Ask any reputable investor out there how you should be spending your money and chances are that they will immediately bring you up to speed on the concept of risk-to-reward and more specifically why you should always keep a close eye on the market before making any investments.

This is largely due to the fact that the world of investments is actually a lot more complicated than it seems, with every different avenue requiring a different method to tackle successfully.

It actually becomes so difficult to dictate the future that you can end up completely messing up your predictions, investing in constantly dropping stocks or losing a lot of money hoping for the peak price to go even higher.

Most newcomers out there that are interested in becoming investors are not capable of surviving a bad investment choice, which is why we are seeing more and more people take the fall because they follow “fad tactics” that never really work out for them.

Today we will be discussing one such tactic that has been proven time and time again to cause financial pain for those that are not versed enough in the industry to know to do otherwise.

The tactic that we are talking about is known as Market Timing and it is actually strangely enough one of the most popular methods that we’ve seen employed by newcomers who wish to make a quick buck while minimizing the risk factor involved.

What is Market Timing?

Market Timing represents the speculative strategy which implies that you, as the investor, start timing out when you are going to put your money into the market, based on your own predictions of the future market movement.

This can also refer to selling stocks, but for the great majority of this article we will be taking on the buyer’s side, as this is the one that is most commonly misunderstood by the masses.

Most of the time, these market timers will buy stocks that are at an all-time low, hoping that this will lead to an eventual increase in numbers and that afterwards they will be able to sell during the peak. This method is very popular because it takes away from the risk factor involved with buying a stock at a high point, which most often than not ends up in a loss for the investor.

Another interesting point to keep in mind here is that these market timers will often times categorize different stock options as overvalued and undervalued. As such, they will end up delaying their trades until the market has “officially cooled off” so that they can start investing properly.

One thing that most of these investors don’t seem to understand though is the fact that the whole basis of Market Timing rests on the recency bias that has been around for many ages now. What this means is that just because something is at an all-time low that doesn’t mean that it will stay there for a long time or that it will eventually get back up to its peak.

Everybody takes part in some level of Market Timing, but what these new investors can’t seem to wrap their heads around is the fact that it should be considered a proponent of the investment, not the key factor of.

There are plenty of long-term buy-and-hold investors that succumb to this practice, which seems to be a good indicator of its validity, but these experienced veterans will not base their whole fortune around it either.

It’s all about balance, and what many new investors don’t understand is that if they always bet their life on the lowest risk factor, they will never make it big in the industry.

The Problem with Market Timing

Now that you know what Market Timing is, what exactly is wrong with it and most importantly, if it is so bad then why does everybody tries that every now and then?

Well, at the end of the day, as we mentioned previously, it is still a viable investing choice especially when it comes to making a quick buck, but remember, there is no way that you can be sure how the stock market goes and more importantly, you can never ensure a profit no matter what the numbers say about the past.

The fact of the matter is that regardless of who you are or how much experience and luck you have backing you up, successfully timing the market is impossible because of how unpredictable it is. The information that you have available for yourself is just as easy for others to access, so you can never truly make a profit by following the herd, especially in this open market.

A good metaphor for Market Timing is to look into a crystal ball and try to discern what you see from it. No matter how much you concentrate on the lines around it, it will always be foggy and hard to read, and the same can be said about the stock market as well.

A lot of the times, these new investors are also more likely to let themselves be ruled over by their emotions. If they predict that a stock’s price is about to increase, they are more likely to invest in it, but if the opposite happens then they can end up dropping out so as to not lose too much money on it.

On the other side of the spectrum, investors can also feel like their stocks have reached their peak early on and they can end up dropping out and taking out all of their money before they eventually go down with the ship.

This doesn’t mean that the stock will start going down immediately, and it can be a huge mistake on the investors’ part if they are too eager to pull out before seeing the numbers reach their peak.

