In case you haven’t been keeping up with the wondrous world of stocks and potential investments, there are currently two extremely popular stock market index ETFs which are pretty much ruling the system as far as we know.

We are talking about the Vanguard S&P 500 ETF (VOO) and of course, its main “rival” on the open market, the Vanguard Total Stock Market ETF (VTI).

Today we will attempt to showcase which are the main differences and similarities between these two ETFs. Regardless of whether you’re a long-time investor with a lot of experience in the field or if you just decided to try your luck in this strange new medium, you’re going to want to look into these two as they could easily maximize your profits if you pay close attention.

But just in case you’re new to both VOO and VTI, let’s discuss what each of them has to offer before we actually go any further. So, without further ado, let’s start off with our first question of the day:

What are VOO and VTI?

As we mentioned previously, these two are the most popular U.S. stock market ETFs that you will find, and at the same time they are both from Vanguard. Stocks have always been considered to be one of the biggest drivers of portfolio returns and index funds are a sure-fire way to get immediate, broad diversification through asset classes.

Why is this important to know? Because since they are both from Vanguard, they also offer the lowest fees you can possibly get and on top of that, they have a very solid track record which makes them a very safe investment on the long run.

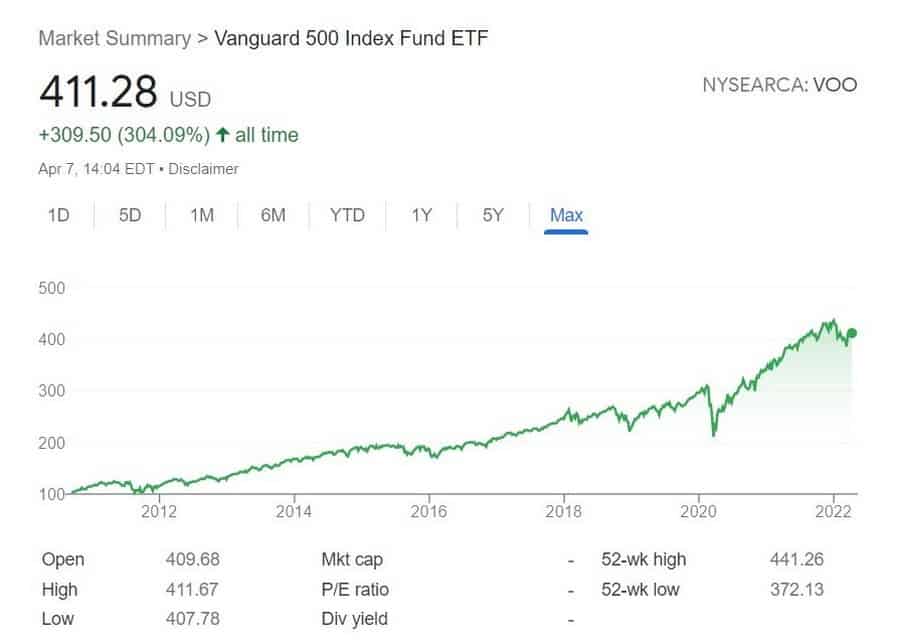

VOO was originally established back in 2010, and almost right off the bat it became one of the top ETFs in the world. It mainly seeks to track the S&P 500 Index which currently holds the top 500 largest US companies. Using this index we can calculate the current market in the US, which is why it is such an important tool to take advantage of.

VTI on the other hand is actually very similar to VOO in that it offers a similar exposure of the US stock market, although the main difference between the two is the key that really separates the investors amongst themselves.

Essentially, VTI also offers a direct showcase of the small- and mid-caps in the US stock market. It is also believed to be more reliable simply because it has been around since 2001, which is why so many more investors have put their hard-earned money into it.

