- The advantages of short selling stocks are that you can profit off of losers and you can hedge your portfolio against bear markets

- The disadvantages of short selling stocks are margin interest, stock loan fees, and most of all – opportunity cost

- Short selling can be a great hedging strategy. Just don’t overpay for the insurance!

Want to play around with the spreadsheet used in the example? Check out this post.

Pros and cons of short selling

Truly understanding the advantages and disadvantages of short selling stocks will help you decide if it’s something that’s right for you.

At its core, short selling is making a trade that will be profitable if the price of an asset goes down. That, of course, is the opposite of what we traditionally think of when we speak of trading or investing. We think about buying something, holding it for a certain amount of time, and then selling it – hopefully for more than we bought it for (going long).

So, how does one sell a stock they don’t even own? By borrowing it from their brokerage. The brokerage might have to obtain the shares from other clients that own the stock in a margin account, or it might have to look to other brokerages to borrow shares.

Once the shares get located, they are borrowed and sold. The brokerage holds the proceeds (and any interest accrued on those proceeds), so you can’t use that money to make other investments.

The particulars of short selling work differently depending on who you place your trades through and what type of asset you’re shorting. This post will focus particularly on stocks.

Advantages of short selling

The most obvious advantage to short selling a stock is being able to make money not only when a stock goes up, but also when it goes down.

Another advantage is that you can hedge your portfolio. If another bubble pops or another financial crisis hits, there’s a good chance your portfolio is going to face a setback. Even if you’re not an indexer and have invested in some really sound companies. If that happens, having shorts in your portfolio could provide gains that offset your losses.

Are you happy with your portfolio’s volatility and returns? Read this post:

ARE YOU SATISFIED WITH YOUR INVESTMENT PORTFOLIO?

How to make money when a stock decreases in price

The fundamental and/or technical analysis used to ascertain that a stock might go down is beyond the scope of this post. If you’re looking for that information and it isn’t already on this site – then my plan is to make it available someday.

The bottom line is – stocks do go down. A lot of them. And, they go down a lot sometimes. The reasons vary, but it happens. Every time it does, and you’re not short that stock, you miss an opportunity. Another opportunity cost.

When you are researching stocks, you’re bound to come across a few “stinkers.” Probably more than winners. If you incorporate short-selling into your portfolio, you can possibly take advantage of those “stinkers.”

By utilizing shorts in your investing and trading strategies you’re playing the whole game. Offense and defense. Not just half the game.

Using short selling to hedge your stock portfolio

The prevailing wisdom might be that stocks consistently go up no matter what. The reality is that a lot of stocks do go down. Even in bull markets. It might be due to poor financial results. Or because it’s part of an industry that’s fallen out of favor. Or because of – who the hell knows why?

Is the stock you’re analyzing missing out on its industry’s “hot trends?” Read this post:

HOW TO IDENTIFY COMPANIES THAT ARE RIDING INDUSTRY TRENDS

So, maybe you think you’ve got some real winners in your stock portfolio. You might very well be right. Those winners might realize their value tomorrow, or it could take a while. In the meantime, until others in the market start to see what you’ve seen, the market might go up or it might go down.

If it decides to go down, having some shorts could help you make money until things start to move in your direction.

When other’s are crying about the losses they’ve incurred in a bear market, you might be breaking even or making money.

Disadvantages of short selling

First and foremost, you’ll pay your typical commission to your broker for placing a trade. Same as if you took a long position in a stock.

If the stock you’re shorting is deemed to be “hard to borrow” by your broker, then you’ll definitely pay a daily fee until you close the position.

Thinking of shorting a stock that pays a dividend? Whoever you borrowed that stock from is still going to expect that dividend payment. Guess who’s paying it?

The final, and possibly most overlooked cost, is the opportunity cost of the capital tied up due to margin requirements.

Let’s get into these costs into more detail.

Commission costs for short selling stocks

Most brokers offer the ability to short. Robinhood, the no-cost online brokerage, does not offer clients the ability to short stocks (as of today).

Typically, the same commission applies for short sales as for long positions. The fact that you’re selling first and buying last doesn’t make any difference to most brokers.

Commissions are just a cost of doing business, though. And, frankly, if commissions are killing you then you have the wrong broker and/or you shouldn’t be investing anyhow.

Margin interest

Most, but not all, brokers will charge their typical margin interest rates on a short position (see “From the broker’s mouth” below).

