Previously, I covered some simple (yet, potentially effective) ways to invest some money. Here, I’ll get into investments that are a little more complicated. However, this is a decision that many of us will have to weigh at some point in our lives – 401(k) vs IRA vs Roth.

“Contribute to an Individual Retirement Account (IRA) or 401(k).”

You’ve certainly heard this advice before. Retirement accounts are very popular with finance gurus. What are some of the details you should know about these investment vehicles?

First of all, there are seven types of IRAs. For simplicity’s sake, we’ll only focus on two here – the traditional IRA and the Roth IRA. We’ll also look at another popular retirement account – the 401(k).

A traditional IRA and the 401(k)

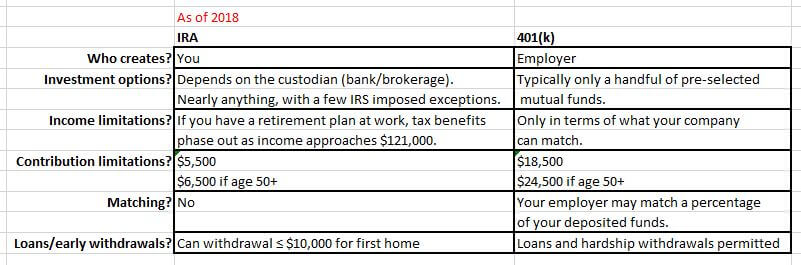

These two plans are similar in tax treatment but they also have several key differences.

*Warning for the potential nitpickers*

This post is for relative newcomers to investing, so I’m going to paint in somewhat broad strokes and write in generalities. Retirement plans have a lot of variables and digging into every little detail is beyond the scope of this post. If you think that something is grossly wrong, leave a comment and I’ll correct if appropriate.

Both plans offer tax-deferred contributions. This means that you will not pay taxes on the money you put into these plans. You will, however, pay taxes when you withdraw at the ordinary income rate (as if the withdrawals were income). The ordinary income rate is typically higher than the long-term capital gains tax rate.

Traditional IRA and 401(k) differences

The first difference between a traditional IRA and a 401(k) plan is that an IRA is a plan you create for yourself. A 401(k) is offered by an employer.

An IRA has a lot more flexibility in terms of investment options than a 401(k). A 401(k) typically only offers a relatively small assortment of mutual funds for investment. The IRS has a few restrictions on what you can invest your IRA money in. Aside from that, the only other limitations will be imposed by the custodian (the company you have your IRA account with).

On the other hand, an IRA has much stricter contribution limits. In 2018, the limit is $5,500 ($6,500 if 50 or older) and the tax benefits may phase out as you earn more. Conversely, a 401(k) has a contribution limit of $18,500 ($24,500 if 50 or older). There is no limit, per se, to your income for the purposes of tax deductibility; only what your employer is allowed to match.

Another critical difference between an IRA and 401(k) is the benefit of matching contributions. With an IRA, the account is created and managed by you, so there’s no one to make matching contributions. On the other hand, employers frequently match (at least a portion of) employee contributions to 401(k) plans. These matching contributions can provide an immediate 25%, 50%, or even 100% return on investment.

Finally, a 401(k) is superior to an IRA in terms of early-withdrawal flexibility. The only way you can withdrawal from an IRA before you are 59½ (without penalty) is if you want to put $10,000 or less toward your first home. A 401(k) allows you to take out a loan from the balance and, if you experience hardship, you might be able to make penalty-free withdrawals too.