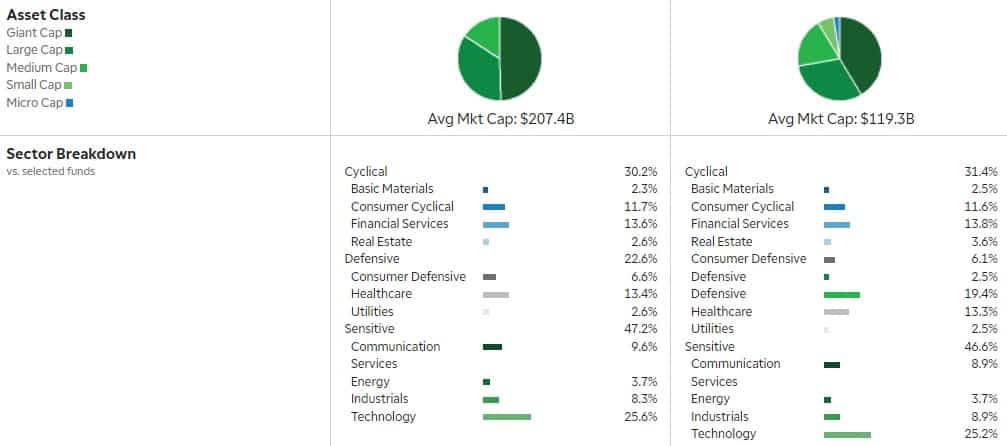

This fund actually directly tracks the CRSP US Total Market Index, and while the VOO ETF focuses on 500 of the largest US companies out there, VTI covers a whopping 4,000 US stocks across every single cap size there is out there.

To put it bluntly, VTI takes up around 82% of the large-cap category, 12% of the mid-cap and 6% of the small-cap stocks.

This is why so many people make the mistake of believing that VOO and VTI offer the same general spectrum, since VOO takes up around 82% of the broader VTI and it is essentially a part of it. We refer to this similarity gap as the VTSAX.

But even so, we know that these two are completely different from one another, in which is why so many investors are at a complete loss when it comes to which one they should go with, or whether they should use both simultaneously.

This question is actually asked pretty much on a daily basis on the internet, especially on Reddit for that matter since so many newcomers and old timers alike are just now realizing that they can exploit both the VOO and the VTI systems for their own benefits.

So, in order to answer this question, we will need to directly explain the difference between these two and why this is such an important aspect to them.

VOO and VTI Volatility

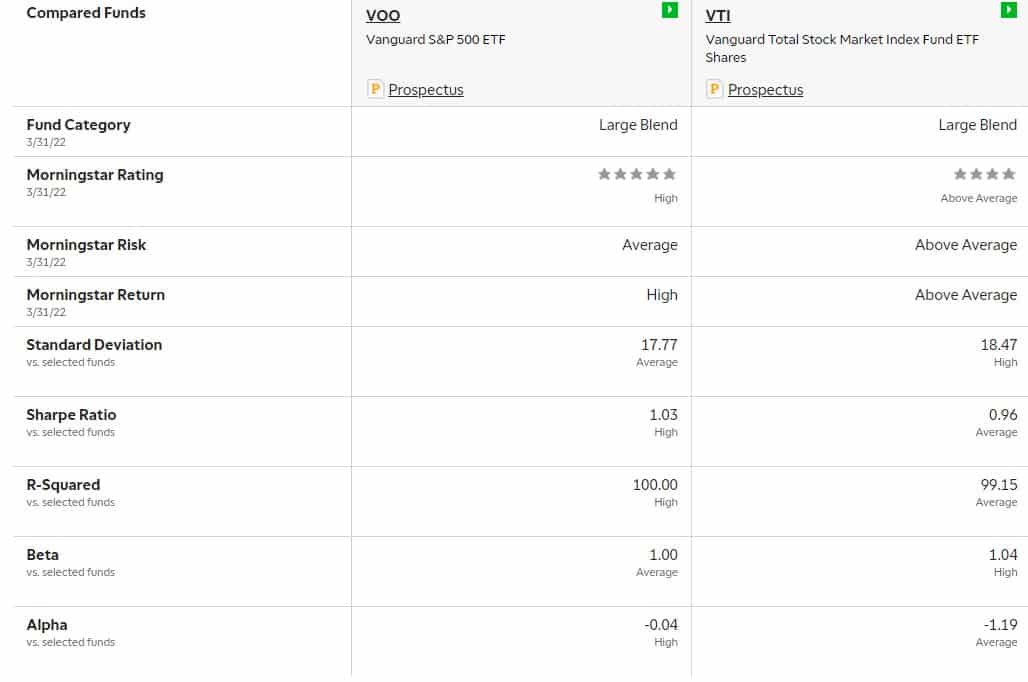

First off, we should definitely start this off by saying that VTI is more volatile than VOO simply because it covers both the small- and mid-cap stocks. These are always known for their volatility, and they can definitely be a lot riskier investments so if you’re looking for a quick buck this may not be the best choice for you.

Since VOO holds around 500 or so stocks under its belt and VTI has around 4,000 though, we can safely say that you will also have a lot more diversity if you go with VTI as opposed to sticking to VOO only.

