No, not for long anyhow. There isn’t enough short volume to depress prices for more than a few days.

Shorting a stock, or “short selling” refers to making money on stock when its price is falling. The process is pretty simple. An investor borrows shares of stock, sells them, and then buys the shares back. Hopefully at a lower price.

This strategy is used for speculation and hedging. It is based on a belief or prediction that the price of the stock is headed downwards.

Sounds simple enough. But, the reality is that things do not always go as planned. Betting on a drop in the price of a stock is a risky strategy that is not often successful. Especially compared to holding on to shares for the long-term.

But, does shorting a stock make it go down? The answer to this question is a bit more complicated than you might think. Before we answer that, let’s go into a little more detail about short selling.

Interested in learning more about how stocks can create wealth? Read this post:

CAN YOU GET RICH BY BUYING STOCKS? – THE IMPORTANCE OF HOLDING LONG TERM

What is a short sale? What does short selling involve?

Imagine you think a stock is overvalued. Its price is $400 per share. Your prediction is that because of the overvaluation, the price is likely to drop. Your strategy here, when short selling, would be to borrow a certain number of such shares from your broker and then sell those shares on the open market.

Now, imagine the price drops down to $275. You can buy the stock back at that price and return them to the broker. In this case, you would make a profit of $125 per share. This is the difference between the original price, $400, and the current price of $275.

What if the price does not go down? But, instead, rises to $500? In that case, you will lose $100 per share.

| Stock Price | $ Profit |

|---|---|

| $0 | $400 |

| $150 | $250 |

| $275 | $125 |

| $500 | -$100 |

| $1,000 | -$600 |

Since a stock can rise infinitely, there’s technically no limit to the amount you could lose. There is a limit on profit, however. Since a stock can only fall to $0.

To summarize, shorting a stock is the sale of shares that the seller does not own. Most of the time, these shares are borrowed from a broker. If the price of the stock falls, the shares can be bought back for less than they were sold for. The short seller will make a profit. If the stock price rises, the stock will have to be bought back for more than it was sold for. The short seller will incur a loss.

Dividend stocks have risks too. Want to know what they are? Read this post:

YES, DIVIDEND STOCKS CAN LOSE MONEY | HOW DIVIDENDS WORK

What risks are involved with short selling?

As you might have sensed, short-selling comes with a significant amount of risk. When buying a stock, an investor can lose the entire amount they invested. For that to happen, things would have to go really bad. With short sales, an investor can lose an infinite amount of money because the price of the stock might keep rising indefinitely. In the worst-case scenario, investors might end up owing money to their brokerage.

Huge risks, however, can result in great profits, when things go as speculated. Indeed, short selling is often used by speculators and for hedging.

Speculators use short selling to make a profit on a potential decline that might hit a specific market, industry, or business. On the other hand, hedgers tend to sell short to protect their gains, mitigate their losses, and diversify their portfolio. Hedgers are often the most active short-sellers.

Most of the time, hedgers’ strategy is to select stocks or sectors that hedge their position for the long term. Speculators tend to have shorter-term horizons.

Engaging in short selling requires good financial knowledge and understanding of the market. For this reason, only savvy investors tend to attempt it. As mentioned, the risks are significant and the losses can be extremely big.

When selling stocks short, you should never assume that you’ll be able to buy back when you want to or at the price you want. There must be a market for the stock you are looking to sell short. Indeed, without a market (lack of liquidity) you might be in a position to incur serious losses. Prices might change very quickly or rise considerably. This could result in a margin call and/or a forced closing of the position. Before engaging in short-selling, you need to understand the risks and make plans for how you can reduce your risks.

Want to balance your risk by owning growth stocks? Read this post:

CONVERSION FUNNEL ANALYSIS – UNAWARE TO LEAD TO PROSPECT TO CUSTOMER TO FAN

How do you tell if a stock is shorted?

