- An online checking account

- “High” interest online savings account

- Certificates of deposit (CDs)

- Money market accounts/funds

- TIPS – Treasury Inflation-Protected Securities

- Municipal Bonds

- Peer to peer (P2P) lending

Best (safe) places to invest money “short-term” and get good returns

Sometimes you need a safe place to put money because you know you’ll need access to it in the near future. In the meantime, however, since it’s a nice chunk of change, you’d like to earn a meaningful return on it. But, it’s also important to you that this amount of money not be put at significant risk of loss. If this is you, here are some ideas for what to do with your money in the short run.

They say everyone should have an emergency fund of three to six months worth of expenses. You probably don’t want to keep that amount of money in cash. Ideally, you would put it somewhere that it could earn a moderate return but where you would also have easy access to it.

Or, maybe you already have your emergency fund taken care of. Now, you just want to put savings away for another short to intermediate-term need. Maybe it’s saving for a vacation, a remodel, or a little bit of money for an older child that will be going to college soon. Perhaps you even got a bonus at work and you’re not quite sure what to do with it just yet.

Minimizing downside risk is key

Rather than putting this money into something “risky”, you want to make sure that you preserve the principal. These investments, for the most part, are “short-term”. I put short-term in quotes because while, technically, some of these investments have maturities longer than one year, they are potentially liquid enough to cash out in less than a year.

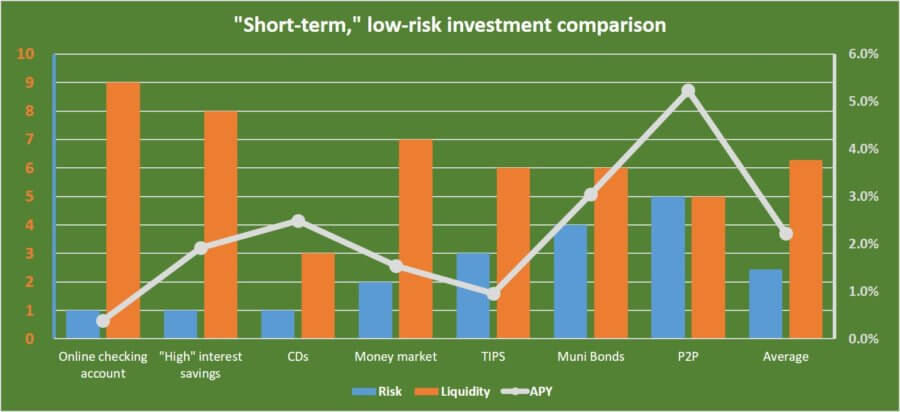

Let’s walk through some of your options from arguably the least risky to the riskiest. I think you’ll be surprised to learn that the potential risk and the return aren’t necessarily correlated.

Full disclosure – of these options, I’ve only had a CD and money market account in the past. Most of the information in this post is from my research.

1. An online checking account

Online checking offers some advantages over a checking account with the bank on the corner.

For starters, fees tend to be lower and interest rates on deposits tend to be higher. This is due, in large part, to the fact that the online bank doesn’t have a building on the corner. They have lower overhead and can, therefore, pass some of those cost savings on to you.

Making a deposit into an online checking account

Maybe you’re concerned about how to get a sizeable chunk of money into the online checking account in the first place? That will depend in part on where the money currently is. If it’s in cash or check form, you’ll probably have to take it to your brick-and-mortar bank (assuming you have one). Then, you’ll have to make a transfer to the online checking account.

If it’s already in an account somewhere, then you should be able to transfer it to the online checking account without too much trouble. Once you have your online checking account up and running, you may or may not be able to make deposits via a network ATM. You’ll have to check with your online bank as to that possibility.

Making withdrawals from an online checking account

Now that we have an idea of how to get money into the account, how do you get it out? Obviously, if you have a debit card, then that’s a possibility. If you’re okay withdrawing cash in smaller chunks, then you can use one of those network ATM’s mentioned previously.

Another trick for taking out large chunks of cash is to get a debit card cash advance from a brick-and-mortar bank.

Are there free ATM’s for online checking accounts?

