When it comes to the wondrous world of stocks and investments, there are a lot of different aspects that we need to learn before we can actually start putting our life savings into the market, to make sure that we don’t end up losing everything we own.

In order to maximize our chances of actually making a profit during our first couple of years in the industry, what we need to do is to do our research thoroughly, no matter how boring or uninteresting it may seem.

There are a lot of different assets you could invest in, including stocks, ETFs, mutual funds, crypto and other securities, and in this article we want to help you understand the market a little bit better, so let’s take a second and properly discuss a key term in the industry: ETFs. What is an ETF you may ask?

ETFs are essentially exchange-traded funds which can be defined as a type of pooled investment security for your purchases. ETFs are known for being able to track a particular index, sector, commodity or almost any other assets that you could think of out there.

While this may sound similar to mutual funds, you need to remember the fact that ETFs can still be purchased and sold off on a stock exchange, while mutual funds are restricted in that case.

To show you how ETFs work today we’ll take a closer look at two of the most popular ETFs right now. We are talking about none other than QQQ and SPY, two of the largest and most popular exchange-traded funds you could invest in.

What is the Difference Between SPY and QQQ?

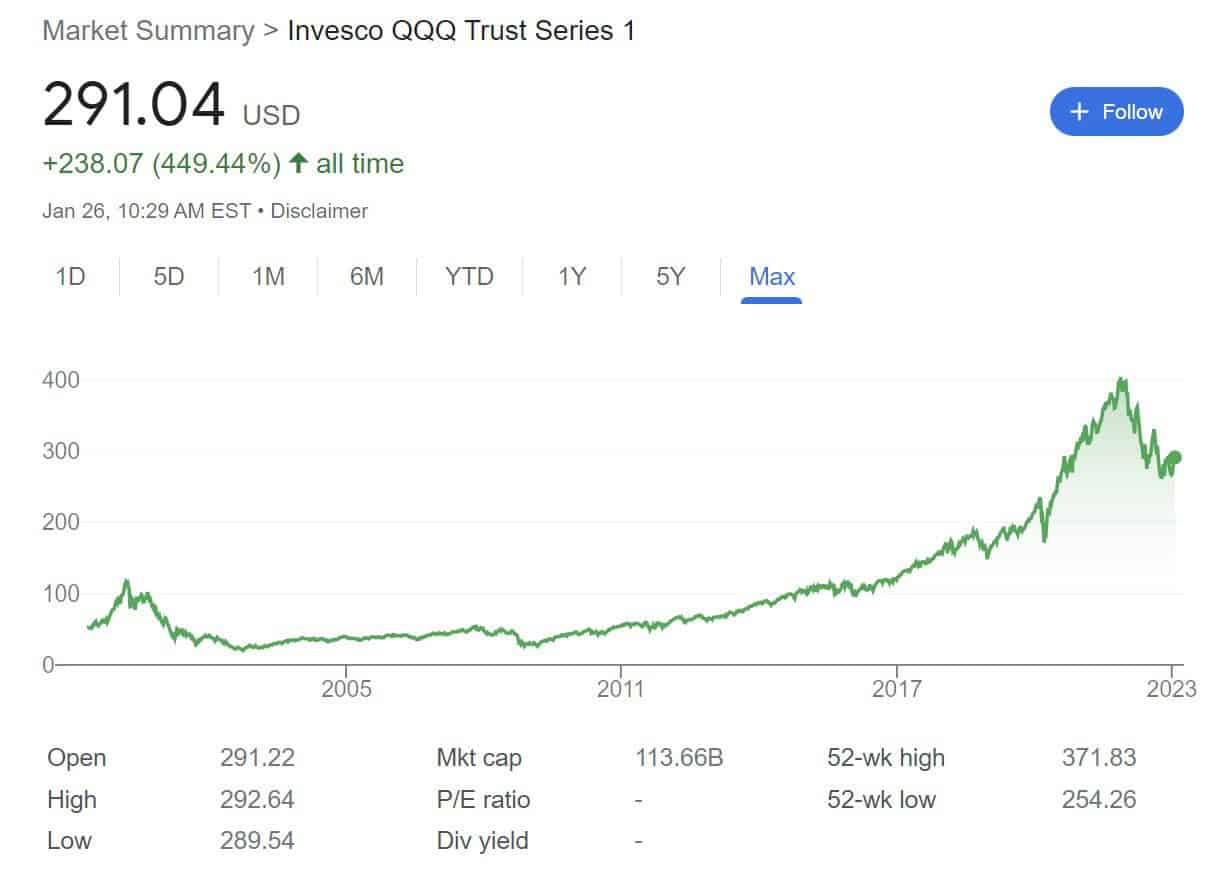

First off, Invesco QQQ is one of the best performing ETFs on the market at the moment, and that’s saying a lot considering how many contenders there are out there for that title. Just look at Vanguard’s VOO and VTI.

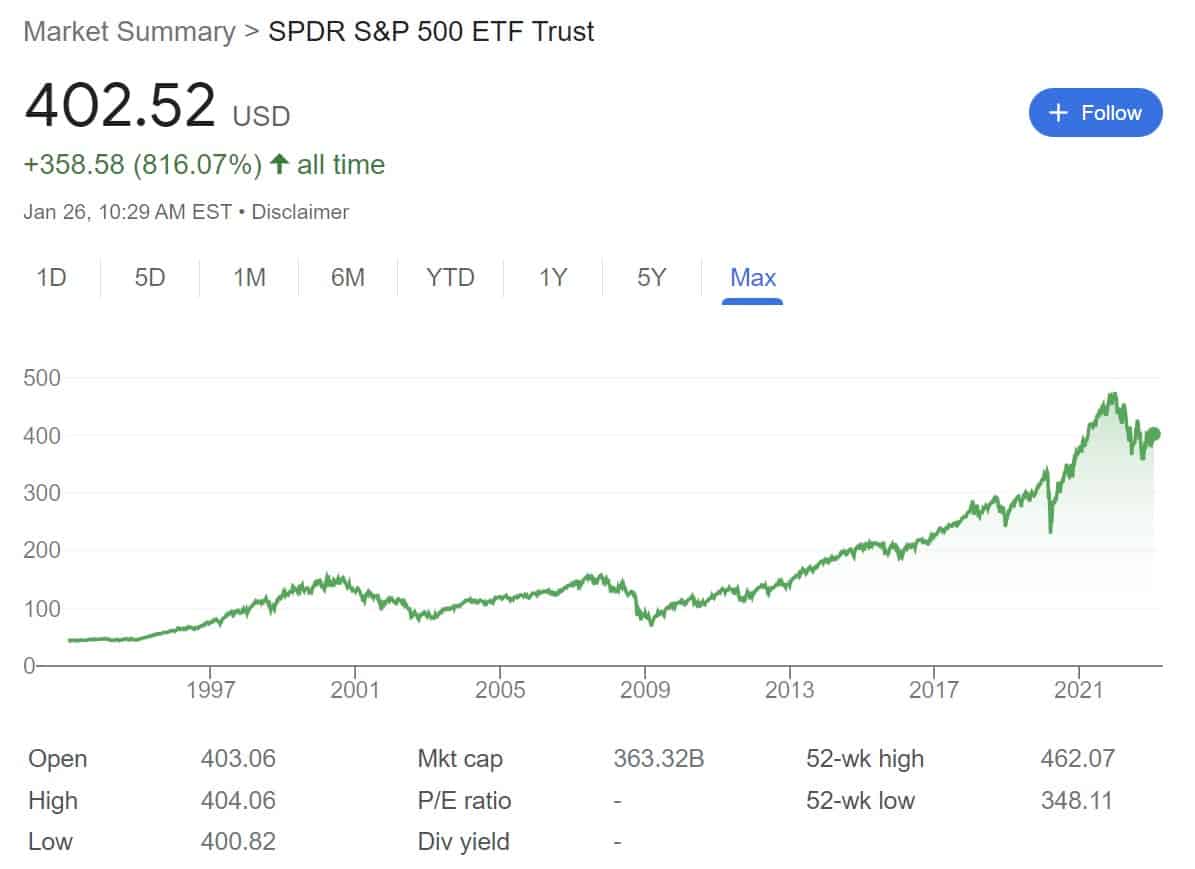

Meanwhile, SPY was actually the first ETF out there and despite the fact that it’s been around for so long, it’s still going strong, being one of the most popular options on the market as well.