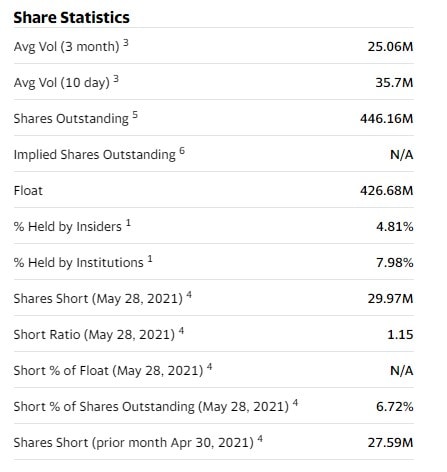

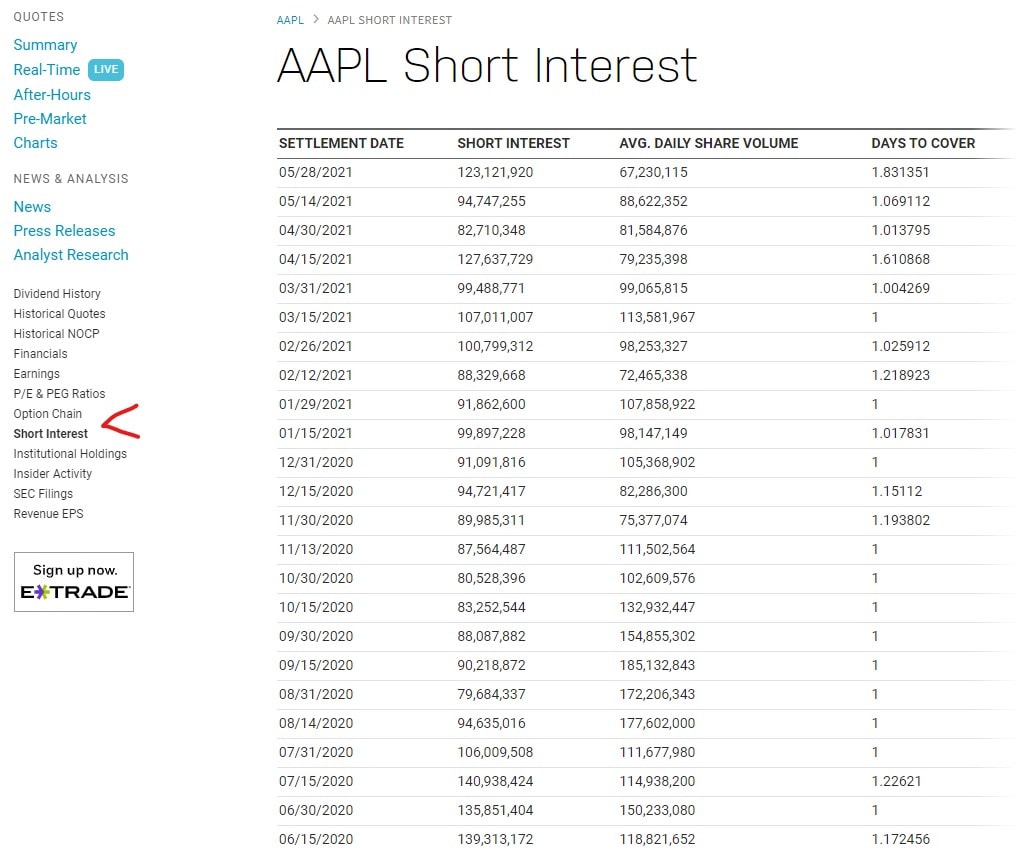

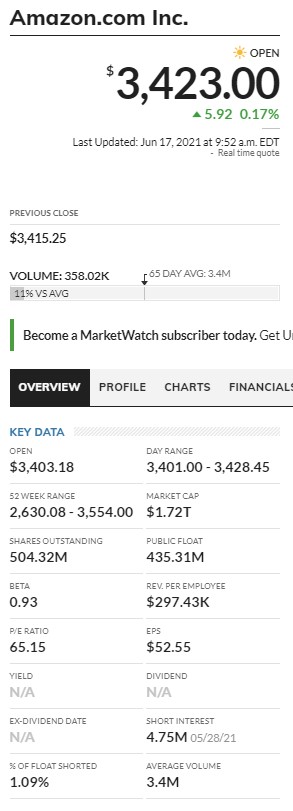

Most financial websites have statistics on a stock’s shorted shares. Look for information such as: Shares Short, Short Ratio, Short % of Float, Short % of Shares Outstanding, Days to Cover, Short Interest, and % of Float Shorted.

Nearly every stock is going to have some percentage of its float shorted. How many shares and what percentage of the float that represents can vary widely. Most financial websites can provide information on shorted stock. The same websites that you use to look up quotes, examine charts, and do your research on.

On Yahoo! Finance, short statistics can be found on the Statistics tab for a given stock. Short information will be under the Share Statistics heading. Here, you’ll find Shares Short, Short Ratio, Short % of Float, Short % of Shares Outstanding, and Shares Short for the prior month.

On nasdaq.com, up to a year’s worth of short interest history can be found by clicking the Short Interest link in the left-hand menu. Additionally, the Days to Cover, based on the Average Daily Share Volume is also provided.

Finally, on marketwatch.com, Short Interest is provided on the main Overview screen. The % of Float Shorted is also calculated here.

When is it a good idea to short sell?

Shorting a stock is not a commonly used strategy by the majority of investors. Firstly, because of the considerable amount of risk involved. In order to be successful, an investor needs to know what’s going to happen in the future and needs good timing. Plus, in the long run, the stock market tends to go up instead of going down.

If you are looking to make a profit over the long term, exclusively engaging in short selling might not be a good idea. Going long is more likely, on average, to be profitable in the long run.

However, short selling might be a good idea when you are extremely sure that a stock is overvalued. And, you are extremely sure that everyone else is going to think it’s overvalued real soon.