Being emotional is not something that you ever want to add to your streak, especially if you are an aspiring investor looking to make a name for yourself. At the end of the day, when we choose based on our emotions, we actually choose to ignore the facts and instead leave ourselves open to being taken advantage of. That’s not something you want, right?

The Alternative to Market Timing

So, what exactly is the right choice in this case? How can we actually make sure that we are on the right track to making good investments and more specifically, how can we avoid losing everything we worked towards?

While completely eradicating these fears is impossible, and the concept of making a bad investment will always be there, let’s just say that there is one method that the studies have wholeheartedly supported over the years and that is “time in the market”.

Time in the market is exactly what it sounds like, the more time you spend on the market the better you will be at predicting the eventual outcome of these volatile stocks.

This also implies that you completely get rid of the recency bias tool, as even though it can end up making you a lot of money on the long run, it is a recipe for disaster if that is your only move going forwards.

So, how exactly does this work? Well, to put it bluntly, you need to form your eye around the market and cautiously observe everything that is happening, while also keeping in mind the volatility of the industry.

Investing early, holding onto that investment and ignoring everything that happens to it over the passage of time could the best way to go, and even though it may feel heartbreaking to see the numbers go down and your profits going down with them, remember, this is all just white noise for now.

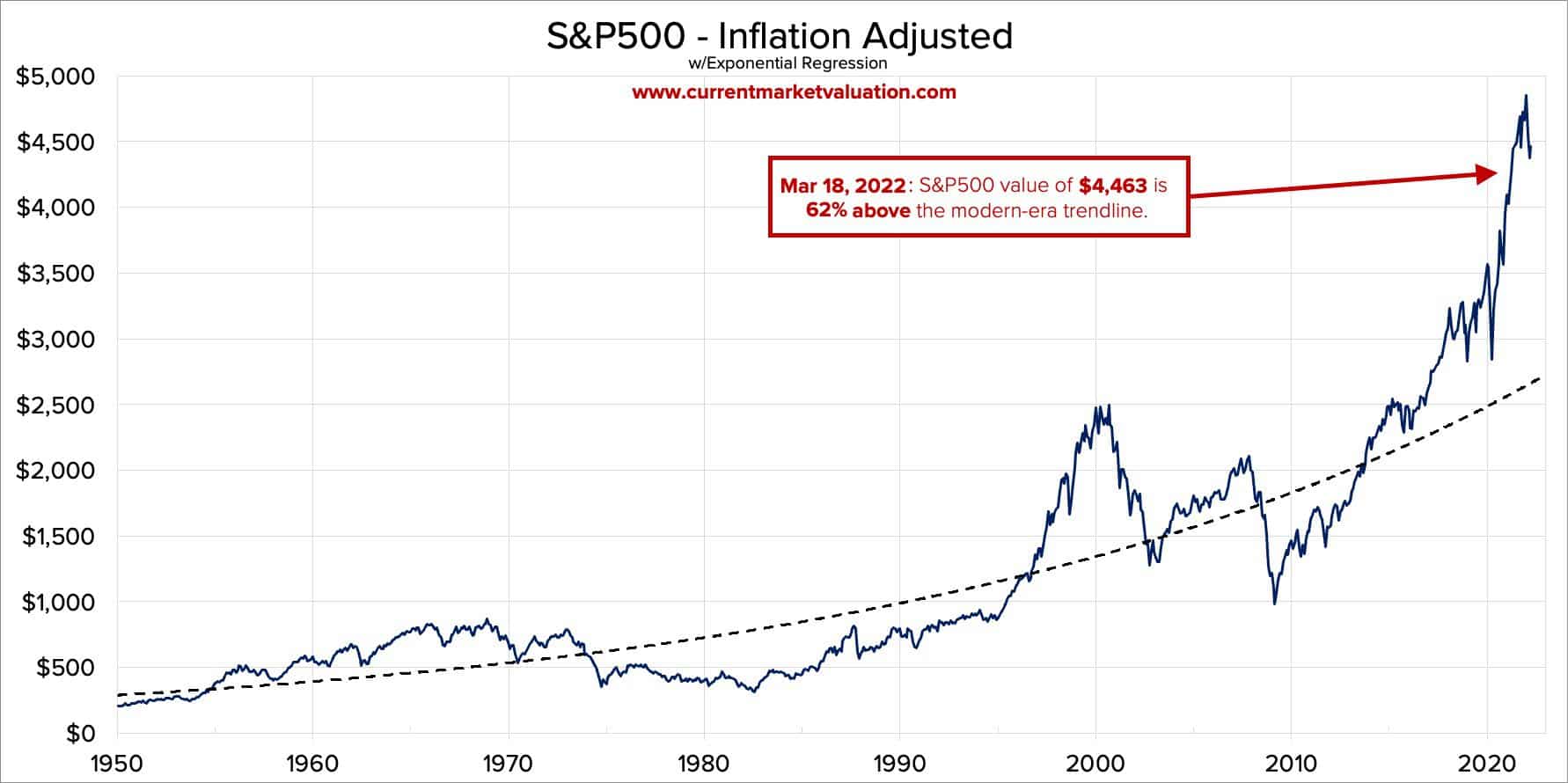

Even Jack Bogle said that if you rely on the recency bias you will have a bad time as an investor and that instead you should keep in mind the fact that the market always goes up more than it goes down, so you shouldn’t focus too much on its slopes and turns.

In fact, when it comes to investments and specifically the stock market itself, you should never allow yourself to be ruled over by your feelings.

Only by ridding yourself of your fears you will be able to come out on top, and while Market Timing can be very enticing, remember that the end results are the only ones that matter to you as a successful investor.

Dollar Cost Averaging vs Lump Sum Investing

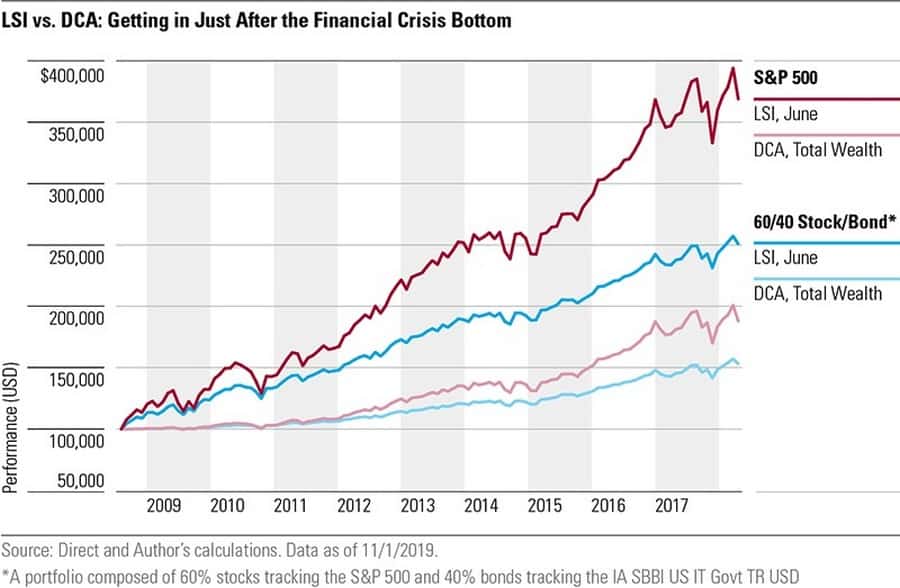

In case you didn’t know by now, the concepts of the Dollar Cost Averaging (DCA) versus the Lump Sum Investing (LSI) have been prevalent key factors that ruled over the decision making of most investors out there, regardless of whether they’re veterans on the field or if they just got into the industry.

