Keeping track of your dividends means monitoring information such as:

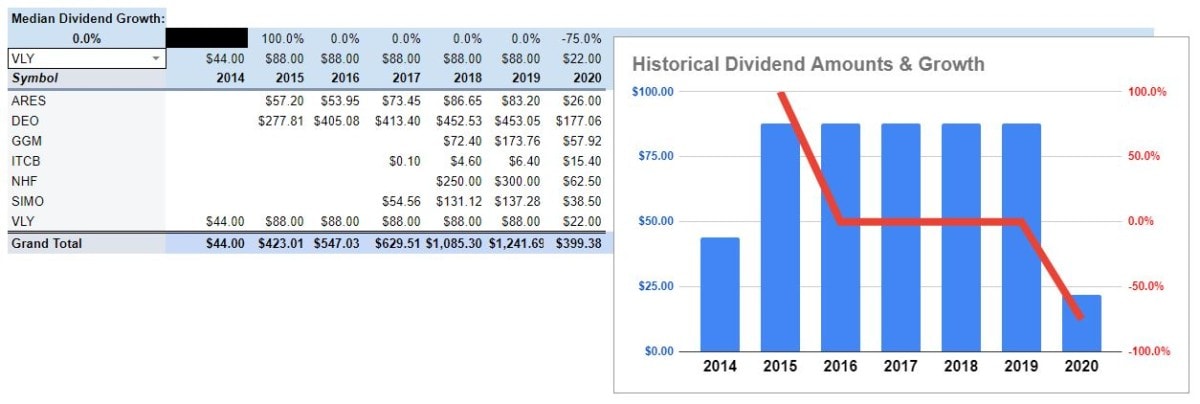

- Date of dividend payments

- Amount of dividend payments

- Dividend yields

- Dividend growth

Investors track dividends because it aids them in understanding the quality of their dividend investments. A better understanding should lead to better decision making.

Investors track dividends by recording information about payments and making calculations. The use of software can make tracking dividends more efficient. The software used to track dividends can include spreadsheets, apps, and website tools.

“Does Robinhood track dividends?” Yes, technically. As do most brokerages. Personal Capital does. So does Finbox. But…it also depends on what you mean by “track.” Are you a serious dividend investor looking for detailed information on income, research, and returns? If so, check out these 24 spreadsheets, apps, and websites. They might give you what you need if Robinhood isn’t.

Admittedly, I haven’t used many of these. So, I can’t offer an opinion beyond my observations. Hopefully, the value you’ll find here is the research I did to provide a unique list of dividend trackers beyond the same five to ten you’ll find nearly every other post on the subject.

Dividend tracking spreadsheets

It’s no secret that I’m a fan of spreadsheets. Some software is exceptional. Most software is merely okay. Nothing can beat the personalization and customization of a spreadsheet – in my opinion.

Here are five spreadsheets to check out if you too want to make a dividend tracking tool that’s your very own. Exactly what you need. Oh, and you can use it on your great big monitors! Not some tiny phone screen!

By the way, if you’d like to download one of these dividend tracking spreadsheets for your own use, click File > Make a copy. DON’T email the author for permission to edit ?.

All of these spreadsheets, with the exception of Tiller Money, are currently free.

Create an Amazing Dividend Tracking Spreadsheet (Excel)

Yes, I put a shameless plug for my dividend tracking spreadsheet at the top of the list. I’ll try not to oversell it though. If you’re interested in reading more, you can click on the link.

I will point out that this spreadsheet is committed exclusively to dividends. Also, to date, my dividend tracking spreadsheet has been downloaded 546 times. Which is 3.4 times per day. Given my modest amount of traffic, that makes it one of my most popular posts/downloads.

Investment Moats Stock Portfolio Tracker

Since this dividend tracking spreadsheet is more focused on portfolio management than dividends tracking, it has a lot of features that you might not be looking for. Conversely, if you’re looking for something more comprehensive, it might be right up your alley.

This spreadsheet obviously had a lot of thought, time, and effort put into it. As far as dividend tracking goes, it can handle dividend reinvestment, cash dividends, and other dividend transactions that contribute to the value of your portfolio.

Public Stock Dividend Tracker

This is a Google sheet made available to the public. Who authored it – I’m not sure.

It’s pretty simplistic. Which is not necessarily bad. Simple is generally good. This spreadsheet utilizes some straightforward tables and graphs.

Like its Investment Moat counterpart, the Public Stock Dividend Tracker seems to be a combination dividend tracking/portfolio management spreadsheet. Which is fine. Those two aspects of investing go hand in hand.

