In general, there are five strategies a business can use to encourage sales growth. These are:

- Market penetration

- Market development

- Product expansion

- Diversification

- Acquisition

Business growth strategies and their corresponding stage

This post builds on the previous, which covered the stages of the business life cycle. These topics are related to Point 2 (of 15) covered in Philip Fisher’s book – Common Stocks and Uncommon Profits.

Fisher asks the reader to decide if management can still grow sales even if the potential of current product lines has been exploited. In order to determine that, I feel that the investor needs to know what growth stage the business is in. From there, they can decide if the growth strategies (if any) are suitable.

Any business at any stage of its life cycle can theoretically execute any of the following strategies. Some growth strategies are just going to suit certain stages better than others, however.

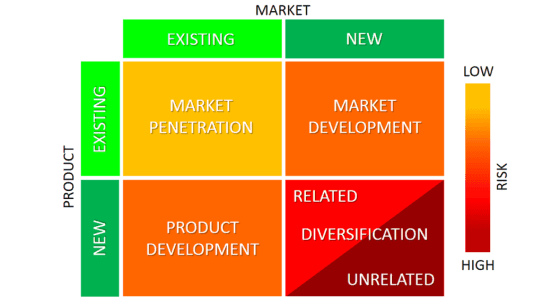

Most of these strategies are conceptualized from the Ansoff Matrix (Source).

1. Market penetration

This strategy is all about a company working with what the company has – existing products and services in existing geographic markets. The goal is to gain a greater share of the market. To take market share from competitors.

In order to accomplish this, a business will need to differentiate itself in one way or another. For instance, lowering prices is one way to accomplish market penetration. Another is by increasing its value proposition to customers. Finally, the business can increase market share through investment in marketing and promotion.

Internet, TV, and cellular service providers use this strategy often in an effort to poach customers away from competitors. They use promotional pricing with the hope that customers will become loyal or (more likely) will be too busy to switch back once the promotional pricing has expired. Examples include AT&T Inc. (T), Comcast Corporation (CMCSA), and DISH Network Corporation (DISH).

At what growth stage will a market penetration strategy work best?

Obviously, market penetration is important for companies in the infancy and growth stages. While the market itself might grow, companies that are hungry for growth will also look to increase their market share in order to ensure their survival. They won’t necessarily compete on price, like the previously mentioned examples. More likely that they’ll compete on value and customer service.

As shown, with the examples above, mature companies also seek to increase their market penetration. Given where they are in the life cycle they can more easily compete on price. The examples mentioned also have the luxury of a subscription-based business model. I wrote about the advantages of certain business models over others here.

2. Market development

Market development involves exploring new frontiers. A company undertaking this strategy is looking to sell existing products and services to new geographic markets.

Retail businesses might choose to franchise to limit risk while trying to develop markets. A similar method to franchising is partnering with distributors to reach these new customers. The ability to sell online over the past few decades has allowed businesses to efficiently reach new markets directly.

At what growth stage will a market development strategy work best?

When RE/MAX Holdings, Inc. (RMAX) went public in 2013, they did so to fund a market development strategy (Source). At that time, they had already been franchising for 38 years. But, their objective was to get into new geographic areas. Since that time, the number of RE/MAX franchises has grown considerably – particularly outside of the U.S. (Source).

When a company is in its infancy, particularly if it’s location-specific, it has to get control of its own backyard before it can worry about increasing its geographic footprint. During the growth and maturity stages, however, market development becomes a practical strategy for ongoing growth.

3. Product expansion

The development of new products and services for existing geographic markets is another strategy for business growth.

The new products and services need not be radically different. They can simply be variations on existing offerings. For example, a premium or bare-bones version of a currently popular product/service. This allows the business to use existing know-how and infrastructure, in large part.

On the other hand, radically different products and services might be dreamt up. This will likely involve a considerable investment in research and development. But if the investment pays off, it could reap huge rewards for those who are first-to-market.

At what growth stage will a product expansion strategy work best?

Product expansion plays an important part in the growth stage. The ability to fine-tune product/service offerings and to settle into a niche is critical for growing sales. That’s not to say that a mature company is incapable of product expansion. It’s just that it would seem to be more critical for a company that’s trying to find its place in the market than one that is already established.

Cola (along with other food and beverage) companies are examples of businesses that use the product expansion strategy. The Coca-Cola Company (KO) is consistently innovating with new flavors in an effort to expand its product offering. Just recently, they’ve started offering Coca-Cola Orange Vanilla in the United States.

4. Diversification

Diversification is a combination of market development and product expansion strategies. New products/services in new geographic regions are the aim here.

Market research and significant investment in promotion can help this strategy succeed in uncharted waters. Investment in infrastructure and human capital might also be necessary.

Speaking of market research (and promotion), I wrote posts on the subject in the context of Fisher’s Point 1: “…products or services with sufficient market potential to make possible a sizable increase in sales…”.

Those posts were:

- Market Size & Growth Rate | Fundamental Analysis for Stocks

- What are Some Examples of Top-Down Market Analysis?

- What is Product Growth Potential? – Business Model Desirability

- Examples of a Bottom-up Approach to Market Sizing

- What is Product Growth Potential? – Riding Business Trends

At what growth stage will a diversification strategy work best?

Since a strategy of diversification enters new markets with new products, it’s potentially a risky proposition. Mature companies, which have a foothold with existing products and markets, might be better poised to employ this strategy.

In the past, General Electric Company (GE), since its 1892 founding, has diversified into many different product and geographic markets. Now, for better or worse, they are involved in industries such as power, aviation, healthcare, and lighting – all around the world (Source).

5. Acquisitions, mergers, joint ventures, and alliances

Sometimes businesses, especially those with money to spend, will opt to let someone else take the risk and do the work of getting a company off the ground. In turn, they’ll happily pay a premium for a proven track record of success.

Or, if they want to mitigate their risk, they might collaborate with another company. While the previous strategies were internally focused, these strategies are externally oriented.

These strategies can be executed horizontally or vertically. Horizontally means that the parties involved are peers or maybe even competitors. Vertically would involve entities that are either above (suppliers) or below (customers) in the supply chain.

With an acquisition, the business gets access to an established customer base. If the acquired business is a really good fit, it will complement and leverage upon the purchaser’s strengths and extraordinary returns could be achieved.

A merger is similar, but will more likely involve companies of roughly equal size and can be more congenial than an acquisition/takeover.

Joint ventures and strategic alliances also share a lot of characteristics. The main distinction is that a joint venture involves a separate entity to be created and is more formalized than a strategic alliance.

At what growth stage will an acquisition strategy work best?

Typically, you might think it would take the financial might of a mature, established business to pull off an acquisition. Amazon.com, Inc. (AMZN) purchased Whole Foods in 2017, and they could easily be considered a late growth company. Though Amazon might not yet be considered mature, financial might is no problem.

Mature companies surely do look to purchase (or otherwise collaborate with) established businesses rather than trying to grow via another strategy. But, if a company in the growth stage has the means, they can further accelerate their growth by via an acquisition, merger, joint venture, or alliance.

Business growth strategies

What are some other business growth strategies might a company use, besides those listed?

How about my examples for companies at each stage of the life cycle? Do you agree or do you have better examples?

Do you have other (better) examples of companies that have employed the various growth strategies?