Can you get rich from the stock market? Video summary

Not only can you get rich by buying stocks, you don’t even need to make a bunch of great stock picks in order to do so. In fact, one exceptional stock pick can make up for a lot of poor ones. That is, if you give that exceptional stock pick enough time to really compound.

Unfortunately, really great stock picks are tough to come by. “Pretty good” stocks can also offset losers, however. You know the ones – the blue-chip, well-run, well-known companies that typically pay a solid dividend and have been around forever. Though, these “pretty good” stocks will have to have a higher weighting in your portfolio, or be held for longer, to have the same effect as the home run stocks.

What is a home run stock?

A home run stock is one that appreciates considerably over a long period of time. These stocks will also have a very high compound annual growth rate (CAGR). You can learn more about CAGR and how compounding affects stocks in my Does Compound Interest Apply to Stocks video and post.

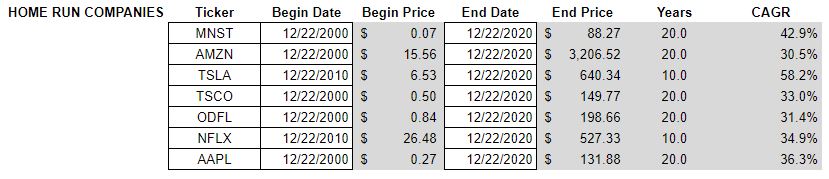

So, what are some examples of home run stocks?

Here, you can see the compounded annual growth rate provided by some of the best-performing stocks over the past 10 to 20 years.

Some of these home run stocks are Apple Inc. (AAPL) with a CAGR of 36.3% over the past 20 years (excluding dividends). Tesla, Inc. (TSLA) with a whopping CAGR of 58.2% over the past 10 years. And, there’s Tractor Supply Company (TSCO), perhaps a lesser-known homerun stock with a healthy CAGR over the past 20 years of 33% (also excluding dividends).

Let’s look at an example of how one home run stock pick can offset a bunch of poor stock picks.

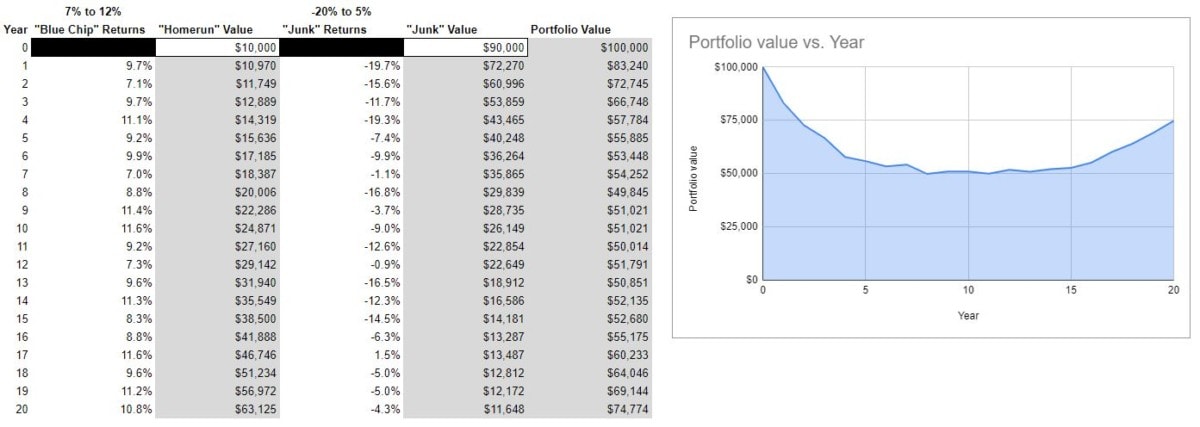

In this example, we’ll pretend that we have a $100,000 portfolio with 10 stocks in it. Every stock had $10,000 invested into it. We have a 20-year time horizon.

What would happen if 9 of those stocks performed poorly, only returning (randomly) between -20% and 5% annually? But, our 10th stock provided (random) returns between 15% and 25%?

As you can see, the portfolio takes a hit initially due to the effects of the junk stocks. Around year 10 however, the effects of compounding on the home run stock begin to take over. From there, the portfolio grows exponentially. After all, a stock can only decrease so much, but it can increase almost infinitely.

So what are the worst-case and best-case outcomes in this scenario?

In the worst-case scenario, the home run stock returns are ”only” 15% per year. While the junk stocks returned -20% per year. In this scenario, it took a long time, but the home run stock still managed to make the portfolio profitable. After 20 years, the portfolio value is nearly $165,000.

