“What is the safest investment right now?” Investing in yourself and paying down debt are two ways to earn a solid return no matter what the economic environment looks like. If you’re interested in capital preservation, then an FDIC-insured savings account provides the most security. All of these options are low-risk.

There are many ways to invest. All it takes for something to qualify as an investment is for you to send money out, time to pass, and money to come back in.

Generally, safer investments earn lower returns. As you’ll see, though, low-risk doesn’t always mean low return.

Investing in yourself provides returns in money AND time

Your biggest asset is your brain. Everything you have, you owe to your brain. I’m going to be so bold as to guess that you haven’t come close to realizing your brain’s potential.

Reading is great, and it’s cheap. You can enroll in a course, online or in-person. You can try to find a mentor. There’s a number of ways to make a low-risk investment in yourself.

I wouldn’t suggest that you mindlessly educate yourself, however. That might sound weird, but hear me out.

First of all, you only have so much time in a day. So, you want to approach an investment like this thoughtfully.

You don’t want to throw time away. Time can’t be recovered.

I would encourage you to focus your time and energy on learning more about a subject related to something you’re good at. Having a natural talent for something gives you a head start and success keeps you motivated.

I started this site because I’m good at building models in spreadsheets. I also have an aptitude for finance.

A while back, I wanted to learn to play guitar. To be honest, I still do. I’d love to be able to play along with some of my favorite songs.

Here’s the problem though – I’m just not talented at guitar. I learned a lot and I did improve considerably over the 2-3 years I practiced. But, the sad reality is that it would have taken me ten times longer to reach the level of someone who was naturally talented at guitar. I could have spent that time so much more productively.

Finally, when you settle on something to learn – MAKE SURE YOU APPLY WHAT YOU’VE LEARNED!!!! Sorry for the caps, but this is a mistake I’m also guilty of.

Say you want to learn more about sales because you think you have some potential there. Don’t just read a book on sales and think to yourself “man, that sure was interesting and made some really good points.” That won’t do anything.

Write out a plan to implement what you’ve learned. For example Week 1 – focus on single option aversion. Week 2 – focus on asymmetric dominance effect. And so on…

By applying what you learned toward real-life situations you take those concepts out of the theoretical and into the practical.

Should you pay down debt or invest?

If you’re in debt and you don’t feel educated enough to make a more sophisticated investment, then paying down that debt might provide you with a very good (and safe!) return.

I know it doesn’t seem like investing to send money out and never have it come back to you. But, you’ve got to change the way you look at it.

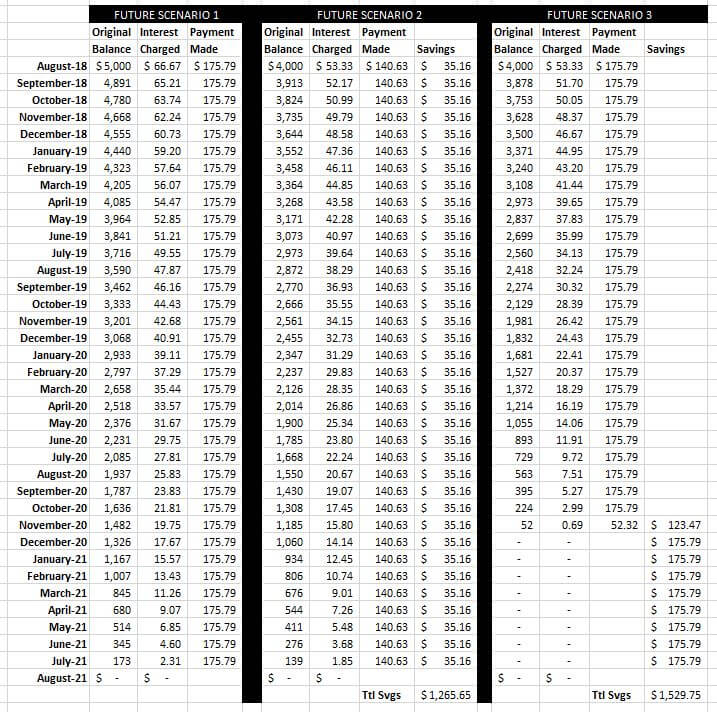

Let’s pretend you have $5,000 in credit card debt (at a 16% APR). You want to pay this debt off within three years. Now, consider three alternates:

In Future Scenario 1, you pay $175.79 a month and in three years, the debt is paid off.

In Future Scenario 2, you have $1,000 to “invest.” You decide to pay down debt and put the $1,000 toward this credit card debt. Now, instead of paying $175.79 a month, you only have to pay $140.63 per month. This saves you $35.16 per month.

This is money that you would have otherwise paid to the credit card company. So, in effect, it’s the same as a cash inflow. Over 36 months those savings add up to $1,265.65! The money you saved returned you your $1,000 and gave you an extra $265.65!

