Investing is definitely one of the riskiest plays you could ever make when it comes to making a profit, and considering just how many lives were ruined by poor choices, it’s no wonder that a lot of people are afraid of taking the first step towards becoming serious investors on the open market.

The truth of the matter is that a lot of the times you can’t actually dispel the riskiness of the process, and most of the time you are stuck wishing that you didn’t make that choice in the first place.

Dwelling over the past is definitely a favorite pastime for a lot of investors out there, but as any professional would tell you, it’s not about the losses, it’s about the experience you’ve gained from the process.

Making the wrong choices today will lead to you choosing the right assets in the future, and for as painful and cost-defective as this strategy can be, it will only benefit you on the long run as you learn the ins and outs of the industry with every choice you make.

But, did you know that there is a way to actually minimize this time frame and actually increase your chances of not losing too much money while testing the waters around?

This may sound like it’s too good to be true but it is real, you can actually make it easier on your wallet by simply working with a prebuilt portfolio instead.

Now, we should mention that these are not guaranteed to completely dispel the riskiness of the process, as mentioned previously. You are still going to have to face off against the system while making your choices, but using a prebuilt portfolio can make your job easier for you on the long run.

So, for today we decided to cover one of the most popular prebuilt portfolios out there, a little-known ray of sunshine that’s called “The Golden Butterfly Portfolio”.

But before you do actually look at what it entails, we do need to warn you that this is not necessarily what you would refer to as an “extensive” portfolio, it is by any rights a lazy portfolio that pretty much thrives off of its simplicity.

It simplifies the investing process and gives you access to most of the far and distant corners of the stock market while also taking part in certain safe havens such as gold and the treasury debt securities.

While it is a lazy portfolio though, don’t think that it is a lazy attempt at one either. After all, the simplest of answers can often times be the best for the most complicated questions out there.

But before we go any further into our guide, how about we give you a brief rundown of what the Golden Butterfly Portfolio really is?

What is the Golden Butterfly Portfolio?

First and foremost, we should mention the fact that this portfolio is a stock market option that was specifically designed for the buy-and-hold type of investors out there.

It was originally developed by the author of PortfolioCharts and, according to him, it was meant to be an alternative to the Permanent Portfolio that was in turn created by Harry Browne.