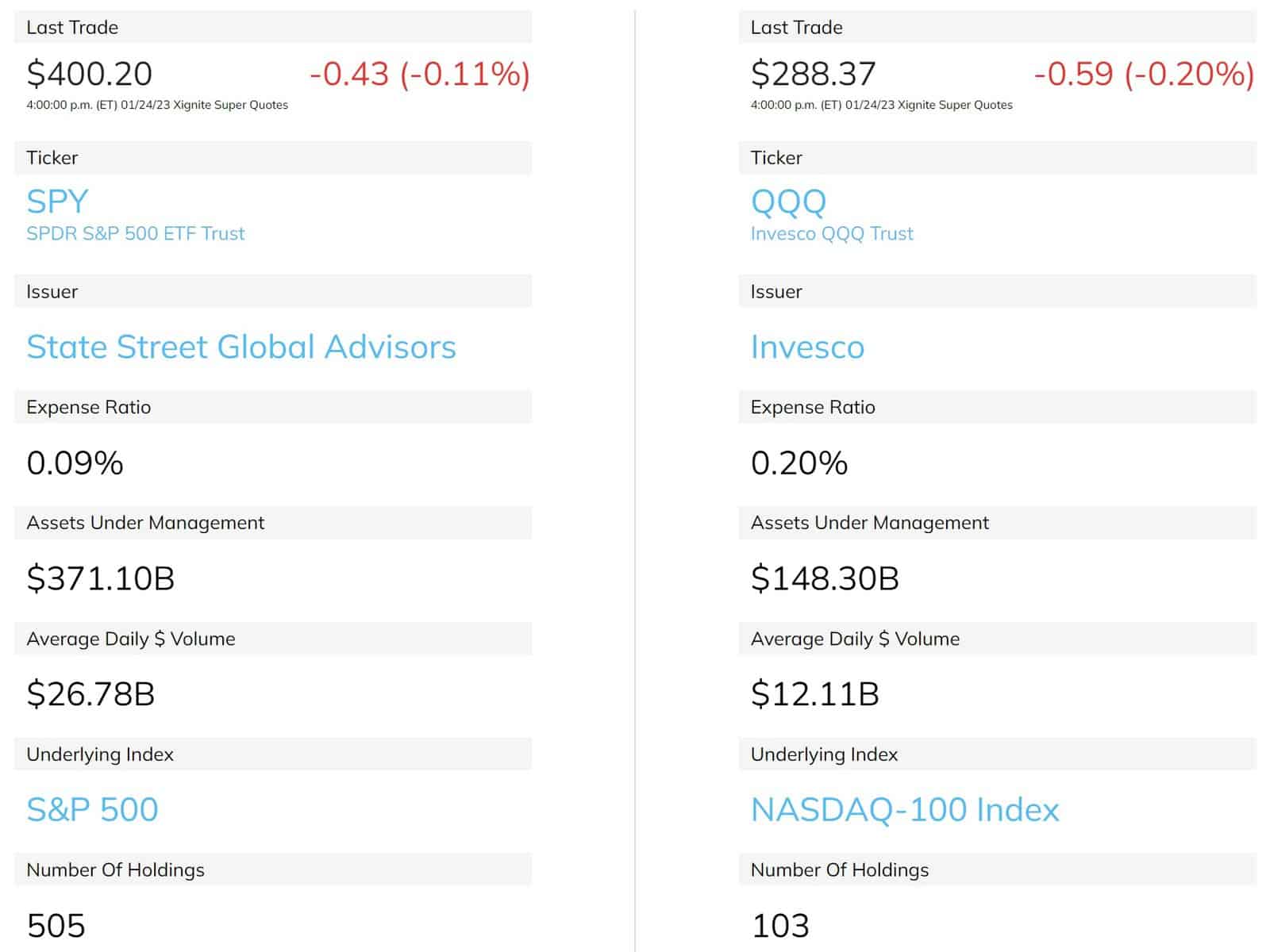

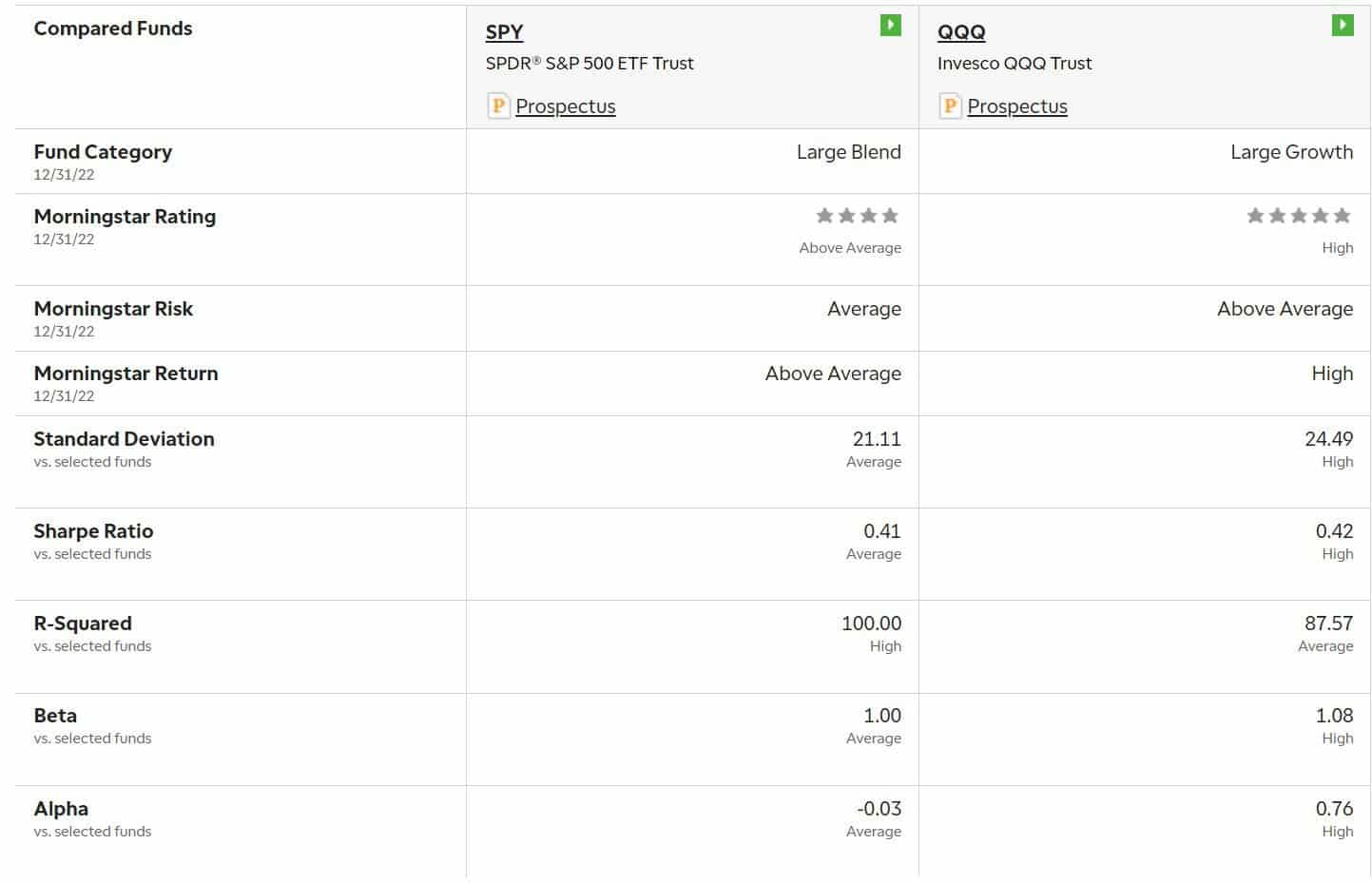

As of today, QQQ holds over $148 billion in assets and it holds over a dividend yield of around 0.74%. SPY on the other hand tracks the S&P 500 index and it holds over $371 billion in assets. As far as its dividend yield goes, it holds around 1.58%.

