Monthly dividends provide reliable and consistent income. Receiving dividend income monthly is appealing because most expenses are also due monthly. Dividend investors need to know what size of portfolio is necessary to meet their income goals.

How much you need to invest to make $100 a month in dividends depends on the dividend yield of the asset you’re investing in. If the yield is < 1% you might need well over $100,000. If the yield is near 10%, you might need less than $15,000.

Most people, for better or worse, only associate income with effort. So, the thought of passive income is enticing.

Almost all of us could use an extra $100 a month. Even if we don’t need it. An extra $500 or $1,000? Even better!

Maybe you don’t need the cash at all. But, the thought of your savings feeding itself hundreds of dollars every month sounds pretty good too! An ever-increasing bit of security in a crazy world. Plus, when the time does come to take that cash out, you’ll reap the benefits of all that compounding.

How does one get to a point where they’re earning an extra $500 a month from dividends? What do they need to buy? How much money is needed?

Interested in the dividend income spreadsheet? Click here.

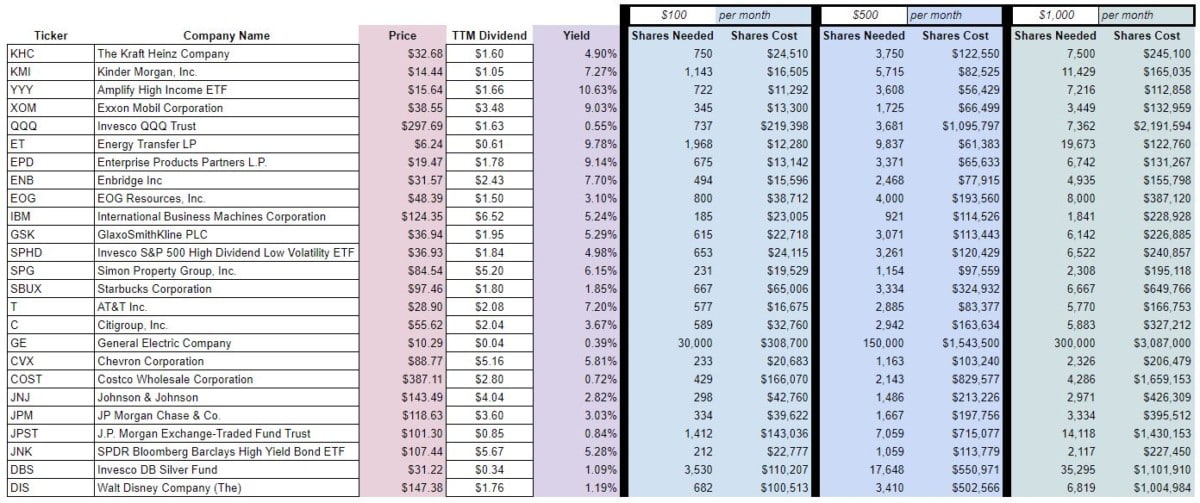

How much do you need to invest to make $1,000, $500, $100 a month in dividends?

As you can see – it depends. It depends directly on the dividend yield of the investment and indirectly on the investment’s price.

Dividend yield = annual dividend ÷ current price

Dividend yields can range from near 0.0% to over 10.0%. Most will fall in the 2.0% – 6.0% range.

Obviously, a company that did not pay a dividend would have a yield of 0.0%.

As prices go up, dividend yields go down. As prices go down, dividend yields go up. If prices are volatile, dividend yields will be volatile.

Investment needed = $__ a month target × 12 ÷ dividend yield

For example, say you found an investment that had a 4% dividend yield and you wanted to make $100 a month:

Investment needed = $100 × 12 ÷ 4%

Investment needed = $30,000

This investment will probably pay a 1% dividend every quarter.

$30,000 × 1% = $300

$300 a quarter is $100 a month.

As the dividend yield goes up, the investment needed goes down. As the dividend yield goes down, the investment needed goes up.

Okay..what stock has the highest dividend yield then?

Since a higher yield reduces how much you need to invest to make $100 (or $500, or $1,000) a month, then you should seek out investments with the highest possible yields, right?

Not so fast.

You must balance between a high yield and a quality yield. A high yield doesn’t mean much if the risk of losing it is also high.

Consider that the dividend yield is high because the price of the investment has fallen sharply. While the market isn’t always the best gauge of value, it could be that the financial health of the investment has deteriorated and future dividends are now in jeopardy. Remember – the dividend yield is measured with past dividends, not future dividends.

