“What is included in a competitive analysis?” A competitive (market) analysis consists of the stock you’re analyzing and its most appropriate competitors. Metrics are chosen to compare each company with the goal of understanding which is best poised for growth. Some metrics are universal, others are more industry-specific.

In order to be an outstanding investment, a company has to be outstanding and its industry. Sure, every company is measured, in some part, by its profits (margins). But, beyond that, there are factors that are industry-specific which a company must excel at in order to rise above the rest.

This notion of comparing a stock to its competition has been touched on in many of the previous posts related to Philip Fisher’s Common Stocks and Uncommon Profits. Sales analysis, for instance. My last post, on financial ratio analysis, was another.

In those posts, sizing up the competition was done to complement the topic at hand. In this post, competition is the focus. Understanding where the stock you’re analyzing stands among its competition is critical to understanding if it can beat the competition. A competitive market analysis allows us to gauge a company’s standing among its competitors.

What is a competitive market analysis?

A competitive market analysis consists of a couple of tasks.

First, you have to identify the competitors.

Then, you need to understand what metrics you are going to use to compare the companies. These metrics are often industry-specific.

When you’re finished, you should understand where your company excels and where it falls short. You can then decide whether your company’s strengths outweigh its weaknesses and if it is in a position to outperform the competition.

By conducting a competitive market analysis you’ll begin to understand where the company you’re analyzing ranks among its competitors. This will help you comprehend its advantages and how well it’s serving its customers. Additionally, it should shed some light on how well the company’s growth strategies are working.

Determining who are the competitors are

Obviously, it’s critical to know who the competition is before you stack your stock up against it.

If you’re analyzing a well-known stock, then you might intuitively know a thing or two about the competition. But, keep in mind, a lot of these bigger companies have different segments – each with vastly different competitors.

Amazon, for instance, competes with retailers. But it is also one of Netflix’s primary competitors in the streaming video space. Microsoft competes with Sony in the arena of gaming consoles. But, also with SAP and Oracle in terms of enterprise software.

Here are some ways to screen for potential competitors:

What are the products and services they’re selling?

If they’re very similar, then there’s a good chance that you’re dealing with a competitor.

However, you should also understand that not-so-similar products/services could be considered competitive. Products and services known as substitutes can be drastically different. Products and services that have drastically different characteristics, but might be purchased in lieu of what your company’s selling

A grocery chain like Kroger (KR) and a restaurant chain like Chipotle (CMG) sell substitute products – namely meals. However, I would not consider them direct competitors because of the differing nature of their business models.

Do their products and services serve the same demographics?

Most brands don’t appeal to everyone. Companies have to pick sub-sets of the total attainable market (TAM) to market to.

For instance, Lululemon (LULU), to me, targets the suburban, upper-class, demographic. Foot Locker (FL), on the other hand, targets more of an urban, multicultural, demographic. Both are in the “athleisure” retail market, but appeal to different customers. So, while there might be some spillover, at first glance I wouldn’t consider these two direct competitors.

Are they selling in the same geographic area?

Many larger companies sell in nearly every geographic area worldwide. If you’re analyzing a smaller, regional company, then the larger company might be considered a competitor. But not necessarily vice versa.

Consider banks. Bank of America operates nationwide. A smaller, regional bank like Union Bank (UNB) does not. Union Bank might consider Bank of America competition. Bank of America might not share that sentiment.

Is it necessary to size up all of the competition?

I would say probably not. After paring the competition down to:

- Those who are selling similar products and services

- Those who are serving the same demographics

- Those who are in the same geographic area

Then, the list of potential competitors should be more manageable. Beyond that, you might narrow your analysis to those that are similar in size.

It might be that you can’t find enough direct competitors (those who meet all three criteria). If that’s the case, then feel free to include those who offer substitute products/services or serve different customers. Don’t just forego the competitive market analysis!

Now, if you do as I suggest and focus your efforts on a couple of specific industries, then you’ll probably already be analyzing the appropriate competition as it is. The extra benefit of doing so is – you might find that one of the competitors is a better investment than the stock you set out analyzing.

The bottom line is – analyzing stocks is time-consuming. And, while it’s important to size up the competition, you don’t have all the time in the world. Therefore, it’s prudent to keep your analysis focused on the stock you’re analyzing and its most appropriate competitors.

