Interested in the compound interest spreadsheet used in the video? Click here.

How do you earn compound interest with stocks? Video summary

Technically speaking, stocks do not earn interest. They earn dividends and capital gains.

Capital gains can be very volatile. Dividends are less volatile. Ideally, dividends will grow, but they can be cut.

Like interest, both capital gains and dividends are subject to taxes.

Stocks don’t earn interest

Again, stocks provide returns via capital gains and dividends.

Savings accounts, CDs, and other such investments pay interest.

Capital gains fluctuate with the minute-by-minute, day-by-day, and year-by-year fluctuations in the stock price. Until that stock is sold and cash is received, the capital gains are known as “paper gains.” They only exist on paper and haven’t been “realized.”

Dividends are similar to interest – in some respects. Dividends are typically paid on a regular schedule. This can be monthly, quarterly, semi-annually, or annually. Though it can change, dividends are also, often, represented as a percentage, like interest. In the case of dividends, this percentage is based on the current stock price.

What are capital gains?

Capital gains are the result of changes in the price of the stock. The price of the stock, over the long-term, should approximate the change in the company’s net income.

Capital gains are not guaranteed. Investing with the hope of capital gains is speculation. That isn’t bad, per se, but it should be understood.

Capital gains will compound, to a greater or lesser degree, until the stock is sold.

Taxes on capital gains are paid when the stock is sold and cash is received. Taxes reduce the net return that the investor realizes.

What is an example of capital gains?

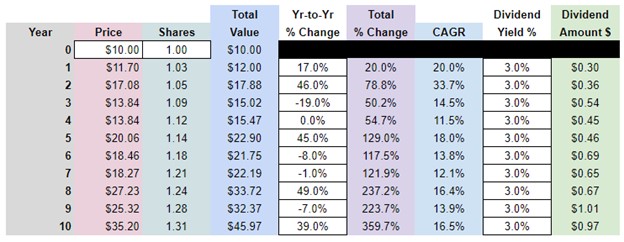

Imagine you owned a stock that decreased in value 10% in Year 1 and went up 25% in Year 2.

What would your total return be?

15%? No, it would be 12.5%.

Why? Well, since the price decreased by 10% in Year 1, the 25% increase was on a lower price.

Say you invested $100 in this stock. Year 1, you lost 10%, so your investment was worth $90 ($100 × 90%). Year 2, that $90 increased in value by 25%. Now, your investment is worth $112.50 ($90 × 125%). Your total return is 12.5% ($112.50 ÷ $100 – 1).

Total returns are also sometime represented as a Compound Annual Growth Rate (CAGR). This is the compounding (and consistent) rate of return that would turn the beginning value ($100) into the ending value ($112.50).

In the example above, the CAGR is 6.07%. Where the hell did that come from?

I won’t get into the math necessary to calculate the CAGR. We can, however, prove that it is, indeed, 6.07%.

Year 1: $100 × 1.067 = $106.70

Year 2: $106.70 × 1.067 = $112.50

How do dividends work?

Dividends are similar to interest in some respects, different in others.

Dividends can be reinvested which emulates the effect of compounded interest.

Dividends tend to be consistent. But, they are not contractually promised as interest is.

Taxes are due on dividends the year they are received. If you reinvest dividends, make sure that you keep enough cash aside to pay taxes.

Questions about Does Compound Interest Apply to Stocks?

“What are some ways to earn compound interest, money wise?”

Again, compound interest is earned through investments like savings accounts and CDs. Stock earn compounded returns.

“How does compound interest work when investing in stocks?”

Capital gains compound due to the compounding of the company’s earnings. Generally speaking.

Dividends only compound if they are reinvested.

“How does the concept of compounding apply to mutual funds?”

In the much the same way it does for stocks. However, dividends can more conveniently be reinvested because of the fractional nature of mutual fund shares.

Contents

- How do you earn compound interest with stocks? Video summary