Maybe you’re concerned about the availability of ATM’s if you have an online checking account? You should definitely do your homework on that before you commit to an online bank. However, there’s a possibility that the bank you choose might be part of an ATM network. Do a Google search about that particular ATM network in your own town and see what you find. When I did this, I was surprised to find how many Allpoint and MoneyPass ATM’s there were in my relatively small city.

Other online checking account pros and cons

If you’re looking to move, an online bank will follow you no matter where you go. Which gives you one less thing to hassle with when you relocate. Unless you’re using a nationwide brick and mortar bank, you might be forced to find a new one when you move.

As already mentioned, online checking accounts typically offer superior interest rates to their brick and mortar counterparts. Online banks are also FDIC insured – meaning that risk is absolutely minimal. The obstacles to getting your hands on the money are a little bit higher than they would be with a brick-and-mortar bank. But, all in all, an online checking account is very liquid.

One downside to online banking is that some people might be put off by the lack of face to face interaction. However, I imagine that most people are like me and do most of their banking via an ATM anyways.

Another potential con is the remote possibility of an internet outage. If your internet service provider or cell provider is on the fritz, you might have to go without online banking until the problem is resolved. The bank’s website can also potentially go down.

All in all, I think the decision to open an online savings account rests upon the frequency and nature of your deposits and withdrawals. If they are mostly in cash and are frequent, then you might consider a different investment. If you just plan on using your debit card, then an online checking account might be right for you.

2. “High” interest online savings account

If you need frequent access to your money, a high-interest online savings account might be a better option than an online checking account. The term “high,” as it relates to interest, is used loosely because the returns will still be low in the grand scheme of things. However, the interest you can earn from an online savings account could very well dwarf what you might get from your local brick-and-mortar bank.

For instance, the average online savings account APY that I found was 1.9%. Compare that with what my personal brick-and-mortar bank is offering right now which is .02%. To help put it in perspective, the average online savings account pays 95 times that rate.

High-interest online savings accounts are FDIC insured, just like their checking counterparts. Therefore, the risk of losing your principal is absolutely minimal. Like most savings accounts, however, they’re not quite as liquid as a checking account.

Regulation D

Online savings accounts also offer access to your money through the same means as a checking account. Of course, transfers are available and even sometimes debit cards and ATM access.

However, due to something called “Regulation D,” imposed by the Federal Reserve, you might be restricted on the number of transfers you can make in a given month. Certain transfers are limited to six. This is why the high-interest online savings account was given a slightly lower liquidity rating than the online checking account.

All in all, a high-interest online savings account offers several benefits over an online checking account – assuming you don’t need super frequent access to your money. The benefits over a brick and mortar bank’s savings account are even more significant.

3. Certificates of deposit (CDs)

CD’s are accounts with a bank where you promise to leave money in them for a certain period of time. Anywhere from one month to five years. As compensation for leaving your money in the CD, the bank will pay you a higher interest rate than it would on a savings account. That higher interest rate is one of a CD’s primary advantages.

CD’s, like other bank products (savings accounts and checking accounts) are insured by the FDIC. This makes them more or less risk-free.

Benefits, detriments, of a fixed interest rate

Another potential advantage is that if you put your money in a CD, you’re locked in at that interest rate. So, in an environment where interest rates are falling, you could be earning excess returns. That hasn’t really been the case for a long time.

Of course, the inverse of that is true. If interest rates are rising, you are locked in at a low rate. Also, if inflation is rising, you are locked in at a rate that is potentially below the rate of inflation.

One of the most illiquid investments

However, as mentioned, you might not have access to this money should you need it. That is unless you want to pay a considerable penalty of up to three months worth of interest. This is one of the CD’s primary disadvantages – it’s liquidity. However, keep in mind that CD terms can range from 3 months to several years, so you can choose a maturity that’s right for you.

Of course, longer terms offer greater interest rates. In the graph above, the term used to figure the average pay was around one year.

The final major disadvantage of CD’s is the opportunity cost. This goes back to the lack of liquidity. If your money is tied up in a CD for many months and/or years, then you’ll effectively lose the ability to take advantage of any other investment opportunities that might come your way. Hence the name – opportunity cost.