But now that we know which one of these is actually the more volatile and riskier one to go with, we should also take a quick second to cover the historical performance between them, since after all, if they are so profitable and easy to use then this should be reflected in their past right?

Historical Performance

We have mentioned previously that VTI is a lot more volatile and that this all stems from the fact that it covers small- and mid-cap stocks a lot more than it covers large-caps, but what we didn’t mention is that these stocks are also typically a lot more rewarding as well.

This added level of risk and reward is known as the Size risk factor premium, and it is one of the basics of stock investment that most any investors out there know about.

This is why we should mention that if you plan on working with VTI you will definitely be able to expect a slightly better outcome than VOO simply because of the added risk/reward factor.

Despite all of this however, the inclusion of the smaller stocks into the mix has also been largely dismissed as a predominant factor in the case of the VTI versus the VOO debate, simply because the risk-adjusted return, or the Sharpe, is pretty much identical between the two at the end of the day.

Since most investors are looking to make it big regardless of the added profit level, it is no wonder that most of them preferred VTI over VOO. This has been proven time and time again as Vanguard’s VTI is a lot more popular than VOO when it comes to the assets that have been purchased through it.

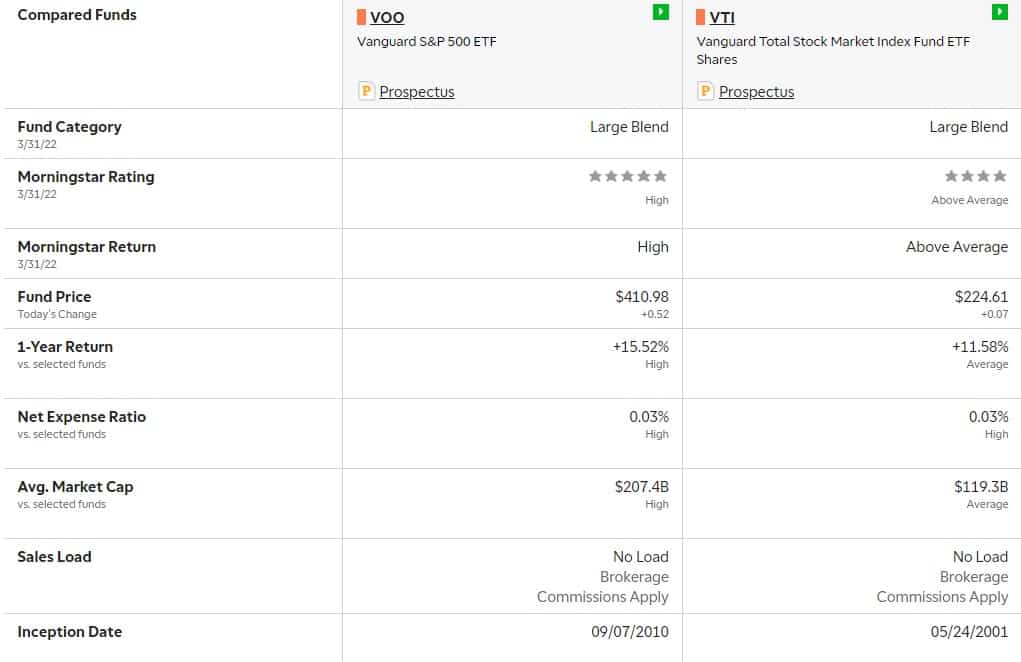

Currently, under management there is around $910 billion in the assets of VTI, while VOO has around $550 billion in assets in total. As far as the expense ratio between the two goes however, they are both around 0.03%, so there’s no real difference to be seen there.