Roth IRA

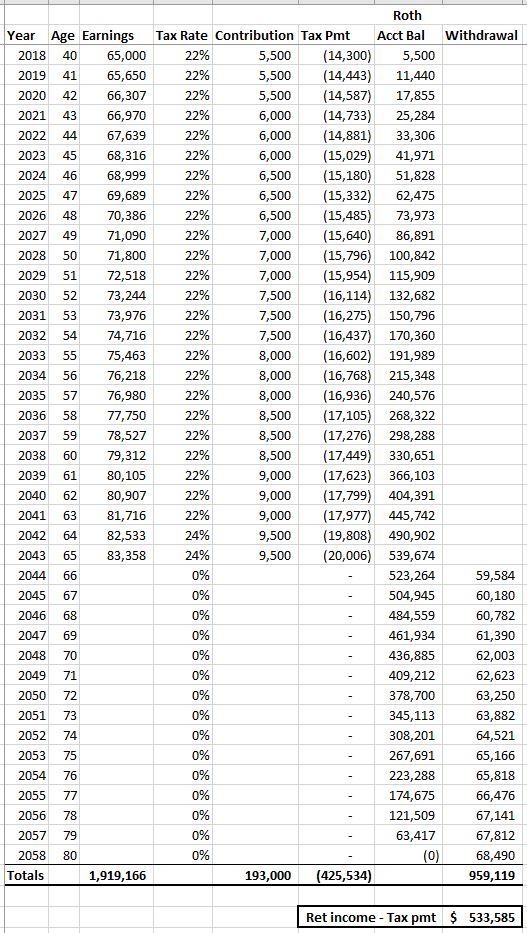

The biggest difference between a Roth IRA and a traditional IRA is the tax treatment of withdrawals.

As mentioned above, a traditional IRA subtracts contributions from your taxable income. So you don’t pay taxes on the amount you contribute. You will, however, pay taxes on traditional IRA withdrawals as if they were regular income.

A Roth IRA does not subtract contributions from your current taxable income – so you pay taxes on that money. However…under normal circumstances your withdrawals from a Roth IRA will be tax-free. That is a huge potential benefit.

A Roth IRA, like a traditional IRA, is an individual account, not a company-sponsored one. Also, a Roth IRA is usually going to have all the same investment options that a traditional IRA is.

Income limitations are higher for a Roth IRA than they are for a traditional IRA. With a Roth IRA, the amount you can contribute ($5,500, or $6,500 if age 50+) begins to shrink as income approaches $199,000.

Being an individual plan, and not a company-sponsored one, there is, unfortunately, no one to match your contributions.

Finally, the early withdrawal rules for a Roth IRA are a lot more flexible than even a 401(k). Contributions can be withdrawn at any time. Earnings, on the other hand, are subject to a few more restrictions.

As I touched on above – for those of you looking to invest in a retirement plan – make sure you educate yourself about the details. Every plan is different and everybody’s situation is different. What might be ideal for one person could be a trainwreck for another?