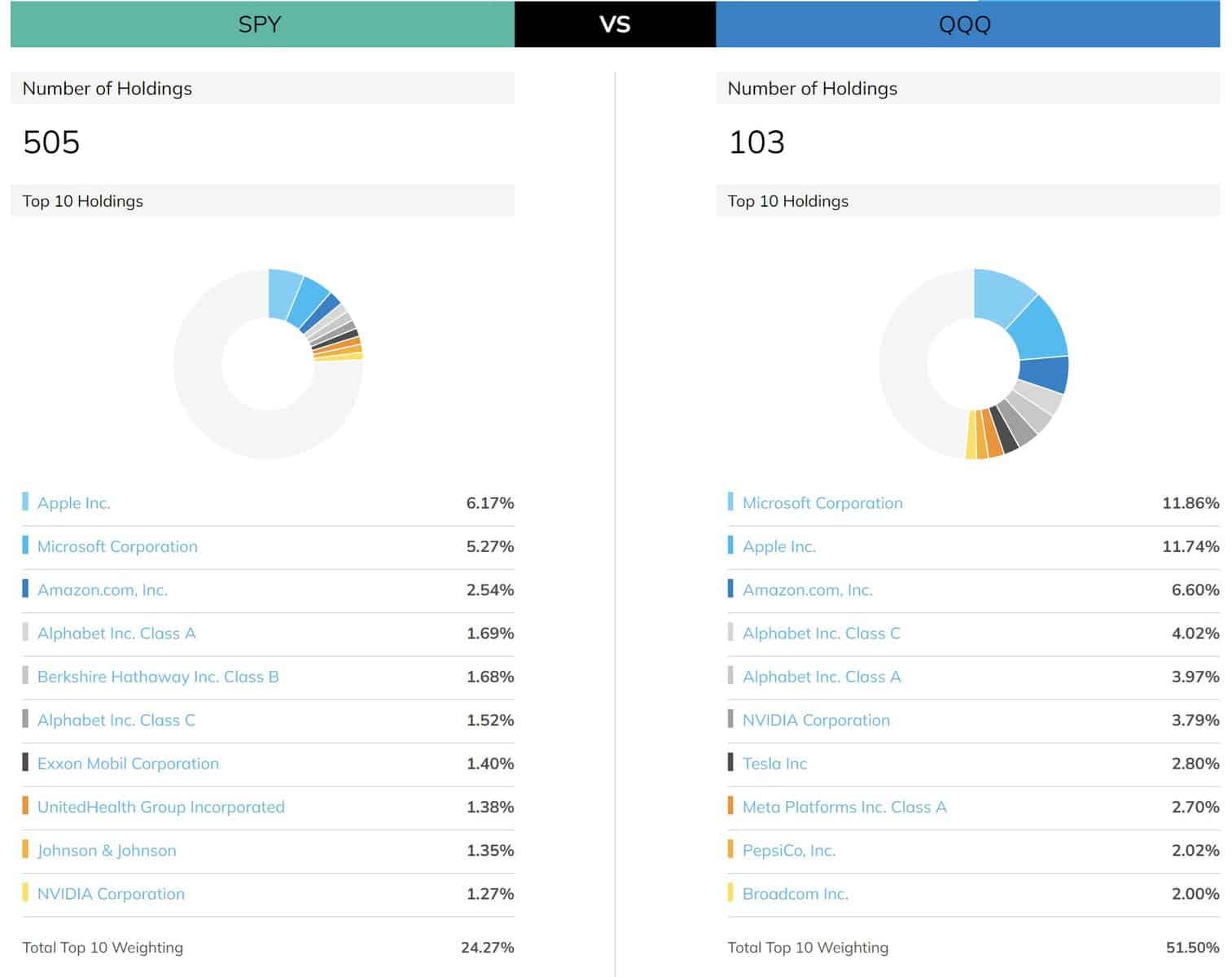

Another massive difference between the two stems from the fact that the QQQ actually holds stock mostly from the big tech companies in the United States including Apple, Microsoft and Google.