This spreadsheet utilizes the GOOGLEFINANCE function for stock quote information. Additionally, it seems to rely upon the IMPORTHTML function to bring in financial information.

This is where it runs into trouble. I know from experience, that IMPORTHTML and IMPORTXML can be powerful in Google Sheets. But, if the data source you’re referencing makes one little change, it can throw a wrench into the functionality. That seems to be what happened here.

If you are interested in using the Public Stock Dividend Tracker spreadsheet, you might have to ignore my previous advice and reach out to the owner by requesting to edit. Then, you can ask them if they can update their IMPORTHTML formulas.

No guarantee that they’ll answer. But, if you think you might find this spreadsheet useful, then it’s worth a shot.

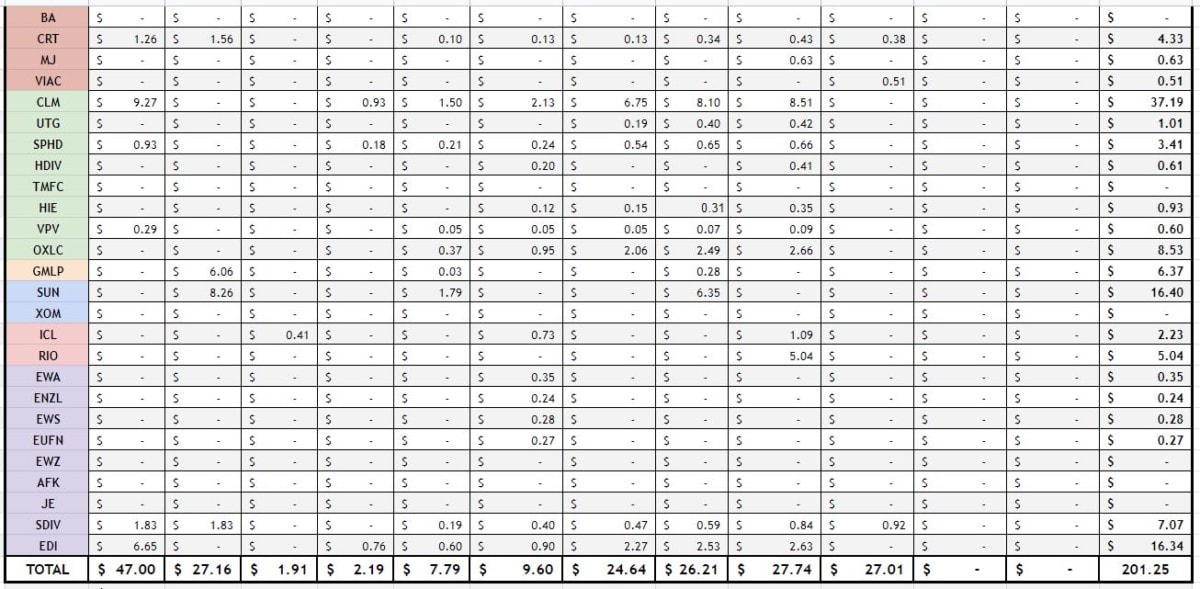

Ben’s Good Ole Fashion DRIP to FARM portfolio

Here, we’ve got another unique offering. I found this Google Sheet on a Reddit thread.

It was obviously designed for individual use, and he just decided to share it. Which is nice. But it might be a little too customized for the average dividend investor to use.

Anyhow, if you’re interested, you can use the Blank Copy worksheet and probably delete the rest.

The individual who created this spreadsheet obviously knows what they are doing. The design and layout are sharp and clean. If you’re dead set on using a spreadsheet for dividend tracking, and none of the others suit your needs, this could be a good option. With a little tweaking…

