This is a post from my now-defunct paid newsletter. It was published on November 9, 2021. In it, I reviewed the performance of stock picks made by Motley Fool and offered some other potential opportunities that are similar to their best-performing stock picks.

Article information

Published July 24, 2020, by Sean Williams

Link: Got $10,000? Here Are 4 Unstoppable Stocks to Buy Now

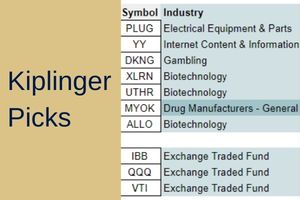

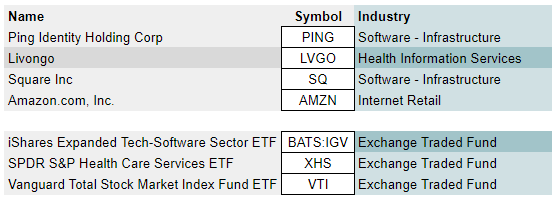

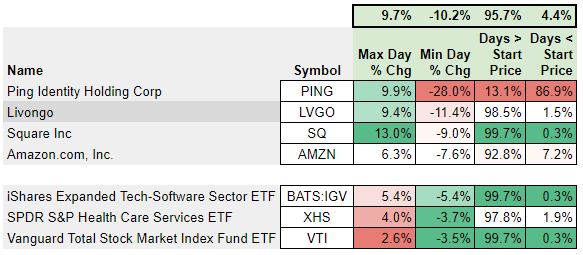

Portfolio & benchmark components

This article lists a total of 4 stocks. In the year-plus since these stocks were recommended, one of them is no longer traded due to merger.

- Livongo (LVGO) merged with Teladoc Health (TDOC) on 10/29/20 – three months after the recommendation. LVGO shareholders received .592 shares of TDOC and $11.33 in total cash. Source.

- It will be assumed, in this analysis, that LVGO shares, at the conclusion of their trading, were valued near the total of TDOC stock and cash expected. For simplicity’s sake, LVGO 10/29/20 close price will be used as the End Price. No dividend will be included.

The exchange (BATS) had to be included with the symbol for IGV in order for Google Finance to pull the correct information.

These stocks are not terribly diverse. All could be considered from the technology sector. Though, LVGO could also be classified as healthcare. Two are from the same industry – PING and SQ.

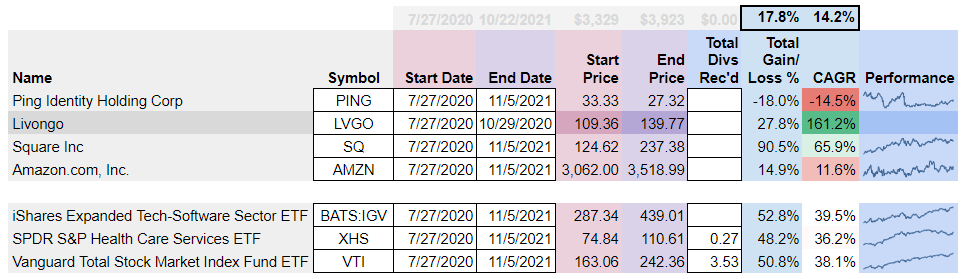

Portfolio & benchmark performance

Dividends will not play a huge part in this analysis.

None of the recommended stocks paid a dividend. Not unusual for those in the technology sector. Likewise, the tech-software ETF, IGV, did not pay a dividend either.

Even the healthcare ETF, XHS, only paid a paltry dividend.