How about the best-case scenario? Here, the home run stock returns a healthy 25% annually. The junk stocks, on the other hand, return a mediocre 5% per year. So, while the junk stocks don’t work against the portfolio in this scenario, it’s the home run stock that really causes the value to snowball. The ending value, after 20 years, is 1.1 million dollars.

If you’re curious, the typical 20-year value for the portfolio in this model was between $325,000 and $425,000.

Is it true that the longer the investment horizon the more are the returns?

As we saw in the previous example, the longer a home run stock has to work, the more it can benefit your portfolio.

It takes time for the home run stock to gain momentum and to compensate for any other poor investments you might have in your portfolio.

To further complicate matters, you don’t even know that you own a home run stock until you’re able to look back a decade or so and realize the exceptional returns that this stock has provided. If you get spooked between now and then, you could miss out on the potential riches that this home run stock could provide. All of the previously-mentioned home run stocks had less-than-stellar years. Nevertheless, over time, their wealth-creating potential manifested itself magnificently.

What if I can’t find a home run stock?

If home run stocks were commonplace, everybody would be rich. They’re relatively rare and difficult to pinpoint especially when a company is in its infancy.

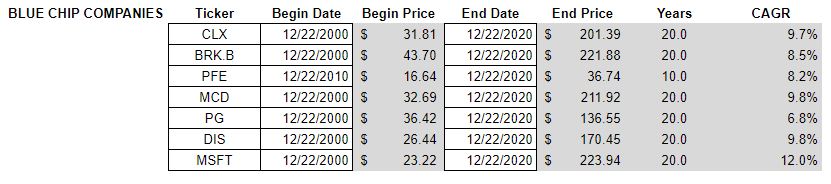

So, what if expectations were lowered a bit and the focus was shifted to blue chip stocks instead? Under the same scenario, how would these household names perform?

Before we look at that, let’s get an idea of what stocks we’re considering blue chip.

First of all, there’s Berkshire Hathaway Inc. (BRK-B) with a CAGR of 8.5% over the past 20 years. McDonald’s Corporation (MCD) with a CAGR of 9.8% over the past 20 years (excluding dividends). And, there’s Microsoft Corporation (MSFT) with a not-too-shabby CAGR over the past 20 years of 12.0% (also excluding dividends).

As you can see, if we assume that the blue chip stock returns 7 to 12% per year, the damage from the poor investments isn’t so easily undone.

Under the worst-case scenario, the total value of the portfolio doesn’t even begin to rise until year 13. After 20 years, the portfolio value is only about $40,000.

The best-case scenario is, of course, better. Though, it did not perform as well as it did with the home run stock. After 20 years, the portfolio would be worth $335,000.

$70,000 to $93,000 was the typical range for the portfolio value after 20 years. So, while a home run stock can fuel compounding growth for your portfolio no matter what, a blue chip stock will probably, at best, offset losses from poor performing stocks.

It will be tougher to get rich with blue chip stocks than it will be with home run stocks. In order to do so, you will need a longer investing time horizon or, fewer poor performing stocks

Do keep in mind, though, that this model only looked at returns from capital gains. Dividends were not considered and would have contributed significantly to the blue chip stocks’ returns. Particularly, if they were reinvested. The compounding effects of dividend reinvestment are also discussed in my Does Compound Interest Apply to Stocks post and video.

Questions about “Can you get rich from the stock market?”

How do people get rich from stocks?

People get rich from stocks by buying and holding quality stocks for a very long time. Typically, at least 10 years. They also avoid poor performing stocks which hold well-performing stocks back.

How do people pick quality stocks and avoid losers? By performing a thorough analysis of the growth potential of a stock. InvestSomeMoney.com has a spreadsheet template to help walk you through some of the steps necessary to thoroughly analyze a stock.

Can you get rich in finance without buy or selling stocks?

Yes, you can get rich in finance without trading stocks. “Finance” is a broad term that encompasses all money management.

Besides stocks, there are many different types of investments people can make (or speculations, the definitions of each are beyond the scope of this video). Real estate, futures, Forex, and crypto are examples. So is starting a business or working in banking or corporate finance.

Can I become rich off of buying stocks?

Yes, you can become rich off of buying stocks. Hopefully, this video showed you that it is possible, particularly if you have a long-term mindset.

You may not have $100,000 to start – as the examples in this video did. But, in this age of commission-free trading, you can dollar cost average your way into home run and blue chip stocks.

If you start young, your chances of becoming rich increase exponentially. However, if you aren’t young, you can still enjoy increased financial security by following the same strategy.