You know that some tech stocks are a good investment. Not only do they greatly increase in value over time – they turn out to be well-run companies with great business models and strong financials.

However…you also know that it’s the winners that get all of the attention. There are some turds in the punch bowl of tech stock history that everyone likes to pretend never existed.

I can’t tell you what bellwether tech companies will continue to grow in the future. I also can’t tell you which up-and-comers will be part of the next acronym (e.g. FAANG).

You’re Curious About Investing in Tech Stocks? Pros & Cons

If you’re wondering if tech stocks are a good investment, think about the following:

- Has every overhyped tech company with a fancy new gadget/service gone on to be successful?

- Is every overhyped tech genius cut out to manage a large company?

- Why not avoid the technology sector altogether and focus on old-school blue-chip stocks?

- What is distinct about the tech stocks that have been successful?

- How have tech stocks performed once their founders have moved on?

What I can do, is take a quick trip down memory lane to look at some old recommendations from talking heads. I can lay out the case they made for these tech companies in the past. Then, you can decide whether you would have invested or not.

With the benefit of hindsight, we can see how well your judgment would have paid off.

In order to do this analysis, I’m going to pick a random year between 2008 and 2018. Then I’m going to search Google up to that time period with the term “tech stocks to buy”. Next, I’ll pick a random search result and a random stock from the list of recommendations.

With that info, I’ll do a little high-level analysis of the anonymous company so that you can decide if it looked appealing when it was recommended. Finally, I’ll reveal what the stock was and how it performed between when it was recommended and now (September of 2021).

Let’s get into it…

Oct 7, 2010 – Nasdaq.com – “8 Tech Penny Stocks to Buy Now”

Company overview:

Develops and manufactures chemical and radiation detection monitors, plus wireless networks for five markets.

- Oil and gas

- Hazardous materials

- Industrial safety

- Civil defense

- Environmental remediation.

Ran by its founder.

Finding the Best Stocks | Impact of Management & Employees

Risk factors include:

- Possible violations of the Foreign Corrupt Practices Act

- Unpredictable future revenues and fluctuating operating results

- May require additional capital

- The market for gas and radiation monitoring is highly competitive

Stock does not (plan) to pay dividends.

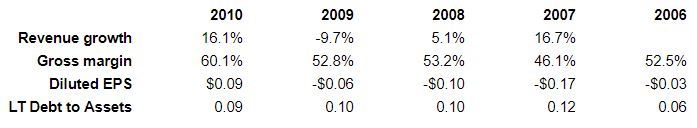

Some selected financial data:

In the 4th quarter of 2010, this stock traded between $1.55 and $1.66.

Here’s what the recommender, Louis Navellier, had to say about this company:

He liked the recent advance in stock price (September 2010) and its year-to-date performance. He presumable thought there was a positive trend to ride.

Combining Technical & Fundamental Analysis | Is It Feasible?

He also liked the company’s revenue growth.

Curiously, Louis also cited that it had recently been announced that this company would be acquired. That’s curious because, in my experience, once an acquisition has been announced, the stock seems to trade at or around the announced acquisition price. It could be that he thought that shareholders would reject this offer and a better one would come along?

What was the company?

.

.

.

RAE Systems (RAE)

Louis had pretty good intuition, it turns out.

The referenced acquisition fell through when a better offer came along. On Jan 18, 2011, it was announced that RAE would be acquired by Vector Capital for $1.75 per share (approximately $104 million, based on FY10 shares outstanding). Source.

I can’t find historical pricing for RAE on Oct 7, 2010. Using the trading range given on the 10-K, we can assume that shareholders realized a return between 5.5% and 13.0%. Not bad for six months or so.

FYI, Honeywell (HON) then acquired RAE Systems for $340 million a little over two years later.

Link to the original recommendation.

May 17, 2000 – Money.CNN.com – “The 25 Best Tech Stocks”

Company overview:

This company is a provider of silicon parts for broadband digital transmission of voice, video, and data.

