“Which is the cheapest source of financing?” Debt is generally considered to be a cheaper source of financing than equity. Particularly during times (such as these) when interest rates are low. Beyond the “low cost of money,” debt also benefits from a tax advantage that equity does not.

Debt, in general, is regarded as a negative thing. But, that’s a somewhat naïve view. If used effectively, debt provides valuable financial leverage which allows a company to ratchet up its return on investment (ROI).

In fact, between the two primary methods of financing – debt and equity, debt tends to be the cheaper alternative. Let’s take a look at why that’s the case.

What is debt financing?

A company can raise capital through two primary means.

- Through the issuance of equity (ownership)

- Through borrowing (debt financing)

Whenever a company borrows from a lender and promises to repay that amount, plus interest, it is considered debt financing.

Debt financing is commonly used by companies of all sizes, public and private. If the proceeds are used wisely, debt financing can be very advantageous.

Terms for debt financing can be short (< 1 year to < 5 years), medium (5 years to < 10 years), or long (10 years to 30 years or more).

A small, private, company would likely borrow from a financial institution like a bank or credit union. A large, publicly-traded, company has more options.

Here are some examples:

- Bonds – Long-term (more than 10 years) debt securities that are sold to, and traded among, investors. Typically, interest-only payments are made until maturity. At which time the principal is returned.

- Notes – Like bonds, but shorter-term (1 to 10 years).

- Commercial paper – A type of unsecured short-term (less than 270 days) debt.

Why is equity more expensive than debt?

When a publicly-traded company chooses an optimal capital structure, they consider the respective costs of debt and equity. By minimizing their cost of capital, they improve the likelihood of employing that capital in a profitable manner.

There comes a point, however, when the issuance of more debt (or equity) might not be desirable. It might not even be possible though it would minimize the cost of capital.

One factor that makes debt financing cheaper than equity is the tax-deductibility of interest payments. All companies, not just publicly-traded ones, are able to deduct interest expense from income before tax obligations are calculated. Therefore, the savings on taxes offsets the cost of interest.

Is the cost of debt financing the same as the interest rate?

No. The formula to calculate the true (net) cost of debt financing = interest rate × (1 – tax rate).

For instance, if a company borrowed at 5%, and the tax rate 21%, the actual cost of debt financing would be 3.95% (5% × (1 – 21%)).

All things being equal, the higher the tax rate, the more appealing debt financing is.

Furthermore, companies that rely on equity financing, often are expected to pay dividends to shareholders. Dividends come out of net profit, which, of course, is what’s left after taxes are subtracted. Therefore the cost of equity financing is not tax-deductible.

Isn’t retained earnings technically the cheapest source of financing?

This is a popular notion. It would seem so since the funds are already in the company’s possession. Plus, they probably don’t have to pay (further) dividends on this balance.

However, keep in mind that these funds belong to shareholders. If shareholders aren’t getting a return via dividends, then they sure as hell expect their shares to appreciate.

The average return from investing in stocks is usually quoted as 6% – 8%. So, when investing retained earnings into company projects, 6% – 8% becomes the cost of capital/hurdle rate. Much more, typically, than debt financing. Especially, considering the tax ramifications.

Also, retained earning isn’t cash. Just because a company keeps a certain amount of retained earnings on its balance sheet, doesn’t mean that it has that amount available in liquid assets.

A simple example of the cost of debt financing

Consider a company that has $200,000 in operating profit and a 21% tax rate.

If they have no interest expense, their taxes payable will be $42,000.

If they had borrowed $100,000 at 5%, they would have a $5,000 interest expense. However, the reduction in taxable income would lower taxes payable to $40,950. Saving them $1,050 in taxes.

| No financing | Debt | Difference | |

|---|---|---|---|

| Revenue | $1,000,000 | $1,000,000 | |

| COGS | 600,000 | 600,000 | |

| Gross profit | 400,000 | 400,000 | |

| SG&A | 200,000 | 200,000 | |

| Operating profit | 200,000 | 200,000 | |

| Interest expense | 0 | 5,000 | +5,000 |

| Tax @ 21% | 42,000 | 40,950 | -1,050 |

| Net profit | $158,000 | $154,050 |

An actual example of debt vs equity financing

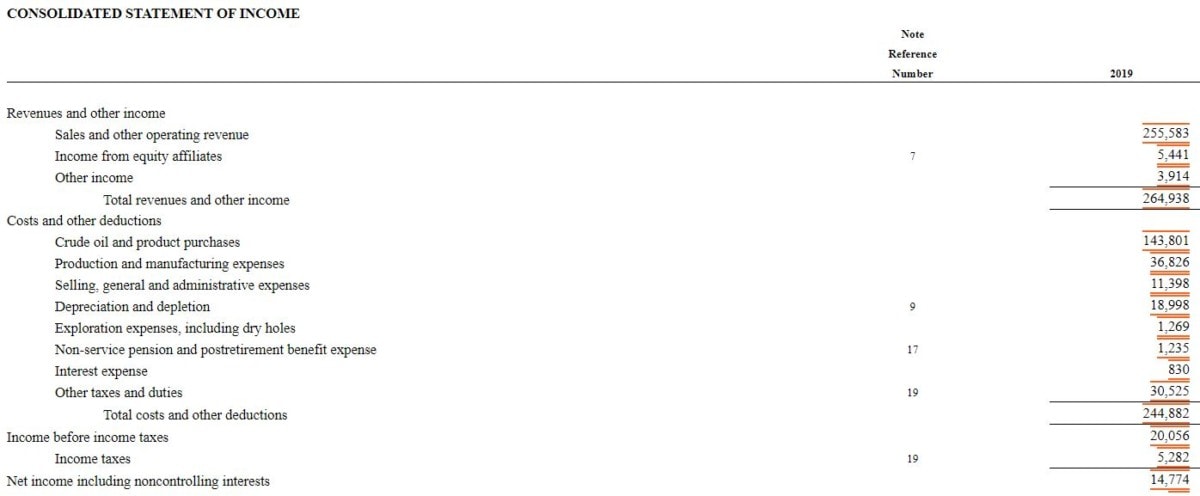

Let’s look at a real-life example of the cost of debt financing. The example company is Exxon Mobil Corporation (XOM).

Credit: sec.gov

As you can see, Exxon paid $830 million in Interest expense in 2019. This represents 1.77% of the total debt ($46,920 million) on their balance sheet for the same year (Notes and loans payable $20,578 + Long-term debt $26,342).

Had Exxon not been obligated to pay this Interest expense, their Income before income taxes would have been $20,886 million ($20,056 million + $830 million). Using the same tax rate (Income taxes ÷ Income before income taxes) of 26.3%, their Income taxes without the interest deduction would have been $5,501 million. An increase of $219 million.

This “interest tax shield” makes their net cost of debt financing a paltry 1.30% (($830 million – $219 million) ÷ $46,920 million).

Which is the cheapest source of financing?

Debt seems negative because of the long-term fixed costs it imposes on a company. However, if the company uses its debt financing wisely, it should earn an ROI that significantly eclipses those increased fixed costs.

If the company can’t do that, then it might not be much of a “growth company.” Therefore, not appropriate for investment – if that’s the type of company you’re looking for.