Gathering competitive market analysis information

The information you gather for competitors will come, predominantly, from the same sources as the stock you’re analyzing. Just perform the same due diligence for a competitor that you do for the company you’re researching.

As a reminder, below are the sources I’ve referenced, thus far, in my posts on the topic of researching stocks. This doesn’t encompass all of the information I’ve had to gather, of course. Sometimes, you just have to search the web to find the niche pieces of information you’re looking for.

This list is NOT exhaustive, it’s simply what I’ve been able to put together to date. There are many great sources for this type of information.

10-K, 10-Q, and other SEC Forms

- Key demographics (market sizing)

- Number of retail locations (market sizing)

- Management bios (senior management qualifications)

- R&D spending (R&D management)

- New product sales (R&D management)

- Revenue history (sales growth, inventory investment analysis, profit margin analysis)

- Historic inventory and COGS (inventory investment analysis, profit margin analysis, cost analysis)

- Operating & interest expenses (profit margin analysis, cost analysis)

- Union info (employees & executives)

- Executive compensation (employees & executives)

- Balance sheets (financial ratios)

Financial news website (e.g. Yahoo! Finance)

- R&D spending (R&D management)

- COGS, operating, & interest expenses (cost analysis)

- Balance sheets (financial ratios)

Company website

- Retail locations (market sizing)

- Average retail sales price (market sizing)

- Participation in trends (product and operational trends)

- Company history (growth stage)

Company Investor Relations website

- Management bios (management qualifications)

SimilarWeb (Chrome extension)

- Approximate website traffic (market sizing)

Google Trends

- Narrowing down industry trends (product and operational trends)

Trendhunter.com

- Narrowing down industry trends (product and operational trends)

Social media influencers

- Identification of trends (product and operational trends)

- Management resumes & personalities (management qualifications)

- R&D headcount (R&D management)

- Sales & marketing headcount (sales per rep)

Wikipedia

- Company history (growth stage)

United States Patent and Trademark Office

- Patent production (effective R&D management)

InvestSomeMoney.com

- Effectiveness of the Sales Organization workbook (sales growth, sales target, inventory investment analysis)

Federal Reserve Economic Data (FRED)

- Inflation rates by product type (inventory investment analysis)

Glassdoor/Indeed

- Employee reviews and pay info (employees & executives)

Web search

- To fill in the gaps…

I’ll end this section with a link to a great post by Buffer that has a lot of tools and tricks for sizing up the competition. These are useful if you want to take your analysis beyond the channels listed above. Additionally, if you’re comparing your publicly-traded company to a private one.

Considering why the competition does what it does

Some information that you gather will make it clear that one company is outperforming another. At least in a given metric. Things might not always be so clear, though.

Philip Fisher’s 15 points give us some inspiration regarding what to think about when comparing a stock to the competition. Here’s how I’ve examined the points thus far:

- What is the market potential for this company?

- Can it reach its potential?

- Does this company have a favorable business model?

- Is this company capitalizing on industry trends?

- Am I confident in this company’s senior management?

- Is this company employing a smart growth strategy?

- Is this company managing its R&D effectively?

- Is revenue growing at a satisfactory rate?

- Across all geographies and segments?

- Does this stock consistently meet its revenue targets?

- Is this company capitalizing on its unique selling proposition (USP)?

- Is this company effectively turning leads into referring customers?

- Does this company invest intelligently in its inventory?

- If retail or manufacturing

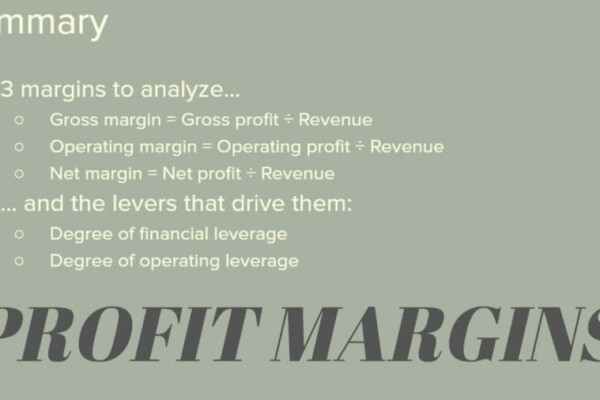

- How appealing are this stock’s profit margins?

- Is it effectively employing operating and financial leverage?

- How good is the company’s employee relations?