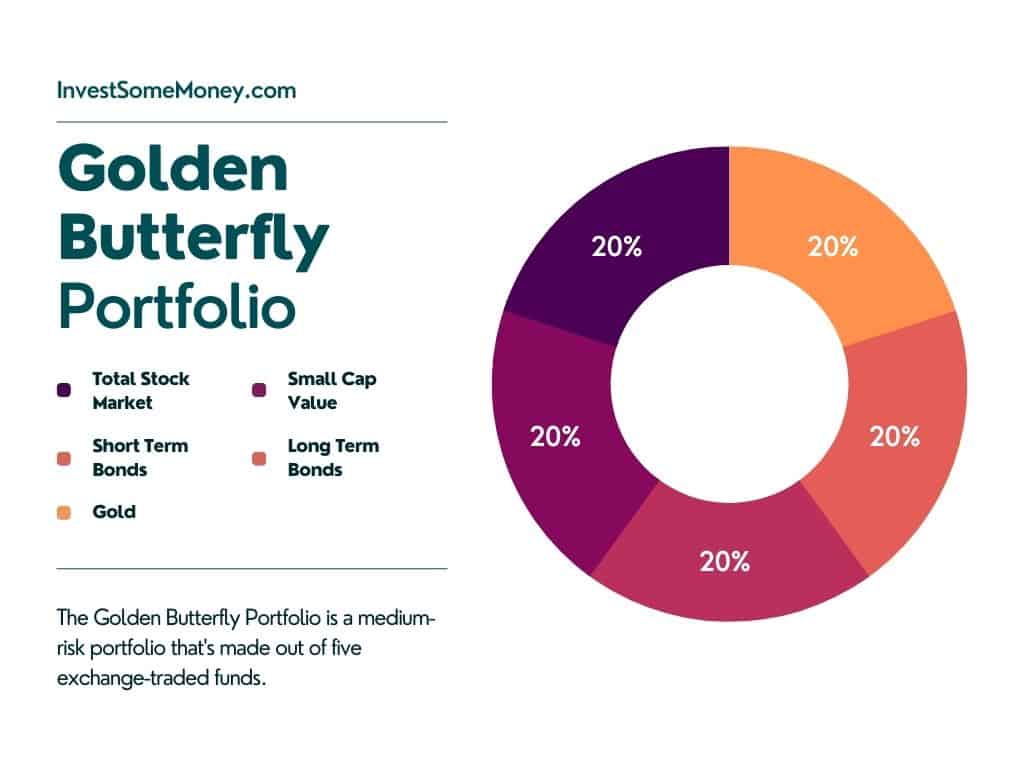

In simpler terms though, the Golden Butterfly Portfolio is made out of five exchange-traded funds, or ETFs for short, and because of how well balanced they each are, you get to take part in three major asset clauses while benefiting from its minimized risk factor.

Both the Golden Butterfly and the Permanent Portfolios were originally created to be self-sustainable during periods of inflation, deflation, economic expansion and of course, economic recession.

While we are on the subject of their similarities though, we should also mention the fact that the Golden Butterfly Portfolio differs from the Permanent Portfolio due to its heavy emphasis on the small-cap value stocks.

For those that have just now decided to get into the industry, you should know that value stocks are known to outperform pretty much any other type of stocks out there when it comes to the long-term effects on the open market.

At the same time, small-cap stocks are known to outperform large-cap stocks simply because their fully-fledged potential is way higher than that of their large-cap peers.

The Golden Butterfly Portfolio Asset Allocation

As we mentioned previously, the Golden Butterfly Portfolio pretty much just spreads its wings all across five different types of assets in order to completely assure a minimized risk factor for the investor. These five are spread across three different asset classes of their own, and they are the following:

- Total U.S. Stock Market – One fifth of the investments is based all around the overall U.S. stock market. This investment pretty much covers any and all the sectors and market caps that there are to invest into, making this quite the diversified option to say the least

- Small-Cap Value Funds – We already mentioned how one fifth of the investments are placed right into this niche due to its value characteristics. This is the main difference that you will find between the Golden Butterfly and the Permanent Portfolio after all

- Long-Term Treasuries – Next up we have the assets that are invested in long-term Treasury bonds and specifically pretty much any of the US Treasury debt securities. We all fear bear markets, which is why this is such a good option as they provide stability when it is most needed

- Short-Term Treasuries – Very similar to the Long-Term Treasuries, this asset investment pretty much covers all U.S. Treasuries but with the added benefit of there being less inflation risk and lower returns. As you can already expect by now, around one fifth of the assets are placed here

- Gold – Last but not least, the remaining fifth of the investments is placed smackdab into gold. Historically, this has been one of the best investments to say the least, especially so against inflation. As such, this is considered to be a must in bear markets even to this day

If you like the idea of the Golden Butterfly Portfolio yet you feel like you could still change those numbers up a little and still get yourself a hefty profit then we recommend that you check out the following options as profitable alternatives:

- The Permanent Portfolio – It is pretty much all the same as the Golden Butterfly Portfolio, except without the small-cap value assets.

- All Seasons Portfolio – Design wise, it is very similar to the Golden Butterfly Portfolio, except for the fact that it is built a lot more so around economic risk parity instead.

- Pinwheel Portfolio – This is yet another great portfolio that we always recommend checking out, especially so if you want to get yourself a more consistent portfolio that offers a bigger payload.

Golden Butterfly Portfolio Versus Permanent and All-Weather Portfolios

In simple terms, the main premise behind the Permanent Portfolio is that it is meant to help you go through any and all of the four main economic conditions out there, aka: expansion, recession, inflation and deflation.

The main difference that we mentioned multiple times over by now when it comes to the Golden Butterfly Portfolio is that it also takes those assets while adding in the Small Cap Value to the mix.

This makes the Golden Butterfly Portfolio a bit more straightforward and aggressive than the Permanent Portfolio, due to the fact that we are pretty much changing the landscape around to a low-volatility, all-seasons portfolio instead.