So, the reason as to why the SPY fund has more money in assets is the fact that it actually is a lot more diverse and it particularly holds a lot of stock over different sectors including finance, energy and of course, consumer discretionary.

Even so, year after year, a common misconception that goes around a lot is the fact that people believe that since the SPY ETF holds over more money in assets, that this somehow translates into that fund outperforming QQQ.

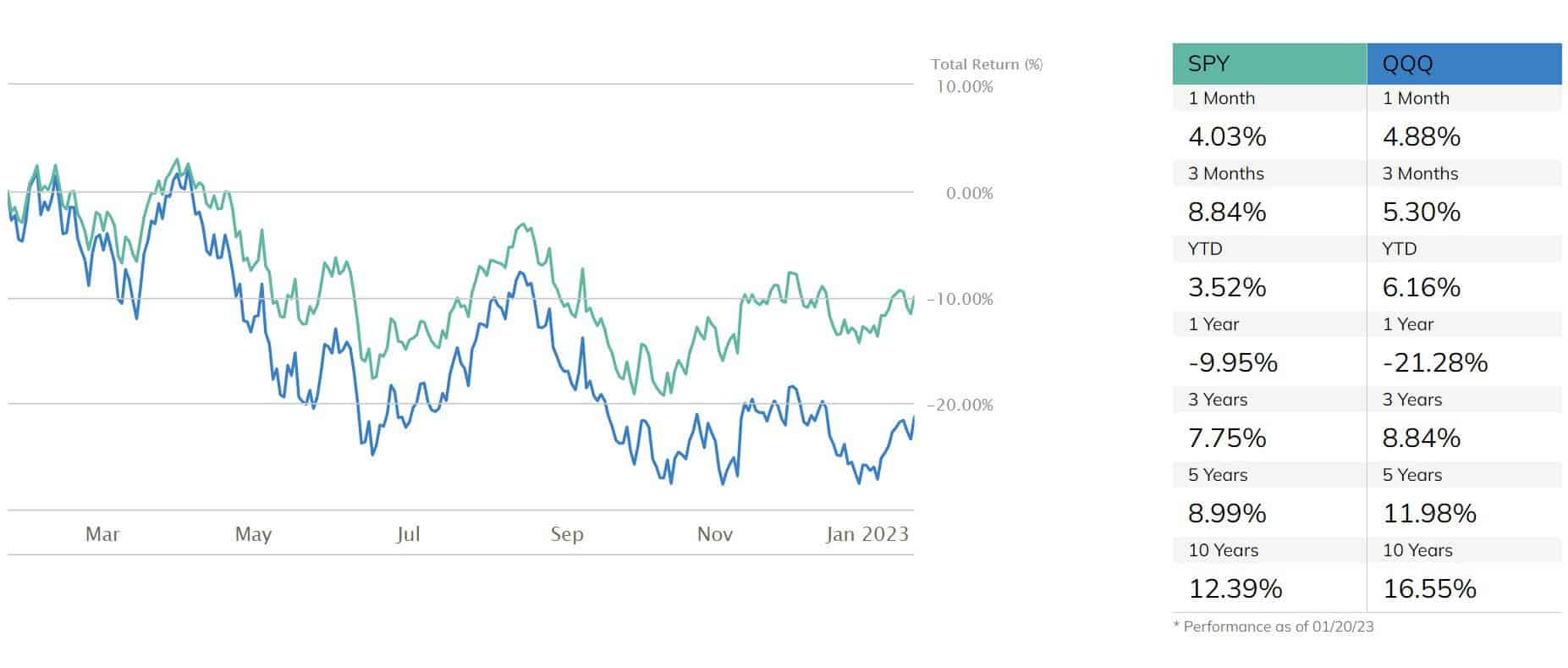

This is inherently wrong especially when considering the fact that for the most part, QQQ has vastly outperformed the SPY fund simply in that tech firms never run out of supplies when it comes to their craft, these industry titans can always improve and break record sales and this gives them a massive advantage.