If you’re absolutely sure that you won’t be needing the funds for a certain amount of time, CD’s can offer you a better return than an online checking account or a high-interest savings account. If you do decide to invest in a CD, you might consider shopping around at smaller banks. Conventional wisdom says that, since smaller banks need the funds more (to make loans), then they might be willing to pay a slightly higher interest rate than the big boys.

4. Money market accounts/funds

Money market accounts and funds are similar types of investments with a couple of important distinctions.

Both tend to invest in very low-risk assets. However, a money market account is an account you would hold with your bank. Much like a savings, checking, or CD account. It is also FDIC insured, just like those other accounts. Also, with some money market accounts, you have the ability to write checks and use a debit card to access funds.

A money market fund, on the other hand, is a mutual fund. It would be purchased through a broker and not a bank. A money market fund is not FDIC insured. Getting cash from any money market fund would entail selling shares of the fund and then making a withdrawal from your brokerage account.

In either case, whether you’re investing in a money market account or fund, both are very liquid and there are a few obstacles to getting your hands on your money. Keep in mind, however, that a money market fund, like a savings account, can be subject to Regulation D restrictions. The number of times you are able to make withdrawals in a given month might, therefore, be restricted to six. Since a money market fund might entail a bit more of a hassle to liquidate, I put the liquidity factor as slightly lower than that of a high-interest savings account.

Fees

A money market account/fund might also have unwanted fees attached. These might come in the form of management fees, closing fees, and fees for excessive withdrawals. Since you are earning such a low rate on your money, to begin with, these fees can take a toll on your returns.

The APY on money market investments should tend to be somewhat comparable to a high-interest savings account. It should definitely be higher than most checking accounts. The average that I found when researching was around was about 1.5%. Like savings accounts or any other investment that you would expect to obtain a low return on, you run the risk of inflation being greater than your return.

Money market or savings account?

Unfortunately, when compared to a high-interest online savings account, you could potentially have less liquidity, less return, and a little greater risk when investing in money markets.

As mentioned, money market accounts (with your bank) are FDIC insured, making them more or less risk-free. Money market funds, on the other hand, are certainly low-risk. But, you still run the risk of a money market fund investing in what it thinks is a low-risk security, only to find out that it’s not as safe as hoped. This is what happened, in some instances, during the 2008 financial crisis.

All in all, a money market account or fund doesn’t really offer any benefits over a high-interest savings account. Really, the only deciding factor when choosing between a money market or high-interest savings account would be the frequency with which you feel you may need to access your money. If you would need a debit card or checks to make frequent withdrawals, then you might consider a money market account. If not, then a high-interest savings account is definitely preferable.

5. TIPS – Treasury Inflation-Protected Securities

Treasury inflation-protected securities (TIPS) are US government bonds that adjust interest and principal amounts to compensate for changes in inflation.

TIPS can be purchased directly from the US Treasury or can be invested in via a TIPS mutual fund. Though each method of investing in TIPS is tied to the same underlying asset, the pros and cons of each are actually quite different.

Buying TIPS from Treasury Direct

Buying TIPS directly from the US Treasury can help ensure that the interest you receive will always be above the rate of inflation. So, there’s no risk of losing purchasing power in that respect. However, the problem with buying direct is that selling them in the secondary market can be challenging. Additionally, if interest rates have risen, you will probably have to sell the TIPS for less than the full principal amount. Also, if you don’t hold TIPS to maturity, you won’t receive the adjustment on the principal to compensate for the effects of inflation. Maturities come in terms of 5, 10, and 30 years – not exactly short-term.

Investing in a TIPS mutual fund

Investing in a TIPS mutual fund means not having to worry about maturities. Dividends will be paid by the fund on a quarterly basis. Theoretically, these dividends should change based on the rate of inflation.

TIPS mutual funds offer some other benefits beyond buying directly from the US Treasury. First of all, there’s the convenience of simply investing via your brokerage account. You can purchase odd dollar amounts and can also automatically reinvest. TIPS mutual funds provide “professional” management and diversification.

The downside to TIPS mutual funds, as opposed to buying direct, are the fees that you will have to pay for that professional management.

