What is a social trader? Simply put, a social trader is someone who takes part in social trading. But, what’s that mean? Social trading is a blend between investing and social networking. The act of buying and selling financial instruments is combined with the online interaction between traders who have similar interests.

Additionally, a social trader observes and possibly copies the trades made by (perceived) experts. This modeling of trades is known as mirror trading, or copy trading.

Copy trading requires no knowledge about the financial markets in general or individual financial instruments specifically. The disconnect between people who want to participate in financial markets, and those with expertise, is likely what led to the creation of social trading. Also, to be fair, it takes no knowledge about the financial markets to participate in any type of trading.

Social trading platforms give social traders access to expert guidance that might not have otherwise been available to them. Social traders can tap into the “wisdom of the crowd” for a relatively low price of admission.

Plus, there’s the added reassurance that the expert you’re copying has their own money on the line. This skin in the game gives social traders confidence because they know that the expert will share in any gains or losses. That’s a benefit that clients of many traditional money managers can’t share in.

Even the World Economic Forum has touted the efficiencies, sophistication, and potential value for traders using social trading platforms. Source.

The innovation of social trading is generally thought to have started around 2010. eToro is considered to be a pioneer in social trading and remains one of the biggest players in the industry today.

Other early platforms included Wikifolio and NAGA Trader.

Newer firms include TradeSocio, ZuluTrade, and ayondo.

(Check out the reviews of these platforms at the bottom of this post.)

Today, social traders are responsible for tens of billions of dollars of financial instruments purchased and sold every year. Source.

Copy trading is, of course, a critical part of social trading. Copy trading’s roots go back a little further, to 2005. Back then, on a platform called Tradency, a system called Mirror Trader was created. With Mirror Trader, users could post their trading records and performance.

Shortly thereafter, users were able to connect their brokerage account. This made the process more automated. Copy trading was born.

Social trading could almost be considered a third type of investment analysis. The other two, of course, being fundamental analysis and technical analysis.

Though, it’s worth noting that whoever the social trader is mirroring is probably using either fundamental or technical analysis. Traders who do their own fundamental/technical analysis could still complement their own efforts by referring to other social traders.

Since social trading is a subcategory of social networking, there can be a lot of noise to wade through in order to get valuable information. It takes time, effort, results, and (hopefully) authenticity to gain a social media following. The same could be said about influencers on social trading platforms.

Social trading platforms often have a news feed just like social media. Via the news feed, social traders can follow and tag others, receive notifications, and post updates on their favorite financial instruments. In addition, social trading platforms often connect with traditional social media platforms (Facebook, Twitter) so that social traders can post updates there too.

One key advantage that social traders have over those who would learn on their own, is that the learning curve may be flattened. This is due, in part, to the availability of expert advice. New social traders can effectively be mentored by some of the best in the game. Imagine being able to learn a sport from those who play that sport professionally. That would be a huge advantage.

The copying on social trading platforms can go beyond just individual trades. Some platforms allow for the mirroring of entire portfolios, dividend-paying positions, and deposits/cash withdrawals.

So, why would a successful trader allow others to piggyback on their success?

Well, in some cases, there’s a financial incentive to do so. Programs such as the Popular Investor program with eToro encourage high-flying traders to share their wisdom. They do so offering up to a 2% kickback from all of the portfolios that are copying them. So, in theory, a Popular Investor could be trading a portfolio worth a couple of thousand dollars. Meanwhile, they’re earning nearly as much in monthly income from the social traders that are copying them!

Interested in learning more? Click on the eToro link above.

To date, it’s not been made abundantly clear how social trading platforms will monetize their popularity. Though, as with social networks, we know that attempts will ultimately be made. It’s likely that the aggregation and analysis of trader data, plus advertising, is the product they will sell.

In order for social trading to work, information must flow uninterrupted among the participants. Fortunately, experts who would seek to stifle the flow of information run the risk of losing clout through less-than-stellar results and a lack of authenticity.

Again, enough emphasis can’t be put on the importance of authenticity and social trading. A key to that authenticity is transparency. This is why statistics such as previous trades, performance, opinions, and any other pertinent information is laid out for all to see. The result is a meritocracy, of sorts, where novices and professionals alike can reap the biggest benefits.

You’ve heard the saying “two heads are better than one.” Well, a team of heads can be even better than two. Just because an individual is an accomplished trader, doesn’t mean that they can’t benefit from the input of others. That’s why some social trading platforms facilitate teams. Teams allow specialties to be pooled together and the hard work of research to be efficiently allocated.

Both social trading and robo advisors are relatively new Financial Technologies (fintech). Both are passive by nature and are appealing to investing newbies. There are, however, some important distinctions.

Social traders rely on the expertise of other individuals. Whereas someone using a robo advisor is relying predominantly upon a software algorithm.

