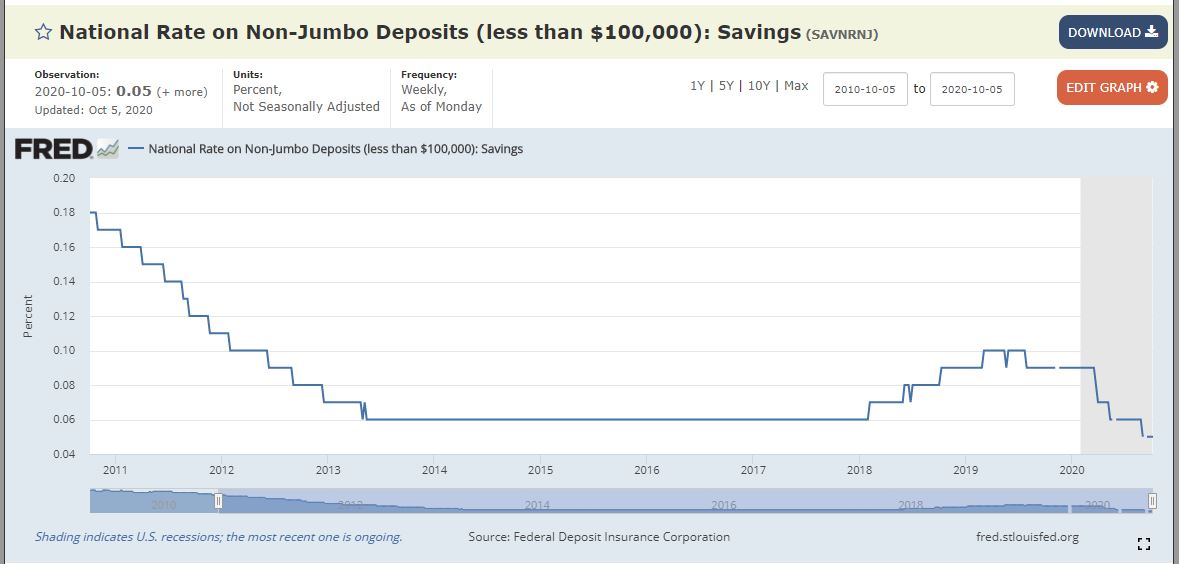

“Should I keep my money in the bank or at home?” Keeping your money “under your mattress,” as the cliché goes, means that you’ll lose purchasing power due to the eroding effects of inflation. While it doesn’t hurt to have easy access to cash, there are better options than hiding it at home. Is a savings account a better option? Not necessarily. There are better alternatives.

Savings accounts are generally considered to be the safest “investment” there is. Savings accounts at banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. The National Credit Union Administration (NCUA) provides the same insurance for savings accounts at credit unions.

This insurance helps to ensure, for all intents and purposes, that you’ll never lose your principal in a savings account. Even if the bank or credit union goes belly up.

However, savings accounts don’t offer very good returns. Sometimes, they don’t even keep up with inflation. So, if you’ve got some money and you aren’t quite sure how you want to invest in the long term, what should you do?