- Do the company’s executives have skin in the game?

- Are they compensated appropriately?

- Are all categories of costs appropriate for the industry?

- Is the company investing in profitable projects?

- Are the stock’s efficiency, liquidity, solvency, and market ratios appealing?

After you’ve worked through some (all?) of those questions, you should have the ability to orient where your stock, and its competitors, stand in their given industry. Then, it’s up to you to decide which of those companies, if any, are poised to excel.

It might be that you can’t draw that conclusion at this point and time. Which is fine. However, during your research, you might have thought of some strategies, or tactics, that these companies could employ that would give them an edge over the competition. If so, it’s just a matter of monitoring and being ready to invest when they wise up and take action.

Efficiently performing a competitive market analysis

There’s a lot to consider when analyzing stocks. It can be exceedingly time-consuming. Therefore, it pays to have a plan for accomplishing this task in an efficient manner.

Not long after I set out to write these posts based on Philip Fisher’s book Common Stocks and Uncommon Profits, I knew that this day would come. The day where I had to start thinking about what steps (points) should be addressed first, in order to find the diamonds in the rough efficiently.

Some of these points are way more research-intensive than others. And, frankly, some are more important. So, it’s a balancing act. The bottom line is – you want to disregard the poor investment prospects as quickly as possible. Then, you want to save the timely and in-depth research for those stocks that have a high potential return.

This is my first pass at it and it’s likely to change in the future:

Step 1. Picking industries

I say this in nearly every post, but I’ll repeat it here. I recommend focusing your efforts on a few key industries. Better, I think, to understand a few industries deeply than all of them just a little bit.

As I see it, there are two ways to decide on which industries to focus on.

The first is to focus on industries in which you have experience.

Maybe you’ve worked in healthcare or manufacturing? Perhaps your family owns a restaurant and you’re very familiar with what it takes to be successful in that industry. You get the point.

You’ve probably held a job before. So, put that experience to use. Utilize your understanding of the day-to-day operations. This expertise can be very valuable when analyzing stocks in that same industry.

Secondly, you can pick industries based on their business models. As I wrote about in this post, some business models are more favorable than others.

If you are a growth investor then you might as well focus on industries that are more conducive to earning recurring revenue. Particularly those with consumable or subscription-based business models.

Step 2. Quick and easy quantitative analysis

Here, we’re looking to narrow the playing field in our chosen industries. I think one of the easiest ways to do this is to use a stock screener.

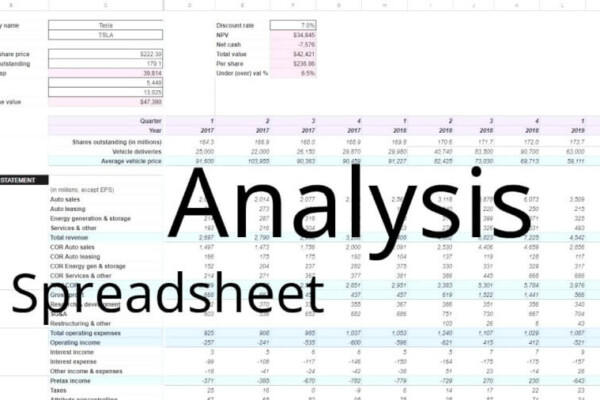

A simple place to start is with ratios. In particular, you can look for some of the best companies in the industry in terms of efficiency, liquidity, solvency, and market ratios. If you see something you like, then you can do a quick comparison (in a spreadsheet) between companies.

Beyond that, revenue growth is obviously important if you’re a growth investor. This is another variable you can plug into the average stock screener. However, I would also recommend plugging this into my Evaluation of the Effectiveness of the Sales Organization workbook (or something similar). Compare your stock and its best competitors. Doing so will help you get a better grasp on the revenue growth situation.

Profit margins can also be referenced in most stock screeners. They can be quickly plugged into a spreadsheet too.

These three criteria should be pretty easy and efficient to research. For those stocks that you’re comfortable with, you can move on to…

Step 3. A more in-depth analysis

If a company makes it this far in your analysis, it can then be scrutinized and even more detail.

First, I would suggest that you dig into the revenue analysis more deeply. It’s revenue that drives growth after all.