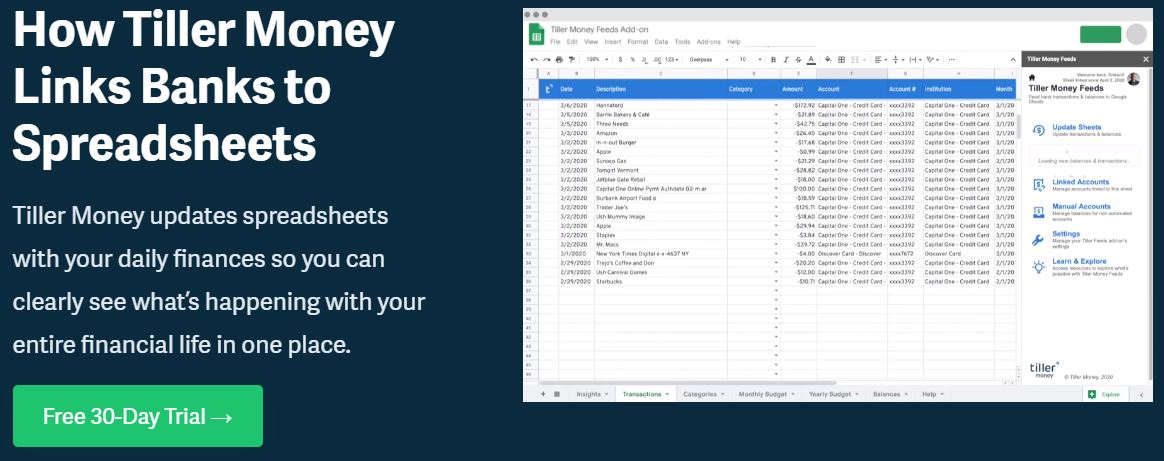

Tiller Money

Tiller Money, at its core, is more of a budgeting tool – as far as I can tell. A “personal finance platform built for Google Sheets,” according to them. That’s why I included it in the spreadsheet section.

However, just because it’s primary focus is something else, doesn’t mean you can’t use it for dividend tracking.

Apparently, Tiller has wide compatibility with brokerages and other financial institutions. Investors are able to import dividends and other passive income information. This, they say, makes it easy to track how dividends are growing.

Tiller Money currently costs $79/year

Dividend tracking apps

Would you rather track dividends on the go? Do you hate spreadsheets?

If that’s the case, then you might be more interested in apps for dividend tracking.

Just like the spreadsheets, though, not every one of these apps is solely focused on dividend tracking. However, you should find that they all address dividends to a greater or lesser extent.

Jstock

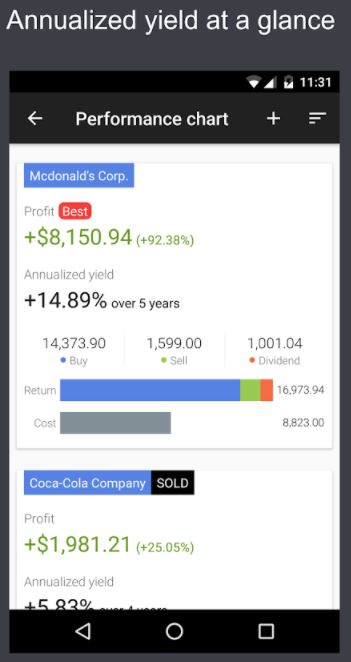

Jstock is open source software, available for the desktop and as an app. It is broadly focused on portfolio tracking and not solely dividends. However, it seems to have a lot of features that will appeal to dividend investors.

If you opt to use both the app and the desktop software, they should integrate together.

Jstock provides analysis on dividends; along with valuation and company health information. It also provides a dividend growth rate over the previous five years illustrated with a historical chart.

The app appears to be fairly well-reviewed with 4.6 stars out of 5 on Google Play. From what I saw, most of the reviews that mentioned “dividend tracking” gave it 5 stars. These reviews spoke about how handy the app was. Several of the reviews specifically voiced how helpful the five-year dividend growth rate chart was.

Jstock is currently free.

The Carrot App

Admittedly, I couldn’t get a read on whether Carrot was an actual app (i.e. available on the App Store/Google Play) or if they just called themselves an app. Carrot appears to be website-based like TrackYourDividends.

Anyhow, the Carrot app was built specifically to provide a low-cost, automated way for investors to track dividends. Specifically, users that are inexperienced and new to the “trading revolution.”

Like other apps, Carrot looks to offer general portfolio management tools in addition to dividend ones.

One of its most sought out features is the scenario builder. Here, you can ask “what if?” Change variables and see what the effect might be in the future. Scenarios are visualized through the use of charts and graphs.

Additionally, beyond the scenario builder, Carrot offers custom alerts, real-time prices, and curated news for all of your dividend holdings.

The Advanced version of the Carrot app currently costs $5/month.