Also, since mutual funds are traded on the open market, the value of the fund shares can also rise and fall in a manner that’s not necessarily consistent with the underlying value. This means that when it comes time to sell, you run the same risk as with buying TIPS direct – that you could lose some principal value and end up not keeping up with inflation. Or, worst-case scenario, losing money. If you look at a historical graph of a TIPS mutual fund such as VIPSX, you’ll see that the change in value, even over the short-term, can be significant.

Other TIPS downsides

One final con for both TIPS mutual funds and TIPS purchased directly is the tax treatment. With both investments, you run the risk of paying tax on what’s known as phantom income. Phantom income is the change in the principal amount due to an adjustment for inflation that the investor doesn’t receive in a given year, but must pay tax on nevertheless.

Selling TIPS directly in the secondary market is more involved than selling TIPS mutual funds. It’s because of this that TIPS are given a slightly lower liquidity score of 6.

The risk of TIPS losing value in terms of principal warrants a risk score of 3. More than the previously discussed bank-based investments. And while it’s great that the interest/dividend payments will adjust with inflation, current APY’s only averaged about 1%. Not great.

With higher risk, lower liquidity, and low returns, it wouldn’t make much sense to go to the trouble of investing in TIPS over some of the previously mentioned alternatives. Inflation is more of a long-term concern, typically. So one of TIPS main selling points might not really impact your decision making if you’re just looking for a place to invest short-term.

6. Municipal Bonds

Municipal bonds are money borrowed by state and local governments to be used for any variety of purposes.

Like TIPS, municipal bonds can be purchased individually or through a mutual fund or ETF.

Since the money is borrowed by a government entity the risk of default is relatively low. If necessary, the state or local government can tap into its tax base in order to repay the bonds. It’s worth noting that there have been some high-profile defaults on municipal bonds over the years. But, statistically speaking, the risk of default is extremely low.

Tax benefits of municipal bonds

Another benefit to municipal bonds is that the interest they earn is federally tax-exempt. In some cases, interest is exempt from state and local taxes too. So, even though they tend to pay a lower interest rate than their corporate counterparts, the advantage of earning tax-free interest can offset the low-interest rates. It’s also generally assumed that municipal bonds are less risky than corporate bonds.

Interest rate risk

Like any other interest-bearing investment, municipal bonds run the risk of losing value if interest rates rise. On the flip side, if interest rates fall, many issuers of municipal bonds will refinance the debt and pay off the bond early. So, if interest rates rise or fall, the bondholder might get the shaft either way.

Using municipal bond funds instead of purchasing individual bonds can help mitigate some of these risks. None more so than the liquidity risk. Individual investors could have a difficult time selling a municipal bond in the secondary market for an acceptable price. Based on what I read, the secondary market for municipal bonds isn’t terribly “user-friendly” for individual investors.

Municipal bond funds

Buying any municipal bond mutual fund or ETF, of course, means that you don’t buy municipal bonds directly. You pool your money with other investors and the money manager buys and sells the municipal bonds. This gives you the advantage of diversification. Diversification lowers the default risk below what it would be if you bought an individual municipal bond.

Since municipal bonds are issued by state and local governments and not the federal government, I gave them a risk rating of 4. The interest rate paid on these bonds, however, is considerably higher than any of the other investment options I’ve discussed thus far. So, there is compensation for that increased risk. Additionally, municipal bond funds, like any other mutual fund or ETF, can change in value significantly over the short-term. That also accounts for the increased risk rating.

The attractiveness of municipal bonds

Just like TIPS funds, municipal bond funds and ETF’s are very liquid. However, considering that individual municipal bonds can be extremely illiquid, a liquidity rating of 5 out of 10 was given.

Without properly timing the market, there’s no guarantee that you won’t lose principal even after collecting healthy dividends on municipal bond funds. With that being the case, I wouldn’t qualify municipal bonds or municipal bond funds as the best option for a short-term, low-risk investment. Though the expected return is healthy, there are too many adverse events that could take place.

7. Peer to peer (P2P) lending

Compared to these other options, P2P lending is a relative newcomer. If you’re not familiar, P2P lending allows investors to act as a bank. Money is pooled with other investors and then loaned to borrowers who pay interest rates based on their capacity, collateral, and creditworthiness.