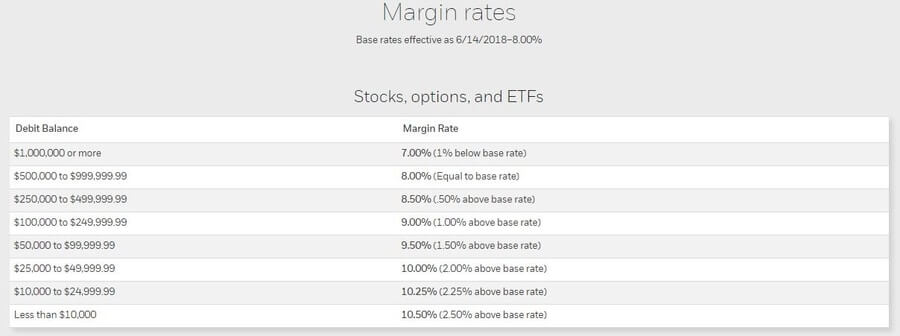

Here’s a look at E*TRADE’s current margin rates:

So, shorting a stock will place a hurdle of 7.0% – 10.5% every year in your way. This means that you may have to earn at least a 10.5% annualized return on your short sale just to break even. If you go with a broker that charges margin interest, you had better be sure that you are right.

“Hard-to-borrow” or “stock loan” fees

Any stock you short may be subject to another fee known as a hard-to-borrow fee or a stock loan fee.

This is not interest, though it behaves like interest. The amount you pay can range from a nominal percentage rate to almost 100%! I’ve even read of instances where the hard-to-borrow fee was 300%!

To be clear – since the most you can make shorting a stock is 100% (sell and buy back at $0) you have essentially no chance at a profit if you have to pay a 100% stock loan fee. At least, if you hold the short position a year or more. If you take a position like this, you had better be damn sure you are right and you had better be damn sure you’ll be right soon.

The stock loan fee is debited from your account monthly. Starting the day after you hold the position past market close.

The amount paid depends on supply and demand. If a stock is hard to find (borrow) the fee is going to be higher. Conversely, if there is plenty of supply – you might not pay anything.

How much does short selling push stock prices down? Read this post:

DOES SHORTING A STOCK DRIVE THE PRICE LOWER?

Most brokerages don’t have a publicly available list of hard-to-borrow securities and their corresponding rate. Many brokerages simply won’t make a stock available to short if it’s hard-to-borrow. This is how they avoid charging clients these fees. If you use a brokerage that allows you to short hard-to-borrow stocks, then make sure you know about any stock loan fees you may be subjected to.

From the broker’s mouth

I emailed TD Ameritrade, Fidelity, E*TRADE, Merrill Edge, and InteractiveBrokers on the matter to see what they had to say. All the emphasis is mine.

TD Ameritrade

We do not charge a stock loan fee for short selling or for hard to borrow securities. If the security is not able to shorted at the time then you will simply get a reject saying that the stock is unavailable for shorting. However, we do have a Hard To Borrow Program that clients can sign up for and there is a fee for enrolling in this program. To be considered for enrollment you have to have margin enabled on the account and at least $100,000 in equity in the account. If you would like to learn more about this program please let me know and I would be happy to provide more information on the fees involved.

There is no margin interest charged for shorting a stock. Margin interest will only be charged when you have a margin debit balance in your account.

Fidelity

Fidelity only charges fees or interest on shares that are hard to borrow. The short interest fee rate is based on conditions in the stock loan market, including:

– The number of shares outstanding.

– Availability of the shares in the stock loan market.

– The prevailing interest rate environment.Since this rate can change, we do not have a document that can be referred to. The easiest way to check on the rate is

enter the symbol into the trade ticket and select “Sell Short” under “Action”. Theamount of shares available to short and the interest rate will populate.

E*TRADE

Thank you for contacting E*TRADE Securities. Great questions! When you short securities at E*TRADE, you are subject to the regular margin interest rates. You can read more about this at etrade.com/margin along with the following resources:

Margin Interest Rates

Margin RequirementsWhen you short hard to borrow securities, you are also subject to the hard to borrow (HTB) interest rate which is essentially the stock loan fee you are asking about.

The difference between the HTB interest and the margin interest is margin interest starts accruing on settled trades while HTB interest is charged the day you start shorting.

We currently do not have a list of HTB securities available to short.

Merrill Edge

There is no additional stock loan fee for every short sale.

Merrill Edge does charge margin interest on short positions.

Interactive Brokers

On the trading platform is an application titled SLB Rates that provides you with the current borrow rates and the number of shares that are available to borrow.

Dividends paid on short sales

If you purchased a dividend-paying stock and your broker subsequently loaned out your shares to a short seller, you’d still expect to receive your dividend payments, wouldn’t you?

The company whose shares you sold short is going to pay the cash to the person you sold the borrowed shares to. They bought the shares with the expectation of receiving dividend payments – just like the person you borrowed from. Well, you can’t split the dividend up an pay each person half! Nope. You’re on the hook for the dividend to the person you borrowed from.