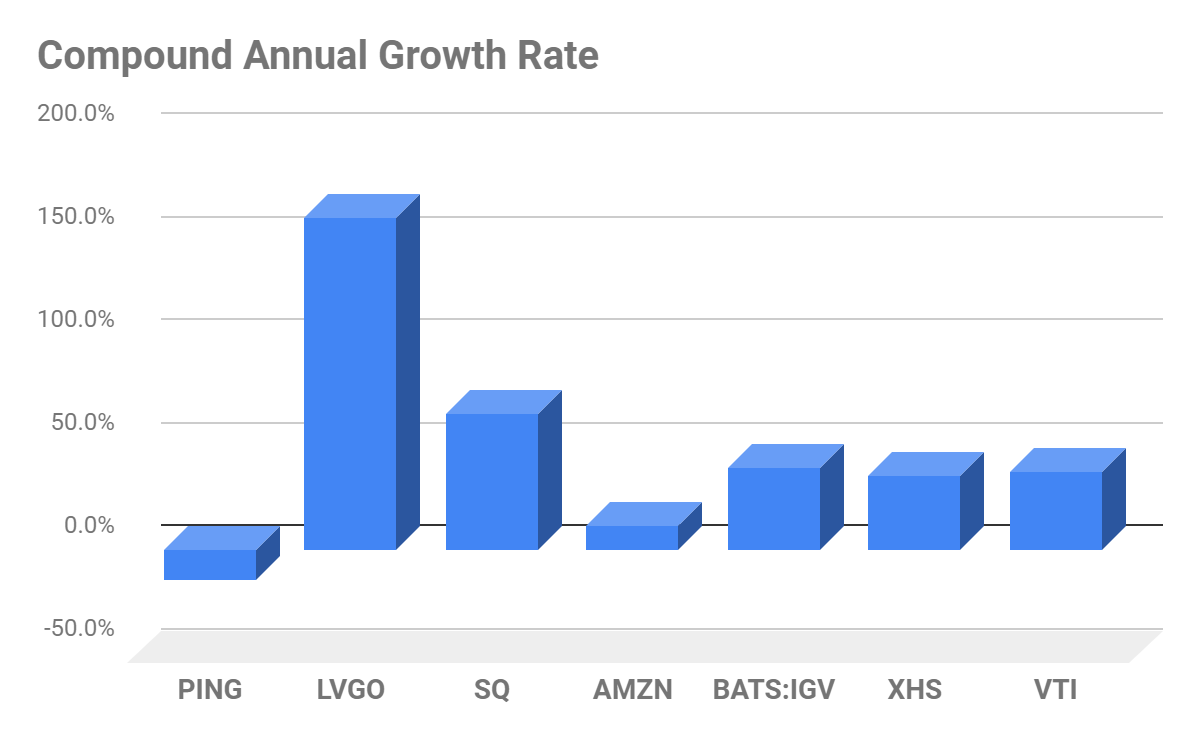

Though the number of stocks recommended were few, there were still a couple of high-performers.

LVGO’s performance is, in part, credited to:

- Demand for telehealth services during the Covid-19 pandemic

- The merger with Teledoc Health

SQ’s performance is, in part, credited to:

- Increased use of its Cash App

- Gross profit increase of 91% year over year

As is not unusual, the company that participated in a merger provided some of the largest returns. Shares that could be redeemed for 27.8% more, three months after recommendation, provided a handsome CAGR of 161.2%.

While AMZN didn’t perform as well as might have been expected – PING was the obvious dud. PING’s poor performance was credited to:

- Missing revenue estimates

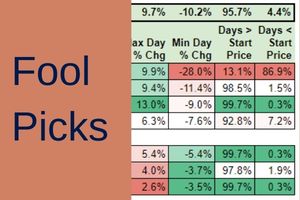

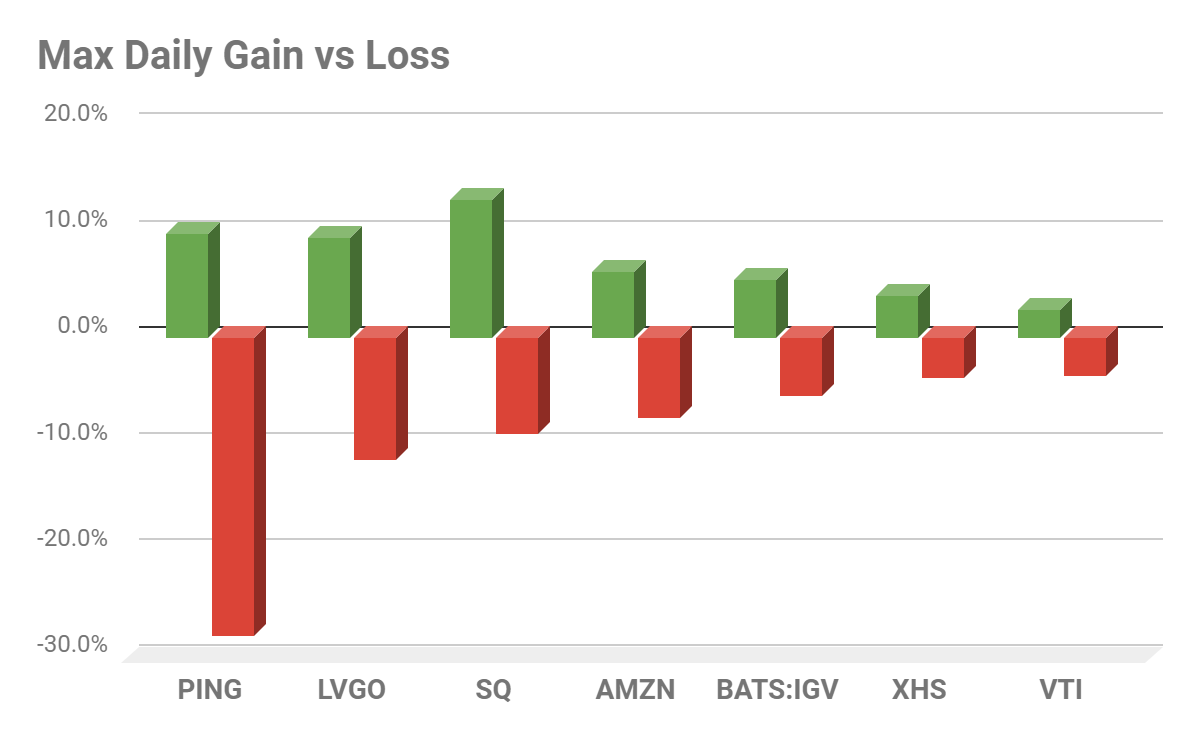

Portfolio & benchmark volatility

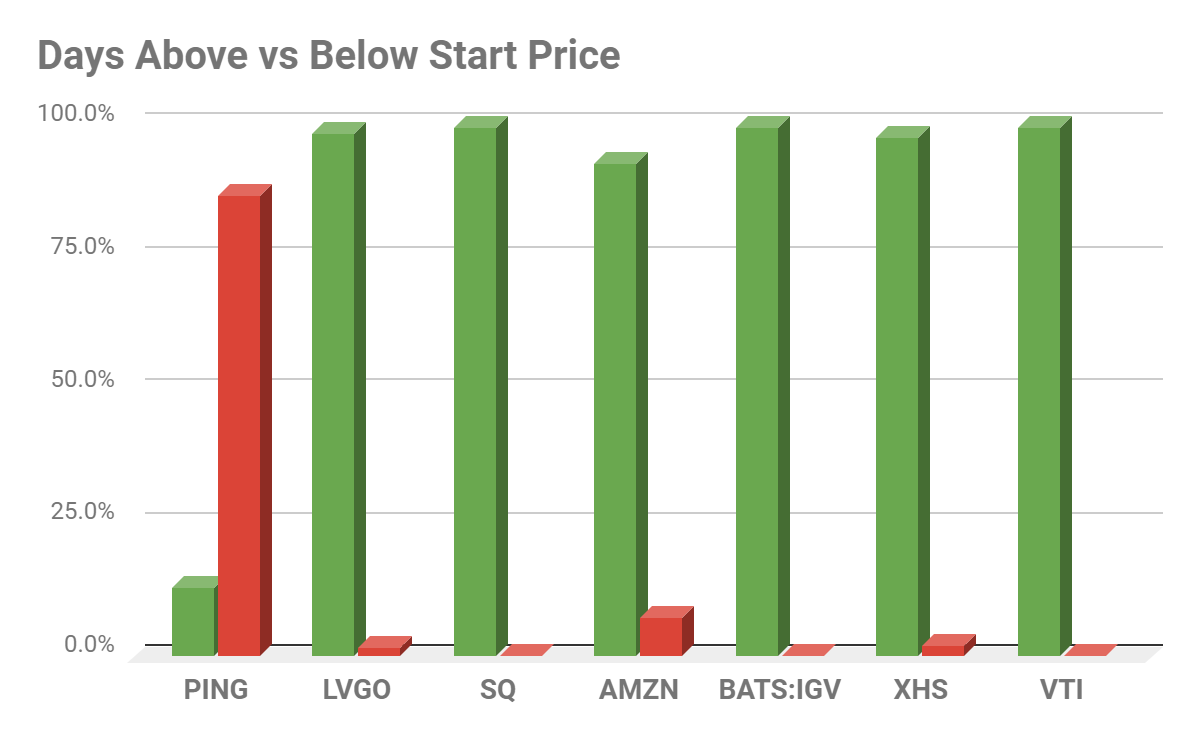

All recommended stocks, except PING enjoyed well over 90% of their days above the Start Price. In fact, had you invested in SQ on 7/27/20, you would have almost never had a day in the red.