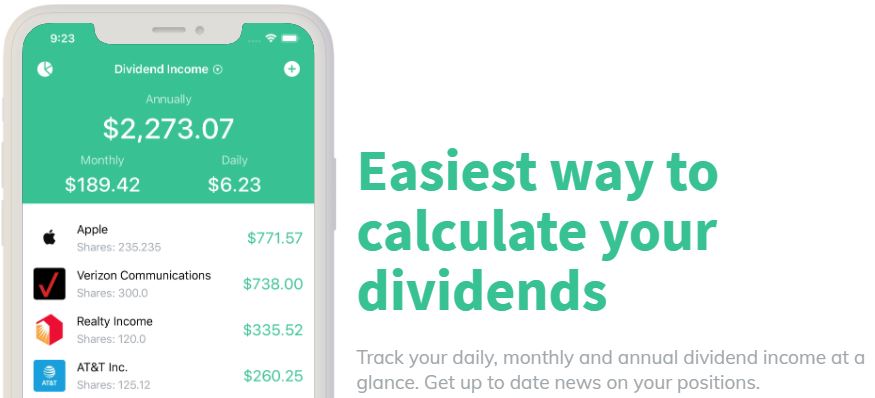

DivCalc

DivCalc offers a daily, monthly, quarterly, and annual breakdown of dividend income. Additionally, DivCalc lets you set dividend income goals and document your progress toward those goals. It also alerts you to upcoming dividends and important news/announcements from the stocks you have positions in.

This app is fairly well-received on the Apple App Store with a 4.0 star rating. Those who gave DivCalc high ratings complimented the user interface. Specifically, how simple it was. However, other users complained that the holdings they were entering were not being saved.

One unique feature of DivCalc is its ability to discover new dividend investments. The app creates lists of stocks that pay dividends and groups them together into different themes. For instance, themes such as trending, best of Reddit, and commercial REITs.

The DivCalc costs $2.99

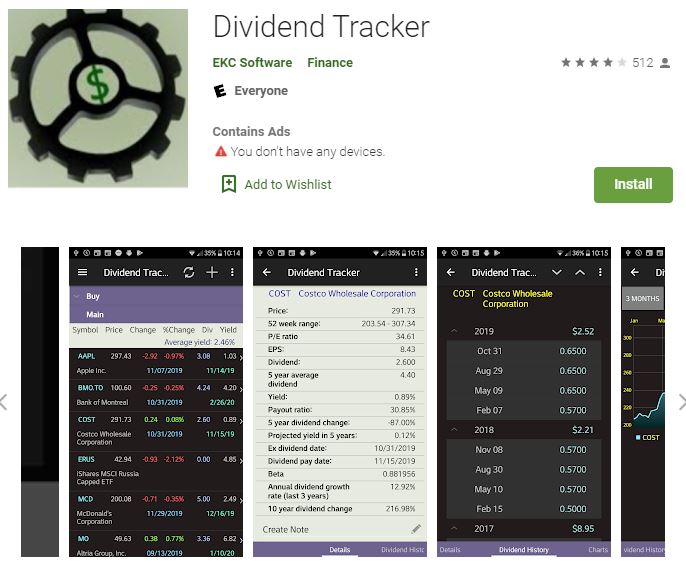

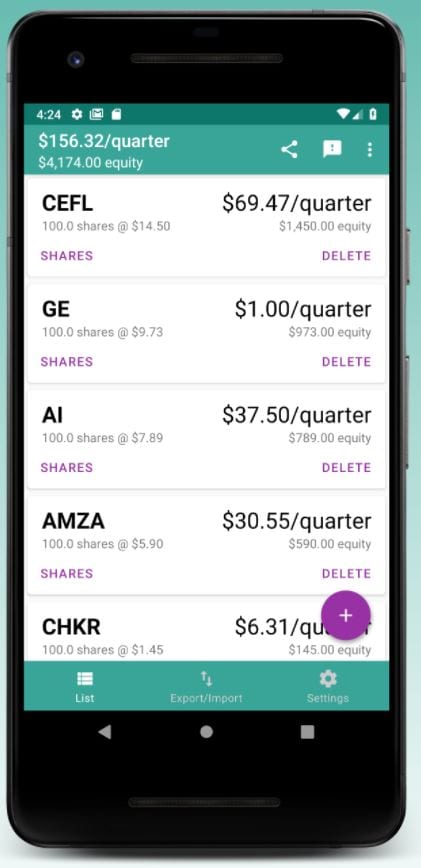

Dividend Tracker

With the Dividend Tracker app, you can create stock lists and view dividend history for those stocks. For each stock in your list, you can see upcoming dividend payments. In addition to the dividend information, some basic stock information is also provided. Things such as charts and news.

Dividend Tracker is also fairly well-reviewed. It currently receives 4.0 out of 5 stars on the Google Play Store. Most of the positive reviews revolved around the app’s general functionality. Some of the negative reviews pointed to the inability to set a default currency and incompatibility with ETFs.