Take for example Microsoft and their continuous rise over the years, let’s just say that regardless of what times we live in, Microsoft will always make it to the end of the finish line without a single 0 being dropped.

At the same time, we need to bring up the fact that QQQ is able to outperform SPY ETF simply thanks to the fact that the stocks in this fund are a lot cheaper than the stocks in SPY.

Take for example Apple, one of the leaders in the tech world, its stock price has actually dropped by around 10% in the past year, but the whole market went down a lot more in the same period so you could say Apple is a winner even in a market pullback.

In fact, QQQ has managed to continuously surpass the SPY S&P 500 stocks for over 10 years now in a row, being able to provide the masses with an annual return average of 20.27% as opposed to the 14.26% that SPY has in store for us.

What Exactly is QQQ?

We mentioned previously how QQQ is one of the most popular funds in the world, but what we have yet to properly convey is the fact that it was actually made to specifically track the NASDAQ 100 Index.

In case you didn’t know what the NASDAQ 100 Index is, the term actually refers to the 100 largest companies that are currently traded on the NASDAQ exchange.

Despite the fact that there are 100 of them in this list, the top names that are responsible for over 1/3 of QQQ are none other than Apple, Microsoft, Amazon and Google.

So, it’s no wonder that people also refer to QQQ as the tech fund considering the fact that most of their market by weight is held over by these tech giants.

QQQ was actually launched way back in 1999 and as far as we know, it holds over an average daily volume of around $12 billion.

On top of all of that, QQQ also has a 3x leveraged cousin TQQQ and a much more affordable brother known as QQQM.

What is SPY?

All things considered, SPY was and is always going to be referred to as the original ETF, and even though it underperformed a little in comparison to QQQ, the fact of the matter is that it still remains one of the top stock funds out there and continues to rise with every passing day.

In case you didn’t know by now, SPY actually came into being around 1993. It actually covers the S&P 500 Index and to be fair, it is by far the most successful at its job.

As you can already tell from the name alone, SPY covers 500 of the top companies in the United States, a considerably higher amount than the 100 that QQQ covers.

Nowadays, SPY is actually one of the main representatives of the US large cap stocks, and it is still considered to be the official barometer of the US stock market.

Another great example of a similar stock fund is VOO from Vanguard. This is considered to be a much more affordable option for those that are looking to invest into the S&P 500 Index, with VOO costing only 0.03% as opposed to SPY which costs 0.09%.

Why QQQ Overpowered SPY?

We mentioned previously that QQQ is actually a more successful than SPY today and we did mention a few reasons behind this. One of them is the fact that big tech companies have been better investments in this past decade and on top of that they are also known to be a lot more affordable on the long run.

There is also another main reason behind the sudden rise of QQQ and most importantly, behind the crazy amount of support that it’s been getting over the last decade or so, and that is what we would like to refer to as the investor herd mentality.

Believe it or not though, but some investors are actually nowhere near as intelligent as you may think. We like to believe that the people that bet their lives on simple equations and predictions are on a higher scale than the ordinary farmers, but the truth is actually quite the opposite.

Nowadays, everyone can become an investor, and we do mean that. As long as you have a few hundred dollars in your bank account you can invest them and start making a profit (or not) in no time from this seemingly miniscule amount of money.

But the problem that comes with this is of course, the fact that nobody wishes to take the downfall, so everyone’s following in on the footsteps of those that made it, essentially leaving behind their individuality and just doing what everyone else is doing.