VOO vs VTI Holdings

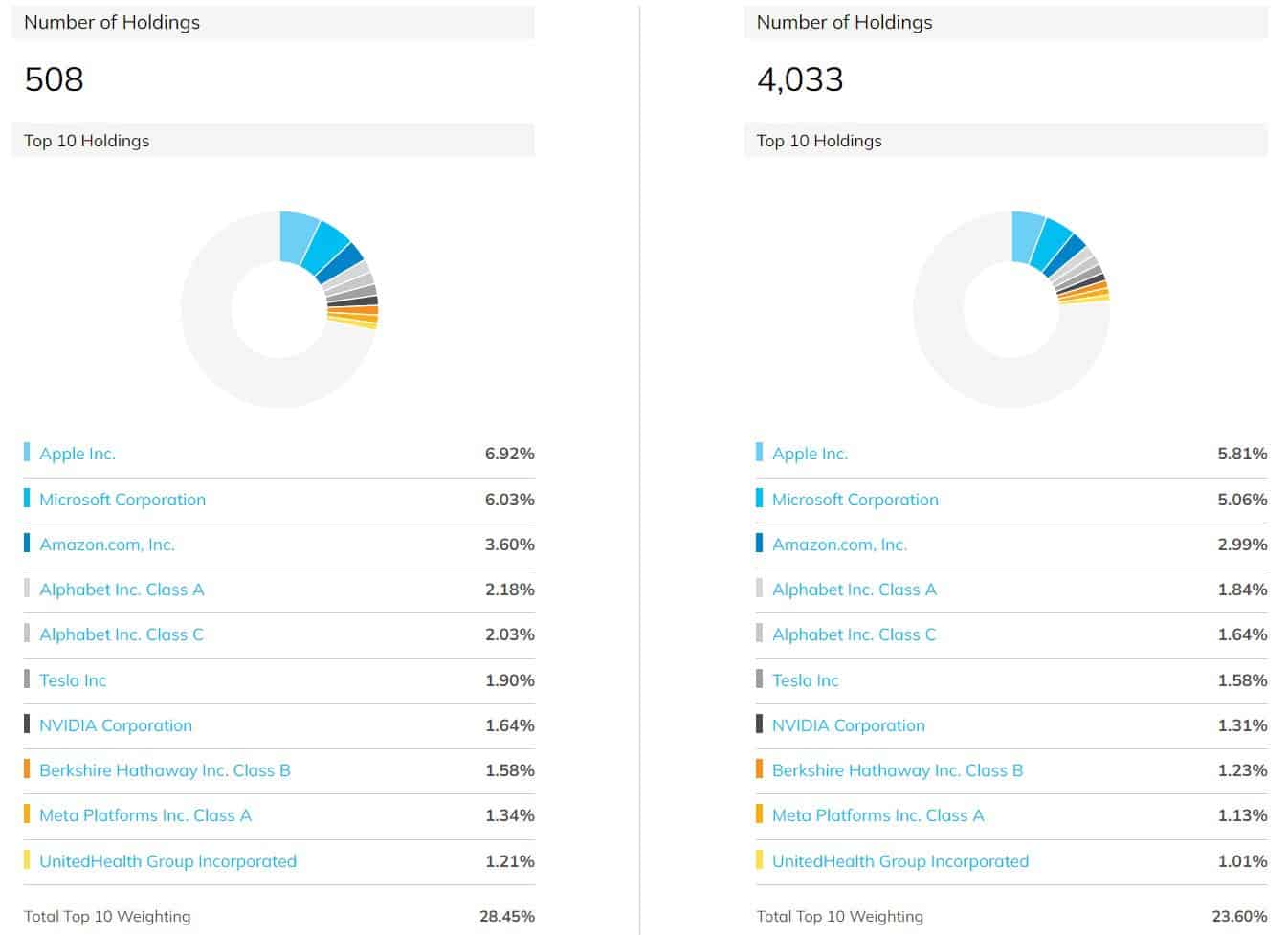

As far as their general holdings go, we can use Morningstar to decipher which are the top 10 holdings in each fund and we can debate over why that is in the first place.

So, VOO currently holds the following stocks:

- Apple Inc – 6.92%

- Microsoft Corp – 6.03%

- Amazon.com Inc – 3.60%

- Alphabet Inc Class A – 2.18%

- Alphabet Inc Class C – 2.03%

- Tesla Inc – 1.90%

- NVIDIA Corporation – 1.64%

- Berkshire Hathaway Inc Class B – 1.58%

- Meta Platforms Inc. Class A – 1.34%

- UnitedHealth Group – 1.21%

At the same time VTI holds the following stocks:

- Apple Inc – 5.81%

- Microsoft Corp – 5.06%

- Amazon.com Inc – 2.99%

- Alphabet Inc Class A – 1.84%

- Alphabet Inc Class C – 1.64%

- Tesla Inc – 1.58%

- NVIDIA Corporation – 1.31%

- Berkshire Hathaway Inc Class B – 1.23%

- Meta Platforms Inc. Class A – 1.13%

- UnitedHealth Group – 1.01%

So, from these stats we can actually tell that the two have similar holdings, in fact they’re practically identical to one another. The real difference between them is the fact that they holds different percentages after all.

Apple is by far the nr.1 holding, although this will most likely change to Microsoft sooner than later as we have seen an increase as of late, and Berkshire Hathaway is around the nr. 10 spot for both of them.