A cost could not be found for the Dividend Tracker app. It might be free?

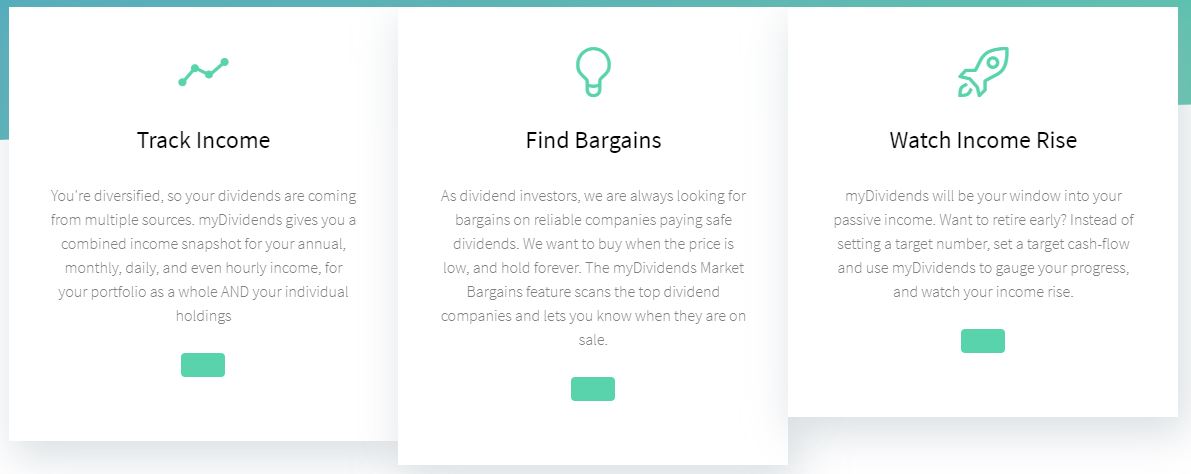

myDividends

The myDividends app touts itself as an easy way to track dividend income. Particularly, across multiple brokerage accounts. One seemingly unique feature is its ability to break your dividend income down to the hour.

The design of this app is very clean, with a lot of white space. It looks simple to navigate.

myDividends is not rated as highly as some of the other dividend tracking apps. On the Apple App Store, it is rated at 3.8 out of 5 stars. The reviews speak highly of the app’s design and functionality. Some of the gripes include a lack of information updating in a timely manner. Particularly the “dividend bargains” feature.

The upgraded version of myDividends is currently priced at $4.99.

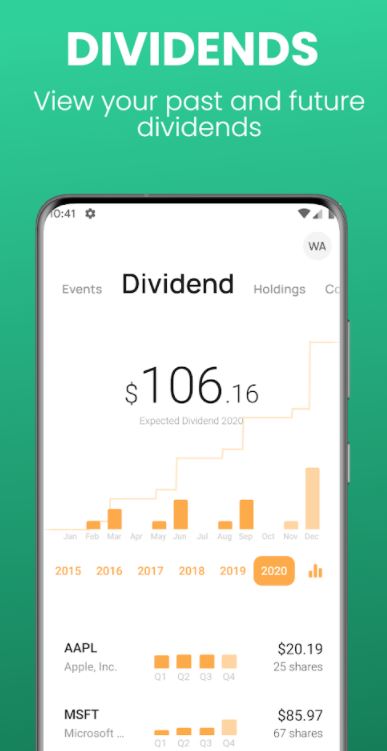

Stock Events

Calling the Stock Events app a dividend tracker might be a stretch. It depends, I suppose, on your definition of a dividend tracker. Dividends are considered events, along with things such as stock splits, earnings announcements, etc.

Therefore, the Stock Events app lets you view all historic dividends and track upcoming dividends, for the stocks you follow, in a calendar.

Stock Events has a 4.4 out of 5 star rating on the Google Play Store. Some of the users mentioned that they liked how the app broke dividends down if you had fractional shares. They also liked that the app provided expected earnings.

On the flip side, many of the negative reviews mentioned technical issues. However, the creator of the app seems to be very responsive. Feedback was taken into consideration and frequent updates seemed to be made.

In-app purchases for Stock Events currently range from $2.99 to $49.99.