If you sold short 100 shares and the company paid a $1.00 dividend – that’s $100 you’re paying to the lender. If you sold short a stock that has a dividend yield of 6%, then there’s another 6% hurdle you have to clear in addition to margin interest and/or a stock loan fee.

The opportunity cost of short selling stocks

Since selling short potentially has an unlimited downside, your brokerage is going to require that you maintain a certain amount of cash in your account in case things go bad (maintenance margin requirement).

The amount of cash you’ll need to have in the margin account, at the time of the sale, is 50% of the position value. This is the initial margin requirement. For example, if you short 100 shares of a $50 stock (position value of $5,000), you’ll have to have $2,500 in cash in the margin account at the time of the short sale.

If the stock moves against you and goes up, the margin requirement might get backed off to 40% or 30% of the position value. This is the maintenance margin. But, since the price of the stock is increasing, the position value is increasing. If it increases enough, you’ll get a margin call. A margin call means that the brokerage is requiring that you deposit more cash in the margin account. If you don’t, they’ll likely close the position for you and buy back the borrowed shares. You’ll realize a loss at that point.

If the stock goes down, as you hope, you’ll probably have to keep a 50% maintenance margin. But, since the position value is decreasing, you’ll likely get cash freed up for other uses.

A detailed illustration of the effects of prices, margin rates, and position profit is provided below.

The bottom line is, you’re always going to have a maintenance margin. Always going to have cash tied up that could otherwise be working for you. Might as well be under your mattress.

More interested in safe returns than tying your money up in maintenance margin? Read this post:

TYPES OF TREASURY SECURITIES – BILLS, NOTES, AND BONDS

A short selling example

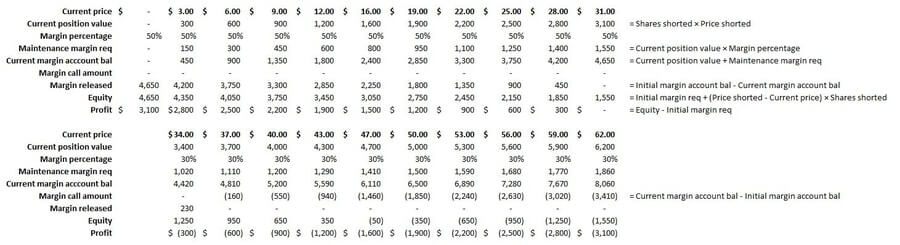

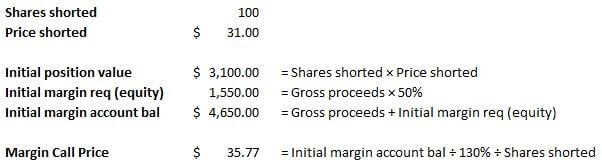

Say you’re convinced that MGM Resorts International (MGM) is going to go down. Maybe you think that their growth will slow or that their stock price is trending down. You decide to sell short 100 shares.

For the sake of simplicity, let’s assume that you’re using a broker that doesn’t charge margin interest or a hard-to-borrow fee. Additionally, we’re going to ignore MGM’s dividend. You think MGM is going to tank hard and fast, so you’re only planning on holding this position for a few days and the record date for the dividend won’t hit during that time.

We’re also going to assume that your broker has the typical 50% initial and 30% maintenance margin requirements.

As of this writing, MGM is trading at about $31.00. Upon entering the trade, you will borrow 100 shares from your broker and sell them on the market.

Here’s are the balances at the time of the short sale:

Also included is the Margin call price, which is a handy bit of information to have. This is the price at which your broker is going hit you with a margin call and insist that you bring the margin account balance up to the appropriate level.