Dollar cost averaging essentially refers to the concept of investing into a stock option in smaller sums periodically and always checking to see the way that the market changed over that period of time.

Lump sum investing represents the other side of the spectrum as in this sense you are choosing to take a large sum of money and dip it all into the stock.

Which one of these is better and which one is worse? According to statistics, it would seem as though, despite being a lot riskier, lump sum investing is a lot more profitable, as you can immediately start seeing a profit, as opposed to using dollar cost averaging which offers minuscule profits every now and then.

Being more fearful of an eventual crash is never good for us because as investors we should always be ready for the worst to happen. If you simply dip your toes into the stock market you won’t find yourself making that much of a profit because you didn’t trust yourself enough.

Dollar cost averaging is also a lot more emotional according to multiple studies, as it implies the fact that you are allowing your fear to get the better of you. By minimizing the risk factor, you are also minimizing your profit capacity, and as an avid investor you should never let your emotions get the best of you.

Lump sum investing seems to be the better choice here, as it ignores feelings about the short-term future of the market and instead it redirects them towards the long-term aspect.

Another interesting fact to point out here is that a lot of us are going to suffer of something known as hindsight bias. This implies the fact that we as humans are more likely to remember our past predictions as a lot more accurate than they really were.

So, if you made the right prediction three out of ten times, you brain equates this as you having made the right prediction more than fifty percent of the time.

As an endnote to this segment, we should mention the fact that by utilizing the dollar cost averaging option you are actually not taking part in the open market, but instead you are choosing to avoid any losses by sitting on the sidelines at all times.

You are preparing for the worse while also waiting for the best, without any plan to back you up in case your predictions end up being right.

By choosing to be on the sidelines you are essentially eliminating yourself as a potential player which will leave a heavy toll on your profits in case your assessment turned out to be correct.

The Costs of Market Timing

As far as the general price of admission goes, you should definitely keep in mind the fact that there are several different costs that you will need to address at one point or another if you try to apply Market Timing to your strategy going forwards.

First and foremost, you will need to understand the fact that fees will always be the bane of your existence.

Sure, there are a lot of different modern brokers out there that try to avoid using fees when it comes to trading in general, but if you decide to continuously add more and more to your investment on a periodical basis you will soon find yourself drowning in fees.

These fees are not going to break your bank and that’s a fact, but they will continuously add to your payments to the point where you will easily be able to spot the difference at the end of the journey, by looking at what you could have had if you were to employ a single lump sum buy order instead.

Second of all, as cliché as it may sound, time is money when it comes to stock investments, and what many people don’t realize is the fact that the more time you spend trying to time your investments, the less money you will be making on the long run.

This is because during that time frame you could have actually bought more orders, you could have spent that time charting or you could have planned out your future investments more.

Think of it this way, if you were to spend a week just staring at a wall and not thinking about anything investment related you will end up losing a lot of money, and this exact same thing happens if you spend that time investing slowly into one stock over the course of the week.

If you have the money at your disposal and you continue to sit on it waiting for the right time to invest, you will find your asset allocation becoming more conservative. The more you hold on to that money the less likely you are to use it, which is another result of emotional investing.

But the biggest culprit when it comes to unnecessary costs related to dollar cost averaging is in the fact that the stock market’s gains for any given year are mostly related to the handful of peak days that were spotted by the experts.

Sure, if you invested in that stock before its peak hour, you would have had a very good profit on your hands, but what you don’t see most often is the fact that the price for it went down almost instantly afterwards, which wouldn’t have been all that profitable for you to say the least.

Conclusion

So, what did we learn here today? We learned the fact that Market Timing is not worth the price of admission, and while it may work out for you if you’re lucky enough, it is not the recipe for success that everyone makes it out to be.

At the end of the day, when it comes to the stock market you can never completely remove the risk factor, you can only learn the way that the cookie crumbles and act accordingly in the future. So, for now we wish you luck ahead and we hope that all of your investments end up as juicy profits.