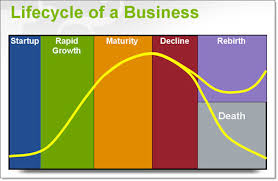

Typically, there are considered to be between 4 and 7 stages to a company’s growth. They go by different names, but the concept is the same.

- Conception

- Infancy

- Growth

- Expansion

- Maturity

- Decline

- Death

In order to understand how well a company is poised for growth, it’s beneficial to know what business growth strategies it might employ. The strategies that a company uses will depend, in part, on the stage of the business life cycle it’s in.

A growth-oriented investor might fall into the trap of looking at past results and not future prospects. By understanding what strategies businesses might use to grow, the investor can be more confident in their ability to find growth-oriented companies.

Stages of company growth – the life cycle

Businesses aren’t alive, per se, but they are similar to living things in that they tend to pass through distinct stages as they are conceived, grow, mature, and, eventually, die.

How many stages they go through is debatable. I’ve seen anywhere from four to seven referenced. The underlying principles are pretty much the same no matter how many stages you divide the life cycle into.

For my part, I like to keep things simple, where possible. In this post, I’ll simply refer to four stages in the business life cycle. Though, one of them (growth), gets sub-divided into two stages.

How do I know what stage of the life cycle a company is in?

The stage of the life cycle that a business finds itself has more to do with its operations and financial position than it does with any hard-and-fast timeline. For example, a company could shoot right through infancy and early growth into profitability within a couple of years. On the other hand, some companies seem to stay in a state of perpetual adolescence and take forever to become profitable.

For example, Facebook, Inc. (FB), love them or hate them, turned profitable in 2009 (Source). That was within five years or so of their founding.

On the flip side, Spotify Technology S.A. (SPOT) has yet to muster a profitable year after thirteen of them in its existence. They did have a profitable quarter at the end of 2018. So, they might be entering the late growth phase soon.

Why does a business’ life cycle matter?

Like the previous post on the qualifications of senior management, this one was written to lay the groundwork for Point 2 of Philip Fisher’s 15 Points from Common Stocks and Uncommon Profits.

Point 2 addresses management’s determination to develop products/services that will further increase sales after the potential of current products/services is spent. In order to ascertain this, I thought it prudent to touch on different strategies that businesses use to grow.

This is merely a framework, not a set of hard-and-fast rules. A company may have traits that imply it’s in more than one stage. Though, intuitively, I think you’ll see that most are either in the growth or maturity stage. These explanations are included to provide context for the growth strategies that a business might undertake.

1. Infancy

Once development is through and products/services are ready to sell, then a company has entered the startup phase. At this point, it is still in its infancy. One of the biggest challenges is obtaining customers. Obviously, this is a precarious stage since the business is fighting an uphill battle to gain momentum.

At this point in its development, a company may still be a ways from profitability. Heck, it might still be fine-tuning its business model. Flexibility is paramount in any stage of life, but during the infancy stage, it is especially important as the company decides what niches it will fill and what its unique selling proposition is.

Most publicly traded companies would have moved beyond the infancy stage.

There’s no shortage of startups, however. A simple search for “hot startups [year]” will yield a bunch of young companies that you’ve probably never heard of. But, could be a hot investment in the future!

2. Growth

The growth stage could be broken up into two sub-stages. We’ll call them early growth and late growth. In both stages, as you would expect, revenue is increasing aggressively. However, it’s not until a company has turned a profit, and continues to do so routinely, that they would enter the late growth stage.

With a clear picture of its identity and a firm idea of how it will continue to grow, the business has reached the early growth stage. At this stage, product and service offerings might be added. The aggressive revenue growth is great; but also presents challenges.

Additional investment might be required in order to fully capitalize on the opportunities facing the business. That, in part, is why they go public.

On the other hand, the desire to maximize growth could trump its ability to adapt. If that happens, the company could “trip over its own feet” and end up not realizing its potential.

2.1 Early growth examples

There’s no shortage of growth companies to invest in. As I write this, a quick glance at an IPO calendar shows me that two familiar names, Chewy (CHWY) and Fiverr (FVRR), are going public next week.

The SEC didn’t have any information, that I could find, on either company yet. But, I think both could safely be classified as growth companies. Though I don’t have access to their financials, they’ve likely left the infancy stage and are looking for equity financing so that they can really grow.

Finally, one more growth company, in a growing industry (cannabis), is MedMen. I wrote about their potential market share/size not too long ago.

2.2 Late growth examples

Stamps.com, Inc. (STMP) is a veteran of the dot-com bubble. Founded in 1996, they came out the other side as a viable business that has continued to grow since. In fact, Fortune puts them at #2 in a list of 100 Fastest-Growing Companies (Source).

They have produced a net profit every year since 2004 except one (2015). They seem to have turned that corner from early growth into mature growth.

Another example of a mature growth company is Nvidia Corp. (NVDA) – #7 on the Forbes list. Nvidia had two years of losses in 2009 and 2010 in the wake of the Great Recession. However, prior to that, they had been profitable since 1998. Again, a company that still seems to be in the growth stage, but isn’t really comparable to Chewy, Fiverr, Uber, or Beyond Meat…

3. Maturity

Once the vigorous growth has cooled off and a company has established itself as one of the primary players in its industry, it has reached the maturity stage. This stage is a crossroads of sorts. Here, the business can opt to milk the cash cow and maintain the status quo. Or…to adopt strategies that will propel it to new levels of growth.

I would classify most publicly traded companies as being in the maturity stage. This is why it must be determined if management has the determination to continue to develop products or processes that will still further increase total sales (Point 2 of Fisher’s 15 Points).

For examples of companies in the maturity stage, look no further than the Dividend Aristocrats. I’ve written about the Dividend Aristocrats and the characteristics of quality high-dividend stocks before.

Compare the growth in net profit for companies such as Proctor & Gamble (PG), Genuine Parts Co. (GP), and Clorox Co. (CLX) to those mentioned in the section on the growth stage. While these companies are much bigger, you’ll find that they don’t have the exponential growth that the smaller companies do.

They might be growing, sure. But if they are, the rate of growth is probably considerably lower than those in the growth stage. It’s probably more in line with inflation and the economy as a whole. They’ve exploited their opportunities and are big and cumbersome at this point. It doesn’t mean that growth is impossible. It might just be harder to come by and require different strategies to achieve.

4. Decline

As the name implies, this is not an enviable stage to be in. A business in this stage could be a lost cause. If the decline is happening after years (decades) of success, it might take a while. If it’s happening to a relatively new business, the demise of the business might be hastened.

At this point, it would take a pretty remarkable turnaround for a business in this stage to become an attractive investment. It’s also possible that it might be acquired for its assets or customers. Maybe at a premium.

J.C. Penney Company, Inc. (JCP), for example, hasn’t been profitable since 2010 – its 108th year in business. Anything’s possible, in terms of a turnaround. But, J.C. Penney is exhibiting textbook signs of a company in decline that is heading toward demise.