Comparison of 401(k) vs IRA vs Roth IRA

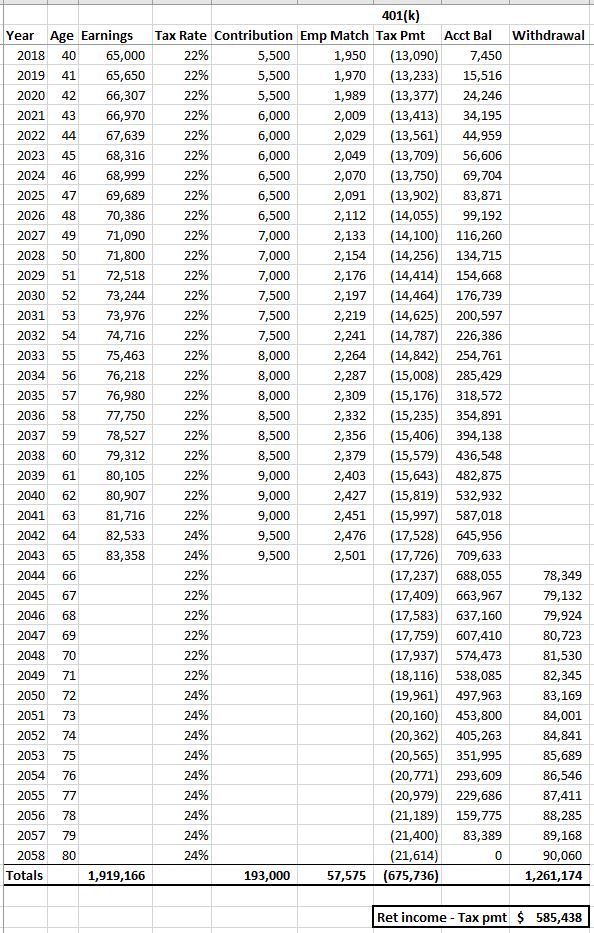

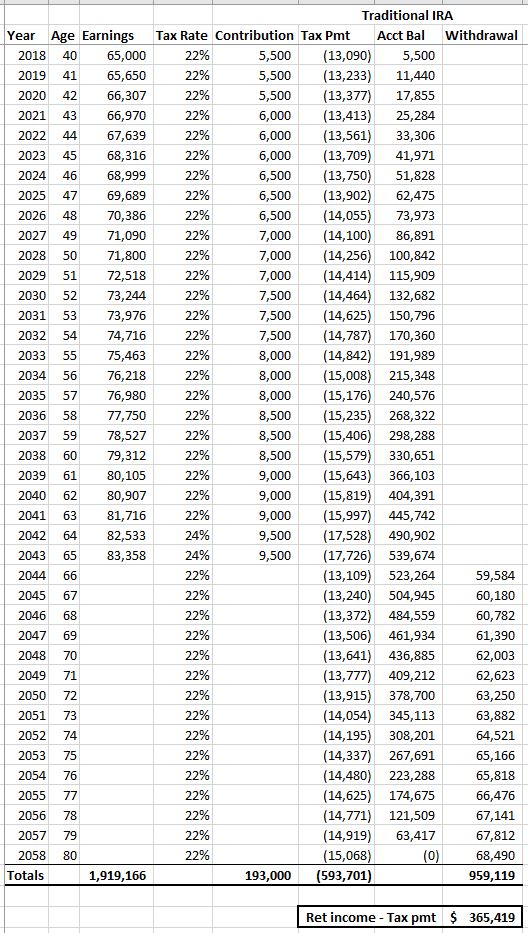

I ran a quick model comparing these three retirement plans to see which might make the most sense. Obviously, this is a simplistic scenario. Real-life isn’t going to play out in such a straightforward manner. There are a lot of other variables to consider. However, I thought this served as a good starting point for comparison.

The assumptions are as follows:

- The individual is not married

- Their life expectancy is 80

- Tax rates will remain the same for the rest of their life (a real stretch)

- Tax rates are flat, not progressive (not true-to-life)

- The employee match for the 401(k) is 50%, but they will only match that percent on 6% of income

- Returns in the account balance are 8% every year

- They plan to take out all of their retirement savings before they die

- They contribute the same amount to all three plans (for an apples-to-apples comparison)

- The yearly contribution starts at $5,500 and increases by $500 every three years

- Withdrawal amounts increase by 1% per year to hedge against inflation

Here’s how things turned out:

As you can see – the Roth IRA’s tax-free withdrawals made a huge difference due to the reduction in taxes. Those savings almost made up for the fact that a 401(k) has the added benefit of employer-match contributions.

401(k) vs IRA vs Roth

Retirement accounts offer you a way to not only invest some money but also avoid some taxes. Tax avoidance is the primary benefit of retirement accounts. That’s what is supposed to make up for the opportunity cost of being unable to spend your own money for decades. There’s an argument to be made too, I suppose, that having that money out of reach allows it to compound and grow in a manner that it might not otherwise be able to.

Taxes are an unfortunate part of investing. But, since they are one of life’s certainties, you need to have an elementary understanding of them if you want to invest. So, if you do want to take part in an individual or company-sponsored retirement plan – make sure you understand the tax implications in addition to the actual investment you will be counting on to grow your money.

Do you agree with the assumptions made in the 401(k) vs IRA vs Roth model? What should be changed?

Are there better alternatives when saving for retirement than these three options?