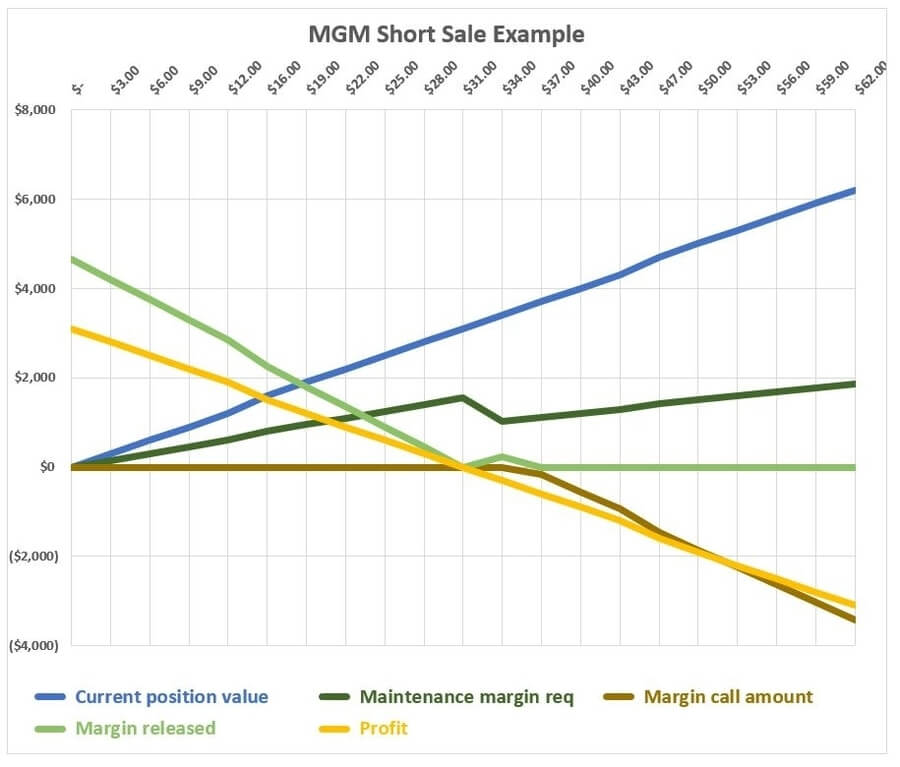

To show what happens when the price of your shorted stock changes, I made this table showing the different balances at different prices:

To paint an even clearer picture – here’s a graph illustrating the values in the table:

Short selling example explained

The equations used to calculate the balances are included to aid in understanding.

A couple notes about the calculations:

As the Maintenance margin req decreases (with the Current price and Current position value), margin is released to the short seller. Conversely, as it increases (also with the Current price and Current position value), a margin call will be made. The Margin released and Margin call amount are only calculated when the stock price goes lower or higher respectively.

Equity – (minus) Profit is always going to equal your Initial margin req.

The Current position value + Maintenance margin req + Margin call amount + Margin released is always going to equal the Initial margin account bal.

Also, the Current margin account bal + Margin call amount + Margin released is always going to equal the Initial margin account bal.

Understanding how all of these balances interact with each other can take a bit to get used to. I hope this example helps you better discern how changes in price can affect not only your profit but your cash balances too.

Think you’d rather be long than short? Read this post:

HOW TO INVEST MONEY IN STOCKS – FROM $0 TO EXPERT ANALYST

Thoughts on short selling stocks from the experts

Mark Brookshire with Avatrade.com

Aside from the obvious (making money when a stock goes down) and hedging, are there any other advantages to shorting stocks?

We encourage investors to learn about short selling and practice making those trades on our virtual trading platform. A common strategy that we see traders use often, when analyzing 2 similar players in a specific industry, is to short the over-priced stock and buy the under-valued stock and wait for them to converge. Another strategy we see traders make is when they think the market is overbought or has run up too high, instead of selling stocks and incurring capital gains, to just short an index and make some money on the expected downturn without liquidating their desired portfolio.

Besides margin interest, stock loan fees, paying dividends, and opportunity costs, what other disadvantages are there to short selling stocks?

The disadvantage that every one talks about is that when you buy a stock, the most you can lose is the price you paid for the stock. However, when you short a stock, it can theoretically go up to infinity and that can bankrupt you. As with all trading, we encourage traders to use stop-loss orders or other strategies to mitigate risk.

What’s the biggest misconception people have about shorting stocks?

Most novice traders think shorting stocks is risky. But I believe if you think a stock is cheap, then buy it; if you think a stock is overpriced, then short it. Sometimes it is easier for you to find the dogs in an industry then the next market leaders.

Short selling can be beneficial but be sure to minimize the risks

Short selling can give you peace of mind and protect your downside. Like any insurance, it comes at a cost. If you do decide to implement short selling stocks into your investment strategy, be sure to go with a broker like TD Ameritrade that does not charge margin interest on short positions.

Also, avoid hard-to-borrow stocks. Unless you are in possession of insider information (which is illegal to trade on) you can’t be sure that a hard-to-borrow stock is really going to go down. Or it might be a situation where you know you’re right, but you don’t know if you can stay solvent long enough to enjoy the fruits of being right. In the meantime, you might be racking up huge fees that could eliminate the possibility of any gains.

All things being equal, favor non-dividend paying stocks over those that do pay a dividend. Especially those with a high dividend yield.

The opportunity cost of cash tied up in maintenance margin is unavoidable. The more right you are about a shorted stock (and the sooner) the better!

If you’re going to short stocks get rid of as many downside risks as you can so that you can put yourself in a position to enjoy the upside.

Did I miss any advantages of short selling?

What about the disadvantages?