This affects both the newcomer investors and the experienced ones as well, and since QQQ has proven to be a very safe option to put your money into, it’s no wonder that masses of people continue to pile up their money in hopes of making an even bigger profit by the end of the day.

This is a very big problem especially when we come to the realization that QQQ, although very viable, is still not the most well-diversified fund out there, quite the contrary actually. Because of this it could never replace the S&P 500 portfolio.

It is a very profitable stock option, we understand that, but by discarding the many advantages that SPY has to offer we are limiting ourselves to only 100 companies, which is not what we want from our country to say the least.

So, this is actually the main reason as to why QQQ has vastly overpowered SPY over the years. To put it in simpler terms, while QQQ is a concentrated bowl full of the 100 top tech companies out there, SPY offers you a full course meal full of 500 different options from different sectors altogether.

The most interesting part about that statement is the fact that QQQ actually had one of the worst starts in the stock fund’s history and that is all thanks to the Dotcom crash.

When we do adjust the risk-return to the current norms however, we can still see the fact that SPY has surpassed QQQ, but this is harder to notice and for the newcomer investor that is looking for a quick way to make an easy buck, the numbers seem to point in the other direction altogether.

Value Stocks vs Growth Stocks

The next big chapter that we would like to cover is related to none other than value stocks and how they changed the way that investors looked at stock funds.

In case you weren’t aware of this by now, value stocks are those companies that are currently trading below what they are really worth and might provide a superior return than growth stocks in the long run.

Most of the big tech stocks have been growth stocks, and while they can outperform the market based on their future potential, you’re always safer with value stocks, especially when we consider the risk factor premium involved.

This is why we recommend you to think twice before you invest into QQQ because in doing so you won’t actually own any Value stocks.

QQQ is a purely large cap growth stocks, and since everything that is now contained into their basket is pretty expensive, let’s just say that the expected returns coming from these investments are a lot smaller than any of us would like them to be.

Value and Growth are very hard concepts to spot in the wild, especially considering the fact that both have reached numbers that we would have never considered to be possible in the past.

With all of that out of the way though, we do need to remind you that just because something is on a constant Growth, that doesn’t mean that it will continue to rise from this moment onwards as well.

Sure, tech may be the future but as far as stock market returns go, there is no real difference between investing in tech and investing in food suppliers.

Everyone is now expecting the numbers to go up, and everyone is dreadfully unprepared in case these numbers don’t come to fruition as they had hoped them to do.

If something happens, and we’re not trying to instill fear into you with this statement, but if something does end up happening you will end up losing a lot more than you’re ready to lose and that’s a fact.

Market timing is very difficult to discern and while a lot of popular investors out there may tell you otherwise, we believe that putting all of your eggs in one basket is the last thing you will want to do with your career.

Sure, these big names may be right and we may get to see the interest rates skyrocket yet again to a new all-time high.

We don’t know any of that yet, but what we do know is that QQQ has proven to have inherently higher interest rate risks than SPY, and while that may not sit well with everybody, remember to keep in mind the fact that these are all assumptions and predictions, and neither are a hundred percent accurate.

Conclusion

So, what can we really take out of this article? What is the real difference between SPY and QQQ? At the end of the day, the difference is what we take from them and what really catches our eye regarding their rates.

If you’re looking for a quick way to make a buck, upon firsthand inspection it would appear as though QQQ is the better option for you. But, while this may be true, it is also coming from a very limited point of view.

SPY has been around for far longer than QQQ, and there is a reason as to why it is actually considered to be one of the main representatives of the US large cap stocks and also why despite the massive profits that came from QQQ investing over the years, SPY continues to hold the bar up above its competition’s paygrade.

At the same time however, we are not trying to deter everyone from investing into QQQ, as it is still a very viable choice to put your money into. But just keep in mind that while QQQ pulls most of its weight from the tech market, SPY also offers a tech niche that you can take full advantage of.

So, regardless of which option you are willing to go with, you can still end up on the right side of history making a profit as long as you play your cards right. Keep your head up in case something goes awry, and always have a backup plan in case things don’t work out for you.