Some people are immediately dismissive of P2P lending as a fad or too risky of an undertaking. However, even though it’s relatively new, lots of respected voices in the personal finance arena are endorsing P2P lending as a viable investment.

P2P diversification

One thing that’s nice about P2P lending is that you don’t have to put all your eggs in one basket. Say you have $5,000 that you want to invest short-term. You don’t have to lend that entire $5,000 to one person and then pray that they’ll pay you back. If you deposit $5,000 with a P2P website, you can break that amount up over hundreds of different loans. Thereby limiting the effects of a few loans that might default.

Another benefit to P2P lending is that you can reinvest the principal and interest payments you receive and take advantage of the effects of compounding.

P2P terms

The typical APY I found on P2P loans was around 5.2%. This dwarfs any of the other alternatives in this post. Loan terms are also flexible, depending on whether or not you want to hassle with trying to sell your loan in the secondary market. You can choose loan terms that are as short as 2 years.

One of the downsides of P2P interest versus, say, municipal bonds, is the tax treatment. Like most other sources of interest income, interest on P2P loans will be taxed as ordinary income. A lack of preferential tax treatment might eat into some of the excess returns that you receive from P2P lending.

Is there a secondary market for P2P?

Since this post is about short-term investments, you might be wondering about the availability of a secondary market for P2P investments. A secondary market for P2P loans does exist. From what I can tell, the company that handles this, almost exclusively, is a company named Folio.

From what I read, Folio does make it fairly easy to sell your P2P loans; but you will have to pay them a fee of 1% for the privilege. Depending on what interest rates have done and the marketability of your loan, you run the risk of taking a loss or not achieving your desired returns. I did find plenty of people who claimed they were able to sell their P2P loans for a premium, however.

Since it is possible to sell these loans, but it has to be done through an entirely different company, I gave P2P lending a liquidity score of 5.

Education is key in P2P

There are, nonetheless, steps you can take to lower the risks of P2P lending. Here’s a good site that I found that offers tips for avoiding loans that will default.

The only reason that P2P lending was given a higher risk rating than all of the other options is due to the nature of who you’re lending the money to. All the other options are either FDIC insured or (in)directly lending money to government entities. Borrowers on P2P websites have neither of those safety nets working in their favor.

P2P lending involves higher risk and potentially lower liquidity than some of the other options in this post. However, I think it’s a viable option for the individual who wants to get a little more aggressive with their short-term investments. As I mentioned, the risk can be mitigated somewhat through education and diversification.

As far as liquidity goes, I gave P2P a score of 5 – basically because of the unknowns. If you’re interested in getting involved in P2P lending, I would recommend starting with a small amount and then selling those loans on the secondary market. Just so you can get a feel for what the true costs are, plus the potential hassle. If you end up feeling comfortable with that, then I think P2P lending might be a great alternative for low-risk short-term investments.

Where to invest money to get good returns

There are any number of things you can do with your money if you want to invest it. In this post, I’ve tried to explore seven different options for low-risk and “short-term” investments.

Each offers advantages and disadvantages. Ultimately, where to invest money to get good returns depends on three things. Your tolerance for risk, need for liquidity, and desired return. You can see an average for all options on the right side of the graph. This gives you a benchmark to compare against whatever investment option you’re considering.

Personally, if I had a couple thousand dollars that I knew I would need in 12 months, I would probably opt for a CD or P2P lending. To feel comfortable, I would have to do a little more homework on the ability to sell the P2P loan in the secondary market. But, assuming that there are no issues, (which I was led to believe), then I think that could be a good option, given the strong returns.

If you’re looking to invest some money for the longer-term, check out my invest some money posts.

If you have some money really burning a hole in your pocket and you want the potential to make some astronomical returns, then check out my post on 5 ways to invest money to make money fast.

Do you have any constructive input? If so, join the conversation on Twitter!

Contents

- Best (safe) places to invest money “short-term” and get good returns

- 1. An online checking account

- 2. “High” interest online savings account

- 3. Certificates of deposit (CDs)

- 4. Money market accounts/funds

- 5. TIPS – Treasury Inflation-Protected Securities

- 6. Municipal Bonds

- 7. Peer to peer (P2P) lending

- Where to invest money to get good returns