That’s a 26.6% total return; 8.2% annualized. A great return for a low-risk investment.

Finally, consider Future Scenario 3. In this scenario, you still pay the $1,000 toward the credit card balance. But, you also decide to keep paying $175.79 per month. Doing so will allow you to pay off the credit card in 28 months instead of 36.

After the credit card is paid off, you no longer have to pay $175.79 per month. Again, the effect is the same as a cash inflow. That money saved adds up to $1,529.75!

A 53% total return on your “investment.” 15.2% annualized. A remarkable return and a safe investment.

As you’ll see, that sure as hell beats what you can get from a savings account.

While it doesn’t fit the contemporary definition, paying down high-interest debt qualifies as one of the lowest-risk (and most lucrative) investments.

Online high-yield savings accounts – better than traditional?

Now we’ll switch gears back to a more traditional low-risk investment. I’ll warn you upfront, savings accounts aren’t going to do much for you. But, they are “safe investments.”

Let’s look at why:

Above, you’ll see a snapshot of current savings account yields. As you can see, at this time, they top out at a paltry 1.85% APY. A classic case of low-risk, low return.

But, better than nothing, right?

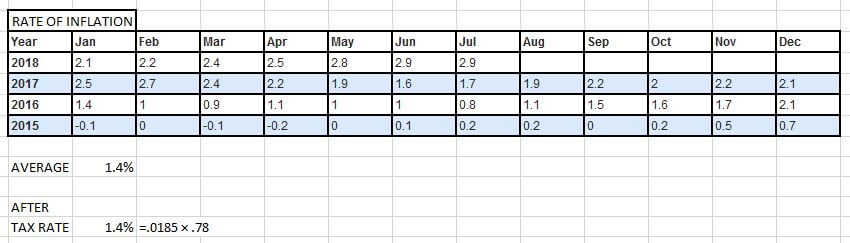

This table shows the twelve-month rate of inflation over the past few years. The rate of inflation for June 2017 – July 2018 was 2.9%.

Of course, a 1.85% return is less than a 2.9% rate of inflation. 1.85% of $1,000 is $18.50. Compare that to the return you could earn from paying down debt.

Yes, you are making a tiny bit of interest. However, overall, you are losing buying power due to inflation.

If we look at the past 3+ years, instead of just the previous twelve months, the rate of inflation averaged 1.4%.

Ah…okay, the return on savings accounts is a little better than that, so you wouldn’t end up negative? Well, don’t forget about Uncle Sam. He’ll take his share. If you’re taxed at a 22% rate, then your net rate of return drops to 1.4% (1.85% × [1 – 22%]). So, you more or less break even.

There are upsides to savings accounts, though. Beyond just being safe investments for beginners.

Putting money into a savings account is better than buying something useless. Also, it’s easy to get access to money in savings accounts (as opposed to some other investments).

You should have a certain amount of cash available in case of an emergency. But, for the foreseeable future, simply socking money away in a savings account won’t really earn you any meaningful return. It is low-risk, though.

Here’s a post I wrote where I compare high-interest savings accounts to other, similar investments. I compare risk, liquidity, and returns.

What is the safest investment right now?

Three safe and easy- to-understand investments were touched on here.

First of all, it’s hard to go wrong with paying down high-interest debt.

All debt is not bad, contrary to what you might be led to believe. If you can borrow money and use it in such a way so that it earns extraordinary returns, then debt is very good.

If you run up a credit card balance so that you can buy trinkets and overpriced things, then it is certainly bad. Paying down bad debt is usually a pretty solid investment.

That’s the rule-of-thumb. If the debt is earning you a return higher than its cost – then it’s good. If not, it’s bad.

Savings accounts are very safe investments for beginners because they are insured by the FDIC. They just don’t earn any sort of meaningful, real, return.

Of the three ideas, it’s my opinion that investing in yourself has the biggest upside.

Beware, though – you can make bad investments in yourself. You can waste valuable time, or worse, you can get destructive ideas in your head. But, as long as you exercise a healthy amount of critical thinking, you should be alright. Investing in yourself is a pretty safe investment.

If you’re sincerely interested in learning about investing (and you are good with finance) then one way you might invest in yourself is to learn about modeling.

Some people consider financial modeling to include only things like mergers & acquisitions, leveraged buyouts, and discounted cash flow analysis – advanced finance sort of stuff.

I disagree. To me, a financial model is any representation of reality in which you can play around with the variables. For example, the future scenarios plotted in the Pay down debt section. Here, I modeled the future and by doing so, gained a better understanding of the current situation.

Financial modeling is the surest way to truly understand money, in my opinion.

What are some other safe investments for beginners?

How about some other investments that are non-conventional, like investing in yourself and paying down debt?