I once read a (rare) thoughtful post on Reddit in /r/entrepreneur, or some similar subreddit. It said something to the effect of “better to be an average entrepreneur in a hot market than a great entrepreneur in an average market.”

The same principle applies to all companies, I think. Not just startups. We can all benefit from tailwinds, and a company is no different.

In this day and age, there are plenty of resources for you to identify trends in a particular industry. Once you’ve identified the trends, you can decide which companies are following them. If they meet all of your other criteria, you can invest with confidence

Inspiration for this post

This is the third and final (?) post on Point 1 from the book Common Stocks and Uncommon Profits by Philip Fisher. Point 1 asks: “Does the company have products or services with sufficient market potential to make possible a sizable increase in sales for at least several years?”

The first post on estimating market size is here.

The second post on business model desirability is here.

Philip Fisher said that there were two kinds of outstanding companies – those that were “fortunate and able” and those that were “fortunate because they are able.” I see the difference as – that the former rides a trend and latter sets a trend. In both instances, however, outstanding companies are moving in the same direction as the trend.

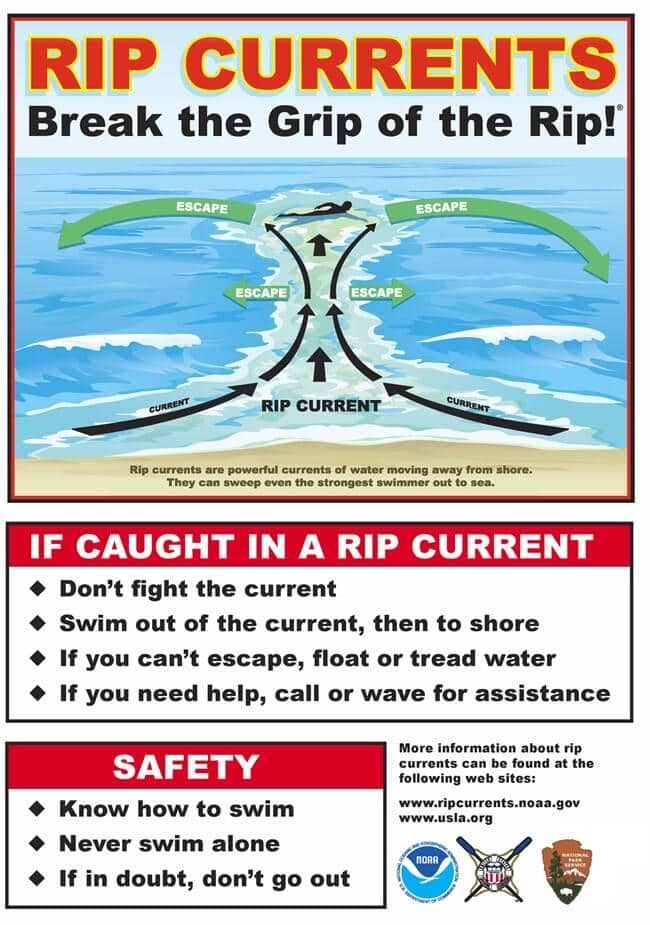

Companies shouldn’t fight the (trend) tide

In every aspect of life, I suppose, it’s to be beneficial to “roll with the punches” and not try to fight forces that are stronger than you. If you’ve been to the beach, you’ve seen the signs about what to do if you get caught in a rip current. You ride it out and do not fight it.

Fortunately, industry trends tend to be a positive sort of thing, not life-threatening; like a rip current. Well, possibly life-threatening for a business – if they ignore them.

In this post, I’ll share some ideas on how to identify industry trends and how to ascertain if the company you’re analyzing is riding them. I’ll also refer back to Foot Locker, and use it as an example.

A company that is able to play its cards right when riding industry trends has a better likelihood of gaining market share and reaching

Use a search engine to research current industry trends

Search engines are something we’re all familiar with, so they’re the best place to start.

If you’re like me, you’ll be surprised at the volume of information you’ll find when you search for trends on a particular topic. In fact, you’ll likely score opinions from several different sources; rather than having to rely on only one.

No need to over-complicate things here. Simply search for “[industry] trends [year].” Or, “[industry] industry outlook.” Obviously, you’ll want to insert your own industry and year in there. For example – “athleisure trends 2019,” “athletic retail trends 2019,” or “retail industry trends.”