You are pretty much guaranteeing yourself a much greater expected returns and a diversification benefit due to the fact that these small cap projects have a much larger potential than the large-cap investments.

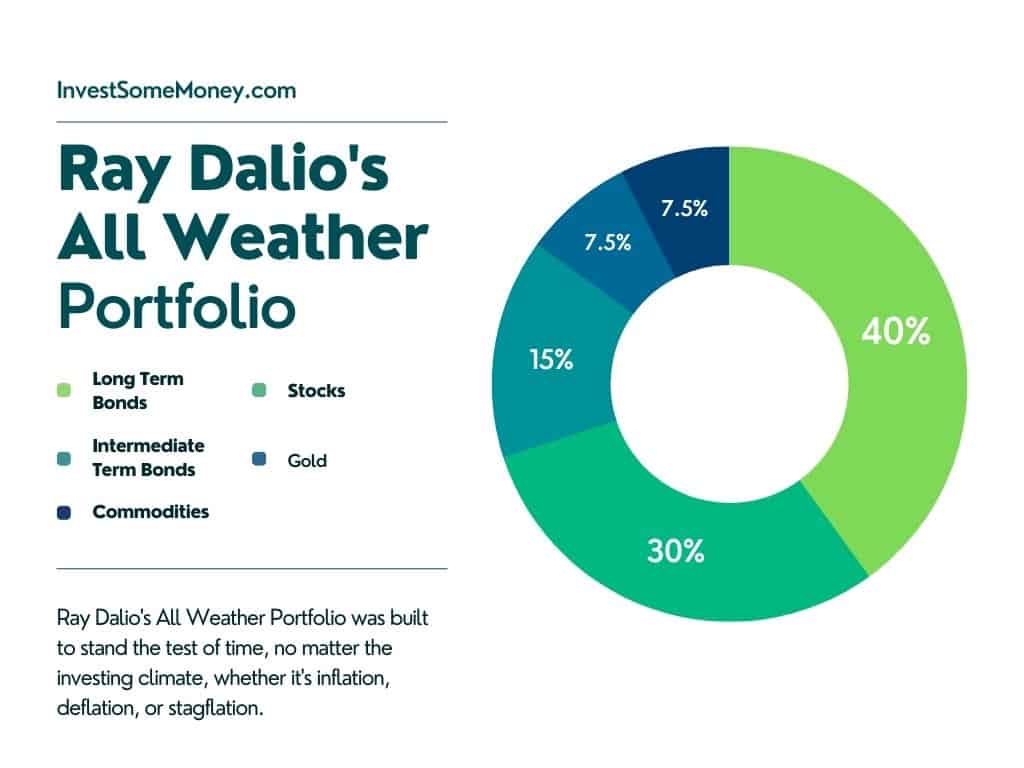

On the other side of the spectrum, we have Ray Dalio’s All Weather Portfolio which has been regarded as one of the safest bets you could ever make in your life.

If you want to invest in more gold and stocks without the added Treasuries then honestly this is going to make for a better option for you for sure.

As the name implies, Ray Dalio’s All Weather Portfolio is meant to pretty much offer you a patterned series of investments which are meant to outlive any sort of market destabilizations that we could come across in the near or distant future.

This is all due to its heavy emphasis on diversification, but if that’s the case, then in which way does this differ from the Golden Butterfly Portfolio?

Essentially, the Golden Butterfly Portfolio is tailored more towards economic expansion, with Dalio caring very little about massive profits and more so about just staying afloat no matter what.

To put it bluntly, both the All-Weather and the Permanent Portfolios are pretty much just safer options than the Golden Butterfly Portfolio will ever be. They are meant to survive any ups and downs in the economical landscape, and are meant to accommodate the investor with the security they provide.

On the other side though we have the Golden Butterfly Portfolio which pretty much just goes all out with its investments. It is a bit riskier to say the least, but the profit margins are a lot more impressive than those of the other aforementioned portfolios.

So, when choosing the best portfolio for you, you need to keep in mind that you will be playing around with fire by choosing the Golden Butterfly Portfolio, so you can always end up getting burned by trying to be a bit too aggressive with your strategy.