We can tell that as far as VTI goes, 5.81 is where the market cap is set off on while for VOO it is at 6.92 percent. These numbers vary from day to day, but the annual consensus is that they usually hover around these percentages.

So, what exactly does this even mean for us? It all stems back to their weighted indexes, and this is what we’re here to discuss next.

Cap Weighted vs Equal Weighted

In case you didn’t know by now, most of the index funds out there are actually market cap weighted. This is a rather simple equation to remember as it simply refers to the fact that the more value there is in the company name, the more power it holds in that particular index.

We know from that graph that Apple is by far the most valuable company in the world, and while Microsoft is definitely on its back, practically overtaking it as we speak, Apple is still considered to be more important for the index than Microsoft is.

At the same time however, we also have equal weighted index funds which do exist out there, although they are a lot harder to come by than the cap weighted funds.

This is because the equal weighted funds take the investors money and they divide them equally to every single company in the index, thus removing the concept of one being considered more important than the other.

As you may have guessed by now, both VOO and VTI are cap weighted index funds, and this is reflected from their top 10 companies and the funds they have allocated to each and every one of them.

This is why they seem to be almost identical to one another, with “almost” being the keyword here. For VOO, these ten aforementioned companies make up around 26 percent of the total fund, while for VTI it is around 21 percent.

These numbers are definitely subjective and they will change a lot as the years roll on by, but what we do need to keep in mind is their total allocated funds as well. Remember that VTI’s total allocated funds are always going to be less that those of VOO simply because they have a lot more companies to invest into.

VOO only needs to spread its capital around 500 companies or so while VTI needs to do so for almost 3,700 companies in total. That means that while VOO will have more stocks allocated to these top 10, VTI will also spread its funds around to smaller companies as well.

At the same time, the dividend yield is different between the two as well. This is because VOO has a TTM yield of around 1.25 percent as opposed to VTI’s 1.20 percent. While this is a key factor between the two, it is still not the most important difference that can make or break your choice.

VOO vs VTI Performance

Here comes the major factor that we need to take into consideration right here, and that is their overall performance on the general spectrum. Taking a $10,000 investment and putting it into these asset classes from 1972, we can see no real difference between either of them. Regardless of which one you chose, the performance seems to be practically identical between the two.

The only real difference we can take away from this is the fact that VTI is a lot more volatile, while VOO is practically a straight line moving swiftly as opposed to VTI’s more erratic pattern.

Even if we were to take a $100 investment and we were to add $100 at the end of every single month we would still have practically the exact same numbers rolling around.

The real key difference between the two is in the fact that investing in the VOO stocks is actually better during shorter periods of time, but this all comes clashing down on the long run as VTI can easily catch back up thanks to its high risk/reward ratio.

How to Choose Between VOO and VTI?

So, considering the fact that they’re almost identical to one another, which one of these two is actually the better choice for you? Well, let’s just take in the odds and calculate them.

First off, you need to take into consideration the fact that your workplace retirement account may already be set onto one of these two, which is why changing this option up may not be for the best. Just take your time and choose the option that was already ordained for you as this will make things run a lot smoother for you on the long run.

If you do plan on investing in an IRA or perhaps you want to take a chance on a taxable account then we do recommend that you do the following:

Go with VTI or some other type of a total stock market index fund if you want something relatively simple and all-encompassing. Remember that VTI covers a much wider array of US stocks, so this is definitely going to prove to be the better choice for you from that point of view.

This doesn’t mean that choosing the VTI option will outperform the VOO, but what we can say however is that this will broaden your horizon by quite a lot because of how many more options VTI offers to you.

The volatility is also very important to note, but on shorter bursts this shouldn’t affect you all that much which is why you shouldn’t let your choices be ordained by that.

But hey, if you want to get your hands on some of the US asset classes then you will definitely want to go with VOO instead. This is because choosing VOO here will allow you to get more control over the specific asset allocations that you are trying to take advantage of.

Conclusion

So, just to reiterate the differences between VOO and VTI and why they’re important for you to make a profit. They are actually a lot more similar than most people would think, while at the same time there are a handful of key differences to keep in mind.

Knowing this, which one of them is actually the better choice? Honestly, there’s no clear winner. At the end of the day, it all depends on what you prefer and depending on your end goal you should be able to make a profit using the one that is better suited for you.

Remember that they are both excellent choices to make, and as far as the US equity exposure is concerned, there is no better step that you could take to fulfill your quest.