Check the results for relevant information. Keep in mind that the best results aren’t always on the first page (as anybody who’s tried to launch a website knows). Make notes of what you find, particularly things you keep seeing mentioned again and again.

Don’t stress if you have a big messy list when you’re done. We’ll work on narrowing that down later.

Use Google Trends to compare what you found

Google Trends is a great way to expand upon what you learned from searching.

While you can’t get absolute data on search terms entered into Google, you can see their relative popularity over time. You can also compare different search terms to understand how they compare to each other.

Additionally, you can search by geographic area or different time periods. Also, you can learn what subtopics might be trending and other terms that you might explore.

Using Google Trends will allow you to really isolate those trends you want to investigate further. Filter your results, so to speak.

For instance, you might focus on trends that you see clearly increasing in popularity. Or, you might forgo researching further on trends that don’t really seem to be going anywhere. Google Trends gives you the opportunity to quantify some of the information that you found from the search engine.

A couple of tips for getting the most out of Google Trends

The first step with researching on Google Trends is to go to google.com. Using Google’s autocomplete feature, we can get an idea of the exact terms people are searching for. I’m no expert on the matter, but my limited experience tells me that simpler terms are more likely to get results on Google Trends. I haven’t had much luck finding data about long-tail keywords.

Another pro-tip is to try the autocomplete results that are higher on the list first. If I knew what went through the minds of the people at Google I’d be making $100,000 a month on this website. So, obviously, I don’t. But, it’s my assumption that Google places the query you’re most likely to search for near the top of the list.

At this point, I can’t tell you specifically what to look for. You’re just going to have to use your own judgment. Personally, I look for trends that are clearly increasing in popularity. Graphs that back up what I found searching online.

I also use the information

Again I can’t emphasize enough – Google Trends gives relative results; not absolute. So, if you are looking up a specific term be sure to also check a general version of that term to put it into perspective. For instance, if the potential trend is “cropped hoodies,” I want to look up “hoodies” just to put things into perspective.

Research on Trendhunter.com

Trendhunter, if you’re not familiar, is a website that aims to keep its finger on the pulse of trends. Not just trends in fashion or other consumables; but rather a wide array of topics including culture, business, and advertising.

Trendhunter serves as a good complement to your other research. My only issue with Trendhunter is that it can result in a little bit of information overload

Sometimes the trends within a particular category can be very niche and not necessarily practical. You might have to sort through some very odd results to find what you’re looking for. Nevertheless, it can offer other ideas you might not have found elsewhere. Or, can help to reinforce the ideas you already had.

The site is updated very frequently and will probably provide a lot of results related to whatever it is you’re researching. I do urge you, however, to take what you find on Trendhunter with a grain of salt. Again, it’s a very good resource but some of the things that you’ll find will probably be a little “out there.” Things that have too narrow of an audience for any company that is big enough to be publicly traded.