Risks include:

- Fluctuating revenue

- Few significant customers

- Acquisition strategy may require the issuance of additional shares

How To Grade Risk Management Strategies for Your Stocks

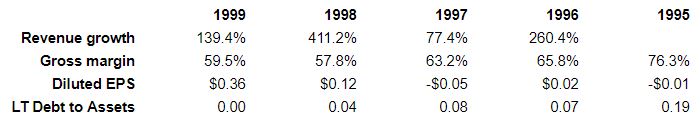

Here’s a glance at some financial data:

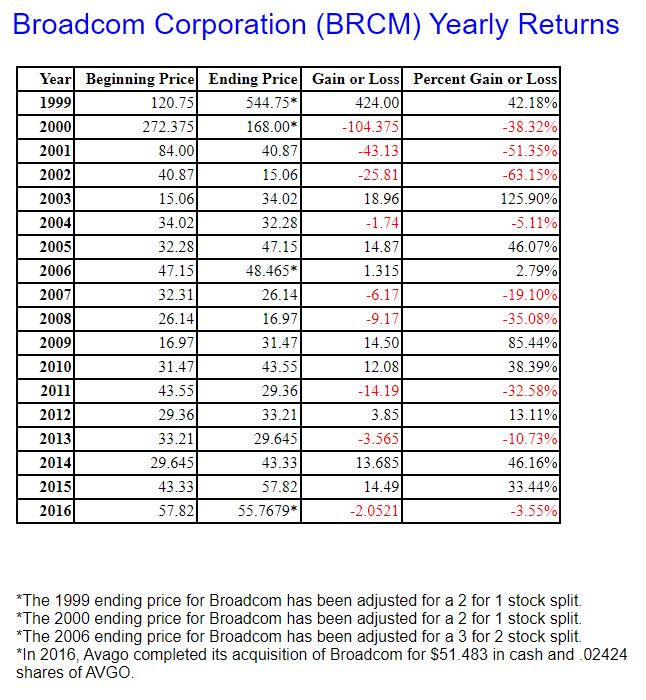

Reliable info is hard to find, but it looks like this stock traded between $168.00 and $272.38 per share in the year 2000. I don’t know what it traded for in May of that year. But, for simplicity, let’s average that range and say you could have purchased this stock for $220.19.

According to my source, this price is not split-adjusted (2:1 in February of that year). Additionally, there was a 3:2 split in 2006. So, if my math’s right, your adjusted purchase price would have been approximately $73.40. Source.

The recommender, Garrett Van Wagoner, said that this stock would benefit “from the blossoming market for broadband communications.”

What was the company?

.

.

.

Broadcom (BRCM)

At a purchase price of $73.40, you would have to be very patient According to my source above, BRCM didn’t ever exceed that price again.

In 2016, BRCM was acquired by Avago (AVGO), which is the current Broadcom ticker symbol. The acquisition price was $51.483 in cash and .02424 shares of AVGO. The AVGO shares are currently worth $12.23 ($504.92 × .02424). So, your BRCM shares can be assumed to be worth $63.71 ($51.48 + $12.23) now.

21+ years later and you still wouldn’t have broken even. Even after investing in a successful and healthy technology company. That’s what you get for investing on the backside of the dot com bubble.

Link to the original recommendation.

Anecdotal examples

The point of this post is not to pick on these particular writers. We’ve all made good and bad judgments over the years.

The point of this post was to take a random look back at tech stock history to see how a couple of recommended stocks performed over time. Only looking at two stocks doesn’t settle the issue as to whether or not tech stocks are a good investment. Hopefully, though, it goes to show that not all stocks perform as well as the FAANG media darlings.

FAANG stocks aren’t the only ones that have delivered exceptional returns either. I would have liked to expand this analysis further. But, the reality is, Google will probably bury this post in the search results and it just doesn’t make sense to commit too much time to something five or so people are going to see every month. Digging up information on old, delisted stocks is somewhat time-consuming.

All that being said, take from this what you will. But, personally, I think it illustrates that not all tech stocks make good investments in the long run. Even those that are otherwise well run and financially sound.