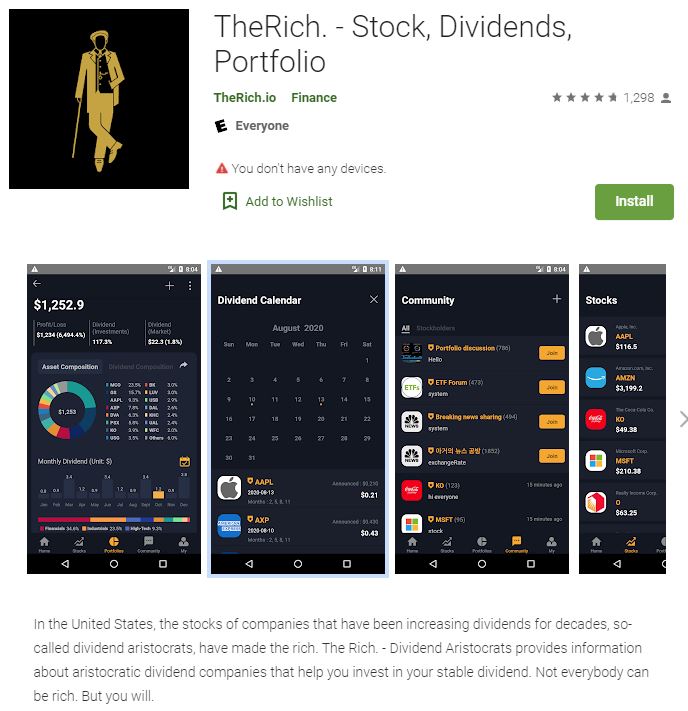

TheRich

The Rich is a stock portfolio app with a big focus on dividends. Particularly, dividend aristocrats. It has, in my opinion, a very sharp looking interface.

As far as dividend tracking goes, TheRich appears to offer a dividend calendar and access to communities where dividends can be discussed.

TheRich is rated 4.8 out of 5 stars on the Google Play Store. Many users praised the dividend calendar and the ability to calculate after-tax dividends. Nearly every review, in fact, mentions dividends one way or another.

No information could be found on the cost of this app. It could be free?

Hold

The Hold app is, primarily, a dividend estimator. For each stock you own, it will track what your expected income will be per month and per quarter.

At 4.2 out of 5 stars (Google Play Store), the Hold app doesn’t have as good of ratings as some of the other dividend tracking apps. The primary complaints were a lack of multiple portfolios and the inability to track stocks from other exchanges.

Hold’s Premium plan is $1.35/month.

Dividend tracking websites

Want the polished interface of an app on a big screen? Then you might prefer a dividend tracking website.

One benefit a web-based dividend track has over a spreadsheet is that you can’t accidentally change a formula or a cell reference and completely ruin it.