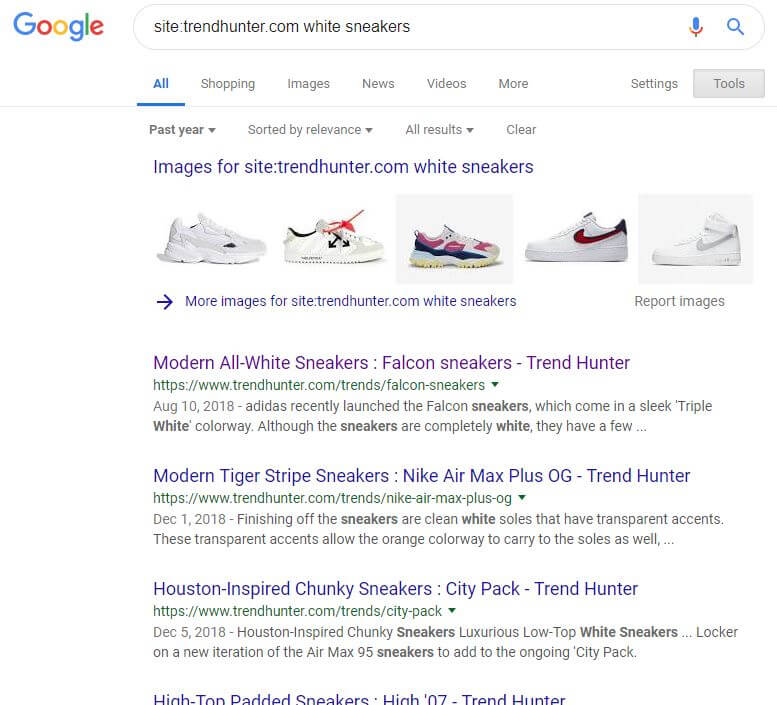

How I search Trendhunter

I’ve had the best luck searching Trendhunter via Google. I do this by searching “site:trendhunter.com [trend].” I feel like searching the site via Google makes for less clutter and makes it easier to find trends related to what I’m looking for.

Additionally, I can use the Tools option in Google to narrow my search to the past year, three years, whatever… Trendhunter.com has been active for a quite a while and some of the results that you might get via Google could be too dated to serve your purposes.

Find and follow industry influencers

Influencers are the individuals that people flock to when they first catch wind of something up-and-coming. People want to know what “so-and-so” thinks about it.

Influencers, in part, (likely) got to where they are due to their ability to keep their finger on the pulse of what’s hot. Also, if somebody wants to stay an influencer for long, they have to stay on top of trends in their industry.

So, how do you find these influencers? Some may have popped up when you did your web search earlier. They might have blogs that cover current events in their industry. Others, though, might exist solely on social media.

In cases like these, try searching for hashtags on social media. See who’s profile keeps showing up. See who’s profile is recommended. Also, don’t hesitate to just ask someone. Say you’re interested in the industry and want to know who is “must-follow.”

Look for free trade publications

Trade publications include blogs, journals, and magazines written for a specific industry. They exist to convey current events, news, information of interest, and trends to the members of that industry.

If you plan on keeping current with a particular industry, than a physical or electronic subscription to their publication(s) might be a good investment.

Most trade publications can be found with a simple search for “[industry] trade publication”.

Finally, size up the company you want to invest in

Hopefully, you feel comfortable that you have a bit of a grasp on the trends affecting the company you’re analyzing. Now, it’s time to actually check in with the company. The goal is to try to ascertain how well they’re capitalizing on those trends.

This is not the sort of thing that you can keep score of – as far as I can tell. You simply want to get a sense of whether or not this company has its finger on the pulse of its market. If a company isn’t picking the low-hanging fruit, so to speak, then I would have my concerns about its ability to realize its true potential.

Certainly, there’s something to be said for blazing paths, not following the crowd, and doing things your own way. But, it’s a rare individual and/or company that can pull that off.

At the end of the day, these posts are about finding growth stocks. Because – that’s what Philip Fisher’s Common Stocks and Uncommon Profits

Keep in mind that trends can be categorized in two general ways. Product/service trends and operational trends.

Product & service industry trends

Your ability to ascertain trendiness depends, in part, on the company you’re analyzing. Also, the industry that they operate in. If you’re analyzing a retail company, as I do with Foot Locker below, then sizing up the company’s trendiness is relatively easy. You just go to their website and look for the trends you found during your research. It’s not hard to get a feel for how well they’re marketing those trends.

If your company is in an industry that doesn’t market directly to consumers, you might have a little more difficulty finding the information you’re looking for. All you can do is work with what is available. Keep in mind that this is a subjective sort of undertaking. Sometimes you’ll have firm data to work with. Other times you’ll have to make certain assumptions.

Operational industry trends

When it comes to operational trends, no matter the industry, finding out if your company is following them could be more of a challenge. A lot of operational trends take place behind-the-scenes and aren’t necessarily publicly disclosed. Reading press releases, SEC filings, and news stories about the company (and the related trend) might help shed some light on the matter.

Once you’ve found all that you can practically expect in terms of your company’s trendiness, you’ll simply have to make a judgment call. Again, there is no right or wrong answer here. No pass or fail score can be given. It’s simply an impression that you get about the company. That impression is only a small piece of your overall impression of the investment worthiness of the company. So, take seriously what you’ve found regarding trendiness. But, also, make sure you keep the big picture in mind.

*This is a long post. Click here to read about how I apply these concepts to Foot Locker.

Contents