Consider starting with a revenue target analysis and a sales vs inventory analysis. These are both quantitative so they’re not as sensitive to subjectivity. They’re also both available on the Effectiveness of the Sales Organization workbook. These analyses will tell you if the company consistently meets its revenue targets and if it invests intelligently in inventory. Of course the latter is only necessary if you’re analyzing retail, manufacturing, or any other business that handles large quantities of inventory.

Next, I’d suggest keeping your focus on revenue. Ask yourself if this company is capitalizing on (or even knows) it’s unique selling proposition (USP). The USP is what distinguishes the company from its competitors. It’s what lifts their product or service from commodity status

Then, ask yourself if the company is effectively turning leads into repeat customers. Before you do that, however, you’re going to need to know the demographic profile of its potential customers Specifically its serviceable available market (SAM).

The SAM is, in essence, the top of the funnel. It’s “leads.” From there, potential customers work through the funnel and, inevitably, some are lost along the way. The goal of the companies you’re analyzing is to carry as many customers as possible from the leads category down to the repeat/raving customers category.

The previous insights will give you an idea if the company you’re analyzing has historically been able to grow revenue. Now, it’s time to make a judgment as to whether they can increase revenue in the future.

The first way to do that is to decide if the company is capitalizing on industry trends. This can mean offering products and services that are trendy, or doing things operationally that are trendy.

Finally, it’s time to think about the company‘s growth strategy. What got them to this point might not carry them in the future. Is their current strategy for growth market penetration, market development, product expansion, diversification, or acquisition? Is the current strategy the correct one?

Step 4. Costs

With revenue thoroughly analyzed, it’s time to focus on the other side of the equation when it comes to calculating profitability and stock valuation.

Almost all businesses will have cost of goods sold (cost of revenue) and selling general and administrative costs. However, that’s where the similarities end.

Are their costs classified as more fixed or variable? Are they weighted more towards product or periodic costs? Are they direct or indirect costs? How do all of these stack up against the competition? Also, how are those costs paying off? Do you think the company is performing quality cost-benefit analyses and investing their money in the right things?

Finally, if your stock is in an industry that relies heavily on innovation, you should delve into one cost in particular – research and development. How well do you feel it’s being managed? Do you feel that they’re spending enough? Are they getting a good return on that investment? Do they have enough people in R&D? What about patents? Are they protecting their intellectual property?

Step 5. Analyzing the people

Ordinarily, I would advocate looking at the people in the company (employees, executives) first. After all, it’s people behind the decisions that result in the numbers we’ve analyzed thus far. However, for good reason, there’s only so much information available on the topic. People are entitled to their privacy after all.

Let’s start with the executives – since they have the most influence. Using what information you can find on the internet, I’d suggest you decide how confident you are in them. What do you think of their compensation packages? Is the company still run by the founder, or a descendant thereof? Basically, you’re trying to decide how much skin the executives have in the game.

As far as employees go, there’s typically a lot of them. So many that you can only hope to get a feel for their attitude towards their company. Using sites like Glassdoor and Indeed you can hopefully get an idea of how they like their jobs and how well they’re compensated. As a rule of thumb – a satisfied employee is a good employee. Don’t forget that these are the people on whose back the company is built.

Step 6. Go, no go

If you make it this far then you are probably at the point where you can make a pretty qualified decision about whether or not to invest in this stock. If your competitive market analysis is favorable, then investing in this stock should come naturally. Or, maybe, you’ve ascertained that one of the competitors is a better investment. That’s fine too. The point here is to make qualified, educated decisions

Maybe now is not the time to invest. At this point, though, you have an in-depth understanding of the industry and the players in it. You’re going to know what will put a company in a position to be successful in this industry.

If the time is not right, you’ll just have to wait. Monitor the industry, update your competitive market analysis as needed. When and if circumstances change, you’ll be ready to confidently pull the trigger.

Contents

- What is a competitive market analysis?

- Determining who are the competitors are

- Gathering competitive market analysis information

- 10-K, 10-Q, and other SEC Forms

- Financial news website (e.g. Yahoo! Finance)

- Company website

- Company Investor Relations website

- SimilarWeb (Chrome extension)

- Google Trends

- Trendhunter.com

- Social media influencers

- Wikipedia

- United States Patent and Trademark Office

- InvestSomeMoney.com

- Federal Reserve Economic Data (FRED)

- Glassdoor/Indeed

- Web search

- Considering why the competition does what it does

- Efficiently performing a competitive market analysis