Here’s two quality websites for dividend tracking…

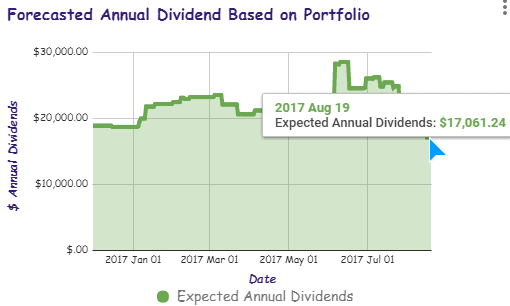

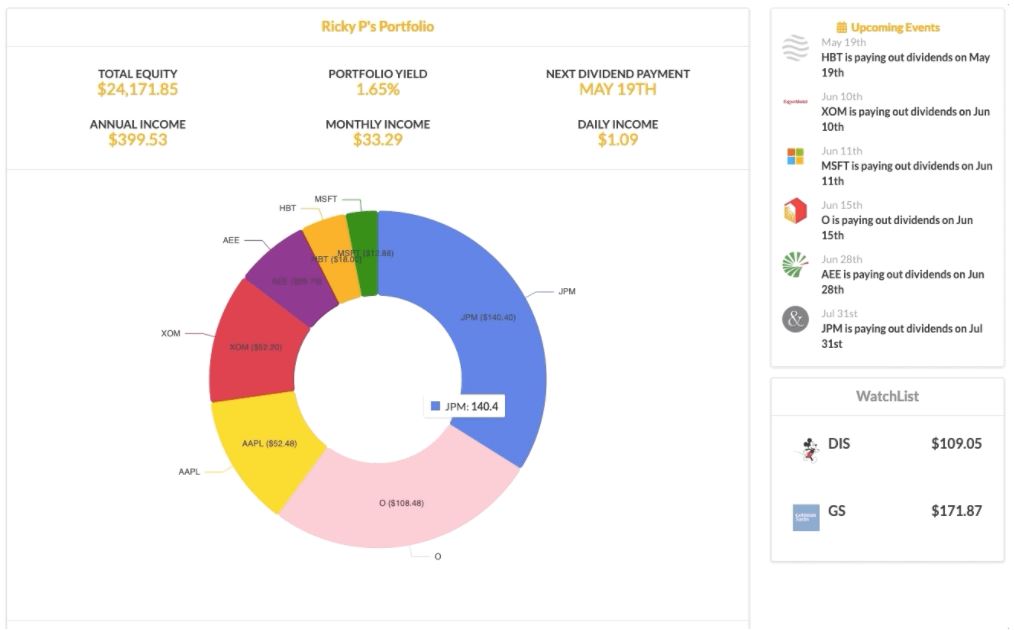

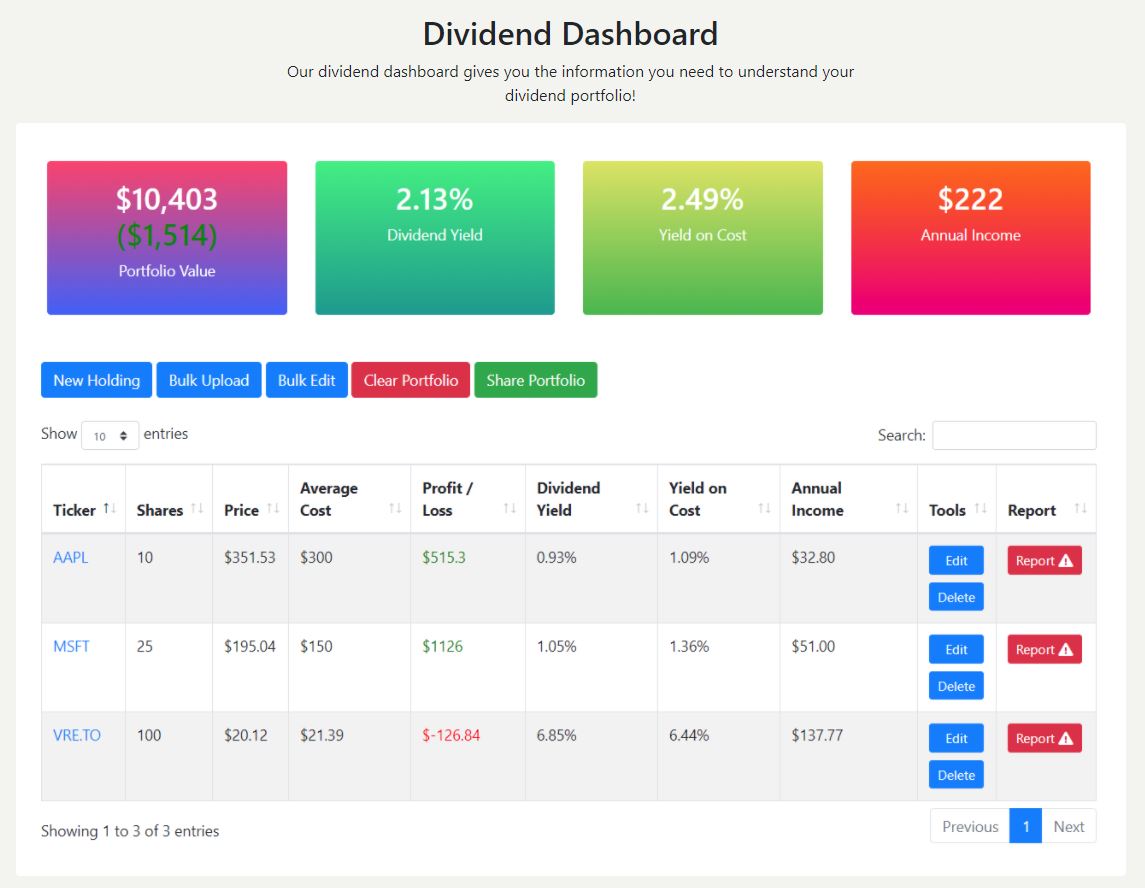

TrackYourDividends

TrackYourDividends appears to be simple to use and comprehensive. If you’re tired of using spreadsheets, TrackYourDividends might be what you’re looking for.

The dashboard is simple and straightforward. It offers clear insights into your portfolio value and dividend income. Furthermore, all this information is broken down by individual assets.

More information is available in the Free Tools section. Here you can find insights on diversification, upcoming dividends, future value, portfolio history, portfolio alerts, and dividend payments.