| 2018 | 2019 | 2020 | |

| Svgs acct nominal rate of return: | 0.17% | 0.09% | 0.09% |

| Inflation: | 2.40% | 1.80% | 1.20% |

| Real rate of return (Nominal – Inflation): | -2.23% | -1.71% | -1.11% |

Other options for safe investment

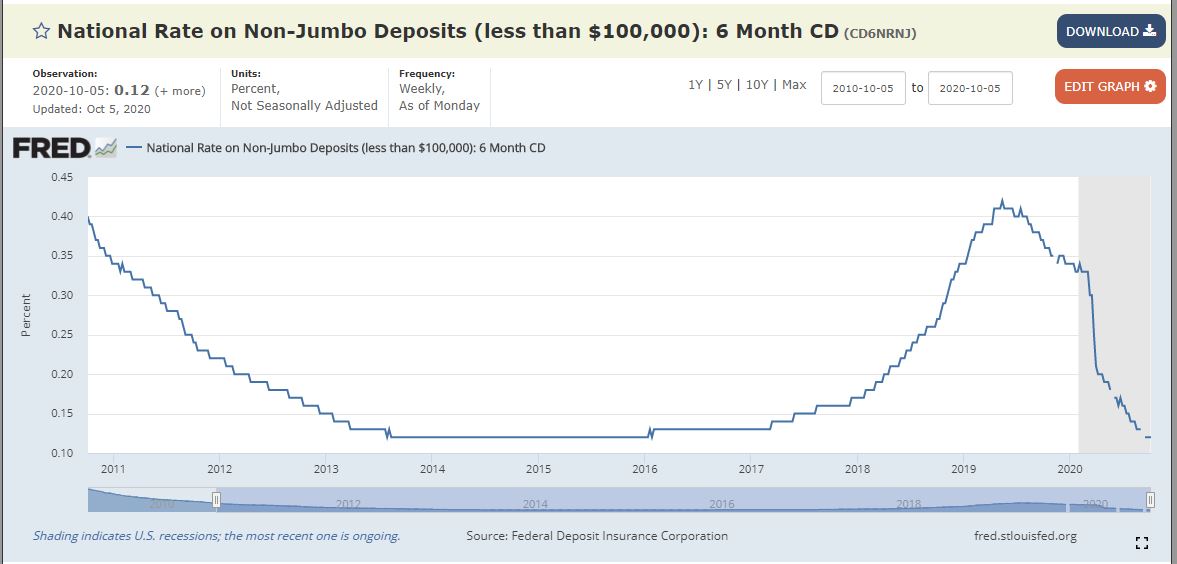

Certificates of Deposit (CD’s) and US government securities offer a very comparable degree of safety to a savings account. Both options can offer reasonable liquidity and better returns than savings accounts.

How does a certificate of deposit work?

CDs are issued by the same banks and credit unions that offer savings accounts. Therefore, they are also eligible for that same FDIC and NCUA insurance mentioned previously.

So why do they offer a better return?

They offer a better return because you have to lock your money up from several months to several years. It’s the promise of not withdrawing your money that earns you the extra interest. If you do withdraw early you will pay a penalty. This penalty is usually equal to a couple of months’ worth of interest.

One workaround for tying your money up in CDs is similar to staggering quarterly dividends so that you can earn a monthly income. This is known as CD laddering.

CD laddering is when you open several CDs with different maturities. For instance, a one-month maturity, three-month maturity, one-year maturity, and so on…

The benefit of CD laddering is that you’ll earn a higher interest rate than if you put all of that money into just a shorter-term CD. You’ll also have access to a portion of your money sooner than if you put it all into a longer-term CD. Plus, if interest rates change (increase), you can also take advantage of that.

What are examples of government securities?

The US government offers several different varieties of fixed-income securities to investors. When you buy these securities, you are borrowing money from the US government. They pay you interest for lending them that money.

Given the US government’s ability to print currency, the risk of default on these investments is pretty low. It might be argued that they would default on their FDIC obligations before defaulting on interest for government securities?