There is another important distinction. Robo advisors are used more for long-term investing. Social traders, on the other hand, tend to have a short-term, speculative, focus.

If you’re not familiar, FinTwit stands for Financial Twitter. It is a subcategory of Twitter users that primarily discuss investing and trading topics. In fact, Invest Some Money could be considered part of the FinTwit community. Though I could hardly be considered an influencer at this point.

I do, however, follow several great accounts that I would consider to be integral parts of FinTwit. These individuals post a lot of trading ideas and commentary around the clock. Those who follow them are free to emulate their trades. Therefore, I would personally consider FinTwit to be a social trading platform of sorts.

Also, there several subreddits where investors and traders discuss their positions. These include r/stocks & r/wallstreetbets. Again, I think this loosely fits the definition of social trading.

FinTwit + Reddit we’re not designed with social trading in mind. However, the concept has bled over into these platforms.

Social trading platform pros & cons

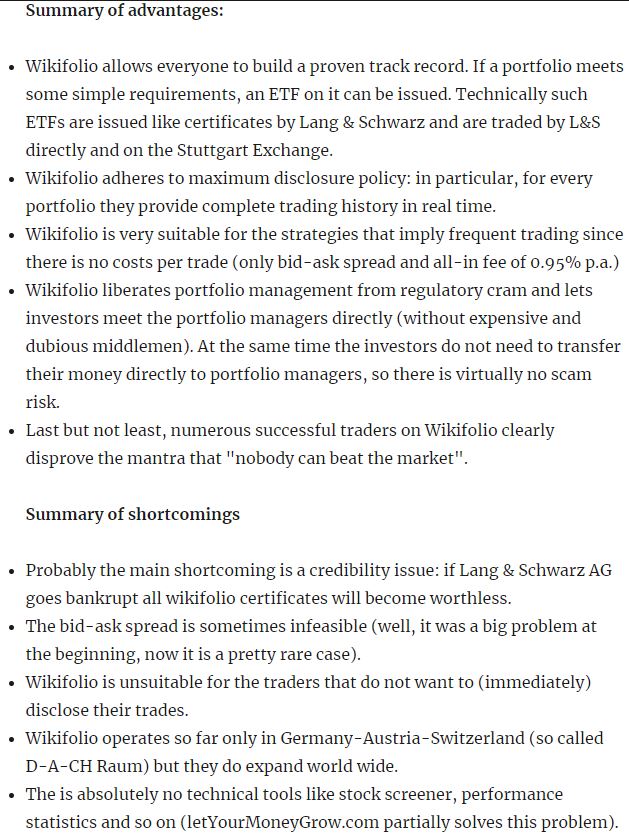

Wikifolio

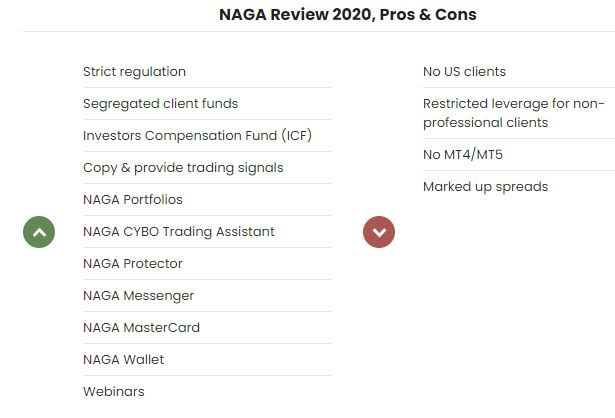

NAGA

ZuluTrade

ayondo

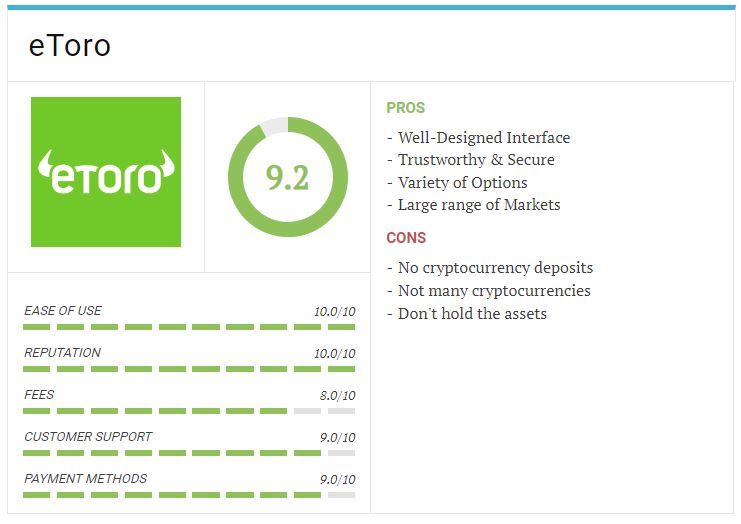

eToro

Contents