This is a post from my now-defunct paid newsletter. It was published on October 12, 2021. In it, I reviewed the performance of stock recommendations made by US News and offered some other potential opportunities that are similar to their best-performing stock recommendations.

Article information

Published Aug. 29, 2019, by Wayne Duggan

Link: 10 of the Best Value Stocks to Buy Now | Stock Market News | US News

**link now redirects to a different post

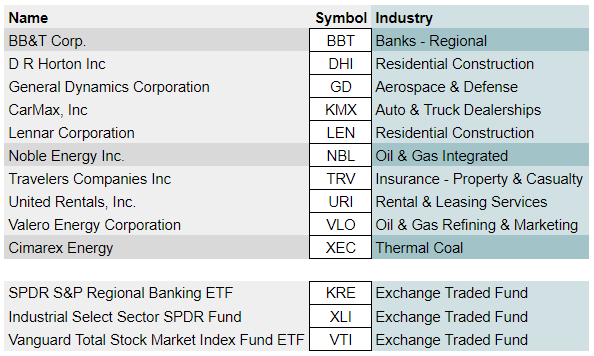

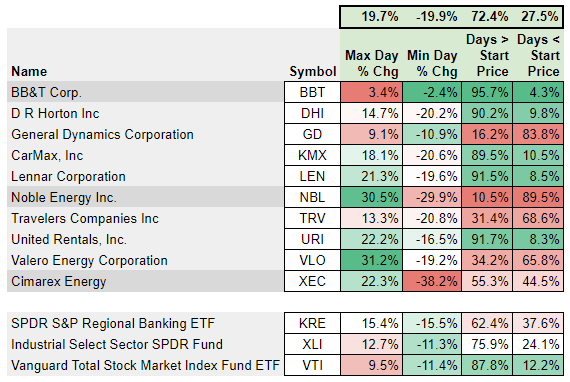

Portfolio & benchmark components

This article listed a total of 10 stocks. In the 2+ years since these stocks were recommended, three of them are no longer traded due to mergers and acquisitions.

- BB&T (BBT) merged with SunTrust Banks on 12/6/21 to form a new entity – Truist Financial Corporation (TFC)

- Chevron (CVX) acquired Noble Energy (NBL) on 10/2/20

- Cimarex (XEC) merged with Cabot Oil & Gas Corp on 9/30/21 to form a new entity – Coterra Energy (CTRA)

These stocks, overall, represent diverse industries. Three (NBL, XEC, VLO) are from the energy sector. Two (DHI, LEN) are from the residential construction industry.

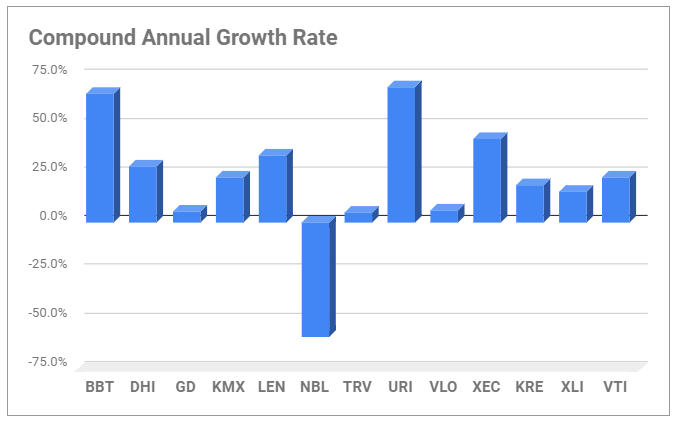

Portfolio & benchmark performance

Most of the recommended stocks were dividend-paying. The only two exceptions are LEN and URI. Ironically, these two stocks were among the best performing.

LEN’s performance is, in part, credited to:

- A solid financial position

- Potential for revenue/earnings growth

URI’s performance is, in part, credited to:

- Infrastructure and public construction spending

- Reducing capital expenditures

Furthermore, the two companies involved with mergers (BBT & XEC) also performed considerably better than the benchmark ETFs.