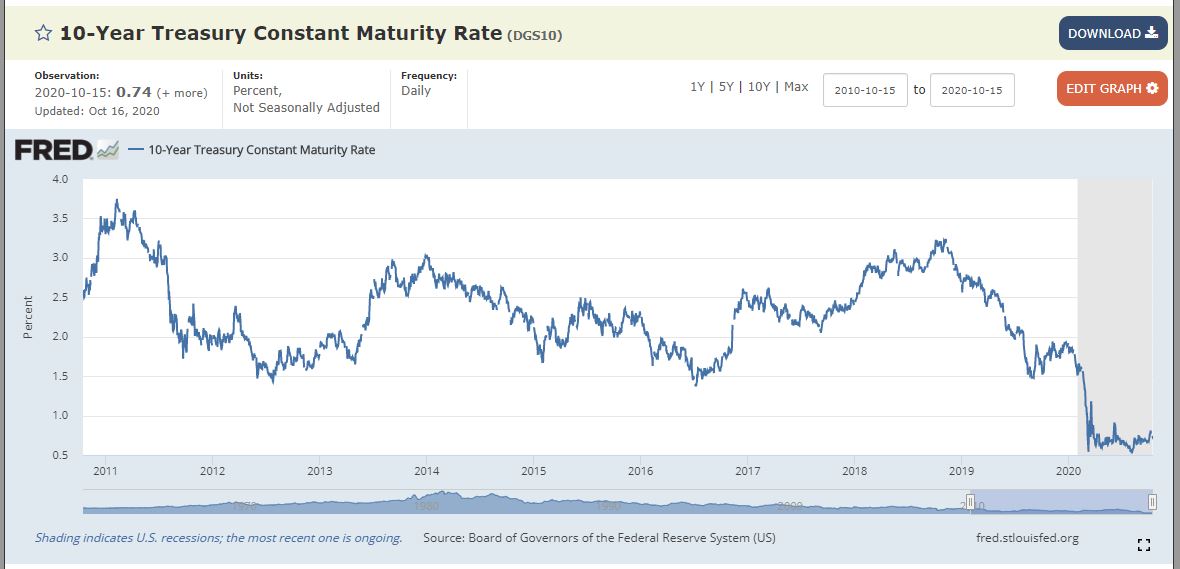

Treasury securities typically pay higher interest rates than savings accounts. Just like CDs, the amount of interest depends on the maturity of the investment. US government securities are characterized by their maturities. Short, medium and long-term are each known by a different name.

Terms for US government securities can go out as long as thirty years. If you were considering a savings account then you probably aren’t looking for that long of a commitment.

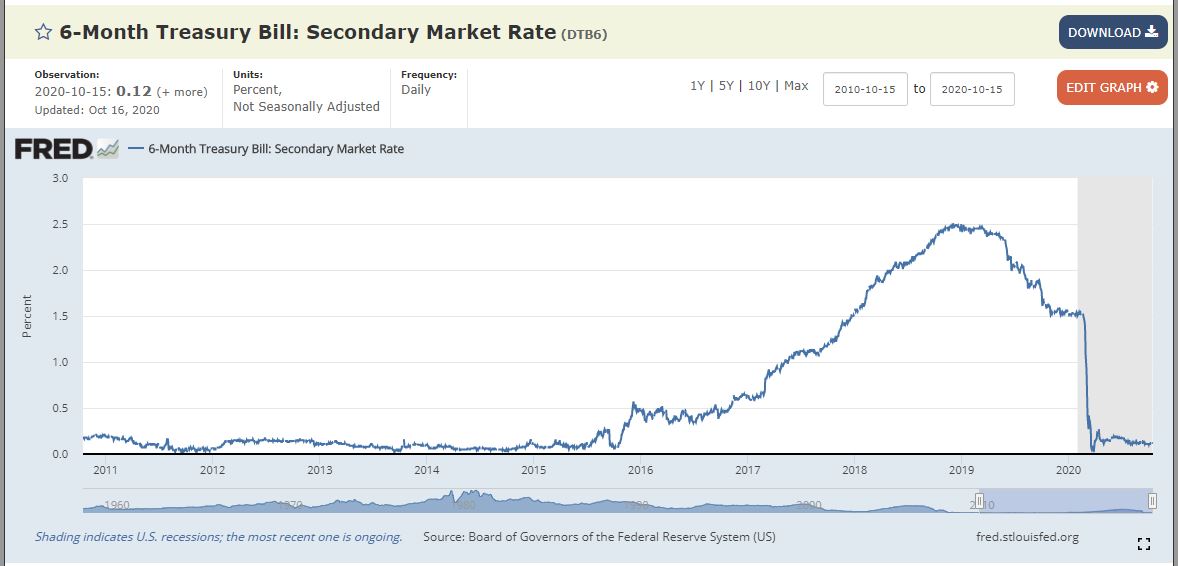

Treasury bills

These are also referred to as T-bills. These investments are short-term with a maturity of one year or less. Treasury bills can be purchased on the secondary market or via your broker. They can also be purchased directly from the government and treasurydirect.gov.

T-bills are unique in the sense that they don’t make interest payments. You buy them at a discount and then redeem the full amount upon maturity.

Treasury notes

Treasury notes, T-notes, have a wide array of terms. They can have maturities from two years to ten years. Treasury notes pay interest twice a year – every six months.

Treasury bonds

Treasury bonds are sometimes referred to as T-Bonds. T-bonds have a maturity of thirty years, making them the longest-term investment option of all government securities. Treasury bonds will pay a fixed interest payment every six months. Like the other US government securities, they can be purchased directly from the government or via your broker.

Should I keep my money in the bank or at home?

Keep in mind that CDs and government securities can lose money if you liquidate them before maturity.

You are trading time and/or access to your money for a higher return with CDs and treasury securities. But, in either case, you’re not really sacrificing any safety. If you know for sure when you’ll need access to your money, then CDs or government securities can be a good alternative to savings accounts.