At the same time, don’t expect insane rewards from the other two portfolios on our list here, they are a lot less risky but they are also a lot less rewarding when it comes to the overall profits. Choose whichever you think is better for you and your current financial disposition.

The Golden Butterfly Portfolio International Route

When surveying over the Golden Butterfly Portfolio strategy you may realize the fact that it only really covers the U.S. assets and nothing more. This is, as you can probably tell by now, quite counterintuitive considering the fact that it is meant to reduce the volatility and risk factor.

This is why, if you want to take full advantage of this strategy while also lowering the risks even further you can always opt for the international version of this program.

While definitely similar, you will instead be focusing on following this route instead:

- 20% of your portfolio’s assets should go to the VT, or the world stock market

- 10% should go to the VIOV, or the US small cap value

- 10% should go to the AVDV, or int’l small cap value

- 20% should be allocated to the VGLT

- 20% should go off to VGSH

- 20% should be making its way to SGOL

Leveraged Golden Butterfly Portfolio

We should take this moment to bring up the fact that you can’t actually construct a leveraged Golden Butterfly Portfolio per se, simply because there are currently no leveraged ETFs that can be used for short-term bonds or small-cap value stocks.

Instead, by having 20% into long-term bonds and 20% into short-term bonds you can get the same thing as holding about 40% of the intermediate-term bonds. While we are on this subject, you can also combine the two 20% stocks into a 40% in order to track the S&P 500 easier.

Next up we need to take care of those three gold ETFs that are currently available for all investors. In order to get the proper match though you will need to allocate your stocks to around 36% 3x stocks, 36% 3x interm, treasury bonds and about 28% 2x gold.

This isn’t the perfect way to do it but it is the best case scenario if you want to go with a leveraged Golden Butterfly Portfolio after all.

Doing this however will add to your portfolio’s risk while also making the potential returns be far greater to say the least.

The potential for losing everything is increased slightly too though which is definitely not something you’d want to see, but if you want to make it big you will need to take the leveraged ETFs route.

The Pros and Cons of the Golden Butterfly Portfolio

Just so you know exactly what you’re getting yourself into, here is a list of the best and worst that you can expect from the Golden Butterfly Portfolio.

For the most part, these are the things that you will need to keep in mind before making your final decision. So, here you have the top pros that you can look forward to right here:

- It is still a relatively easy to understand and lazy approach to investments. If you don’t have the time, knowledge or desire to actually do the research yourself to see which investments are worth looking into then this may very well be the best option for yourself

- Second of all, you will also be getting a lot of small-cap value exposure. Small-cap stocks are known to outperform the market a lot of the times so you can already expect pretty big payouts considering the fact that half of this portfolio’s stocks are allocated into them

- Last but not least we have the easy to customize basis of it all. This strategy is very simple and easy to follow, which means that you can easily fiddle around with the amounts to make it better for yourself.

While those are all fine and good though, it’s not all sunshine and rainbows, you will also need to watch out for the following cons that come with investing into the Golden Butterfly Portfolio:

- The fact that you are putting so much into gold can definitely be a negative if you don’t know what you’re doing. Sure, investing into gold is always great against inflation, but gold also tends to be a lot more volatile than its counterparts, to the point where it can even end up being outperformed a lot by other safe-haven investments

- Second of all, investing into Treasury Bonds is always going to be a bit iffy considering the fact that they are considered to be relatively short-term investments that almost never bring any real profits back, they just bring back cash equivalents by the end of their term

- Last but not least, considering the fact that you put over 60% of your portfolio’s resources into gold and short/long-term Treasury debt securities, you can’t possibly expect to get a huge payoff out of this deal since you can only do so from the 40% you put into stocks

Conclusion

So, there you have it, the Golden Butterfly Portfolio and all of its ups and downs. While it is definitely not the absolute best strategy to follow out there, it has really withstood the test of time so far and honestly, it may very well be one of the safest bets you can have at getting a decent profit while also keeping it safe at the same time.

Regardless of whether you choose to opt for it or not, we would like to thank you for reading and we hope that today you learned something new about the wondrous world of stock investments and all that it entails.

Contents