The higher the yield, the more dividend income you can earn – all things being equal. Dividend investors know that too low of a yield is no good. They also know that good dividend yields need to be balanced with quality financials. This helps ensure that good yields can be enjoyed for a long time to come.

A good dividend yield might be considered anything above the yield on a 10 year Treasury note (currently 1.15%). Anything below that would incur excess risk for a lower yield.

A high dividend yield, consistent earnings, the right business model, and solid financials are some of the characteristics of quality high-dividend stocks.

Stocks with high dividends are appealing to those who want an investment that puts off healthy cash flow. There’s more to an investment than big dividends, though. There’s a company behind those dividends which may or may not be sound. Here are some things to investigate when performing your due diligence on high-dividend stocks.

What should you look for in high-dividend stocks?

Dividend yield

Well, obviously the first characteristic you want to look for in a high-dividend stock is a high dividend yield. If you’re not familiar, the dividend yield is expressed as a percentage, and it is equal to the stock’s dividend ÷ the stock price.

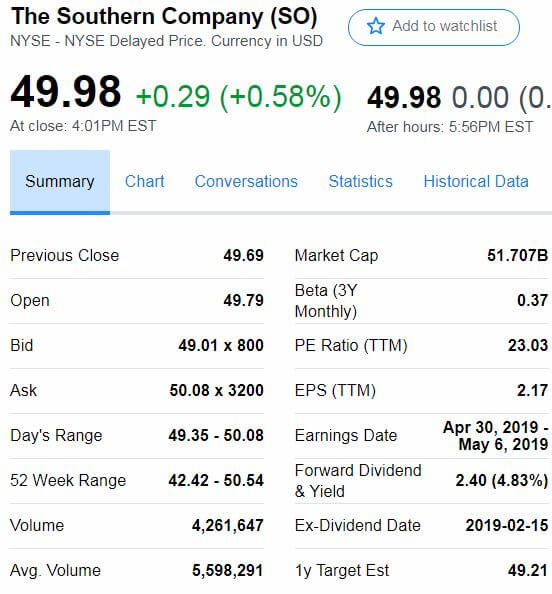

For instance, The Southern Company (SO) has, as of today, paid dividends of $2.40 over the last year. Its closing price, yesterday, was $49.69. This gives it a dividend yield of 4.83%.

So, what makes for a high yield? I haven’t found any clear-cut answer on this subject. But, here’s a “rule of thumb.” Consider any dividend yield that’s higher than a benchmark as “high yield.”

What benchmarks? As I mentioned above, you could use the 10-year Treasury note yield. But, that’s not too high of a hurdle at 1.15% (as of today). Alternatively, you could use the dividend yield for a comparable index fund. For example, the dividend yield for the SPDR S&P 500 ETF (SPY) is currently 1.52%.

Neither of these examples is very lofty. “High-dividend stock” is a relative term, though. Again, f the stock you’re looking at has a yield less than the 10-year Treasury note and/or SPY, you’re almost assuredly not in “high dividend stock” territory.

Earnings consistency

Dividends are paid from net income. They are profit distributed to the owners of the company. Therefore the company paying dividends should have a consistent and, ideally, growing net income.

Investing in income stocks, as they’re called, is, by its nature, a long-term undertaking. So, sporadic profits, peppered with occasional losses probably wouldn’t inspire anyone to count on growing dividends over the long-term. Instead, what you’re probably looking for is a long history of solid earnings and a steadily growing dividend.

Check out the so-called dividend aristocrats for examples of this type of company.

Dividend aristocrats must be in S&P 500 (large companies), have 25 years (!) or more of consecutive dividend increases, and meet other requirements related to liquidity. As of today, there are 57 of these dividend aristocrat companies.

The dividend aristocrats won’t necessarily be “high-dividend stocks.” But, they serve as a good models for the type of company that would pay consistent dividends.

Business model

There’s no shortage of sites recommending high-dividend stocks for you to invest your money in. If you come across such suggestions, you might notice a theme. Most of these stocks fall into one of the two most desirable business models I cover in my What is Product Growth Potential – Business Model Desirability post.

This is no accident. Because the consumables and subscription business models generate consistent revenue (and earnings) it’s these type of companies that re able to pay consistent and growing dividends.

Financial statement history

This is kind of broad characteristic. What I mean by “financial statement history” is the behavior of operating margins, cash balances, and sales, compared to dividends, over time.