The benchmark ETFs also enjoyed well over 90% of their days above the Start Price.

PING went the opposite direction. It has spent the vast majority of its time in negative territory since 7/27/20. It also had, by far, the biggest one-day decline of all the stocks: a 28.0% loss.

SQ was the only stock to have a bigger one-day move to the upside than its biggest move to the downside (+13.0% vs -9.0%). The sector/industry-specific benchmark ETFs were able to match this feat, while VTI was not.

Portfolio & benchmark visualization

Current opportunities

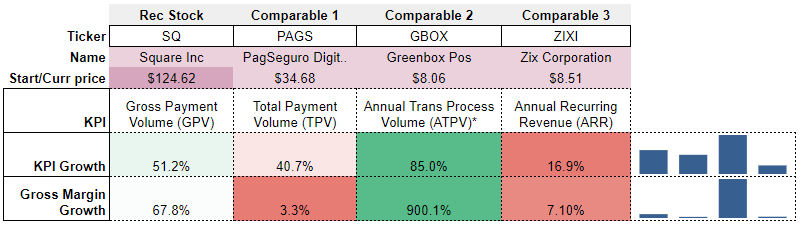

Similar to SQ

**GBOX ATPV forecasted

Admittedly, Fool.com did not offer much in the way of quantifiable metrics to base its SQ recommendation on. So, assumptions had to be made. I selected two metrics that I thought Fool.com was hinting toward – KPIs and Gross Margin Growth.

Among companies in the Software – Infrastructure industry, only GBOX seems to compare favorably. At least among the selected metrics. Their KPI Growth, if achieved, will be well above SQ’s. Additionally, their Gross Margin Growth, as reported on their latest SEC filing, was astronomical.

Others have praised GBOX moving from being traded OTC to the Nasdaq and its exceeding payment processing volume forecasts. Source.

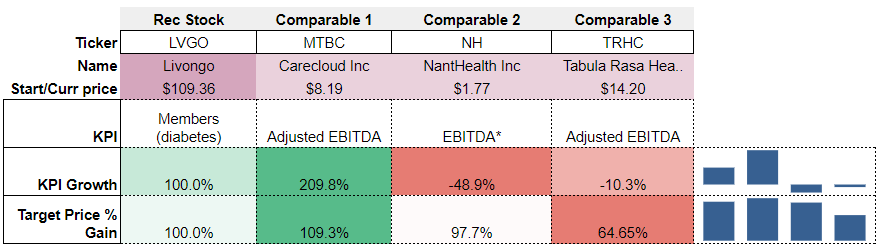

Similar to LVGO

**No KPI named

Again, Fool.com did not offer much in the way of easily quantifiable metrics. So, again, assumptions had to be made. In this case, KPIs were also chosen, as were Target Price % Gains.

Based on these metrics, only one other stock stands out. That stock is MTBC. MTBC has nearly the same Target Price % Gain as LVGO and a considerably higher KPI Growth.

Others have acknowledged MTBC’s appeal as an acquisition target. Source.

**To learn more about each section of this newsletter, please read the About Talking Head Stock Pick Review post.

Disclaimers

All of this information in this newsletter is assumed to be correct and accurate as of the date of writing. No guarantee is made regarding accuracy, however. Readers are encouraged to double-check data and to do their own research.

Nothing in this newsletter should be constituted as investment advice. This newsletter is provided for informational purposes only.

Current opportunities disclaimers

Current opportunities represent stocks that have qualities that approximate those listed for the best-performing stocks in the article. When possible, they are also from the same industry/sector.

Only the attributes mentioned in the article are researched. No other qualification is provided as to the worthiness of investment. A multitude of factors influence a stock’s investment performance. Readers are encouraged to do their own due diligence if there is a current opportunity that they are interested in.

Current opportunities are merely offered as a starting point for further research. Absolutely no assurance is given regarding the performance of any stock or other investment.