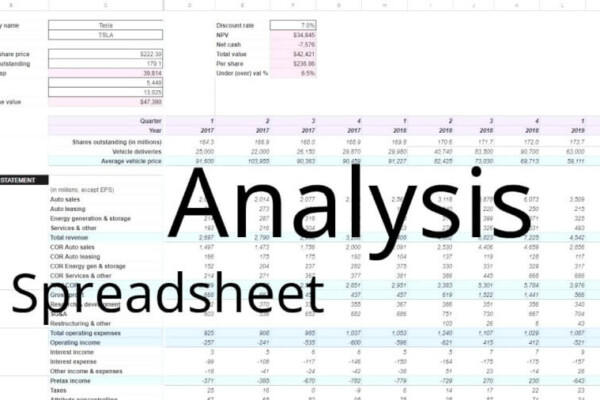

No need to go crazy here. Use a plain ol’ spreadsheet or document. Copy and paste their names and titles. Then, just include some notes of things that stood out to you. Maybe some links as a reference…

Beyond that, you’ll probably want to make notes that relate to Fisher’s 15 Points. Or, whatever alternative system of analyzing stocks you might use.

That’s it. You’re just looking for a little bit of organization so that you don’t have to start research from scratch if you should circle back to analyzing this particular company again.

Senior management qualifications

The context of this post mainly revolves around scrutinizing senior management for the purpose of speculating how their decisions will affect the value of the company.

However, if you’re an aspiring executive, these exercises could serve as a good model for rising to, and excelling at, a senior management role yourself.

What other means are there to learn more about a company’s senior management?

Are there other search tips you would recommend when “digging a little deeper?”