“Do stocks go down when dividends are paid?” Yes. After a stock goes ex-dividend, the price of the stock usually falls by the amount of the dividend. That’s typically an inconsequential dip, though. Stock prices can fall much further, due to a number of other factors.

Most dividends aren’t high enough to guarantee a profit when investing in a stock.

For instance, a $20 stock paying a $.80 dividend (4% yield) would have to be held for 25 years before returning the original investment and guaranteeing a profit. This assumes that the dividend never changed over those 25 years. Which, is unlikely, of course.

Nevertheless, it illustrates that even though dividends are great, they aren’t great enough to guarantee profitable investments in stocks.

You CAN lose money on any stock

No stock is immune from losing value. Dividends help offset capital gains losses, sure. However, given that dividend yields typically range from 2% to 6%, there’s only so much help they can offer.

Fortunately, dividend stocks are typically purchased as long-term investments. Therefore, if the stock is a sound investment, it’s likely that its value will recover from short-term setbacks.

Dividends are, generally, less likely to be reduced than the value of the underlying stock is to lose value. So, while time can potentially correct capital gain losses, you can hopefully count on a quality dividend stock to continue to provide a steadily increasing return over the long-term.

What causes dividend stocks to go down?

There’s no comprehensive list of the reasons that stocks lose value. At least no list that I’m aware of. That list could, almost, be infinitely long.

Stocks go down for a lot of reasons. Some of them are logical. Some of them are illogical. Others are a complete mystery.

Many people consider dividend-paying stocks to be safer than non-dividend-paying stocks. The rationale might be that dividend-paying stocks are typically more mature and have less volatile sales. Therefore, they are immune, somehow, to losing too much value.

While, yes, paying a dividend does imply a certain amount of proof-of-concept in the business model. Not to mention a degree of financial stability. Neither means that dividend stocks can’t go down.

Even if the company is well managed, there are factors outside of the company’s control that can cause a dividend stock to lose value.

Regulation, legislation, litigation, other similar factors can negatively impact business results. The extent to which these factors are interpreted by the market can cause a (mild or steep) decrease in the stock price.

How do I get downside protection for dividend stocks?

Ideally, you wouldn’t obsess over the day-to-day and week-to-week volatility of your dividend stock. However, if you are concerned with a loss in value, there are steps you can take to protect your downside.

One way is through the use of options. Stock options are complicated and this post won’t go into detail on their functionality. It will, however, address some simple strategies you can employ to get the downside protection you’re looking for.

For starters, you can buy a put contract for every 100 shares of the dividend stock that you own. A put contract locks in a sales price. The put will increase in value if the dividend stock’s price declines. If the price of the stock does not decline, then you will lose what you spent on the put contract. You can think of the cost of the put contract as an insurance premium.

Alternatively, you can sell call contracts on your dividend stock. Again, one contract for every 100 shares you own. Ideally, these would be out-of-the-money calls so that you don’t have to prematurely give up ownership of your dividend stock. Since you’re selling these call options, you won’t see any appreciation from the change in stock price. However, if you’re able to sell enough call options over time without getting the dividend stock called away from you, your gains could offset your losses in the underlying stock.

Again, options are complicated and potentially very risky. So, educate yourself before employing these (or any other) option strategies.

Mistakes that dividend stock investors make

As a rule of thumb, dividend stocks are considered safer than growth stocks. However, the two types of stocks aren’t always mutually exclusive.

Dividend stocks aren’t 100% safe. There are several pitfalls that investors can stumbly upon when picking dividend stocks.

Chasing high yields

High dividend yields are enticing. A stock with a 25% dividend yield would return your initial investment in four years. At that point, it would be essentially impossible to lose money on that stock.

But, 25% dividend yields are rare. If you do find them, the risks could be higher than the return. Dividend yields must always be balanced with dividend quality. A great yield isn’t worth much if the likelihood of receiving it over the long-term is low.