To predict that, you need to be constantly up-to-date on an industry or company’s performance. Is this industry and/or company experiencing difficult times? When times are tough, the probability of their stock losing value is much higher. The probability of you making a profit is also higher.

Does shorting a stock make it go down?

The simple and most practical answer here is NO.

Only 10-15% of shares in circulation are lent for short-sellers. That percentage is very low. This means that when the price drops, it has little to do with short selling. Rather, the real reason for prices dropping is long holders panicking.

Short sellers being able to depress share price is simply just a myth. One that is not supported by practical experience. Over the long term that is.

Short-sellers alone do not have the power to hold down the price of a stock for any significant amount of time. They can succeed in doing so in the short term. But the effects won’t last for long.

Markets are dominated by the intensity of demand and supply. Which does have the power to drop or raise the price. Usually, when the balance between buyers and sellers is disrupted, the result is the modification (either the increase or decrease) of a share’s price. To put it simply, when the supply is higher than the demand rate, share prices drop. Likewise, as soon as the demand is higher than supply, prices rise.

What is called the short-selling cycle is merely the result of a drop in price which increases the number of shares that short sellers are willing to sell. That is because as the price drops, short-sellers see a higher probability of making profits. So, they are willing to sell more. This causes prices to go down further.

Accordingly, buyers can also become less willing to buy. Perceiving a lower likelihood of profit. But, at a certain point, short-sellers begin buying back shares to lock their gains.

Short selling effect on stock prices

Short selling does not cause the price of a stock to go down. Not for any significant period of time anyway. Read more here.

Shorting stocks is a strategy used by speculators, gamblers, and hedgers. Savvy investors who are willing to accept high risks for the opportunity of good profits.

Stock prices tend to be very volatile. So, if you have the opportunity to sell while prices are going down, you might not be able to make the profits you had hoped. As prices can reset almost instantaneously.

Before going all-in with short selling, make sure you have a lot of knowledge about the market. Ensure that you are very clear on the risks you are running. If you are right, you have the opportunity to profit in up and down markets.

Why does everyone hate short-sellers?

Short-sellers drive stock prices down (even if only temporarily) and work against those who want them to go up.

Most executives probably harbor, at the very least, a mild dislike for short-sellers. Elon Musk, CEO of Tesla, Inc. (TSLA), has made his hatred for short-sellers well-known.

Short sellers, by their nature, drive down the price of a company’s stock. Executives, on the other hand, are incentivized to drive up the price of their company’s stock. These incentives might manifest themselves through bonuses, stock options, or an increase in the value of the shares they already own. So, it’s not hard to see why executives hate short-sellers.

Don’t discount the possibility, however, that executives might use short-sellers as a scapegoat for their own shortcomings.

Not only are short-sellers making a bet against executives and other owners of the stock, but they also tend to be vocal about why they think a stock is a loser. If short-sellers were passive and simply entered their positions and kept quiet, there might not be so much hatred against them. However, since many short-sellers choose to actively campaign on behalf of their short position, they draw a considerable amount of hate.

Not everybody on the long side of the equation hates short-sellers, though. Some people appreciate the feedback they provide. Feedback through more accurate valuations or providing insight into truly poorly ran companies. Other people look at it from the perspective that the short-sellers allow them to invest at a lower price.

What happens if a stock is heavily shorted?

Shorting will drive down the price of a stock. Heavy shorting will probably drive the stock price down further. After that, if the company continues to perform poorly, long positions may liquidate and the stock will fall even further. Conversely, if the company reports positive results, a “short squeeze” may occur.

A short squeeze is when a heavily shorted stock begins to rise in price due to buyers rushing in to purchase shares. This might force the short sellers to cover their positions or face a margin call. The buying of the short sellers can exasperate the popularity of the stock and cause it to rise even further.

So, what triggers a short squeeze?

Sometimes, it’s unexpected positive news. Other times, it’s a coordinated effort by a group of individuals – as we’ve seen recently with GameStop Corp. (GME), AMC Entertainment Holdings, Inc. (AMC), and other “meme” stocks.

Look for short squeezes on Fridays or the last trading day of the week. This is when short-sellers might be skittish about going into the weekend without the ability to cover their shares. Unfortunately, short squeezes are tough to time and capitalize on.

Heavily shorted stocks with low market capitalization could be better candidates for a short squeeze. If their low market capitalization is due to low shares outstanding, it could take lower demand to initiate a short squeeze. A low market capitalization due to a low price could also play a part if that low price incentivizes long positions to purchase more shares.

Contents

- What is a short sale? What does short selling involve?

- What risks are involved with short selling?

- How do you tell if a stock is shorted?

- When is it a good idea to short sell?

- Does shorting a stock make it go down?

- Short selling effect on stock prices

- Why does everyone hate short-sellers?

- What happens if a stock is heavily shorted?

This was very useful information.

Thank you