If margins are thin you might notice that the dividends aren’t all that consistent either. Particularly if a business has high fixed costs or interest expenses – its ability to pay a consistent dividend might be hampered.

Obviously, there has to be cash available in order to pay a dividend. While, yes, dividends are paid from earnings – keep in mind that earnings are calculated using many non-cash items. Things like depreciation and amortization are going to affect cash on a different timeline than they are going to affect earnings.

Finally, check out the sales history. In particular, during times of economic contraction. What happened to dividends during those times? If a company continues to pay a steady (or increasing) dividend even when times are tough, you can have some confidence that it is likely committed to doing so in the future.

Why do these characteristics matter?

Dividend yield

The higher a stock’s dividend yield, the higher the amount of income you earn investing in that stock. There are other things to consider, beyond dividend yield, of course. High yield does not, in and of itself, make for a good investment. But, everything else being equal, the higher the yield the better.

Dividends are appealing, in part because they represent a guaranteed return from an investment. If you’re the type of investor who is looking for income, then you’re probably also looking for security. Returns from capital gains, even with prudent investments, can be subject to the whims of the general public and the market. Dividends are less subject to these whims.

Also, if your dividends are qualified (rather than ordinary) then they will be taxed at the capital gains rate. This rate is consistently lower than income tax rate.

Keep in mind, that today’s stock with a so-so dividend yield could be tomorrow’s high dividend yield stock if you buy and hold. Yield is based on the purchase price of a stock. If the dividend increases and your price paid stays the same, then your yield will increase too!

Earnings consistency

For all the same reasons that dividend yield is important, earnings consistency is important too. Why? Because dividend yield depends, in large part, on earnings consistency.

Consistent earnings increases the likelihood of a consistent and growing dividend. If your counting on dividends for your income then consistent earnings give you a sense of security. It makes you feel like you can count on this money to continue to come in the foreseeable future.

Earnings that are volatile will not give you the same sense of security. It’s feasible that management, due to the volatility, will be leery to raise the dividend and they might even cut it to conserve cash.

Business model

Dividend yield depends on earnings consistency. Earnings consistency depends on the business model. In large part, anyways.

Consumable and subscription business models lend themselves to earnings consistency – for obvious reasons. While there are no guarantees in business, these business models, by their nature, operate under the assumption that people are going to keep coming back for more. If people keep coming back for more, then the company will continue to make sales and likely profits.

The time for money and 1 time, low-price business models are just not as easily scalable as consumables and subscription-based. Therefore, they don’t lend themselves to providing growth in sales and earnings. A lack of growth in sales and earnings won’t translate into growth in dividends.

The 1 time, high-price business model can facilitate growth. But, it’s inconsistent. This contrasts with the guaranteed income that many people desire from investing in high-dividend stocks

Financial statement history

Leverage is a double-edged sword. When things go right, leverage can make them go really right. If things go wrong, leverage can make them go even worse. Companies’ use of operating leverage and financial leverage can have a huge effect on its profit margins.

So, while leverage can be effectively utilized through the use of fixed costs and borrowed money, it doesn’t necessarily lend itself to the consistency of earnings. That’s a broad generalization, but a fair one, I think. It all depends on how well the company employs the assets that its leveraging.

Concerning cash balances – keep in mind that it’s not only operating activities that affect cash. Financing and investment activities also do. Don’t neglect the cash flow statement when you’re performing your fundamental analysis. Look at the amount spent on property plant and equipment, on share repurchases, and on bond/loan repayments. These items could be sucking up cash that would otherwise be paid in dividends.

Finally, I probably don’t have to tell you that a company needs sales in order to generate a profit. It also needs a profit in order to pay dividends. Keeping sales rolling in (and more importantly cash) during tough times, puts a company in a position to pay consistent and growing dividends.

Accounting tricks can be employed to give the impression of consistency and/or growth in profit. But, the timing and amount of sales is more difficult to fake.

How to find high-dividend stocks

The easiest way to narrow down your search for high-dividend stocks is to use a stock screener. Of course, after finding candidates in the screener, you’ll want to analyze further. InvestSomeMoney.com’s posts on fundamental analysis can help with that.

Here are some stock screeners to check out:

Are there other characteristics you look for in a high-dividend stock? If so, what are they?

How do you find high-dividend stocks to invest in?