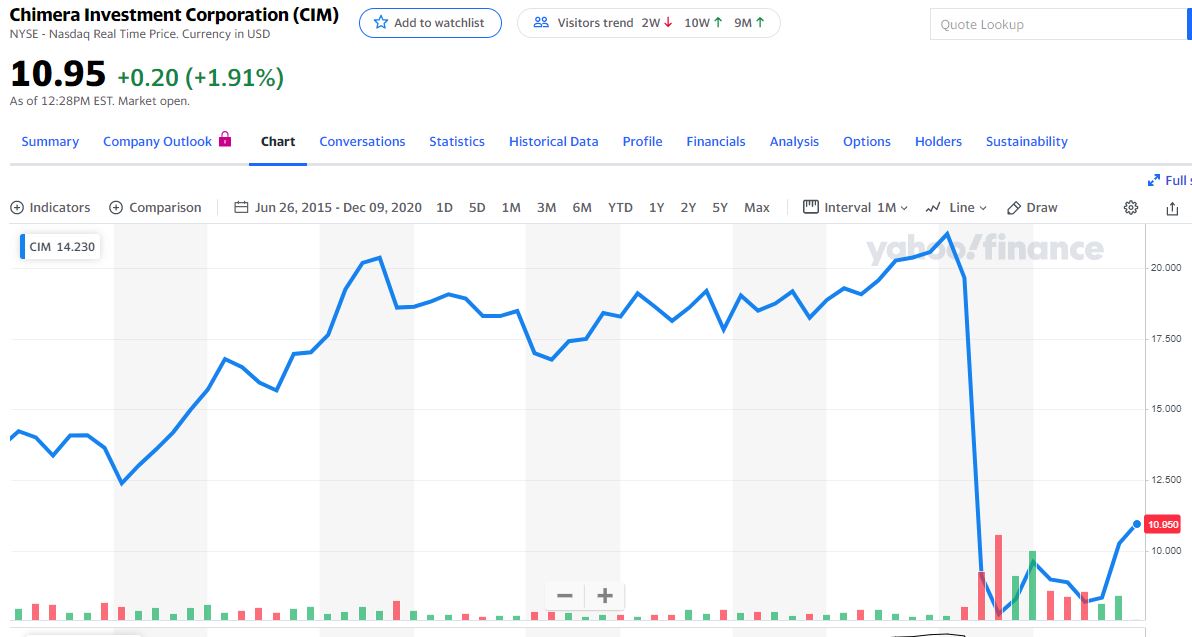

Consider Chimera Investment Corporation (CIM). On June 26, 2015, CIM traded around $14.25. Its dividend yield, at that time, was about 13.26%. Source.

Five and a half years later, CIM trades at $10.95. A loss of 23.2%.

Ignoring revenue and earnings growth

Revenue drives earnings. Earnings drive dividends. Beyond that, growing revenue and earnings signal a healthy company. One that is less likely to lose value.

Maybe you think that dividend stocks are boring companies whose days of growth are behind them? That’s not always the case, however.

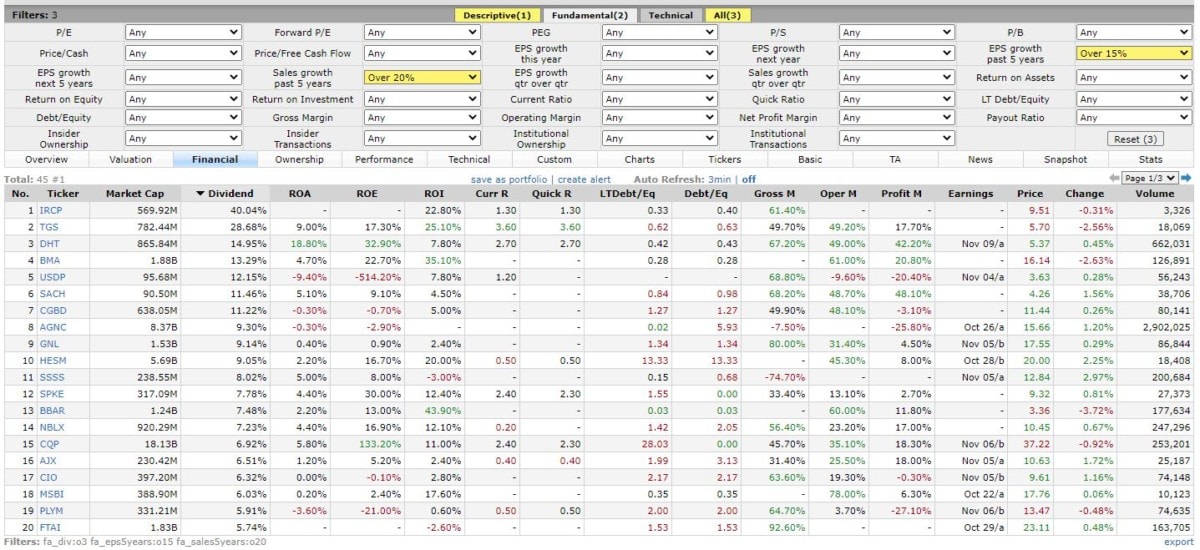

Even today (December 8th, 2020), with equities near all-time highs, there are still a number of stocks with yields over 3% who have also experienced respectable sales and earnings growth over the past five years.

Of course, this is not to say that any of these companies are truly worth investing in. It merely points out that there are growing companies out there that pay respectable dividends.

Disregarding dividend payout ratios

A company’s dividend payout ratio is the percentage of earnings it pays out in dividends. Again, like dividend yields, don’t fall into the trap of thinking that higher is always better.

While we all want a return on our investment as quickly as possible, we don’t want it to be at the expense of future gains. If a company pays out all of its earnings now, it won’t have a safety net for when times get tough.

Generally speaking, a dividend payout ratio of less than 50% is safe. If it starts to fall below 30%, the company could be overly conservative.

On the other hand, a dividend payout ratio above 80% should raise red flags. These companies could be putting future dividends at risk.

Of course, all of this depends on the company, the industry, and the economy as a whole. Be sure to look at the entire picture before making an investment decision.

Do stocks go down when dividends are paid?

Dividend stocks have a certain degree of risk – like any other investment. Even though dividends put money back into your hands, the value of the stock can still go down. This can cause your overall investment to lose money. Dividend stocks can lose value for the same reasons any other investment can lose value. Internal and external environmental factors will always play a part.

While complex options strategies exist that can help mitigate the risk, they come at a cost. The best way to avoid losing money on dividend stocks is to do your research and to invest in companies with safe dividends.

Contents