Information on your dividend stocks can be manually entered/edited or uploaded in bulk. TrackYourDividends has the ability to link to several different brokerages for automatic updates.

TrackYourDividends also has the capability to track mutual funds, ETFs, and bonds. Price updates are automatic.

It also appears that you can link your bank accounts and credit card statements to track your dividends. This would be particularly useful for those who rely upon dividend income.

TrackYourDividends Premium Dashboard is currently $59.99/year.

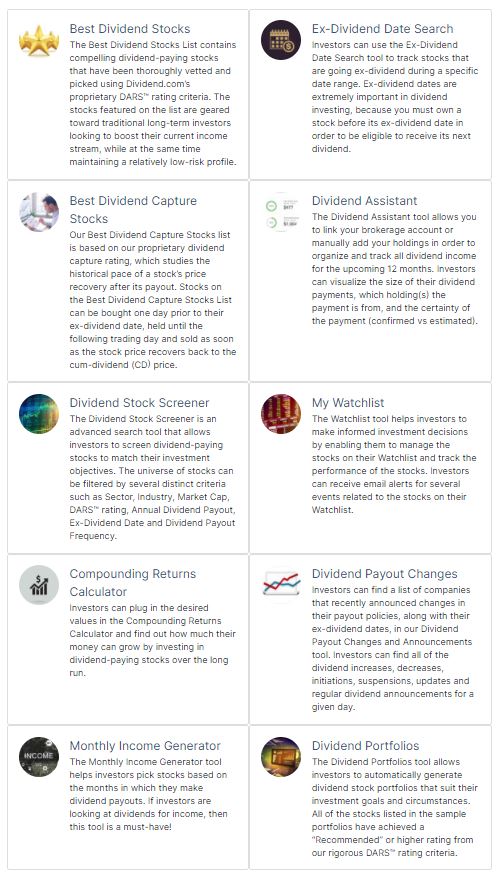

Dividend.com tools

Dividend.com is a well-known domain for dividend investors. This website has an extensive set of tools. Most of which are only available to Dividend.com Premium members.

Best Dividend Stocks

Dividend.com uses a proprietary DARS rating system to choose these stocks. The aim of the list is to minimize risk while boosting long-term income.

Ex-Dividend Date Search

The Ex-Dividend Date Search allows you to search for stocks that are going ex-dividend during a specified time frame. Presumably, to allow you to invest before you miss out on the dividend.

Best Dividend Capture Stocks

This list looks at stocks that tend to rebound after a reduction in price due to a dividend payout. The goal is to Capture Stocks solely for the purpose of getting dividend income. Not to hold them long-term.

Dividend Assistant

The Dividend Assistant is actually a tool called Propelor. Propelor is still in beta, as of this writing.

You can request early access if you’re interested. In Propelor, you can link your brokerage or add holdings manually. Then, you can track dividend income for the next year. This is the most comparable tool to all the others that I’ve discussed in this post.

Dividend Stock Screener

The Dividend Stock Screener is like a traditional stock screener, except geared towards dividends. For instance, dividend-paying stocks can be filtered by industry, DARS rating, ex-dividend date, and payout frequency.

My Watchlist

My Watchlist is exactly what it sounds like. It allows users to compile lists of dividend stocks and track their performance. You can also set it up for email alerts when certain events are triggered.

Compounding Returns Calculator

This tool is available to everyone. It’s a simple form that will calculate your returns based on three variables:

- Money invested

- Return rate

- The number of years.

The calculator delivers results in a table that breaks returns down by year.

Dividend Payout Changes

Here, you can find a list of stocks that have increased or decreased their dividend payouts. Changes in ex-dividend dates are also listed. This could serve as a starting point for choosing a company to analyze?

Monthly Income Generator

This tool helps you pick stocks based on when they pay dividends. As I discussed in my monthly dividend post, if you’re interested in monthly income, you can stagger the timing of quarterly dividend payments to achieve the same effect. A tool like this would help you to save time searching for investments that pay dividends in the months you need to meet your monthly income goals.

Dividend Portfolios

The final Dividend.com tool allows you to create hypothetical dividend stock portfolios in order to come up with a model that will suit your needs. It only uses “recommended stocks” based on its DARS rating system.

Dividend.com Premium currently costs $149/year.

How will you keep track of dividends?

Brokerages like Robinhood keep track of the dividends you receive. So do sites like Personal Capital and Finbox. Serious dividend investors want information tailored to them, however.

The right dividend tracker can help you build the best possible portfolio. It can help you be proactive about your dividend investing and reach your goals more efficiently.