Can you get monthly dividends from quarterly dividend stocks?

Yes. This can be done with a strategy known as dividend laddering.

Dividend laddering works by staggering the months in which quarterly dividend stocks pay.

Typically, stocks pay dividends in January, April, July, and October. In order to receive monthly dividends, you’ll have to find stocks (or other investments) that pay in:

- February, May, August, and November

- March, June, September, and December

It’s important to note that just because an investment pays its dividend in a given month, that doesn’t mean that it’s a good investment. Don’t sacrifice quality for the sake of monthly dividend payments.

There are, also, stocks that pay monthly dividends. They’re rare, but they do exist. Most of these stocks are in the real estate sector. However, there are a number of stocks in other industries.

Dividend investing mistakes to avoid

Dividend investing Is usually regarded as passive. Once you’ve done your research and bought the stock, the bulk of your work should be done. Even passive investing can be screwed up, though.

Beginner dividend investors can fall victim to certain pitfalls. Here are some dividend investing mistakes to avoid.

Obsessing over high dividend yields

As mentioned earlier, a balance must be found between dividend yield and dividend safety. Yields that are 7%, 10%, 12%, or higher are enticing.

The yield, in many of these cases, is artificially high because the price of the stock has fallen. The price of the stock has fallen, often, because the future financial prospects of this particular investment have been called into question.

So, what can happen is that the dividend is slashed sometime after you purchase one of these “yield traps.” Then, you’re left with a mediocre investment that’s not paying you the dividend yield you hoped for.

Disregarding low dividend yield stocks

On the flip side, having tunnel vision can cause you to miss out on good investments that currently have low dividend yields.

If you anticipate that dividends will grow in the future then a low dividend yield today can be a healthy yield (on cost) tomorrow. Again, keep in mind that dividend yields look to the past, not the future.

Dividend yield on cost (YOC) is calculated in the same manner as dividend yield; except it uses the price you originally paid for the stock instead of the current price. Once you buy the stock, your cost is locked in. It’s not going to change. So, if you bought a stock years ago when the dividend yield was 1% and that dividend has grown 100% since, you now have a 2% dividend YOC.

As the dividend continues to grow, your YOC will also continue to go up.

Not considering the dividend payout ratio?

The dividend payout ratio is the percentage of earnings that the company pays out in dividends.

You might think the higher the dividend payout ratio, the better. That’s not the case though. The company needs to hold back a certain amount of earnings for when times get tough. If it pays everything out to the shareholders it won’t have any excess cash when it needs it.

As a rule of thumb, a dividend payout ratio over 80% is a red flag. A ratio of 50% or less should be considered very safe.

Paying too much for a dividend

A stock’s dividend yield is not the only financial ratio to consider when investing.

A dividend yield can appear healthy (but not too high) and you can still overpay for the stock. if the market’s irrational exuberance has over-inflated the stock price – then the yield will be less than it might have otherwise.

Again, dividend yields don’t happen in a vacuum. They are paid by companies that provide goods and services to customers. The health of the underlying company it’s critical for investors who want to make consistent money from their dividends.

Not reinvesting those dividends

Yes, this post is about making $100, $500, $1,000 a month in dividend income. That would generally mean taking dividends out in cash.

However, if you don’t need the money, reinvesting those dividends can really help your monthly passive income grow.

Many companies offer dividend reinvestment plans (DRIPs). The main benefit of DRIPs is the ability to purchase fractional shares. Many brokerages also give you the opportunity to reinvest dividends. If all else fails, in this day and age of $0 brokerage commissions, you can easily reinvest dividends manually.

DRIPs also offer the benefit of dollar-cost averaging. With DRIPs you’ll continue to acquire more shares (and, consequently, more dividends) every quarter. Within a few years, you might be shocked at how much your monthly dividend income has increased.

“How much do I need to invest to make $100 a month in dividends?”

Whether you need the cash or not, making smart dividend investment decisions is a good way to improve your financial situation.

Just make sure to analyze the companies you want to invest in. Doing so, along with diversification, can help ensure that your dividend income consistently grows over time.

It might be that you don’t have enough to invest to make $1,000, $500, or even $100 a month in dividend income at this time. If that’s the case – come up with a plan, make smart investments, and consistently stick money away for your dividend investments. Before you know it, you’ll be making your target monthly dividend income.

Contents