Conversely, the performance of NBL was abysmal. This poor performance, up to the point of acquisition, was credited to:

- Declining oil demand/prices in 2020

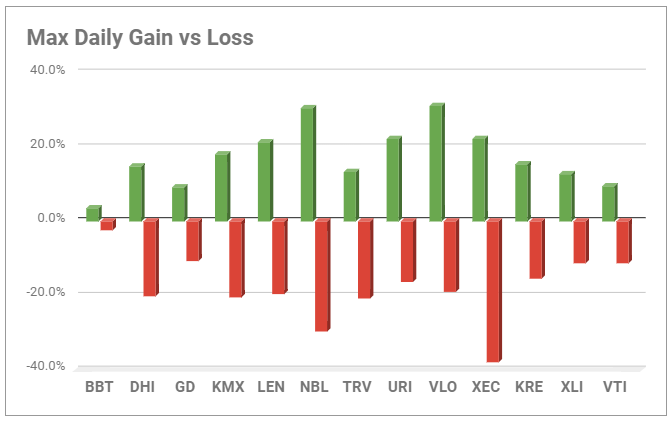

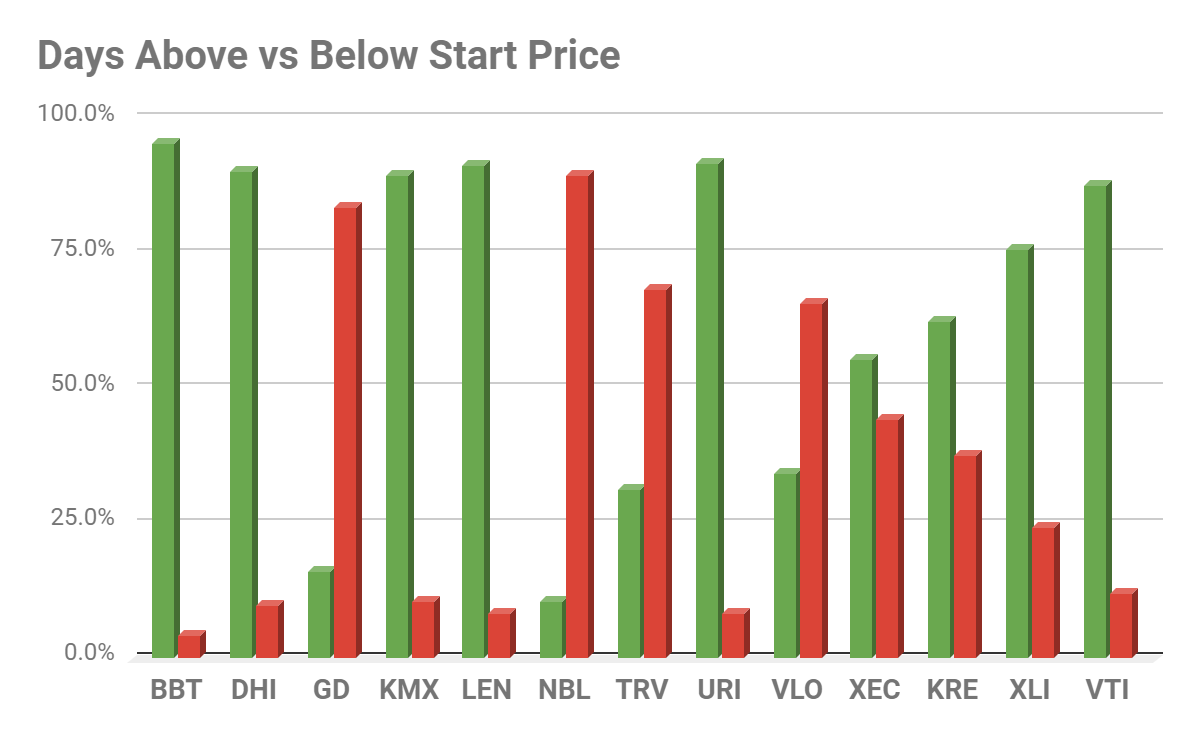

Portfolio & benchmark volatility

About half of the recommended stocks enjoyed 90% or more of their days in positive territory. VTI was also near the 90% mark.

BBT saw little volatility in terms of daily price changes. It was, however, only traded for a little over three months after the recommendation.

NBL saw some of the biggest daily price changes both to the upside and downside.

VLO, somewhat surprisingly, saw modest downward price changes (relative to the other recommended stocks). But, nevertheless, VLO spent most of its time in negative territory.

Due to their diversity, the ETF benchmarks saw fewer downside (and upside) daily movements than most of the individual stocks.

Portfolio & benchmark visualization

Current opportunities

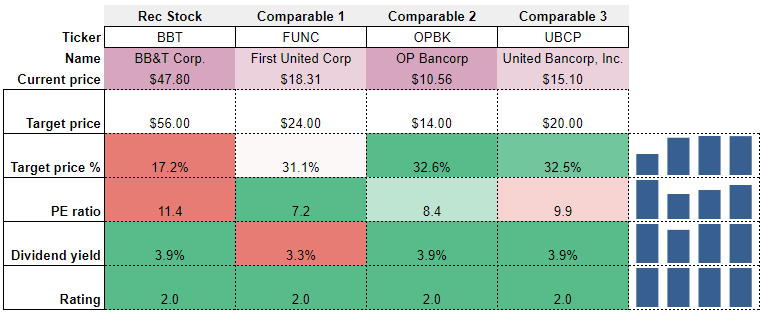

Similar to BBT

U.S. News provided a lot of quantifiable metrics on which to base their recommendations.

Compared to other opportunities in the regional banking industry, OPBK compares favorably along all observed metrics. The target price % is higher, the PE ratio is lower, and the dividend yield is the same as it was for BBT.

Others applauded OPBK’s profitability and EPS growth as contributors to its upside. Source.

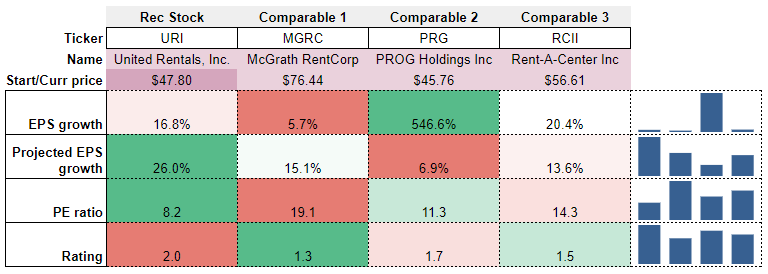

Similar to URI

A $15.00 price target was mentioned in the U.S. News article for URI. This must have been a misprint. URI traded near $113 at the time of publication.

Each of the opportunities similar to URI looks more attractive based on certain metrics and less attractive on others. Based on the metrics listed, I’d say RCII seems the most appealing.

Solid EPS growth with a modest PE ratio implies that that growth may not yet be priced in.

Other sources mention various other price ratios in support of RCII’s upside potential. Source.

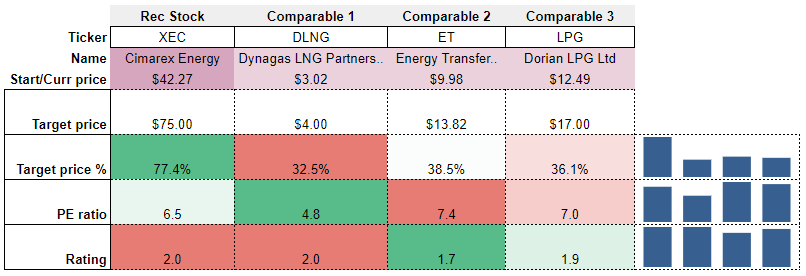

Similar to XEC

None of the comparable opportunities match XEC’s target price % (a target price it achieved, by the way). However, they all would amount to solid gains if reached.

None of the comparable stocks really stands out. All PE ratios are single-digit. LPG, however, seems to find a healthy balance among all variables.

Other sources mention LPG’s popularity among hedge funds as support for the stock’s upside. Source.

**To learn more about each section of this newsletter, please read What is Talking Head Stock Pick Review? (at the bottom of this page).

Disclaimers

All of this information in this newsletter is assumed to be correct and accurate as of the date of writing. No guarantee is made regarding accuracy, however. Readers are encouraged to double-check data and to do their own research.

Nothing in this newsletter should be constituted as investment advice. This newsletter is provided for informational purposes only.

Current opportunities disclaimers

Current opportunities represent stocks that have qualities that approximate those listed for the best-performing stocks in the article. When possible, they are also from the same industry/sector.

Only the attributes mentioned in the article are researched. No other qualification is provided as to the worthiness of investment. A multitude of factors influence a stock’s investment performance. Readers are encouraged to do their own due diligence if there is a current opportunity that they are interested in.

Current opportunities are merely offered as a starting point for further research. Absolutely no assurance is given regarding the performance of any stock or other investment.